alexsl/iStock Unreleased via Getty Images

Tencent Has Been Mired In A Multitude Of Headwinds

After a protracted decline following a peak in February 2021, the share price of Tencent Holdings Limited (OTCPK:TCEHY)(OTCPK:TCTZF)(0700:HK) traded in a narrow range from late August 2021 to February this year. The half-year stabilization in TCEHY stock allowed shareholders of Tencent to heave a sigh of relief.

2022 was anticipated to be the recovery year and through mid-February, TCEHY stock established an ascending triangle pattern which is recognized in technical analysis as a bullish chart pattern. Unfortunately, the share price took a turn for the worse and plunged to levels not seen since late 2019, effectively giving up more than two years of gains.

The plethora of headwinds facing Chinese Internet stocks are well known: We can trace their falling from grace to the official scuttling of the initial public offering [IPO] of Alibaba Group’s (BABA) fintech arm, Ant Group, in early November 2020. Investors viewed the sudden suspension of the mega and highly sought-after IPO at the eleventh hour with shock and the idea that ‘Beijing is capricious’ began to propagate.

A series of regulatory tightening moves thereafter reinforced the thinking and the decimation of the for-profit after-school tutoring industry virtually overnight in late July 2021 led investors’ fear of Beijing’s resolve reaching the zenith. Outside of China, delisting concerns due to the Holding Foreign Companies Accountable Act [HFCAA] and trumped-up allegations that the Chinese government was planning to repudiate Variable Interest Entities [VIEs] exacerbated the bearish sentiment.

With the Chinese internet companies operating under a harsher regulatory environment and fear mongers having a field day on what the U.S. government officials can do in their eagerness to ‘contain China’, related stocks continued to decline. The pressures from both Beijing and Washington even led to various quarters calling Chinese stocks “uninvestable”.

Although Tencent Holdings has its primary listing in Hong Kong – its TCEHY and TCTZF shares are traded ‘over-the-counter’ [OTC] – it was unable to escape the discount accorded to Chinese ADRs for the risk of delisting from U.S. stock exchanges. Besides being painted with the same stroke by market players for being Chinese, Tencent is also negatively impacted by the poor stock performances of its various investments – many of them are Chinese ADRs – as a holding company. Thus, it isn’t unfair that TCEHY is suffering from the same bearish sentiment ailing the sector.

Readers may have noticed in my earlier chart that a descending triangle pattern fitted the prevailing share price movement of TCEHY stock. Contrary to the bullish ascending triangle pattern, the descending triangle pattern is a bearish one. The last time something similar developed was May-July 2021 and the share price of TCEHY took a big tumble down thereafter.

An obvious negative driver for the current down leg is the economic damage resulting from the lockdowns in numerous areas in China, including the financial powerhouse province of Shanghai and the manufacturing hub of Guangzhou. The gaming unit of Tencent Holdings is well poised to benefit from the population stuck at home. However, with reduced business activities on closures, Tencent is seeing curtailed transactions on its payment app and will likely report lower advertising spending – a major contributor to its revenue – for the past weeks.

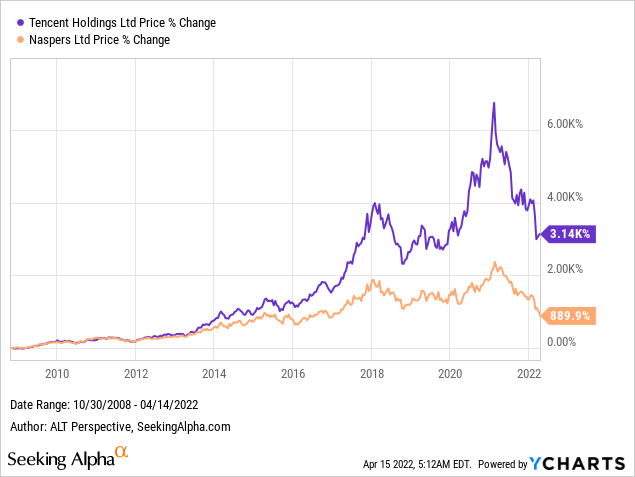

For long-term investors, the ups-and-downs of TCEHY stock are part-and-parcel of the tribulations-filled but rewarding journey of owning the social media and gaming giant. Naspers Limited (OTCPK:NPSNY)(OTCPK:NAPRF), a South African company that was an early investor in Tencent Holdings, was one such beneficiary. Its fortune ebbed and flowed with Tencent for the past decade and more. Since October 2008, TCEHY is up over 30 times even after the recent crash, while NPSNY is up nearly 9 times.

Naspers gains based on its hefty Tencent stake (YCharts)

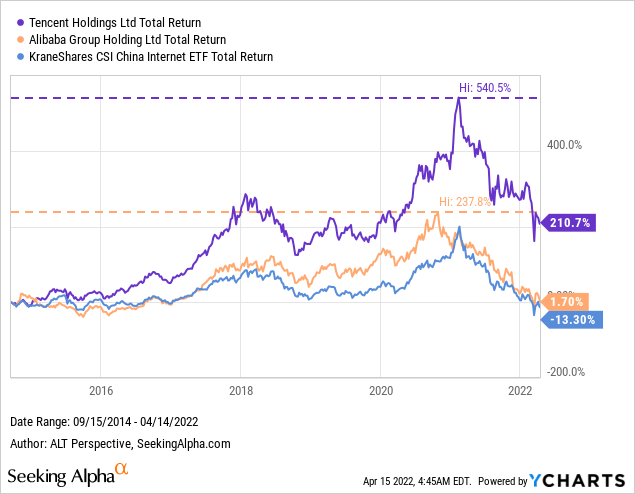

After the wallop following the suspension of Ant Group’s IPO, BABA stock began to slide and has since lost nearly all the gains post-IPO. In the same period, TCEHY managed to retain a 211% total return. At their respective peaks, BABA stock hit a total return of 238% while TCEHY doubled the feat, achieving a 541% total return.

Total returns of Tencent, Alibaba, and KWEB ETF (YCharts)

Is Tencent Stock Overvalued?

With TCEHY’s outperformance over BABA stock, it is no wonder that some of my friends questioned if Tencent stock is overvalued. The discussion may seem odd considering the big cut in the market cap of Tencent from its peak already.

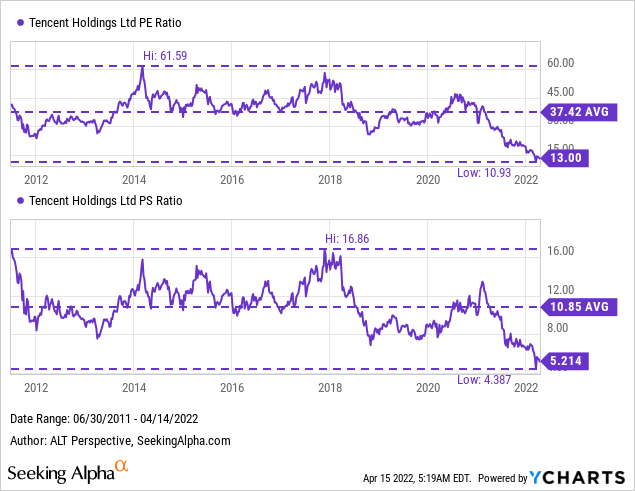

Indeed, Tencent Holdings’ PE ratio has fallen to a decade low of 13.0 times. This is a far cry from the high of 61.6 times it enjoyed in 2014 and also substantially lower than the multi-year average of 37.4 times. Tencent Holdings’ PS ratio has also crashed to a decade low of 5.2 times, against the peak of 16.9 times it was valued at in late 2017. The current PS ratio is less than half the multi-year average of 10.9 times.

Tencent Holdings Ltd PE ratio & PS ratio (YCharts)

It can be argued that the various challenges faced by Tencent may have crimped its profit outlook and its valuation multiples. For instance, the corporate donations that the Chinese Internet giants have pledged in support of the ‘Common Prosperity’ agenda propagated by Beijing, restrictions on gameplay and spending by minors, as well as the curbing of monopolistic practices with ‘walled gardens’ enabling high margins.

Tencent is showing its adaptability and monetization prowess

However, this would be assuming that Tencent is just sitting like a lame duck and unable to mitigate the situation. To assuage shareholders’ concerns, Tencent elaborated at length on its strategies for maintaining its strong market position and capturing growth opportunities.

On advertising, Tencent is expecting a growth recovery in late 2022 while new game releases would juice revenues from this year. Its cloud and long-form video businesses are expected to improve on profitability as the company reduces expenses on items like marketing. Given that its peers would similarly abandon a growth-at-all-costs mentality, Tencent should be able to maintain its market share despite lower spending.

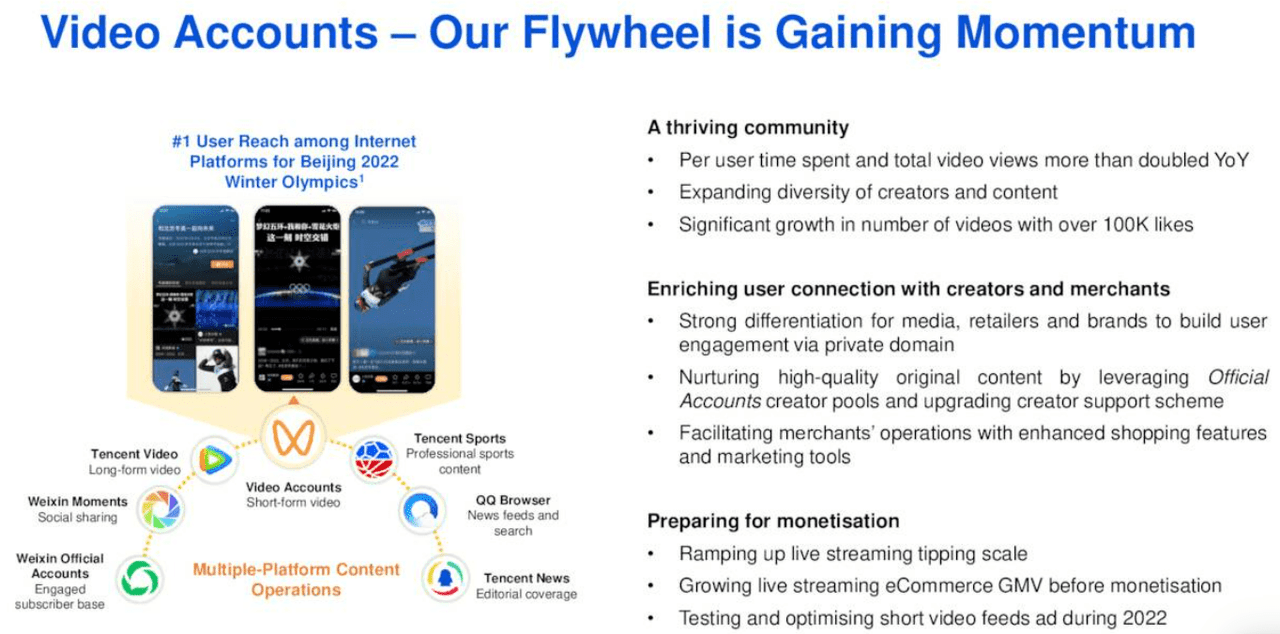

Tencent

The dire straits the gaming industry was in since last year due to the nine-month suspension of games approval could supposedly be a thing of the past with the Chinese authorities approving last week the first set of video game licenses since July 2021.

Naysayers may pick on the fact that Tencent’s offerings weren’t on the initial batch of approved games. However, it should be highlighted that in late 2018 when China resumed the games approval following a hiatus then, Tencent was also missing from the initial batches. Yet, the company went on to receive dozens of game approvals in the following two years. That supported TCEHY stock to resume its uptrend and it hit a record high in early 2021.

Even as its core gaming unit is regaining its footing, Tencent is working on increasingly monetizing its video accounts (short-form videos) and its suite of popular products like Tencent Meeting and Tencent Docs in the form of Software-as-a-Service [SaaS], emboldened by its proven success in monetizing freemium 2C products.

Tencent

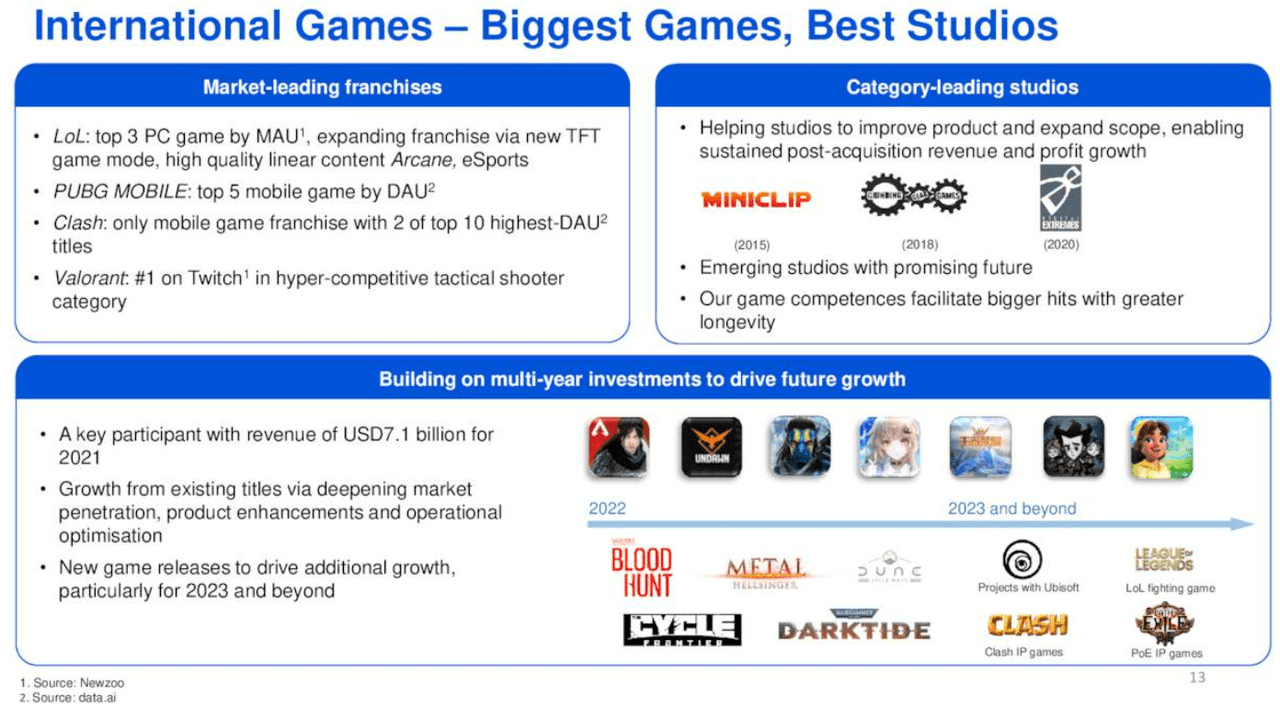

Tencent also intends to keep growing its international games with the support of a “compelling pipeline backed by franchise expansions at our market-leading studios and consistent enhancements of our category-leading studios.” Shareholders who are also game players may be pleased with the steady games pipeline Tencent presented during its fourth-quarter 2021 results.

Tencent Holdings

Given the execution history of Tencent management, the company could deliver on its strategies and prove the investing community to be too bearish presently. Consequently, five years down the road, we could come to realize that TCEHY stock was actually undervalued rather than overvalued.

What Is Tencent Stock’s Outlook?

Tencent’s quant rating and analyst recommendations

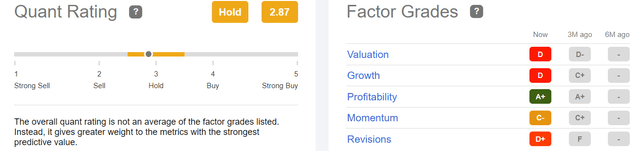

According to Seeking Alpha’s quant rating, TCEHY is currently a ‘hold’ with a score of 2.87. This isn’t a good sign but looking at the factor grades contributing to the scoring, TCEHY stock has improved from three months ago.

Growth deteriorated two notches to D from C+ but Valuation inched up from D- to D and Revisions jumped from F to D+. Profitability remained a stellar A+ grade. The deterioration in Momentum is expected given the share price movement.

Seeking Alpha Premium

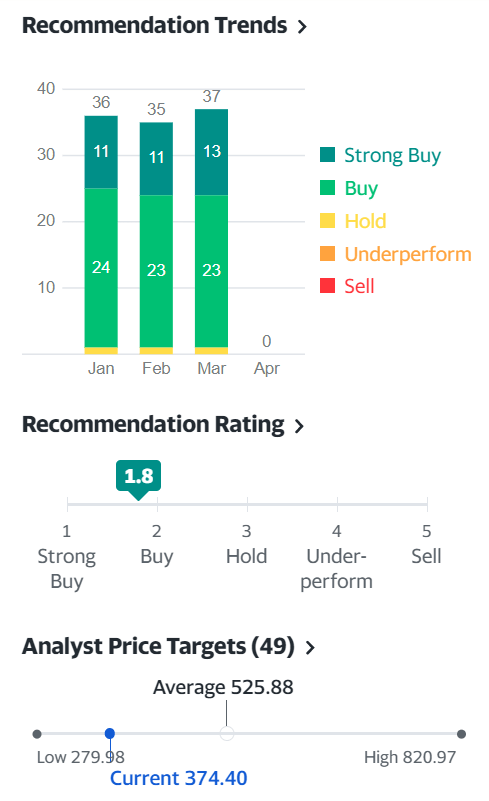

Wall Street analysts are more sanguine about Tencent. Based on the latest recommendation compilation for March, of the 37 calls, 13 are ‘Strong Buy’, 23 are ‘Buy’, and only 1 ‘Hold’, with no one saying ‘Underperform’ or ‘Sell’, giving it a high rating of 1.8. Compared with February, there are two more ‘Strong Buy’ calls in March.

For the price targets, analysts are split, with the most bearish slapping HK$279.98 on the low end for the Hong Kong shares (lack of coverage for TCEHY) and the most bullish expecting the stock to hit an incredible HK$820.97 within the 12 months. The current share price is a mere HK$374.40, meaning a downside of less than HK$100 even if the most bearish target is reached but an upside of more than HK$446 if everything is rosy and the high-end price target is achieved.

Yahoo Finance

Beijing is signaling its embrace of foreign investors

Regarding the bearish reports like “large-scale layoffs” happening at Chinese tech giants, we may have forgotten that such moves announced to placate shareholders on management’s cost-cutting endeavors are common in the U.S. as well. Jobs could be quietly added subsequently and outsiders would be none the wiser. There were speculations that the layoff announcements were made to extract concessions from Beijing or simply to signal to the regulators that they should back down on their scrutiny.

However, the Chinese authorities aren’t easily taken in and the recent revelation by the Cyberspace Administration of China [CAC] that the country’s 12 tech giants hired more workers than they lost in the past nine months should be a reminder that investors should not take anything at face value. Rather than experiencing job losses, the total employment at “A-list tech companies such as Alibaba, Tencent, ByteDance (BDNCE), JD.com (JD), Pinduoduo (PDD), and Ant Group… has increased steadily,” according to a statement by CAC.

As for the stock discount on Chinese stocks amid allegations that the Chinese government was planning to repudiate Variable Interest Entities [VIEs] and delisting fears due to the HFCAA, perhaps shareholders were again too pessimistic. Last year, the China Securities Regulatory Commission [CSRC] reiterated its implicit support for the VIE structure and reassured investors several times of their continued effort to reconcile the demands of the SEC with Beijing’s national security needs.

CSRC put the delisting fears to rest on April 2, confirming plans to revise confidentiality rules to give U.S. auditors full access to the U.S.-listed Chinese firms’ audit reports. As if sensing that market players weren’t taking it seriously, it followed up with a reiteration of its commitment to facilitate overseas IPOs on April 9. CSRC Chairman Yi Huiman said in a speech to a business group that the regulator “will keep the channel of overseas listings unclogged.”

This signaled Beijing’s intention to continue protecting the interest of foreign investors. I’m not saying they are altruistic, but it shows they want to attract overseas funding and are savvy (or shrewd, if you prefer) enough to keep investors happy.

Is TCEHY Stock A Buy, Sell, or Hold?

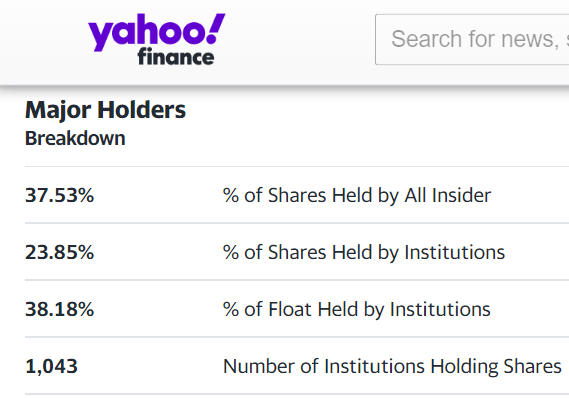

Chinese stocks receive a lot of brickbats from retail investors. However, a whopping 1043 institutional investors have other thoughts. 24% of Tencent shares are owned by institutional investors, representing 38% of the float.

Yahoo Finance

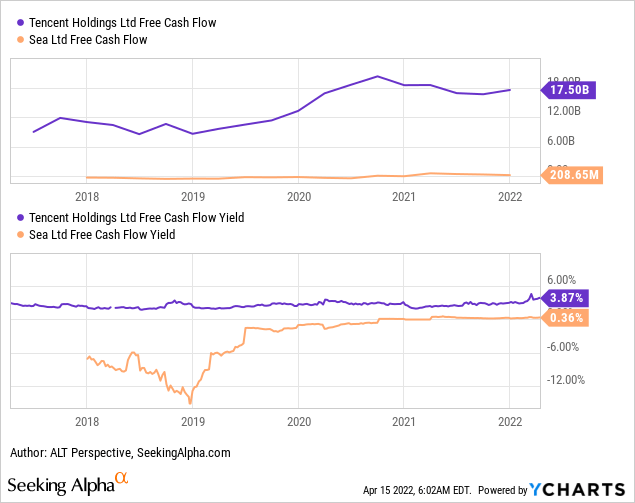

Institutional investors could be comforted by Tencent Holdings Ltd’s solid free cash flow of $17.5 billion and an FCF yield of 3.9%. This is impressive when compared with Sea Limited (SE), affectionately named the Tencent of Southeast Asia and “Baby Tencent” by some market players. Sea Ltd has an FCF of $209 million and an FCF yield of 0.4%.

Why is this important? Well, Tencent is a proven “fund manager,” with numerous success cases including Tesla (TSLA), Sea Limited, Meituan (OTCPK:MPNGF)(OTCPK:MPNGY), and Pinduoduo. While the Chinese regulators have hiked their anti-monopoly stance, Tencent can continue aggressive acquisitions overseas. In late March, Zenvia (ZENV) announced a 10.2% stake (of its Class A shares) acquired by Tencent in an SEC filing.

Tencent vs. Sea Ltd Free Cash Flow Yield (YCharts)

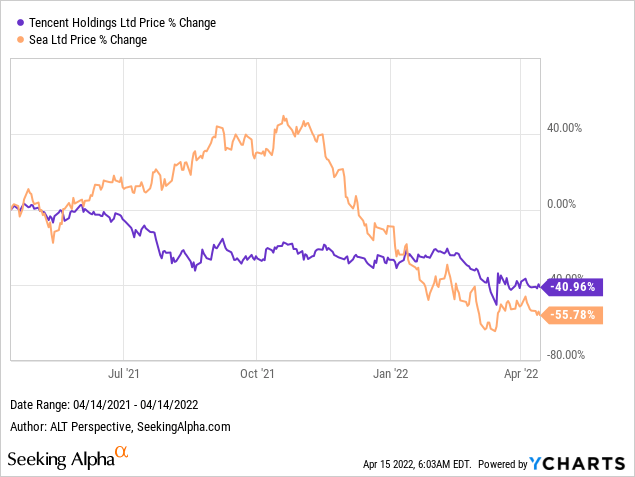

This Baby Tencent that received loads of love from growth investors brought ecstasy and then misery as SE stock outperformed Tencent for much of 2021, but subsequently gave up all the superior returns and more when reality trumped ambitions. Over the past year, TCEHY stock is down 41% while SE stock is down 56%, despite being up over 40% at one point.

TCEHY vs SE stock performance (YCharts)

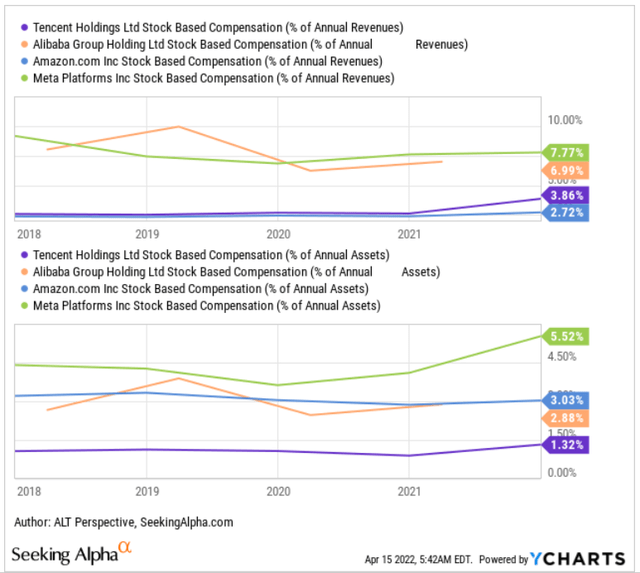

As tech stocks came under intense scrutiny this year, much attention has been placed on the hefty stock-based compensation [SBC]. This is not an issue for Tencent Holdings with its SBC scheme costing it only 3.9% of its annual revenue, higher than Amazon.com Inc. (AMZN) but lower than Alibaba Group and Meta Platforms Inc. (FB). Based on the percentage of annual assets, Tencent Holdings is the lowest among the four companies at a mere 1.3%. Meta Platforms, the parent of Facebook, topped the quad again with its SBC costing it 5.5% of its annual assets.

Stock based compensation (% of annual assets and % of annual revenues) – Tencent, Alibaba, Amazon, Meta Platforms (YCharts)

Evaluating whether Tencent is a good stock to buy, sell, or hold, we need to look at both sides of the developments. Earlier in this article, I mentioned the Chinese economy is struggling with the country’s worst Covid-19 outbreak since 2020, inevitably dragging down TCEHY stock in the near term.

However, Beijing is not sitting by. On Friday, China’s central bank announced that it will lower banks’ reserve requirement ratio that determines the amount of deposits banks have to set aside. The move would release 530 billion yuan ($83 billion) of liquidity to spur lending and help businesses.

In my previous article titled Is Alibaba Stock A Buy Or Sell After $25 Billion Buyback Announcement? I pointed out that non-Chinese companies are increasingly targeted by foreign governments, even as the governments where the companies are based are themselves looking at ways to rein in the tech players.

Today, it is Japan’s turn to flex its muscles, requesting Google (GOOGL)(GOOG), Meta Platforms, and others to register their overseas global headquarters in Japan. With the frequency of regulatory actions on international businesses rising, Chinese companies can take a breather. Investors may come to appreciate that not only Chinese companies are subjected to political headwinds and question why they are according to them a “China discount.”

The push for Chinese alternatives provides Tencent offerings with a good shot at global monetization

I recently watched a Chinese talk show helmed by prominent academia, Dean of the China Research Institute of Fudan University, Professor Zhang Weiwei, who together with guest speaker Professor Jin Canrong, discussed the Russia-Ukraine war. Professor Jin is the Deputy Dean, School of International Relations, and Deputy Director, Center for American Studies, of the Renmin University of China. During the question-and-answer section of the show, the duo emphasized the need for the Chinese population to be able to effectively challenge the narrative propagated by Western countries which has been facilitated by international platforms. Considering the message here and from other Chinese expert commentaries I came across, there seems to be a recognition that China needs its platforms to be adopted internationally.

Why is this important for China? Take for instance Common Prosperity, which has been painted in a very bad picture as an example of Beijing determined to suck private companies dry. However, watching quality Chinese talk shows targeted at domestic audiences, it was made clear that China recognizes a simple wealth redistribution method is not the solution to Common Prosperity. The combined ‘wealth’ of all Chinese private enterprises today remains sorely insufficient.

Hence, Beijing wants to support more entrepreneurship. At the same time though, it wants successful business owners to undertake more societal responsibilities, much like how American corporations are doing with their rich Corporate Social Responsibility [CSR] programs. There is a mantra summing up Beijing’s approach (my translation): “Let’s first create prosperity, then spread prosperity.” Did any Western media explain this phenomenon?

ByteDance’s TikTok is China’s most successful international social media platform. However, Washington has recognized its popularity and the danger it poses – i.e., TikTok displacing Facebook as the global dominant social media platform would diminish the ability of the U.S. to control the Western narrative. Former President Trump’s attempts to bring down TikTok must have highlighted to Beijing the importance of having more alternatives.

Tencent has proven its execution prowess, creating hugely popular messaging apps WeChat and QQ. However, the bulk of its users are in China. I believe Beijing will come to support Tencent to push its super apps for adoption internationally. Foreign governments are increasingly wary of the dominance of American platforms like Facebook/WhatsApp, Twitter (TWTR), and Amazon. They could welcome Chinese alternatives to balance out the American equivalents, providing Tencent offerings with a good shot at global monetization.

Even if this does not materialize, the compression of Tencent’s valuation multiples has made the stock attractive. With the suspension of new games approval lifted, it is a matter of time before we see Tencent’s titles getting approved. Every game title of Tencent being approved would be a share price upside driver for TCEHY.

After a year of downdraft in TCEHY amid a multitude of bearish issues, it probably doesn’t take much for the market to be excited and once the positive momentum gets going, fear of missing out [FOMO] could quickly propel the stock higher. Bystanders regretting not getting on board the bargain boat could eventually give in and feed the momentum.

Hence, summing up all the positive catalysts mentioned in this article, I rate Tencent a good stock to buy.

Be the first to comment