bravo1954/E+ via Getty Images

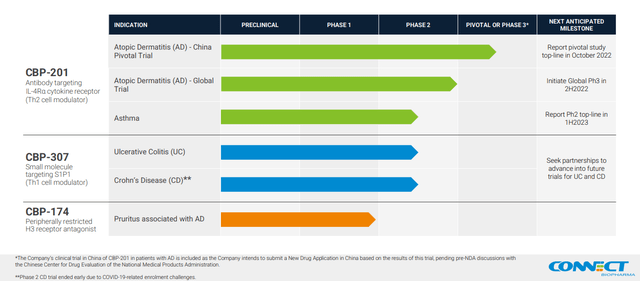

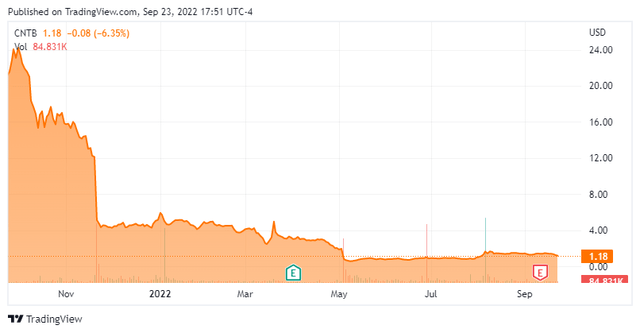

Connect Biopharma Holdings Limited (NASDAQ:CNTB) is a microcap (<$75 million) biopharmaceutical company developing T cell-driven therapies to chronic inflammatory diseases with 3 drugs in the clinical-stage (Figure 1). On their Sept. 13 fiscal 2022 half year report was an announcement that they expected top-line results next month for the pivotal CBP-201 atopic dermatitis (or AD) trial in Chinese adults. CBP-201 is an antibody targeting interleukin-4 receptor alpha (IL-4Rα) like Dupixent, the blockbuster drug jointly sold by Sanofi (SNY) and Regeneron (REGN). Previously in November 2021, the WW001 global Phase 2 AD clinical trial met its primary efficacy endpoint, but Connect Biopharma didn’t provide immediate specifics. The market dropped the stock 58% (Figure 1) as it took the lack of details as an unfavorable comparison to Dupixent. Subsequent analyses released in January didn’t lift the share price. Nevertheless, the explanations shared by the company were reasonable, and the actual results bolster the likelihood of success in China.

Figure 1. Pipeline, Page 4 of September 2022 Corporate Presentation

Connect Biopharma pipeline (Connect Biopharma)

Figure 2. One-year price chart

Connect Biopharma price chart (Seeking Alpha)

A Huge Showcase Opportunity for CBP-201

On July 11, Connect Biopharma said that China’s Center for Drug Evaluation of the National Medical Products Administration (or CDE) had deemed a positive primary efficacy analysis based on the 255 patients already enrolled, together with data from the CBP-201 Phase 1 and global Phase 2 AD trials, would be enough to support the filing of a New Drug Application in that country. CBP-201 patients in the current study received a loading dose of 600 mg followed by 300 mg every two weeks (Q2W). The primary endpoint is the Investigator’s Global Assessment (or IGA) 0,1 response rate, which is the proportion of patients whose IGA score is 0 and/or 1 (“clear/almost clear” skin) with a decrease of IGA score by at least 2 points from baseline, as measured through the first 16 weeks (Stage 1 of the treatment period) of the 60-week trial. Key secondary endpoints include Eczema Area and Severity Index (or EASI)-50/75/90 response rates, which are the proportion of patients with ≥50%/75%/90% improvement in EASI score from baseline to week 16. Per CDE recommendations, IGA and EASI response rates will be analyzed as co-primary endpoints.

The 300 mg CBP-201 Q2W is the strongest regimen tested so far, and the only cohort in WW001 that demonstrated statistically significant improvement (p value<0.001) in the primary endpoint of EASI % reduction from baseline at Week 16 (-63% vs -40.7% for placebo), as well as multiple key secondary endpoints listed in Table 1. Scores on the EASI range from 0 to 72, while the IGA ranges from 0 to 4, with higher scores indicating greater severity on both scales. There was also a greater treatment benefit of CBP-201 among patients enrolled in the China sub-population (-82.9% vs -34.9% for placebo).

Table 1. Efficacy results of WW001

|

Full analysis set |

Placebo |

China subgroup |

Placebo |

|

|

EASI-501 |

54.4% |

33.9% |

50.0% |

33.3% |

|

EASI-752 |

47.4% |

14.3% |

50.0% |

0.0% |

|

IGA 0 or 13 |

28.1% |

10.7% |

33.3% |

0.0% |

1 % of patients with ≥50% improvement in Eczema Area and Severity Index score from baseline to week 16

2 % of patients with ≥75% reduction in EASI score from baseline at week 16

3 % of patients with 0 or 1 point on Investigator’s Global Assessment and ≥2-point reduction in IGA from baseline at week 16

Although it is a me-too follow-up to Dupixent, CBP-201 has the potential to be best-in-class among IL-4Rα antagonists. In 2020, a Phase 1b study exhibited early, rapid and durable improvements in several measures. At week 4, EASI change from baseline was 74.4% for the 300 mg dose compared with 32.9% for placebo. Additionally, 42.9% of patients receiving 300 mg achieved a score of 0 or 1 in the IGA, compared with 12.5% in the placebo group. IGA response is the primary efficacy endpoint required for FDA approval.

Value and Financial Outlook

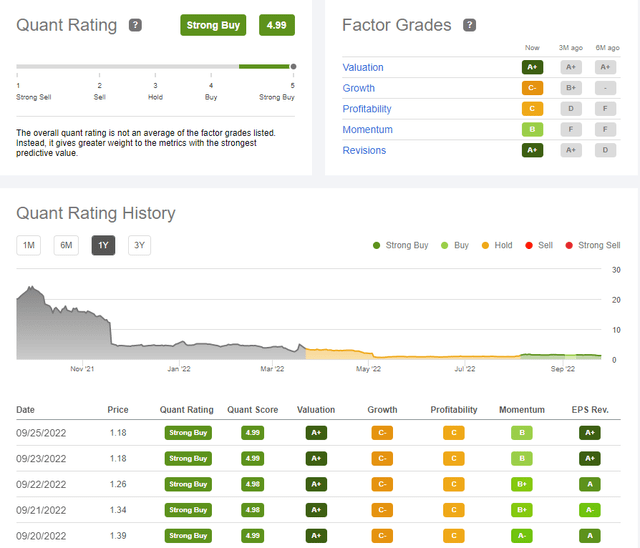

According to Quantamental analysis, Connect Biopharma has been a deep value Strong Buy play for a while (Figure 3) and is trading well below cash. Liquidity is not a problem. As of June 30, 2022, the company had $212.9 million in cash, cash equivalents, and investments, which CFO Steven Chan stated was sufficient to fund operations into at least 2024, but cash outflows suggest a need for financing if no partnership help is acquired before the end of next year. H1 2022 operating loss was $60 million, of which research and development expenses took $50.8 million while supporting 6 trials involving all three clinical drugs. Two studies ended: the Phase 1 trial of CBP-174, a peripherally acting antagonist of histamine receptor 3 for the treatment of pruritus associated with AD; and a Phase 2 trial of CBP-307, a modulator of a T-cell receptor known as sphingosine 1-phosphate receptor 1, for the treatment of ulcerative colitis (UC). Another two have been terminated early, and the asthma study recruitment is slower than expected, so H2 R&D should be lower. The global Phase 3 initiating by year end might eventually enroll more than 600 patients, assuming patients will be randomized in a 2-to-1 ratio to receive either CBP-201 or placebo, and 200 patients in the control group, as in the Dupixent pivotal trials. Consequently, R&D will increase in 2023, but gradually because it takes longer to set up clinical sites over several countries. H1 administrative expenses totaled $10.7 million and may likely stay in the $10-12 million range for the next year. It is reasonable to expect the company to end 2022 with at least $160 million and burn $75-80 million in H1 2023.

Figure 3. Quant Rating

Connect Bio has practically put all its eggs in one basket. If the trial meets the primary endpoint, which it likely will, they may not need financing at all. Since they hold global rights to a potential second-to-market to Dupixent, CBP-201 will draw heavy interest, even if it ends up making a fraction of the original. A mere 10% penetration of the first-in-class agent (Dupixent Q2 sales were over $2 billion) would project to at least $800 million in sales annually, or over 10 times CNTB’s current market cap.

Risks

The greatest risk is for the China-specific trial to fail. That would render its Stage 2 irrelevant and likely derail the current plans for the worldwide 4-trial Phase 3 AD program. Since the Phase 2 study in chronic rhinosinusitis with nasal polyps was terminated due to disruptions from COVID-19 and the Ukraine War, any residual hopes for CBP-201 hinge on the readout for the asthma Phase 2b trial, which CEO Zheng Wei said was delayed 6 months to H2 2023. With nothing else on the horizon for a year, CNTB shares would probably sink well below $1, miss regaining compliance with Nasdaq Global Market’s $1 minimum price requirement, and get demoted to the third tier Capital Market.

Even if positive, the results may, like WW001, not meet market expectations. Differences exist between trial designs and subjects enrolled, so caution should be exercised when comparing data across trials; but a cursory glance at the performance of the Dupixent dose that was ultimately approved (Table 2) show it to be numerically greater than CBP-201 in WW001.

Table 2. Efficacy results of Dupixent in major trials of adult subjects with moderate-to-severe AD, using the current recommended initial dose of 600 mg, followed by 300 mg given every other week (Q2W)

|

Dupixent |

Placebo |

Dupixent |

Placebo |

Dupixent |

Placebo |

Dupixent |

Placebo |

Dupixent |

Placebo |

|

|

EASI-50 |

78.1 |

29.5 |

68.8 |

24.6 |

65.2 |

22.0 |

80.2 |

37.5 |

70.7 |

28.9 |

|

EASI-75 |

68.8 |

23.0 |

51.3 |

14.7 |

44.2 |

11.9 |

68.9 |

23.2 |

57.3 |

14.5 |

|

IGA 0 or 1 |

39.1 |

11.5 |

37.9 |

10.3 |

36.1 |

8.5 |

38.7 |

12.4 |

26.8 |

4.8 |

The company reported median baseline EASI scores of 20.1 to 22.1 and 25% to 40% having IGA score = 4 in the WW001 patient population. They noted that patients started with a lower AD disease severity than what was observed in Dupixent trials (Table 3). It is easier to show improvement in a sicker population, especially compared to those taking placebos.

Table 3. Clinical characteristics of Dupixent trial patients at baseline

|

CHRONOS |

SOLO 1 |

SOLO 2 |

LIBERTY AD CHRONOS |

Chinese Phase III |

||||||

|

Dupixent |

Pbo |

Dupixent |

Pbo |

Dupixent |

Pbo |

Dupixent |

Placebo |

Dupixent |

Placebo |

|

|

IGA 4 |

49.2 |

47.5 |

48.2 |

49.1 |

49.4 |

48.7 |

50.0 |

46.7 |

57.3 |

55.4 |

|

EASI median |

33.8 |

32.9 |

30.4 |

31.8 |

28.6 |

30.5 |

30.9 |

29.6 |

30.3 |

31.0 |

The treatment arm also had a very high patient discontinuation rate of up to 19%, mostly due to withdrawing consent or patients being lost to follow-up. This is in comparison to the 6.3–9.5% rates cited for prior anti-IL-4Rα Phase 3 trials. In addition, there were ZERO discontinuations owing to treatment-emergent adverse events from the 300 mg Q2W group. Missing data in drug research is pervasively handled using the Last Observation Carried Forward (LOCF) approach, which is what regulatory agencies such as the FDA require. In the case of WW001, the numerous discontinuations could have biased the results. While missing data would’ve been split among the placebo and treatment groups, the active group is unfavorably affected since LOCF replaces the missing data with earlier values that tend to be higher (worse) than the true missing values because CBP-201 didn’t have enough time to work yet, thus understating the benefits of the treatment.

Conclusion

It is a real possibility that some clinical sites could’ve been disrupted somehow as part of China’s zero-COVID-19 policy. Large cities lockdowns throughout the year include Ningbo, Shanghai, Shenzhen, Dongguan, Shenyang, Wuhan, and Chengdu. Nonetheless, despite all the problems that plagued WW001, the 300 mg Q2W group hit all its goals, so the chances of outright failure for the China study are remote. If the unthinkable happens, then Connect Biopharma will still have $200 million that’s no longer tied to supporting CBP-201, as well as two clinical assets that are worth something.

While less likely than a stellar readout, lower-than-anticipated response rates still leave the door open for approval. If it is, and the fast onset is confirmed, CBP-201 will be competitive in the AD space. Speed is king, unlike in clinical trials where onset times are averaged. In real-life, dermatologists will notice the quick results. Since it wouldn’t be good practice to have patients waiting weeks longer for improvement on other agents, prescribers will try CBP-201 first, keep patients for whom it works, and possibly switch the non-responders to alternative treatments.

To conclude, biotechs are risky buys in the best of times, but unprofitable (those with no marketed products) small-cap stocks are especially vulnerable in a bear market. Even the typical run-up in front of a clinical trial result has been absent. However, if this study impresses, this is a contrarian opportunity in China that could indeed make CNTB a multi-bagger. The company anticipates a new drug application in 2024 and possible approval as early as 2025. Sanofi executives have placed that country’s adult AD market at 900,000. A month after placement on China’s National Reimbursement Drug List, Dupixent was used on 1,000 patients, growing to 30,000 patients after 3 quarters! Assuming China pays half of what Dupixent costs in the U.S. (~$2,000 per 300 mg dose), and if CBP-201 is initially tried on only 200 patients and grew to 5,000 after a year, those patients staying long-term on it would represent $120 million in sales annually as early by 2026. Although realistically, Connect Bio will be a partnership or acquisition target way before then.

Be the first to comment