cagkansayin

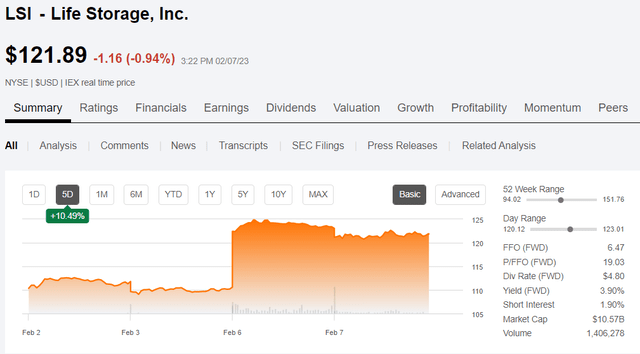

On February 5, after the market close, Public Storage (NYSE:PSA) publicly announced its intent to buy Life Storage (NYSE:LSI). The all stock deal would give 0.4192 shares of PSA for each share of LSI and represented a value about 19% above the unaffected price of LSI. As tends to happen with such announcements, the buyer’s price dropped and the targets price jumped up.

LSI was up more intraday, but it settled just over 10% above the unaffected price.

SA

Anytime there are this many moving parts it introduces the possibility of significant mispricing so I like to dive in and look for ways play it in an advantaged fashion.

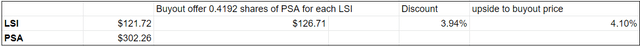

On Portfolio Income Solutions, I maintain a live spreadsheet of the currently outstanding real estate arbitrages, and this is the latest addition to the list. At the pricing as of the time of writing the LSI leg is about 4% cheaper than its proposed merger value.

Portfolio Income Solutions Arbitrage Tracker Spreadsheet

That’s a little bit bigger than a normal merger arbitrage spread, likely because the deal is not yet agreed upon. This article will examine the best ways to play the event.

With any sort of M&A we should consider the range of outcomes, how good or bad each outcome is and the relative chances of each outcome.

Scenarios to think about:

- Current offer accepted?

- Chance of higher offer

- Range of plausible higher offers

- Chance of higher offer accepted

- Recourse for PSA or shareholders if refused

- Downside if deal fails to manifest

Current offer accepted?

Prior to the public takeover attempt, PSA had contacted LSI privately and tried to get the deal done at essentially the same price. LSI management dismissed the buyout attempt so the public offer is PSA’s way of forcing LSI to reconsider, potentially with pressure from shareholders who want the buyout premium.

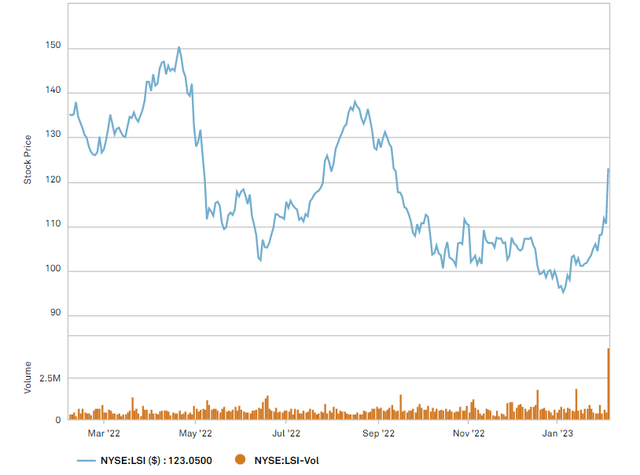

While it was a 19% premium against the unaffected price, it is worth noting that LSI has been down significantly, so the merger valuation is not out of the range of its norm.

S&P Global Market Intelligence

So while a good deal for LSI shareholders I don’t think it will stoke enough enthusiasm that investors will force management’s hand. Therefore, if PSA really wants to buy LSI, they will have to put in a higher bid.

Higher offer?

Big companies like getting bigger, particularly when they can take out one of their larger competitors in the process. So I am quite confident PSA wants to buy LSI, but it is a matter of being able to do so in a way that can be justified as financially responsible.

Thus, in assessing the possibility of a higher offer we should look at the financial merits of the merger to get a sense for how much wiggle room PSA has to increase while keeping the deal accretive.

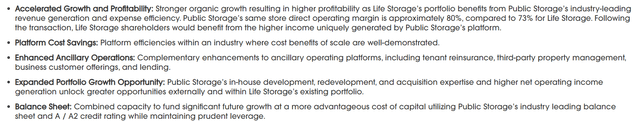

According the PSA’s press release, there are five types of synergies in the merger.

PSA

Some of these are valid, others are hopeful but unlikely to be significant.

I have covered the self-storage sector for the better part of a decade and have not been impressed by PSA’s property level operations. There has been a clear divide within the sector with CubeSmart (CUBE) and Extra Space (EXR) generating superior same store NOI growth with PSA and LSI lagging behind.

PSA fell behind in upgrading to internet based advertising and relied on the yellow pages long after EXR had entered the digital era.

Instead, PSA’s claims to fame are its size, balance sheet and highly conservative decision making. This company is solid, but I don’t think they will be getting too much in the way of revenue synergies or growth opportunities.

This leaves the main synergies as G&A savings, operational savings due to overlapping submarkets and potentially cost of capital advantages.

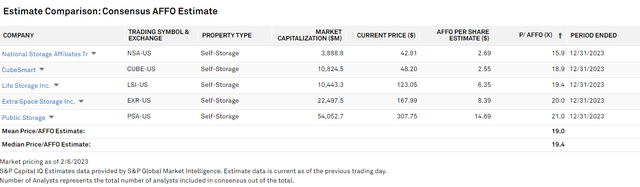

Beyond the synergies listed, I want to point out one more source of value creation from the proposed merger: valuation delta. PSA trades at a couple turns more expensive AFFO multiple than LSI which makes a stock for stock merger slightly accretive to AFFO/share by default.

S&P Global Market Intelligence

Note that the above AFFO multiples are at the merger adjusted prices. This gap implies that PSA could up the offer by about 10% and it would be AFFO neutral prior to synergies.

Synergies

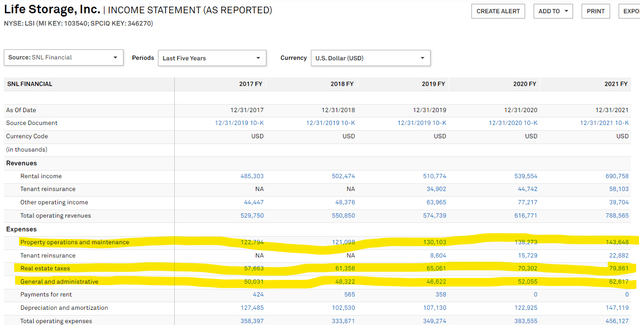

G&A savings is going to be by far the biggest bucket here. LSI management rakes in some rather hefty paychecks which has caused G&A to ramp north of $60 million per year. Most of LSI’s property operations fall under different expense line items which indicates the G&A is corporate overhead rather than property related operations.

S&P Global Market Intelligence

Since PSA has fully developed corporate and already exists in nearly all of LSI’s regions, almost all of the G&A can be eliminated on a run rate basis.

Severance will need to be paid and the golden parachutes are significant. After netting out these mitigating factors I would estimate the annual G&A savings to be roughly $50 million.

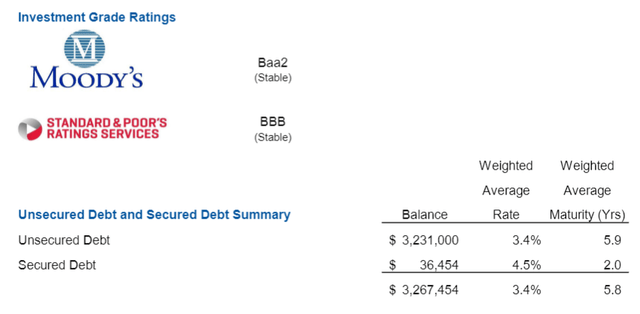

The other synergy bucket that seems like it would be material is cost of capital. With its mostly common and preferred structure, PSA has managed to achieve one of the strongest credit ratings among REITs. It certainly has access to a lower cost of capital than LSI.

However, there is an offsetting factor here in that the ability to refinance debt accretively is not based on the spread between PSA’s cost of capital today versus LSI’s cost of capital, but rather versus the cost of the already outstanding debt.

As it turns out, LSI had locked in some low cost debt making their weighted average cost 3.4%.

LSI

So while PSA has a fantastic balance sheet, there is absolutely no way they can refinance at less than 3.4% in an environment where the 10-year treasury is above that.

The Higher Offer

Ultimately I think PSA will come in with a slightly higher offer. I think the G&A run rate savings in combination with benefits of scale and market share is enough to make the deal palatable to PSA shareholders at a going in AFFO neutral price.

That would represent an offer about 10% higher than the current offer although PSA might try a 5% higher offer first and see if they get a bite.

A way to play it

I think there is some opportunity in buying LSI at current pricing. In addition to the roughly 4% arbitrage spread it could get an additional up to 10% from a higher bid from PSA.

That is significantly more upside than most arbitrage type plays. There are, however, two negative factors that have kept us to a very small position size.

- The deal could fall through even if PSA ups the bid. LSI management are young and probably want to keep their jobs. They could just reject despite the deal clearly being good for LSI shareholders because the process of a hostile takeover is long and costly such that it might not get pursued.

- Self-storage fundamentals remain in a rough spot. This makes it difficult to recover your capital if the deal doesn’t go through. The initial reaction after a failed merger is typically for the target to fall back down to the unaffected price which would be about 10% south of here. Since self-storage is weak and the AFFO multiple is fairly high I don’t see a great path to recover and would probably just have to eat the loss if the merger fails.

Thus, the viability of the play depends on the relative chances of a higher bid compared to merger failure. I think the chances are somewhat high for PSA to juice the offer, but it is really hard to put a number on it.

Be the first to comment