Alena Kravchenko/iStock Editorial via Getty Images

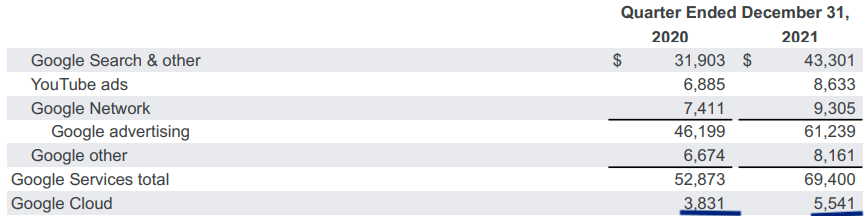

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is showing strong progress in the cloud business, with a growth rate higher than many of its peers. It reported quarterly revenue of $5.5 billion for cloud business in the recent quarter. This equates to a $22 billion annualized revenue rate. Even at this massive revenue scale, the YoY growth was 45%. The operating income for Google Cloud improved from negative $1.2 billion to negative $0.89 billion. This has led to a positive swing in operating margin of 16 percentage points compared to year-ago period.

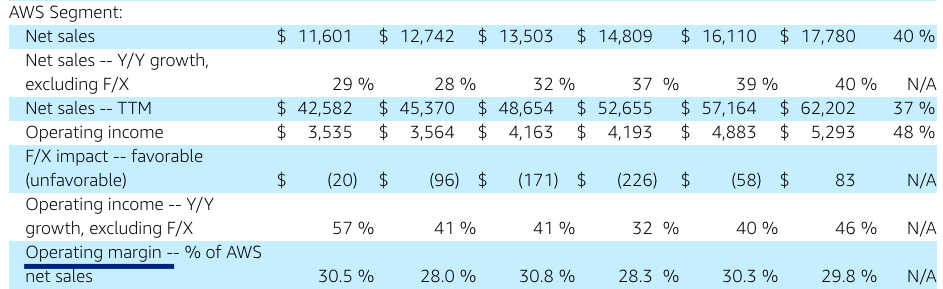

Google Cloud is still way behind Amazon’s (AMZN) AWS in terms of operating margin. AWS has regularly shown operating margin of 30%. As Google Cloud shows the benefits of economies of scale, we should see smaller margin gap with the market leader AWS. If Google is able to maintain the current revenue growth, the cloud division alone will be contributing $100 billion in revenue by 2025. Better operating margin in this business can also lead to additional operating income of $15 billion to $20 billion by 2025. Hence, Google Cloud would be one of the key drivers for top line and bottom line growth in the near term and will also be a key pillar for better valuation multiple for the stock.

Robust growth momentum and future risks

Google Cloud is already a core service for the company contributing $22 billion in revenue on an annualized rate. Even at this base, the company has managed to show 45% YoY growth. This growth momentum is due to rapid progress of Google Cloud in the domestic U.S. market as well as international regions.

Company Filings

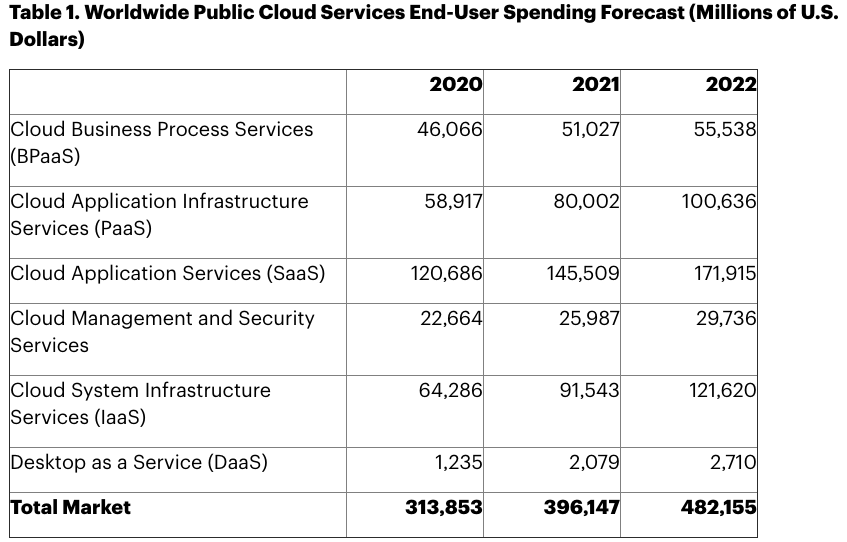

The cloud industry is also undergoing some massive changes. Many clients are looking at using a mix of cloud service providers instead of relying on a single company. This should help Google as it is still a smaller player compared to Amazon and Microsoft (MSFT).

Gartner

According to recent estimates, cloud spending would continue to increase over the next few years as new services are transferred to the cloud. This will be a big tailwind for Google Cloud growth. If the company can maintain 35% to 40% YoY growth, we should see annual Google Cloud revenue jump to $100 billion by 2025. The recent quarterly revenue was $75 billion or $300 billion on an annualized basis. If Google Cloud delivers the growth rate estimated above, it will be a key factor behind the top line growth of the company in the next few years.

There is a risk that the above estimates do not materialize. Amazon, Microsoft, Google, and other cloud players are showing strong growth momentum. However, it remains to be seen if we might soon see a ceiling in terms of revenue. Once the industry reaches maturity, the growth rate would decline for all companies. The margins might also decline as all cloud companies battle to gain a higher market share. Currently, the growth phase does not seem to be over. Many business sectors are rapidly moving to cloud platforms and reducing their own in-house infrastructure.

Google could take advantage of the current dynamics in this industry and continue to deliver 35% to 40% YoY growth over the next few years which should help it reach $100 billion revenue rate by 2025. Better economies of scale should also help Google improve its margins significantly.

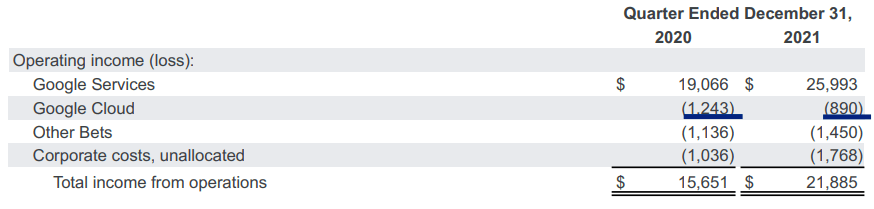

Improvement of margin

Revenue growth without margin improvement would not help Google. There is a 45% margin gap between AWS and Google Cloud. This will likely shrink significantly in the next few quarters as the revenue base of Google Cloud increases. In the recent quarter, Google Cloud reported operating income of negative $0.89 billion compared to negative $1.2 billion for the year-ago period. However, the impact on operating margin is even bigger due to higher revenue base. In the year ago quarter, the operating margin was negative 32% while in the recent quarter it is negative 16%. This is a 16 percentage point positive swing within a year.

The main reason behind this massive 16 percentage point swing in margin is the benefit of economies of scale. Future revenue growth should further help in improving the margin as the infrastructure cost could be divided among more clients giving better utilization.

Company Filings

Google is still behind AWS in terms of operating margin. Amazon has regularly shown a 30% operating margin in AWS while also reporting strong revenue growth.

Company Filings

Ideally, as the revenue base of Google Cloud increases, the margin gap between AWS and Google Cloud would also shrink. AWS has a revenue rate of $68 billion while Google Cloud is currently at $22 billion. It should certainly be possible for Google to increase operating margin within Google Cloud to 20% by 2025. At this rate, the operating income for Google Cloud would be $20 billion on a revenue base of $100 billion. Currently, Google has annualized operating income of close to $80 billion. Hence, Google Cloud will be a main contributor to operating income growth for the company if there is continuous improvement in margins for this service.

Impact on stock

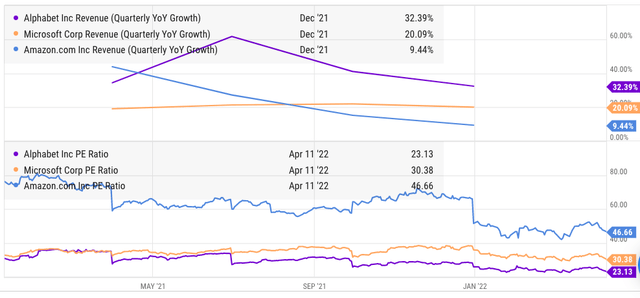

The future growth and margin of Google Cloud are not adequately priced in for Alphabet stock. The stock is trading at a lower PE multiple compared to Amazon and Microsoft. AWS contributes close to 60% of the operating income of Amazon and also a similarly big share of the valuation. Microsoft is also trading at a much higher multiple compared to Google while showing lower revenue growth.

There are no direct comparisons for Google Cloud service. However, we can look at Microsoft stock which trades at 12 times its P/S ratio. Google Cloud has a higher revenue growth rate and a strong potential for margin improvement. If we put a PS ratio of 15 to 20 for Google Cloud, the standalone valuation of this service would be close to $500 billion or more than 30% of the current market cap of the company.

If Google Cloud ends up reaching the $100 billion revenue rate by 2025 with a good margin, the standalone valuation of this service would also increase dramatically. Even at a very modest PS ratio of 10, Google Cloud should have a standalone valuation of over $1 trillion by 2025. Hence, Google Cloud will be a key valuation driver for Alphabet stock in the next few years.

Investor takeaway

Google Cloud is showing 45% YoY revenue growth and has reached annualized revenue rate of $22 billion. There has been a 16 percentage point improvement in operating margin over the last year. We should see further margin improvement as the margin gap with AWS shrinks. At the current growth trajectory, Google Cloud should hit $100 billion in revenue by 2025 which will make it a key driver for top line and bottom line growth and will also be the main contributor to valuation.

At a P/S ratio of 15 to 20, Google Cloud is already worth close to $500 billion, with a potential for better valuation as the revenue base and margin increase. Investors should closely look at the revenue, margin, and industry trends to gauge the future potential of Google Cloud and its impact on Alphabet stock.

Be the first to comment