Flory/iStock via Getty Images

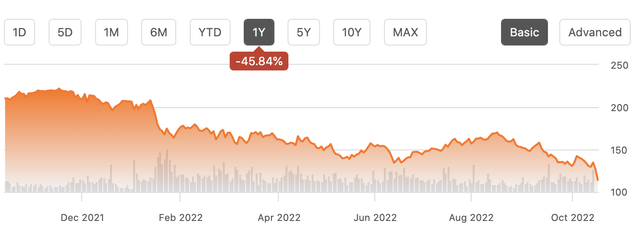

Coming into its Oct. 14 earnings release, First Republic Bank (NYSE:FRC) shares had been a poor performer, and its Q3 results did little to right the ship, sending shares down another 15%. While the results themselves may not look so poor, there’s extreme skepticism that management is pursuing the right strategy in the current environment, which I would describe as seeking client growth over profit margins. Even after underperforming, shares still have a premium multiple to other banks that is just hard to justify.

In the company’s third quarter, GAAP EPS beat by $0.02 at $2.21 thanks to lower-than-expected expenses. However, while revenue was up 17% to $1.5 billion, that was a bit light of expectations because the bank’s net interest margin compressed from 2.80% to 2.71% this year. While the margin declined, net interest income still rose 20.6% to $1.3 billion, given the absolute higher level of yields.

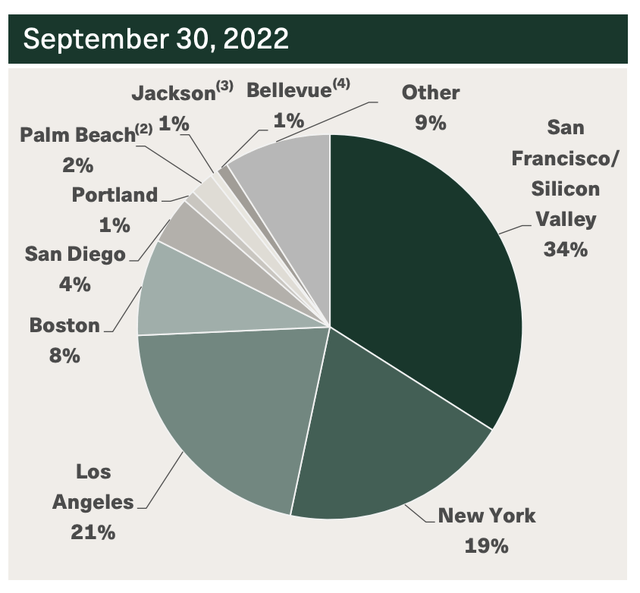

First Republic is a niche bank that targets high net-worth households, and it has been aggressively growing its penetration among this cohort. Indeed, clients are up about 5k YTD to 44k. FRC operates primarily in New York and California, with smaller operations elsewhere. Thanks to ongoing client growth, loan originations were $18 billion, the second-highest quarter ever. Accordingly, total loans were up 24% to $158 billion and deposits up 19% to $172.4 billion. Wealth management assets were down 1% as market declines offset client inflows while revenues were up 2.4% given a movement into higher fee products.

The benefit of doing business with high-net-worth households is that they have the highest credit quality. Over the company’s history, its net charge-off rate averages just 3bp per year. Its credit costs rose just marginally from $34 million last year to $36 million this year. 61% of its loan book is comprised of single-family mortgages and home equity, as secured loans, losses tend to be lower than on unsecured loans like credit cards. If there is a true credit quality downturn, First Republic’s loan book will very likely outperform other banks.

The downside is that you are dealing with very sophisticated clients, and when your offerings are selling very quickly, one should question whether they’re being priced too low. In other words, FRC may be winning market share but taking a less profitable chunk of the market. In a rising rate environment, we generally would expect banks to see widening net interest margins as deposit rates stay stickier than loan rates. Indeed, this is a leading thesis for why to own banks during periods of higher rates.

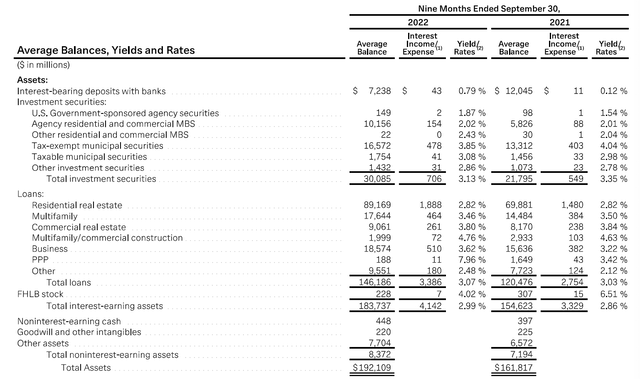

However, as noted above, FRC’s net interest margin compressed by 9 bp. An examination of their financials suggests that FRC is offering too-low interest rates on loans in order to win business and get that strong client growth. Below you can see that the rate on interest-bearing assets rose 13bp to 2.99% while its funding costs rose 15bp to 0.49%. That funding cost increase is not surprising and consistent with FRC passing on just a fraction of the Federal Reserve’s rate increase to depositors.

The asset side is where I see significant surprises. For instance, the absolute yields on its tax-exempt municipal securities declined by 19bp, and it allocated more of its portfolio to mortgages even as their yields only rose 1bp. Now, the bank can trade its security portfolio more quickly than it can move its loan book, so it can change these decisions next quarter if it wanted to.

What’s really surprising is the rate it earned on residential real estate loans stayed constant at 2.82%, and the rate it earned on multifamily and commercial real estate properties declined by 0.04%. As a reminder, over the past year, the 30-year mortgage rate has more than doubled to nearly 7% from 3%. Given the amount of new loan growth at FRC, one would expect the rates on its real estate loans to be rising now.

From a borrower’s perspective, the fact FRC is not following the market up in rates is very attractive, which is why more households are happy to do business with FRC. As a shareholder, one is left to question whether pursuing this growth will be worth it, given the potential interest income it’s leaving on the table. Management is essentially betting it will win more business (likely on the wealth management side) over time, and this lower interest income is the cost of customer acquisition.

That remains to be seen, and with the Fed continuing to raise rates but many real estate loans fixed rate, that net interest margin is poised to get squeezed even further, making this customer acquisition strategy even more costly. Rather than being a bank that wins from higher interest rates, FRC has turned the prospect of further Fed rate hikes into a potential headwind as funding costs rise faster than interest income.

At the same time, while the company has sufficient capital, it does not have so much excess capital as to easily absorb this growth, as higher loan totals require holding more capital. Tier 1 leverage was flat at 8.59%, and its Common Equity Tier 1 ratio of 9.28% is above its 7% minimum (inclusive of capital conservation buffer). This CET1 ratio is lower than other banks like JPMorgan Chase (JPM) which is at 12.5% in part because FRC genuinely does not need as much capital to run its business given the higher credit quality of its loan book.

Still, because it does not want capital to fall from here, the company issued 2.6 million shares to raise $402 million during the quarter. As a result, its shares outstanding rose by about 1.5% to 183 million. Its CET1 ratio was 9.15% at the end of Q2, so this issuance has helped capital rise a bit even as the balance sheet grows. At a time when other banks are preparing to buy back stock next year to reduce share counts because they have excess capital, FRC is a net issuer of stock and buybacks are unlikely over the forecastable horizon. Not only is FRC underpricing loans in order to win customers, it has had to issue equity to finance this strategy, diluting existing shareholders’ ownership of the company. As you can see, this is an aggressive bet by management, which could pay off in several years if these new households do additional business with FRC, but this strategy is adding uncertainty during a period where the economy itself provides enough uncertainty.

First Republic has a tangible book value of $72.54, so at $114, it’s trading over 1.5x tangible book. Assuming tighter NIMs and growing assets broadly cancel out and credit losses stay stable, the company has about $9 in earnings power, so it trades at about 12.5x earnings. When JPMorgan is trading at 9x earnings with a diversified business that’s proving itself in this period of uncertainty, it’s hard to justify paying more for FRC when it is paying so much to win low-margin business and exposing itself to the risk of a NIM squeeze. Even down 45%, I see downside to $100 or about 11x earnings, and I would sell FRC in favor of banks like JPM.

Be the first to comment