niphon

Investment Thesis

Roper Technologies, Inc. (NYSE:ROP) demonstrated the success of its growth strategy by delivering good top-line and bottom-line results in the third quarter of 2022. The company’s growth strategy is focused on compounding cash flow by growing its operating portfolio in niche markets by acquiring and expanding businesses having high margins and higher levels of recurring revenue. This strategy has helped the company shift its portfolio from a highly cyclical and project-oriented business to a recurring revenue model with high-margin and less cyclical businesses. Notably, the company is progressing well with the divestitures of the majority of its industrial business and acquired Frontline Education in October 2022. Frontline Education has high margins, and 90% of its revenue is recurring in nature. Roper’s portfolio is now 75% software and 25% water and medical products. The demand environment for the majority of Roper’s businesses is healthy and the management hasn’t experienced any decline in the market conditions yet. Looking forward, I believe the company’s improved mix of businesses in its operating portfolio along with healthy market conditions should help the company to deliver good revenue and margin growth in the coming year. Hence, I believe the stock should outperform in the medium to long term.

Last Quarter Earnings

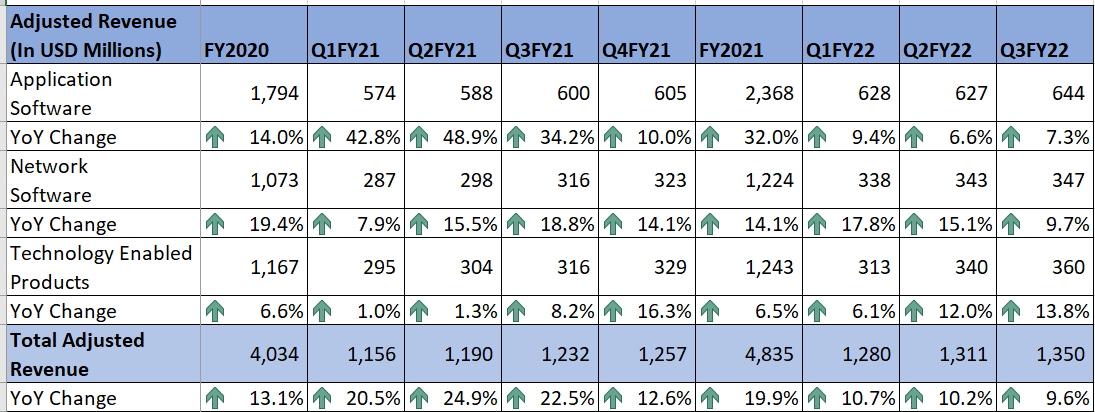

Roper reported better-than-expected results for the third quarter of 2022. Revenue for the quarter was $1.35 billion, up 9.6% Y/Y and beating the consensus estimate of $1.31 billion. Adjusted EPS was $3.67, up 17.6% from the year-ago quarter and above the consensus estimate of $3.45. The company’s adjusted EBITDA grew 11.7% Y/Y to $555 million, while the EBITDA margin at 41.1% represents an increase of 80 basis points (bps) Y/Y.

Revenue growth was attributed to higher demand across all segments, as well as growth in the software recurring revenue base, which grew 11% organically. Higher volume generation as a result of good demand and improved quality in the company’s portfolio of businesses contributed to the increase in adjusted EBITDA, margins, and EPS.

Revenue Analysis and Outlook

In the third quarter of 2022, Roper’s revenues totaled $1.35 billion, reflecting an increase of 9.6% from the year-ago quarter. Organically, revenues expanded by 10%. The increase was attributed to strength in demand across all the segments and the majority of its niche markets. Also, 11% organic growth in software recurring revenue benefited the company’s top-line results. However, unfavorable movements in foreign currencies adversely impacted revenue by $20 million or 1.6%.

ROP’s Historic Revenue Generation (Company Data, GS Analytics)

Looking at individual segments, revenue in the Application Software segment increased by 7.3% Y/Y or 7% on an organic basis to $644 million. Recurring revenue, which accounts for approximately 75% of the segment’s revenue, grew 8% in the quarter. The increase in recurring revenue was driven by good customer retention and the continued migration of clients to SaaS (Software-as-a-service) delivery models. The majority of businesses in this segment grew impressively. Vertafore’s bookings growth was solid in the quarter while Deltek and Aderant benefited from new customer additions and migration toward SaaS solutions. CBORD, a nutrition and Access Management software company, saw strong demand in both the education and healthcare end markets. CliniSys has increased its market share in Europe, and Data Innovations has gained a wallet share in large healthcare systems. Strata continue to expand through new customer additions, cross-selling, and renewal activity.

For the Network software segment, revenue increased by 9.7% Y/Y and 10% on an organic basis to $347 million. The increase in revenue on an organic basis was attributed to a 16% growth in recurring revenue in the segment. For the segment’s Foundry, SHP, and SoftWriters businesses net retention increased in the quarter. Average recurring revenue in the Foundry business grew in double digits and also stands to gain from favorable long-term market conditions. iTrade and iPipeline saw good customer addition which led to an increase in average recurring revenue. However, U.S. and Canadian freight matching businesses experienced slowing demand on the carrier side. Despite the softening in market conditions, the business was able to increase average revenue per customer along with an increase in the new customer base.

Lastly in the Technology Enabled Products segment, revenue increased 13.8% Y/Y and 15% on an organic basis to $360 million. The sales growth in the segment was attributed to accelerating demand in the end markets. The Neptune business experienced strong orders and stands with a healthy backlog at the end of the third quarter. Higher orders and a healthy backlog were a result of an increase in market share. Verathon and Northern Digital also experienced a healthy demand environment throughout the quarter.

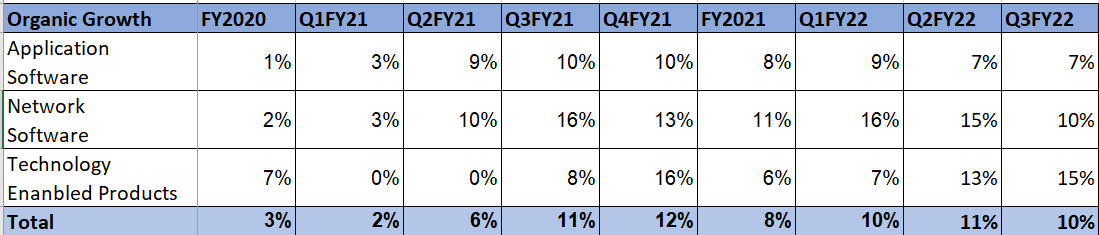

ROP’s Historic Organic Growth (Company Data, GS Analytics)

Over the last two decades, Roper’s growth strategy has helped it improve its business portfolio and accelerate its revenue growth. The strategy focuses on growing the company’s portfolio by acquiring and expanding in niche markets with market-leading technology businesses while divesting low margin cyclical businesses. In line with this strategy, the company announced divesting the majority of its industrial business in the second quarter. The sale, expected to be completed by the end of 2022, will help the company transit toward higher-quality businesses. The company also acquired Frontline Education for $3.7 billion in the current quarter. Frontline is a provider of SaaS software solutions, targeted to the U.S. K-12 education market, and has a high single-digit organic growth outlook and higher recurring revenue of approximately 90%. The business is added to the Application Software segment. As a result of these and other transformative actions over the last few years, the company’s portfolio is much less cyclical and no longer project-oriented. In the portfolio of the company, 75% of the business is software and 25% is medical and water products. The proportion of recurring revenue in the company is 60% with 75% of software revenue recurring in nature.

Looking forward, I believe the company holds good revenue growth prospects in the coming year. The demand environment in the majority of its end markets including healthcare, legal, education, government contracting, utilities, and food should continue to remain healthy. In addition, the company has shifted more towards domestic revenue generation after its divestiture of the majority of the industrial businesses. The U.S. now comprises 85% of its operations, which should help it against headwinds related to foreign currency translations. The diversified and improved mix of businesses with high levels of recurring revenue should help the company boost revenue in 2023.

In addition to good organic growth prospects, the company expects to be active in the M&A market as well. The company ended the last quarter with ~$1.89 bn in cash and cash equivalents and ~$5.96 bn in long-term debt. In Q4, the company is expected to spend ~$3.72 bn on the Frontline purchase and receive ~$2.2 bn in cash from after-tax sales proceeds of industrial business. Also, the company generated ~$350 mn in FCF last quarter and the number should be in a similar range for Q4 as well. If we account for ~$70 mn in quarterly dividends, net debt should be around $5.2 to $5.3 bn by the end of this year. The current consensus EBITDA estimates for FY22 is around $2.2 bn. So, net debt to EBITDA should be around mid-2s by the end of this year. I believe the company can leverage up to 4x net debt to EBITDA given its less cyclical and stable business portfolio. In my opinion, the company can potentially deploy $4 billion-plus to do opportunistic acquisitions by the end of FY23 if we look at the company’s ability to increase leverage and its good free cash flow generation profile. This should further aid its growth.

Margin Outlook

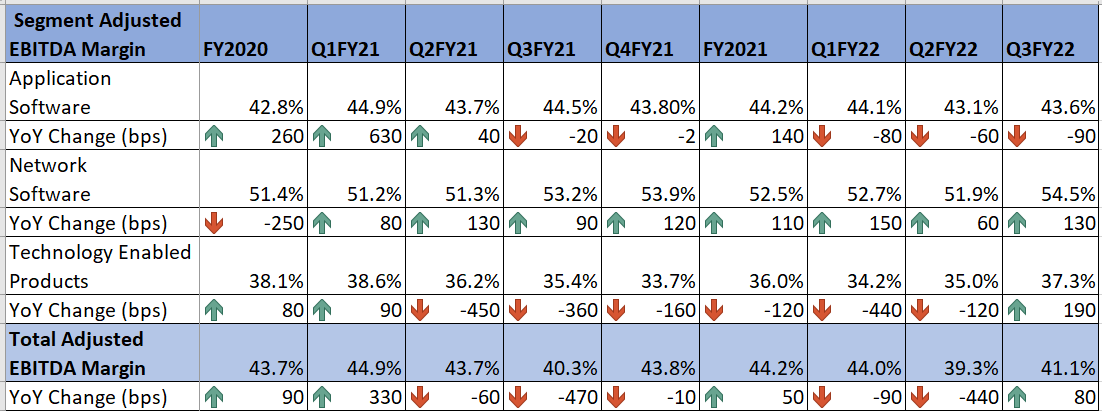

The company reported growth in adjusted EBITDA and EBITDA margin in the third quarter of 2022. Adjusted EBITDA increased by 11.7% Y/Y to $555 million, while the adjusted EBITDA margin increased by 80 bps to 41.1%. The increase was attributed to higher levels of organic growth in the company. The adjusted EBITDA margin in the Application Software segment was 43.6%, a decline of 90 bps Y/Y. The decline was due to significant labor cost inflation. In the Network Software segment, the adjusted EBITDA margin increased by 130 bps Y/Y to 54.5%. The increase was attributable to higher organic growth in the segment. Despite supply chain challenges, the adjusted EBITDA margin grew by 190 bps Y/Y to 37.3% for the Technology Enabled Products segment. The increase was a result of a healthy backlog in its businesses and higher organic growth within the segment.

ROP’s Adjusted EBITDA Margin (Company Data, GS Analytics)

Looking forward, I believe, adjusted EBITDA and EBITDA margin should grow in 2023. In the Application Software segment, the addition of high margin Frontline Education should help the segment to recover its EBITDA margin. In the Network Software business, healthy market conditions in the majority of its businesses should help boost volumes and adjusted EBITDA margin. In the Technology Enabled Products segment, easing supply chain challenges should be beneficial for the margins. So, I am optimistic about the company’s margin expansion prospects.

Valuation and Conclusion

Roper is currently trading at a P/E of 27.17x 2023 consensus estimate of $15.96. This is slightly below its 5-year average forward P/E of 28.28x. Looking forward, I believe, the company should be able to deliver good growth helped by an improved portfolio, higher levels of recurring revenue, and healthy market conditions for the majority of its businesses. Further, I am optimistic about the long-term value creation potential as the company continues to focus on transitioning towards a high-margin, less cyclical business portfolio. Hence, I believe long-term investors can consider taking a long position in the stock.

Be the first to comment