gorodenkoff/iStock via Getty Images

Q2, so far, has proven to be the quarter that gave us an onslaught of bad news throughout the growth/tech space. There are very few exceptions to this trend, and GoodRx (NASDAQ:GDRX) is one of them. The embattled consumer-health company, known for offering deep discounts on prescription drugs to consumers, resolved one of the key fundamental risks clouding its future, while also showing a strong response to massive price increases implemented on its subscription programs.

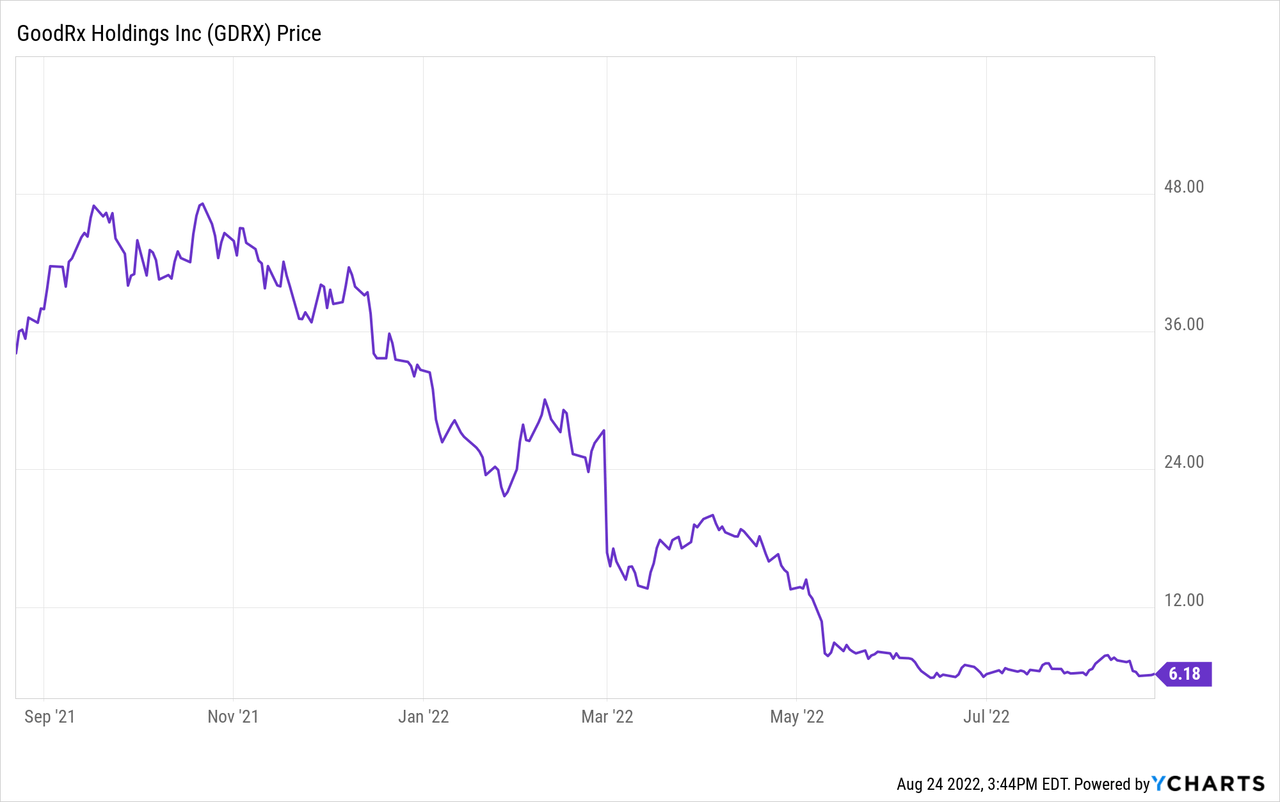

The initial reaction to GoodRx’s Q2 business update was a nearly 30% rally, though the late August gloom that has plagued the broader markets has sapped much of that strength away. Year to date, GoodRx remains down more than 80%, leading many investors to ask the question: is it time to buy the dip?

I’ll cut to the chase here: after absorbing GoodRx’s latest updates, I am substantially more sanguine on the company’s prospects than before. However, given lingering COVID-driven demand impacts and the expectation that GoodRx’s margin profile will continue to decline, I remain only neutral on GoodRx.

To me, GoodRx remains a mixed bag of both positive and negative factors. On the bright side here:

- Revenue diversification efforts. Though GoodRx made a name for itself through prescription drug discounting, the company has recently diversified its revenue streams through subscription plans, online health content, telemedicine, and pharmacy services.

- Reliable revenue streams. In theory, prescription drugs are recurring purchases – so GoodRx’s cut of these transactions is also a recurring revenue stream, on top of its subscription revenue. This revenue also comes at quite high gross margins, adding to GoodRx’s scalability potential.

At the same time, however, we have to be wary of the risks:

- The grocer issue demonstrated how reliant GoodRx is on third-parties. Without strong relationships with retailers and pharmacies, GoodRx’s room to grow is severely handicapped.

- Lingering COVID impacts. Doctor and pharmacy visits continue to be down versus pre-pandemic levels. While GoodRx is of the belief that this has led to a backlog of undiagnosed conditions that will eventually lead to a splurge of prescription drug purchasing, this thesis has not yet played out.

There’s a cloud over the business in the near term. GoodRx has ceased its guidance for the year, citing that the impacts from the recently resolved grocer fallout are difficult to estimate. Then there’s also the company’s warning that adjusted EBITDA margins are coming down, due to the revenue growth slowdown as well as overall inflationary pressures.

The bottom line here: while we are positive on the company’s resolution of the grocer issue (into which we’ll dive into more detail in the next section), there are still too many unknowns in this small-cap name that make it difficult to invest comfortably at current levels.

There is a value component here: at current share prices near $6, GoodRx trades at a market cap of $2.46 billion and an enterprise value of $2.39 billion. Based on trailing twelve-month adjusted EBITDA of $236.0 million, GoodRx trades at just over ~10x TTM adjusted EBITDA – a bargain. But with lack of clarity on whether the company will be able to grow its top line and earnings, it’s best to adopt a watch-and-wait stance and stay on the sidelines for now.

Q2 download

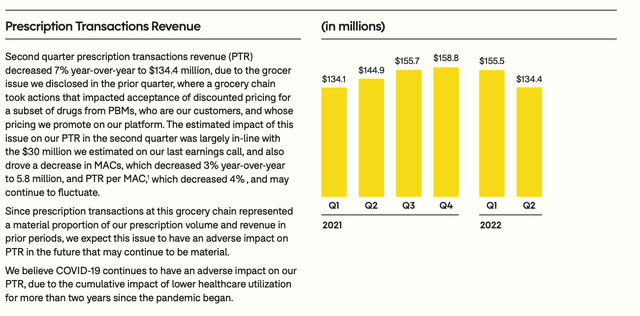

Let’s now cover the major highlights coming out of GoodRx’s second-quarter update. First off, the company saw prescription transactions revenue decline -7% y/y to $134.4 million, as shown in the chart below:

GoodRx prescription transaction revenue (GoodRx Q2 shareholder letter)

The company attributed the majority of this decline, however, to a roughly $30 million impact from the non-acceptance of GoodRx discounts at one of its large grocery partners, widely believed to be Kroger (KR). In the absence of this impact, revenue would have grown 13% y/y.

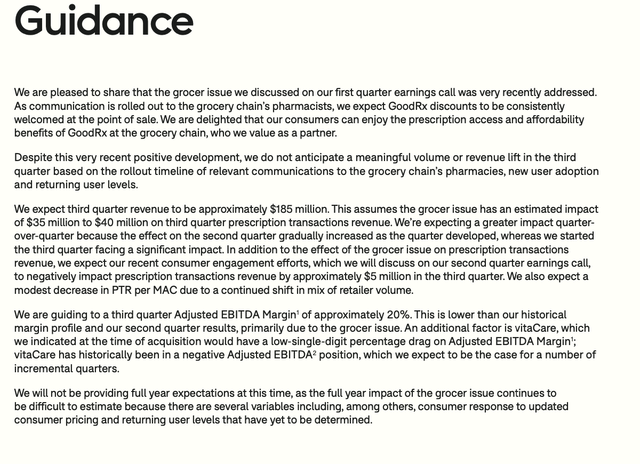

The good news – and the main reason the stock initially spiked post-earnings – is that this dispute has been resolved. As noted in the guidance statement below, this grocer is now in the process of rolling out communications to its pharmacist partners who will again be accepting GoodRx discounts.

GoodRx guidance statement (GoodRx Q2 shareholder letter)

As also noted above, however, GoodRx is withdrawing its full-year guidance because it expects to continue being impacted by this issue in Q3 and potentially Q4 as the re-acceptance is being rolled out.

Outside of the noise from this dispute, however, GoodRx still noted that it is seeing growth below expectations owing to COVID headwinds. CEO Doug Hirsch was transparent about leadership’s disappointment in the company’s results, as per his prepared remarks on the Q2 earnings call:

We are disappointed with our performance this year, and I suspect you feel the same way. We anticipated both higher growth and stronger margins and that we would be helping more Americans get the healthcare they need at a price they can afford.

On our fourth quarter earnings call, we reset expectations because our historical cohorts from the COVID period contributed less than we expected, then our prescription transactions offering was impacted by the grocer issue we discussed on our first quarter earnings call.

We did not expect to be in this position. I can say that Trevor and I, as both founders and significant GoodRx shareholders, have no higher priority than getting GoodRx back on track.”

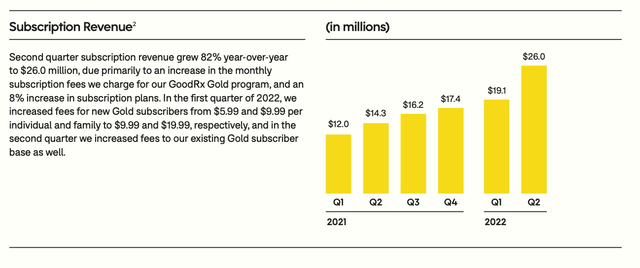

One bright spot in the quarter, however: though subscriptions are still a relatively small ~14% slice of overall revenue, it grew massively in Q2 due to an increase in subscription prices. Q2 subscription revenue of $26.0 million grew 82% y/y and 36% sequentially versus Q1:

GoodRx Q2 subscription revenue (GoodRx Q2 shareholder letter)

The company implemented a significant increase in subscription rates, from $5.99 to $9.99 for individual plans and $9.99 to $19.99 for family plans. These rates applied both to new subscribers as well as existing ones. The company noted it was pleased with the customer response to these price increases, and that churn met expectations.

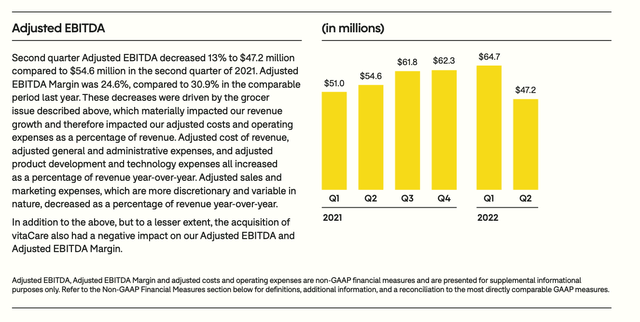

Overall profitability still tanked, however, given the revenue overhang from the grocer issue. Adjusted EBITDA declined -13% y/y to $47.2 million, which represented a 24.6% adjusted EBITDA margin – six points weaker than in the year-ago Q2.

GoodRx adjusted EBITDA (GoodRx Q2 shareholder letter)

GoodRx expects adjusted EBITDA margins to continue sliding to the ~20% range in Q3.

Key takeaways

The resolution of GoodRx’s grocer dispute lifts a major cloud from the company’s near-term future, as that dispute had the potential to upend the company’s entire business model. At the same time, however, that dispute was not GoodRx’s only issue; weak prescription demand trends have been another overhang on the company since the pandemic began, and there doesn’t seem to be a near-term fix in place. Watch and wait here, but don’t rush in.

Be the first to comment