Dave Kotinsky

Although many of the most iconic food and beverage brands are owned by massive conglomerates, some of the most well-known are controlled by firms that are comparatively small. One of these, a company that markets itself as the second largest producer of packaged bakery foods in the US, with brands under its belt such as Nature’s Own, Dave’s Killer Bread, Wonder, and Tastykake, is Flowers Foods (NYSE:FLO). The recent financial performance achieved by the company has been rather impressive. Moving forward, this looks set to continue. Although shares of the company have gotten a bit pricier, they do still look fundamentally attractive on a forward basis. Because of this, I do still rate the enterprise a ‘buy’, even if the easy money has already been made.

Fundamentals are strong right now

Back in November of 2021, I wrote an article talking favorably about Flowers Foods. At that time, I said that the company’s growth was attractive and shares were cheap. Recent financial performance had been mixed, with revenue and cash flows looking weaker year over year while profits were up nicely. However, I saw the future of the company as being positive and ultimately rated the enterprise a ‘buy’. Since then, the company has performed better than I would have anticipated. Even though the S&P 500 has dropped by 19.1%, shares of Flowers Foods have generated a profit for investors of 6.3%.

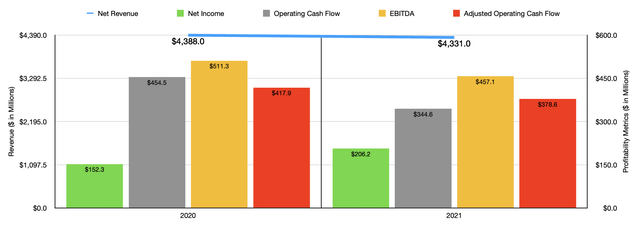

This upside for shareholders at a time when the broader market has suffered is not without cause. But at the same time, not everything has been fantastic. Let’s consider financial results covering the entirety of the company’s 2021 fiscal year first. When I last wrote about the firm, I only had data covering the first three quarters of that year. Today, I now have data covering through the first quarter of 2022. For 2021 as a whole, revenue came in at $4.33 billion. That’s actually 1.3% lower than the $4.39 billion generated in 2020. Although financial results in the third quarter of last year were robust, the same cannot be said of the final quarter of the year. Sales dropped from $1.02 billion in the fourth quarter of 2020 to $984 million the same time last year.

On the bottom line, things were equally mixed. Net profits for 2021 totaled $206.2 million. That’s significantly higher than the $152.3 million generated just one year earlier. On the other hand, cash flow metrics suffered. Operating cash flow declined from $454.5 million to $344.6 million. Even if we adjust for changes in working capital, it would have fallen from $417.9 million to $378.6 million. Meanwhile, EBITDA also suffered, declining from $511.3 million to $457.1 million.

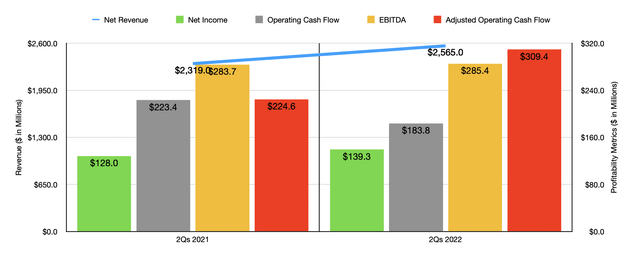

Nobody would have guessed, based on the financial results I detailed here, that shares of Flowers Foods would have significantly outperformed the broader market in such a short timeframe. However, even though the company suffered last year compared to the year prior, it seems to be thriving this year. Revenue in the first half of 2022 came in at $2.57 billion. That’s 10.6% higher than the $2.32 billion achieved in the first half of 2021. With the end goal of combating inflationary costs, the company decided to raise its prices.

This, combined with changes in product mix, helped to push revenue up by 13.9%. This was offset some by a 3.3% decline in volume. The same strength the company experienced in the first half should continue throughout this year. Previously, management anticipated revenue of between $4.660 billion and $4.695 billion for the entirety of 2022. Now, the expectation is for sales of between $4.764 billion and $4.850 billion. At the midpoint, this would translate to revenue of $4.807 billion for a year-over-year increase of 11%.

Although the pricing actions the company took were aimed at combating inflation, the fact of the matter is that the business overshot and did so in a way that is rewarding for shareholders. Net income in the first half of the year totaled $139.3 million. That’s up from the $128 million generated one year earlier. Other profitability metrics also improved. Operating cash flow went from $223.4 million to $183.8 million.

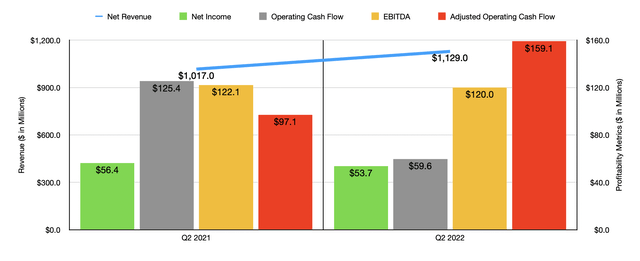

But if we adjust for changes in working capital, it would have risen from $224.6 million to $309.4 million. EBITDA also fared well, climbing from $283.7 million in the first half of 2021 to $285.4 million the same time this year. Unfortunately, when it comes to just the latest quarter alone, the picture was a bit weaker. Revenue of $1.13 billion translates to an 11% increase over the $1.02 billion generated the same time last year. But net income fell from $56.4 million to $53.7 million. Operating cash flow declined from $125.4 million to $59.6 million, while EBITDA dropped from $122.1 million to $120 million. The only bottom line metric that improved year over year was adjusted operating cash flow. This rose from $97.1 million to $159.1 million.

It’s difficult to know what to expect for the entirety of the year. But management does currently anticipate earnings per share of between $1.25 and $1.30. At the midpoint, this would translate to net income of $272.2 million. Assuming that other profitability metrics follow the same trajectory, then operating cash flow should be around $449.8 million while EBITDA should be around $603.4 million.

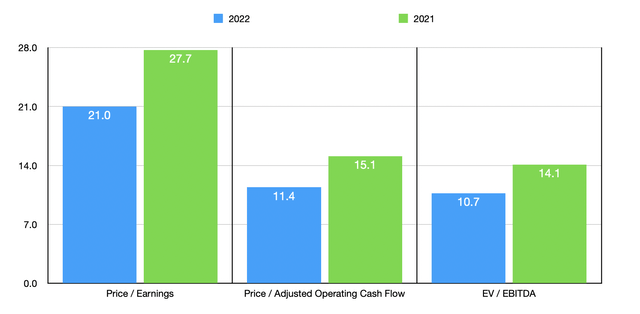

When it comes to pricing the enterprise, the process is fairly simple. Using our 2021 results, we can see that the business is trading at a price-to-earnings multiple of 27.7. This compares to the 21.2 the company was trading for based on my prior calculations for the 2021 fiscal year. The price to operating cash flow multiple is 15.1. That’s up from my prior calculation of 11.3. Meanwhile, the EV to EBITDA multiple should be 14.1. That compares to the 11.1 that I calculated in my prior article. Using our 2022 estimates, shares do start to look a bit cheaper. These multiples would be 21, 11.4, and 10.7, respectively.

To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 7.2 to a high of 52.9. Using the EV to EBITDA approach, the range is from 5.3 to 24.7. In both cases, two of the five companies were cheaper than our prospect. If we, instead, use the price to operating cash flow approach, the range would be from 8.4 to 46.4. In this case, only one of the five companies were cheaper than Flowers Foods.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Flowers Foods | 21.0 | 11.4 | 10.7 |

| Pilgrim’s Pride (PPC) | 7.2 | 8.4 | 5.3 |

| Post Holdings (POST) | 7.5 | 13.0 | 7.8 |

| Lancaster Colony Corp (LANC) | 52.9 | 46.4 | 24.7 |

| The Simply Good Foods Co. (SMPL) | 36.7 | 32.9 | 20.7 |

| Hostess Brands (TWNK) | 27.4 | 17.1 | 16.2 |

Takeaway

Based on all the data provided, I will say that, fundamentally speaking, Flowers Foods looks to be in pretty good shape. The business has been able to exert pricing power over its customers with remarkable effect, though the second quarter was a bit weaker in this regard. In addition to this, there are other positive aspects to owning the company. For instance, on May 26th of this year, management increased the company’s share buyback plan by 20 million shares, raising it to 25.4 million.

Having said that, shares are starting to look a bit pricier, especially when it comes to the results for its 2021 fiscal year. On a forward basis, the stock does start to look much more appealing again. Because of this, I am slightly bullish on the company moving forward. But I also acknowledge that the easy money has certainly been made.

Be the first to comment