Sundry Photography/iStock Editorial via Getty Images

The Coca-Cola Company (NYSE:KO) just reported its Q2 earnings which beat expectations highlighted by solid growth despite the difficult macro environment. Indeed, the company has once again reaffirmed its blue-chip status as a market reference point for high-quality fundamentals. Shares have outperformed this year and we see more upside going forward with the financial trends justifying a higher premium for the stock. We like KO as a consumer staples leader that is well positioned to continue delivering positive returns over the long run.

Coca-Cola Earnings Recap

We last covered KO with an article back in 2020 arguing that the company was set to emerge “stronger out of the pandemic”. From the historic disruptions to the business that year, management took the opportunity to streamline the global footprint with a focus on top-performing core brands. Efforts over the period include exiting some niche beverage products while also accelerating a corporate consolidation to generate cost savings. In many ways, the latest quarterly results confirm the strategy is paying off.

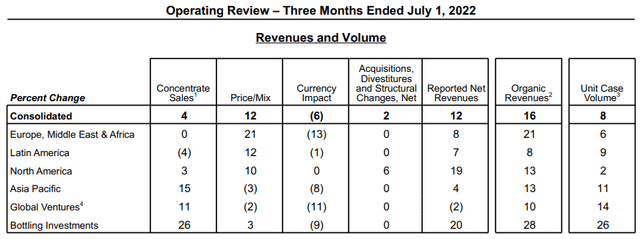

Q2 non-GAAP EPS of $0.70 increased 4% year-over-year and came in $0.03 above the consensus. Similarly, net revenue of $11.3 billion climbed 12% from the period last year or 16% organically. The story here is that since reshaping its portfolio by “retiring” over 200 products, the effort has allowed for greater control of pricing actions in the most profitable categories. On this point, Q2 sales benefited from a 12% increase based on pricing and sales mix which was further boosted by a 4% consolidated increase in concentrate volume.

Management explains that the results this quarter also captured a continued improvement in fountain sales globally which were limited in 2021 during the early stage of the post-pandemic reopening. The strength here was global with all regions generating positive unit case volume growth and higher organic revenue over Q2 2021. Coca-Cola explains that the company has gained market share in the total nonalcoholic ready-to-drink beverages category.

The comparable operating margin at 30.7% fell 100 basis points from 31.7% in Q2 2021, pressured by some currency headwinds considering a stronger US Dollar along with some ongoing charges related to the 2021 acquisition of “BODYARMOUR” sports drink. Nevertheless, the “underlying” operating margin increased 40 basis points based on the top-line growth.

Overall, this was a strong earnings report that helped brush aside concerns that the company was getting hit by global inflationary cost pressures or facing a demand cliff on fears consumers are cutting back on packaged beverages.

In terms of guidance, an important update here is that Coca-Cola is revising higher its full-year currency-neutral non-GAAP EPS growth target between 14% and 15%, compared to a range of 8% to 10% discussed back in Q1. The “comparable EPS” growth guidance between 5% and 6% implies a target of $2.45 compared to $2.32 in 2021. The more favorable earnings outlook here considers the stronger Q2 sales trends which pushes the full-year organic revenue growth forecast to a range of 12% to 13%, from the old 7.5% midpoint guidance. Finally, we’ll note that the company expected to generate $10.5 billion in free cash flow this year.

Is Coca-Cola a Good Long-Term Investment?

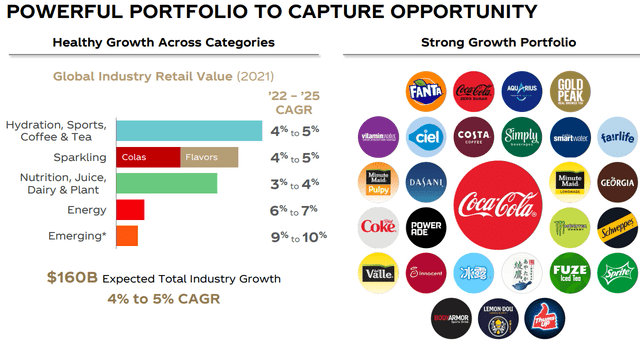

It’s easy to get caught up in the short-term headlines and lose track of the big picture of what makes Coca-Cola such a great company. The attraction here is its brand portfolio that goes beyond just “Classic Coke” with several other brands that are established leaders in emerging and high-growth beverage categories. Management explains that the global industry is expected to generate an average annual growth rate between 4-5% in terms of retail value through 2025. The opportunity for Coca-Cola is to further consolidate its market position by leveraging its global logistics infrastructure and bottling partner relationships.

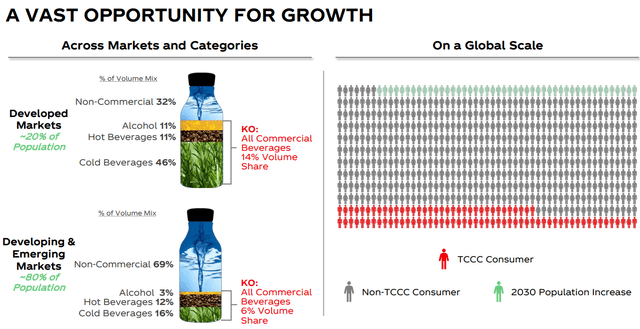

An important dynamic to consider is the growth potential of developing and emerging markets. The idea here is that from the 20% of the world’s population in countries classified as developed, KO maintains a 14% share of all beverage sales by volume. On the other hand, the company’s share in developing and emerging markets is less than half at 7% given the majority of consumption is based on non-commercialized beverages. The potential that the market share spread converges over time represents billions of potential new consumers and a runway for steady long-term growth.

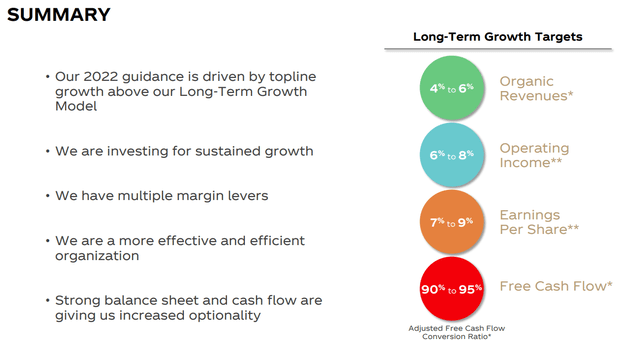

The outlook for Coca-Cola is supported by several structural tailwinds. The company expects to generate organic revenue growth between 4%-6% per year over the long run, while EPS can average a higher 7%-9% with an effort to expand margins. Notably, the 2022 guidance is above the long-term targets highlighting the strength of the business this year.

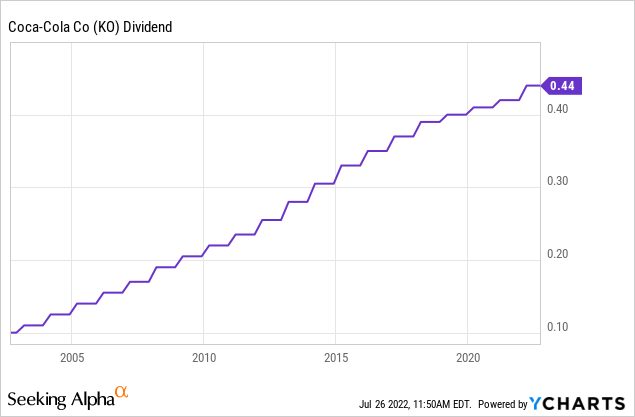

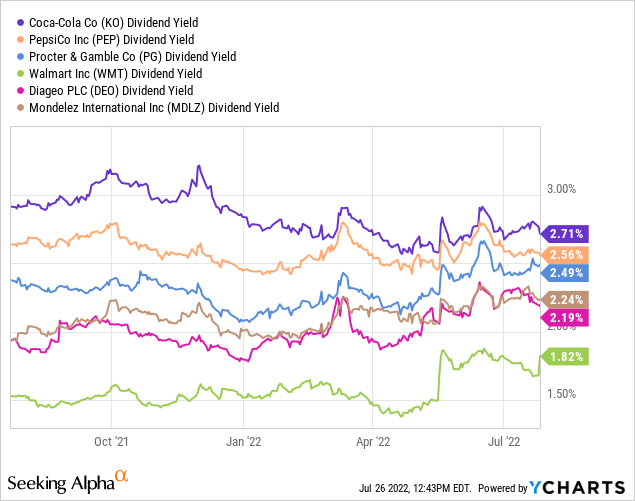

As it relates to KO being a good long-term investment, keep in mind that the company has increased its quarterly dividend in each of the last 60 years. With a current yield of 2.7%, the expectation is for continued annual dividend growth at least in line with earnings.

Is KO Overvalued?

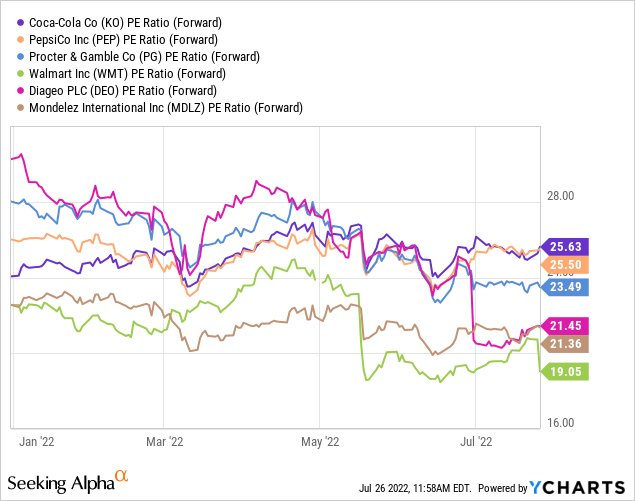

KO trading at a forward P/E of 26x represents a premium to most other consumer staples sector or beverage industry comparables. That said, we believe the spread to peers like PepsiCo Inc (PEP) trading at 25x or Procter & Gamble Co (PG) closer to 24x is justified based on Coca-Cola’s current operating and earnings momentum.

What we like about KO compared to its perennial competitor in PepsiCo Inc is that Coca-Cola has maintained its more pure-play on beverages profile while Pepsi has diversified into snacks and packaged foods over the last few decades. In our view, the beverages category is more defensive amid volatile economic conditions with consumers more likely to shift purchases of food types compared to drinks.

The Q2 results showed Coca-Cola management is effectively dealing with the challenging macro backdrop, at a time when other companies are struggling. Walmart Inc (WMT), for example, came out with updated guidance ahead of its quarterly report, cutting its earnings outlook. In other words, Coca-Cola’s strength explains why shares command a premium.

At the same time, other metrics can suggest shares are still undervalued. From the same peer group of stocks, KO’s dividend yield is the highest at 2.7%. The potential that the yield narrows towards the group average closer to 2.5% implies the share price has upside from here. Putting it all together, we won’t say KO stands out as incredibly cheap, but shares have room to reprice higher.

KO Stock Price Forecast

The call here is to stay bullish and expect more upside as KO benefits from its appeal as a low-risk and otherwise defensive profile amid volatile market conditions. We can also expect shares to gain momentum in an environment where the macro outlook improves adding an incremental tailwind of demand.

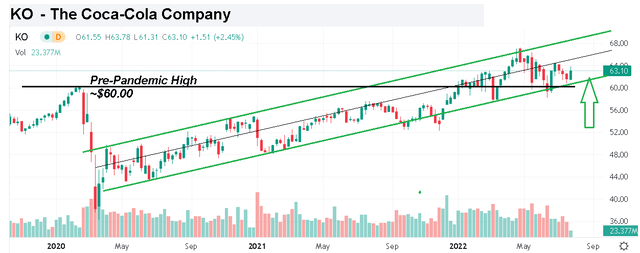

From the stock price chart, shares are currently trading above the pre-pandemic high of around $60.00 back in early 2020. The setup we see playing out is for a multi-year breakout as a continuation of the trendline that has been in place for nearly two years. As long as the company continues to execute on its strategy, and quarterly earnings confirm the earnings trajectory, shares should remain bid. To the upside, the next target is $67.00 which was the recent all-time high set in April.

Is KO Stock A Buy, Sell, or Hold?

In response to the argument that Coca-Cola stock is pricey, our take is that the latest Q2 earnings report confirms that KO deserves its premium valuation. We rate KO as a buy with a price target for the year ahead at $75.00, representing a 30x multiple on the current full-year consensus EPS. The bullish case is that earnings growth continues to outperform as the company generates financial efficiencies through pricing actions and its shifting sales mix.

The main risk to consider would be the potential for a deeper deterioration of the global economic conditions beyond the current baseline. A sharp drop in consumer spending or a new wave of global supply chain disruptions could undermine the earnings trajectory. Monitoring points for the next few quarters include the operating margin and free cash flow trends.

Be the first to comment