CreativaImages

Introduction

I like writing about under covered stocks on SA, and today I’m taking a look at MedAvail Holdings (NASDAQ:MDVL). It’s a company focused on pharmacy automation kiosks and the growth of its business looks compelling. However, the operating expenses are high and the company is set to run low on cash again soon. I think that another stock dilution seems inevitable in the near future. Overall, I don’t think that the business is worth much in its current state and I’m bearish. Let’s review.

Overview of the business and financials

MedAvail is a pharmacy technology and services company whose main product is a MedCenter. This is a pharmacist controlled, customer-interactive, prescription dispensing system that looks somewhat like an ATM on the outside.

MedAvail

It’s an interesting concept but there are several competitors with a similar business, including Omnicell (NASDAQ: OMCL) Dispension Industries, Pharmaself24. What MedAvail is offering doesn’t seem to be unique.

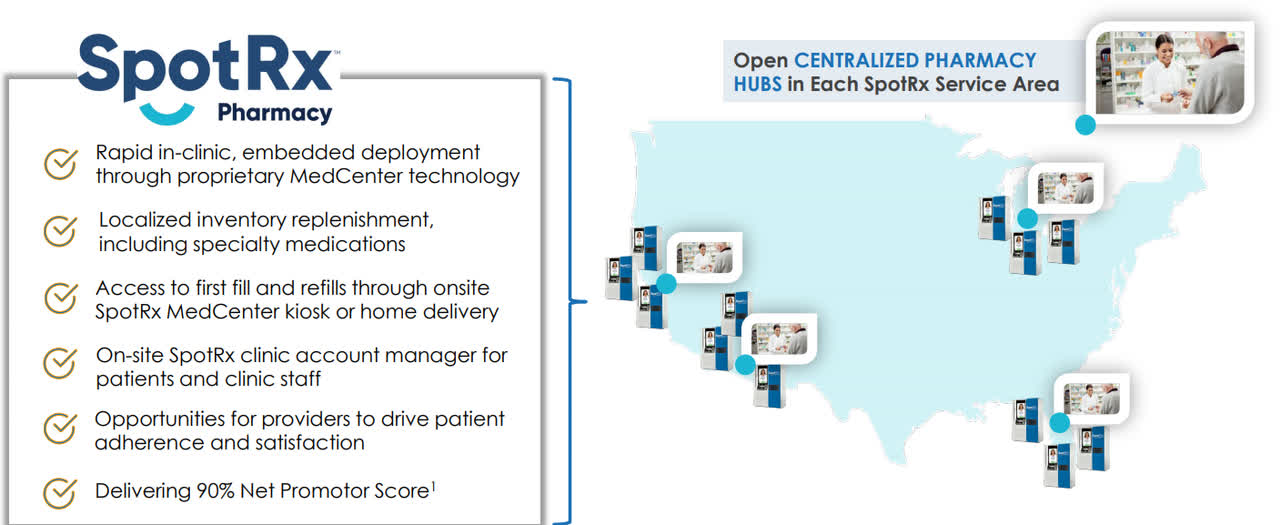

The company also operates full-service retail pharmacies under the SpotRx brand that use its automated pharmacy technology. MedAvail has bet on a hub and spoke model and it currently has operations in the states of Arizona, California, Michigan, and Florida. It plans to set foot in Texas and Illinois in the near future. MedAvail has partnered with several large brands, including IMA Medical Group, CareMore Health, Cigna (NYSE: CI), and Cano Health.

MedAvail

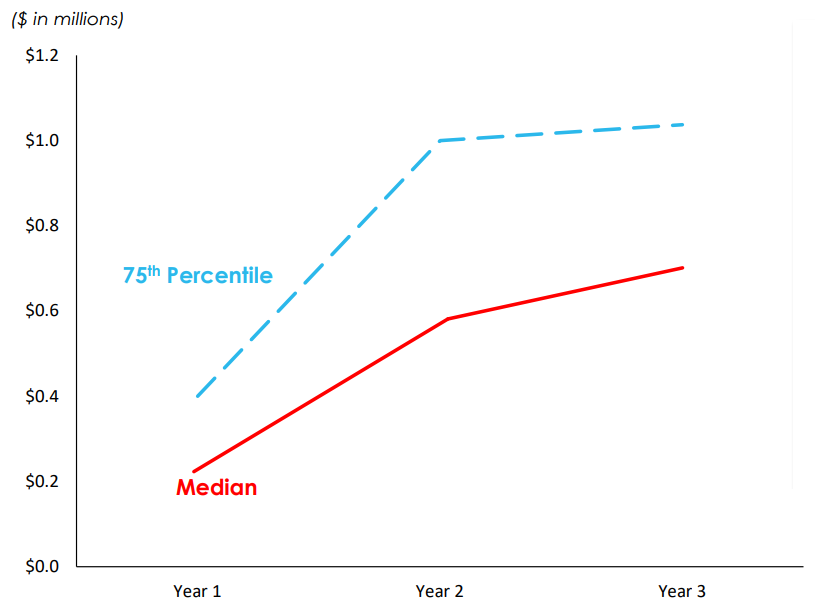

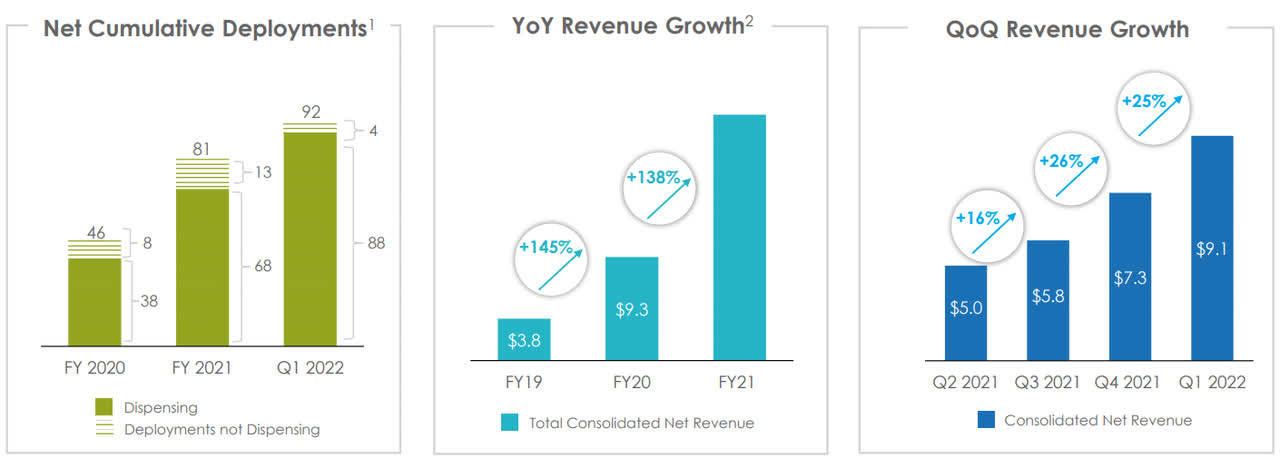

The dispensing units usually ramp up to $1 million in annual revenues by their second year. As of December 2021, MedAvail had a total of 13 dispensing units that were operating for over 18 months, and it plans to set up about 25-30 dispensing units in 2022. For the graphs below, note that net cumulative deployments exclude decommissioned clinics, pilot and demo sites.

MedAvail MedAvail

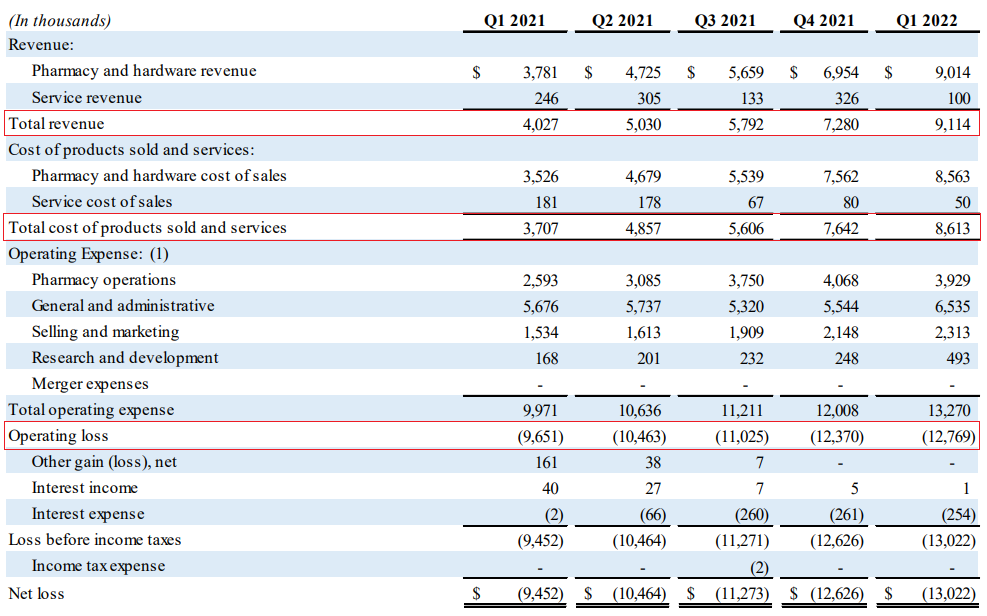

In Q1 2022, retail pharmacy and hardware revenues increased by 126.3% year-on-year thanks to a $5.4 million increase from volume growth in prescription revenue at existing sites as well as new sites in Florida and Michigan. Unfortunately, there don’t appear to be significant economies of scale as the total cost of products sold and services soared by 132.3% to $8.61 million. In addition, operating expenses rose by 33.1% which led to a widening of the operating loss of MedAvail to $12.8 million in Q1 2022.

MedAvail

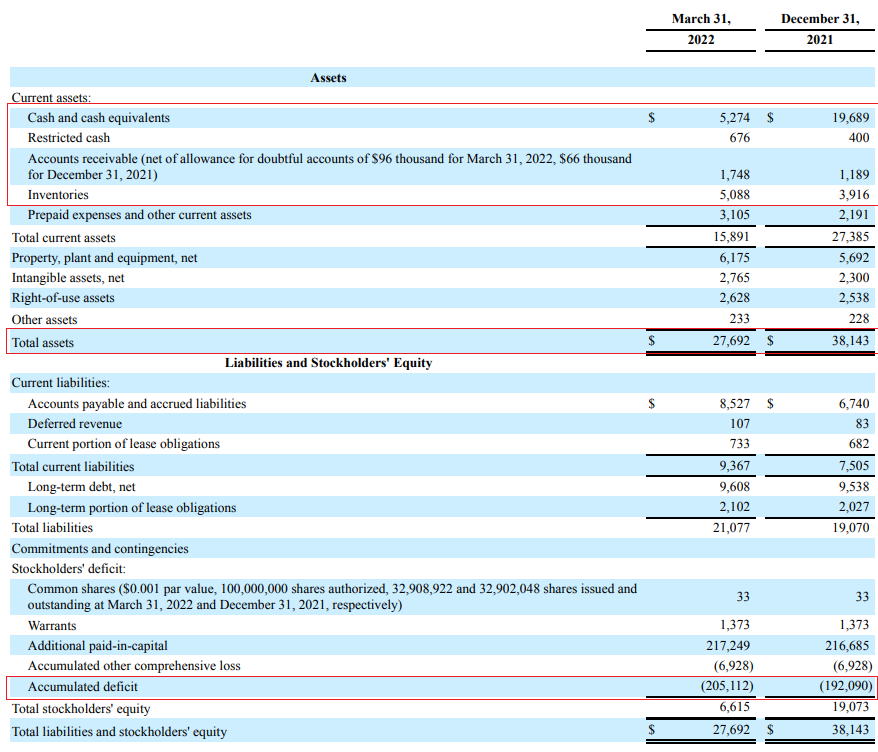

Looking at the future, the targeted milestones listed in MedAvail’s latest corporate presentation include increasing the network of dispensing MedCenters to more than 100 in existing markets. I don’t think this should be hard to achieve considering there were already 88 dispensing units in operation as of March 2022, up from 68 units in December 2021. The company also aims to reduce its quarterly cash burn by 20% by improving its gross margin and achieving greater hub pharmacy utilization. It also highlighted a procurement strategy for sourcing pharmaceuticals at optimal cost to drive utilization and the appropriate mix of medications. However, I don’t see a path to profitability anytime soon considering the gross margin hasn’t seen much improvement over the past few quarters and that the operating loss has increased by over 37% in just a year. In my view, this is a major issue as it has led to an increase of net cash used in operating activities to $13.3 million in Q1 2022, compared to $9.8 million a year earlier. As a result, MedAvail closed March with cash and cash equivalents of only $5.27 million. The company then raised $40 million through the issuance of 37.6 million shares at $1.0625 apiece in April 2022. Yet, I think that another large private placement is likely to take place around the end of 2022 due to the increase of cash used in operating activities. I think that more stock dilution seems inevitable at the moment.

Turning our attention to the balance sheet, we can see that MedAvail has an asset-light business model and cash, receivables, and inventories accounted for almost half of the $27.7 million in total assets at the end of Q1 2022. I find it concerning that the accumulated deficit has surpassed $200 million.

MedAvail

Overall, I expect MedAvail to continue growing its revenues at a rapid pace and I think the annual run rate could surpass $50 million by the end of 2022. However, the gross margin is barely positive and when you add operating expenses, the picture isn’t pretty. And with net cash used in operations growing rapidly, I think that another large capital increase is likely in a few months. I’m bearish but I don’t think that this is a good time to be short selling MedAvail. According to data from Fintel, there are 250,000 shares available for borrowing as of the time of writing but the short borrow fee rate is 79.39%. And if you want to rely on put options instead, the lowest available strike price at the moment is $2.50.

Looking at the risks for the bear case, I think there are two major ones. First, I could be wrong about the lack of value in the business of MedAvail. The company has an interesting product and I think it’s possible it could become a takeover target for a large pharmacy chain looking to diversify its business. Second, sometimes the share prices of microcap companies can increase for spurious and unknown reasons, and it’s possible that this could happen here in the future.

Investor takeaway

MedAvail started out as a prescription drug-dispensing kiosks startup back in 2012 and I think that it has accomplished a lot over the past decade. The company continues to grow rapidly but the issue is that the operating margins don’t look good which leads to significant cash burn. I don’t expects the situation to improve anytime soon and it seems that another large capital increase around the end of the year is likely.

I’m bearish on MedAvail but I think this isn’t a good moment for short selling its stock as the short borrow fee rate is almost 80%. In my view, risk-averse investors should avoid this company for now.

Be the first to comment