We Are

Introduction

A couple of weeks ago, Microsoft Corporation (NASDAQ:MSFT) announced it was entering the creative industry through Microsoft Create:

Microsoft Create

This article aims to go over what Microsoft Create is, what it includes, who it targets, the opportunity ahead, and what it means for competitors such as Adobe Inc. (ADBE) and Canva.

What is Microsoft Create, and what does it include?

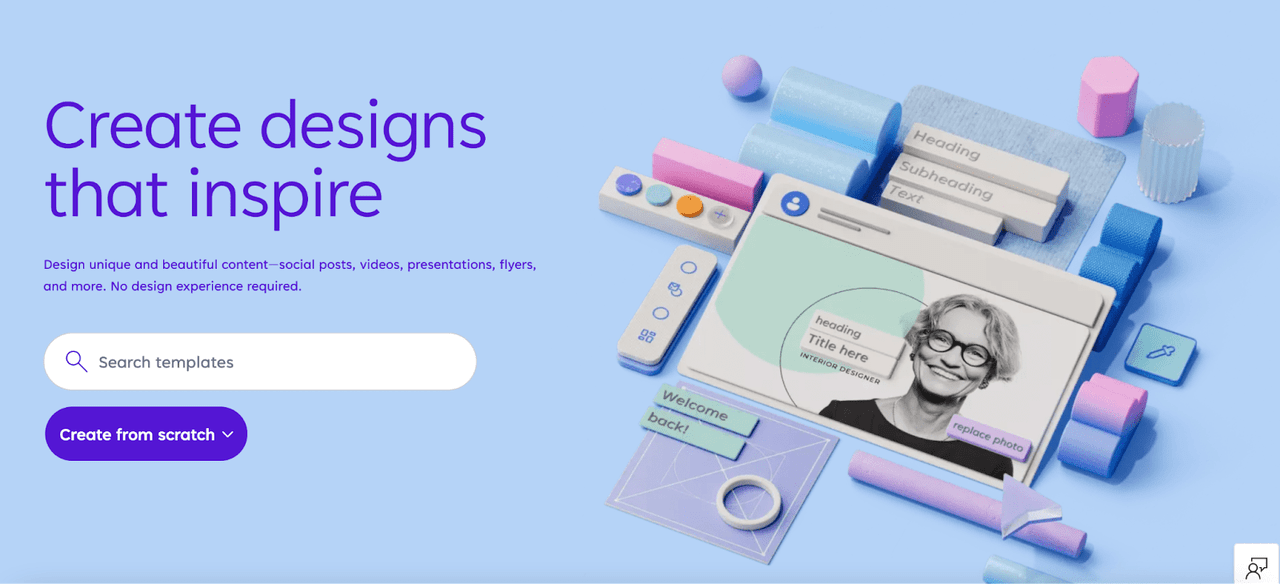

Create is Microsoft’s new ecosystem for designers. Create was born because Microsoft wanted to tap the market of content creators. They can produce digital designs through a series of apps.

The “ecosystem” includes both “new” design apps (Designer and Clipchamp) as well as legacy Microsoft apps:

Microsoft Create

The apps at the core of Create are Designer and Clipchamp, so we’ll look at those two in a bit more depth. The rest of the apps included in the package are well-known.

What is Designer?

Microsoft Designer

Designer is a graphic design app. It aims to help users create digital designs without too much effort. Through a series of templates and generative design technology, Microsoft’s goal is to make the digital creation process seamless for inexperienced creators.

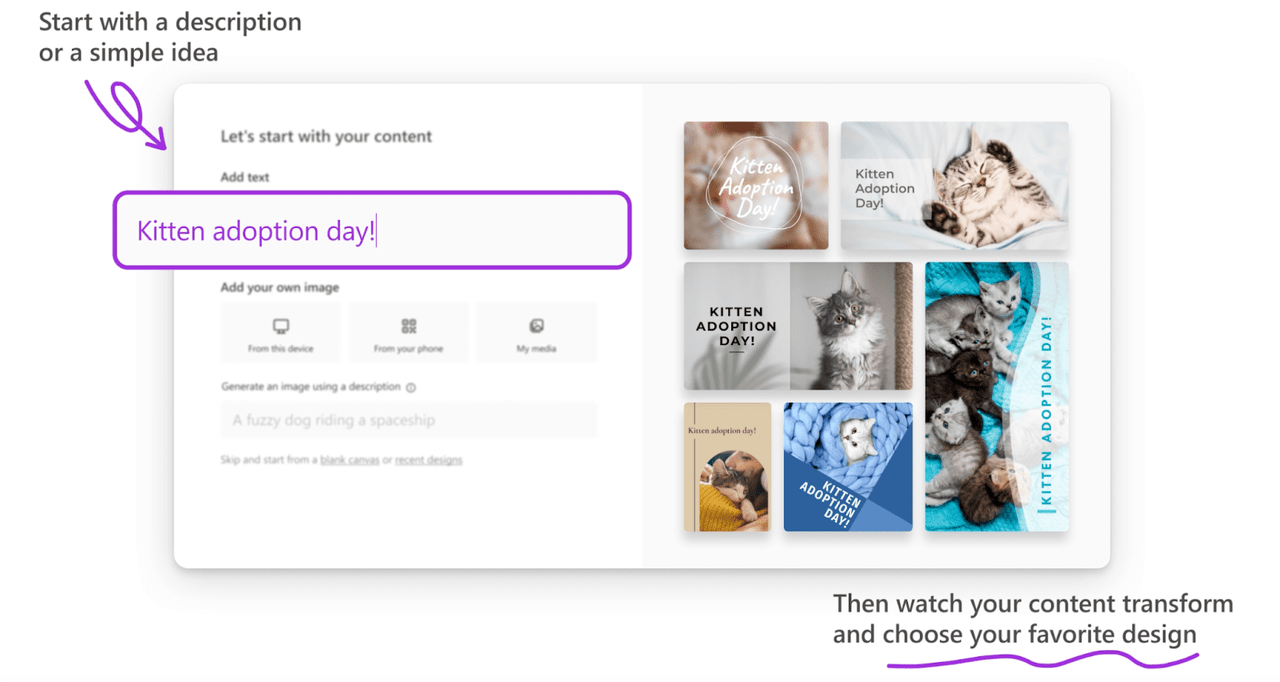

So, imagine you want to create a social media post, but lack the inspiration to do so. No problem, you open Designer, type a short description of what you are looking for, and the program will offer you some templates that might fit your needs:

Microsoft Designer

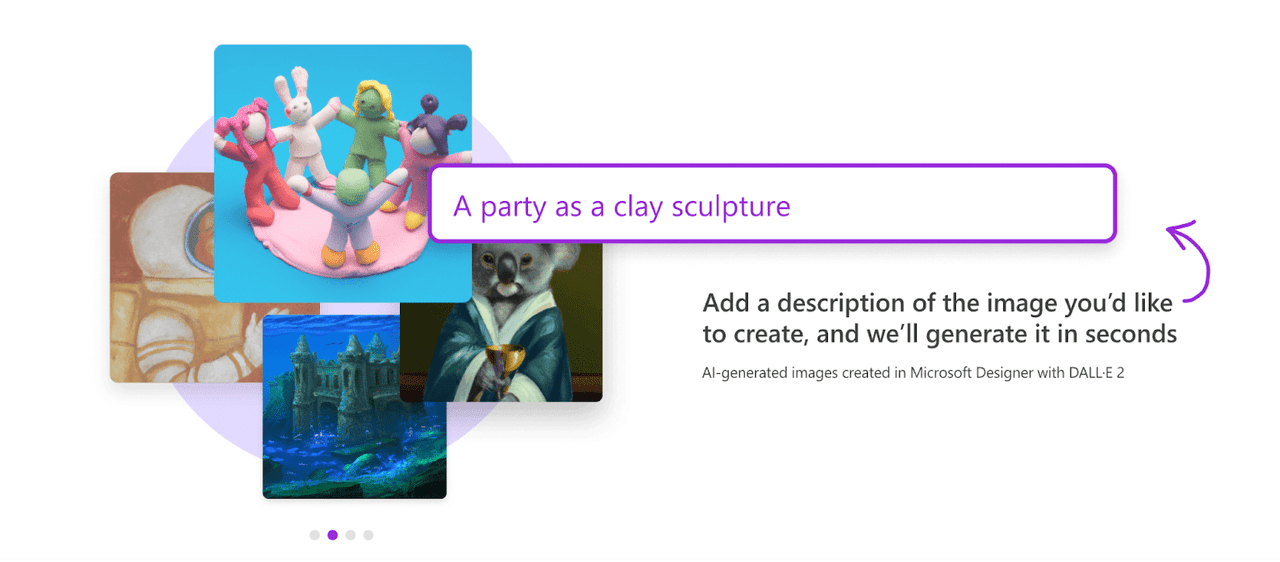

You can modify whatever you like in this template to personalize it further. However, Microsoft goes even deeper and allows users to create proprietary and unique images by typing in a simple description. This is known as generative AI:

Microsoft Designer

In Designer, generative AI is backed by DALL-E 2, an Open AI application that creates images from a description in natural language. DALL-E was one of the pioneers in the space, and while it’s not perfect, it’s a pretty exciting tool.

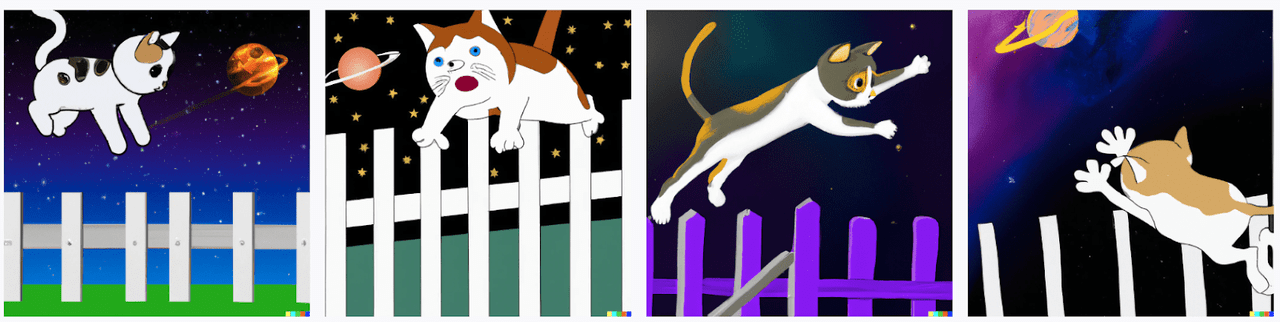

So, for example, if I were to type the following in DALL-E: “a cat jumping a fence in space,” the program will come up with a series of unique images that fit this description:

Dall-E

Of course, it doesn’t look extraordinarily professional but take into account that DALL-E took only a couple of seconds to generate these images.

So, with Designer, Microsoft is trying to simplify the design task while simultaneously helping the designer create something unique through AI. Fast, easy, and unique is a perfect combination for the customer that it aims to target. We’ll talk a bit more about this later on.

Microsoft Designer is still in beta, but we already know it will be monetized through a freemium model and that it will be free for Microsoft 365 paid users:

Once the app is ready for general availability, it will be available both as a free app and with more premium features available to Microsoft 365 Personal and Family subscribers.

Source: Microsoft Blogpost

I assume that free users who don’t subscribe to Microsoft 365 will also have access to premium features via a subscription, but this has not been confirmed yet. Designer will be launched as app-only initially, but Microsoft is also planning to release it in Microsoft Edge, its web browser, to allow seamless collaboration and real-time editing on the web.

What is Clipchamp?

Clipchamp

Microsoft Climchamp is also a design tool, but focusing on video editing. Microsoft acquired it in 2021.

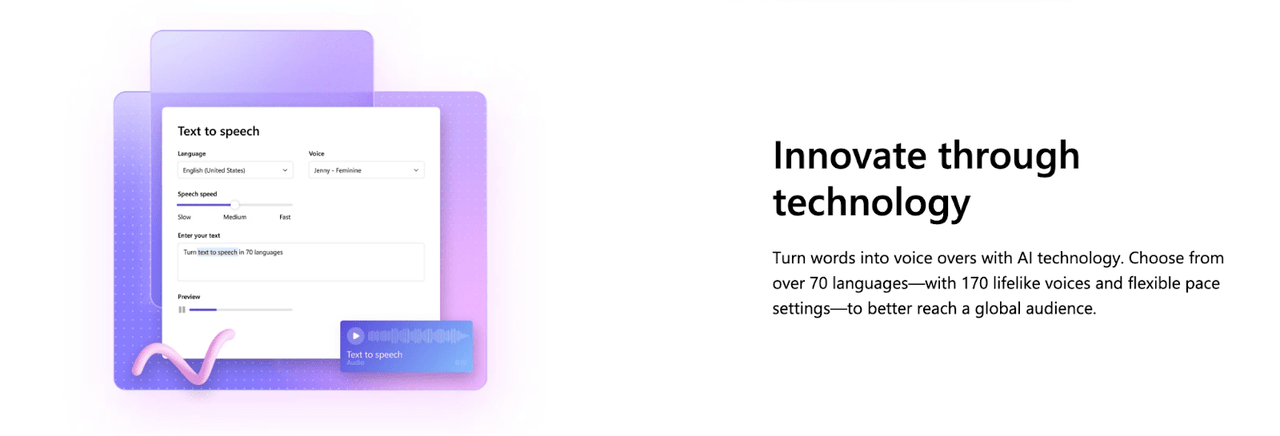

It follows a similar model to Designer, offering a curated library of royalty-free videos, so users do not have to be technically skilled when creating something from scratch. It also allows the import of videos and incorporates AI functionality, but slightly differently than in Designer. For example, Clipchamp leverages AI to turn text into voice, which is helpful in case users want to add narration for their video:

Microsoft Clipchamp

There are some inroads into AI-generated video, but it’s much less mature than generative images.

Now that we know what Designer and Clipchamp allow users to do, let’s see who they target.

What customers does Create target?

We can separate the creative industry into two main customer groups: professionals and non-professionals.

Professionals are those individuals whose main activity is creating digital content. This group includes individuals working for creative agencies, creative departments, or freelancers. The professional creative industry is not new and has been historically dominated by Adobe thanks to some of its products becoming the standard: Photoshop, Lightroom, Premiere…

Non-professionals, on the other hand, include individuals who don’t make a living off digital content creation directly but engage in digital content creation on a recurrent schedule. The non-professional industry is not consolidated yet, and it’s growing very fast. These two characteristics are leading to intense competition in the space with the likes of Canva, Adobe (with Adobe Express), and now Microsoft.

Key characteristics in both industries differ as their constituents are looking for different things. While professionals look for tools with many exceptional features that allow them to create unique expert-looking designs, non-professionals settle for ease of use and an extensive library of templates. Nobody on the non-professional side goes to Canva and opens a blank page. Instead, non-professionals will almost always start working from a template.

Based on the description above, it should already be quite clear to what segment Microsoft Create caters to: the non-professionals.

The opportunity ahead

The non-professional industry is proliferating fast, fueled by the digital economy. Thanks to digital interactions increasing rapidly throughout the last decade, which the pandemic has accelerated, individuals can now monetize their content online relatively seamlessly.

This has led to what many people know as the content creator economy. Many individuals have discovered they can work on their terms and make a living without needing to work for a company. Unfortunately, this was not as easy one decade ago because the tools to do so lacked the necessary scale.

According to VdoChiper, the content creator economy size is estimated to be more than $100 billion, and growing. There’s been an enormous rise in platforms that allow creators to monetize their content, such as Twitch, Youtube, Instagram, Tiktok, etc., and these platforms seem to be here to stay. Hey, we are on such a platform here.

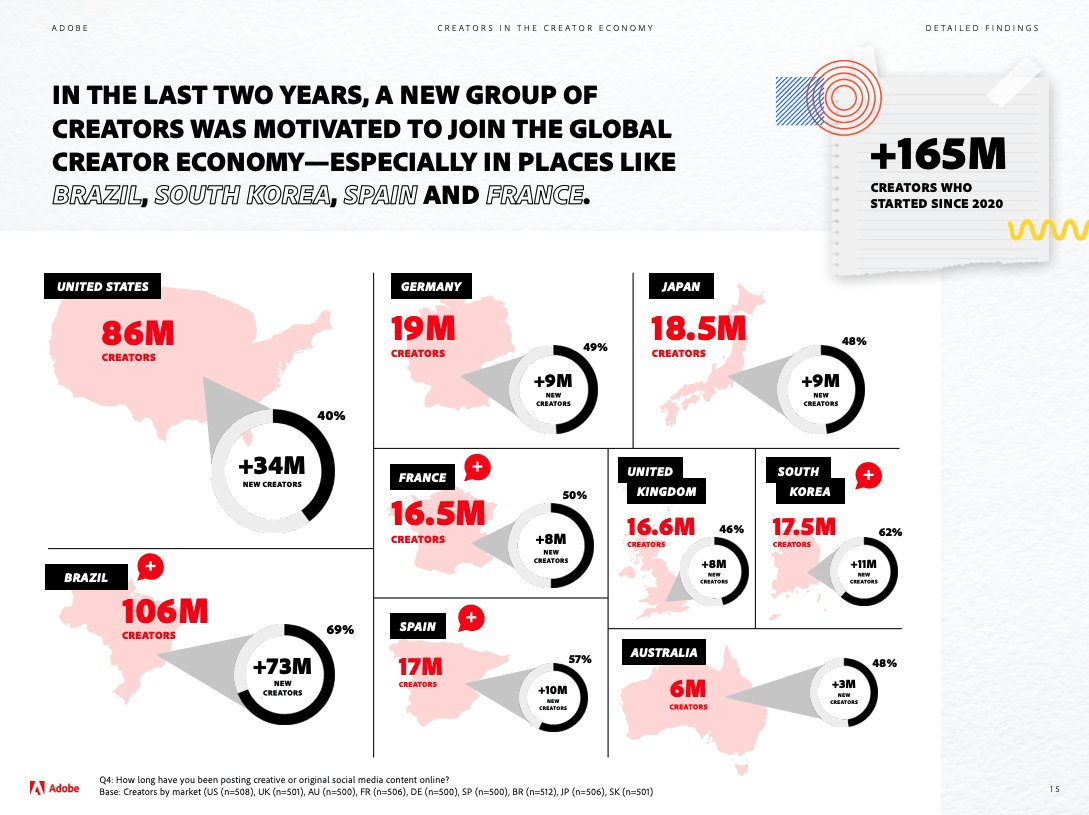

The creator economy is growing hand in hand with the number of creators, which is skyrocketing globally, according to Adobe:

Adobe

With more and more creators entering the ecosystem, there’s an unmet need to deliver the necessary tools to create this content, and this is precisely where the opportunity lies. There are many tools to distribute this content, but few tools to create it.

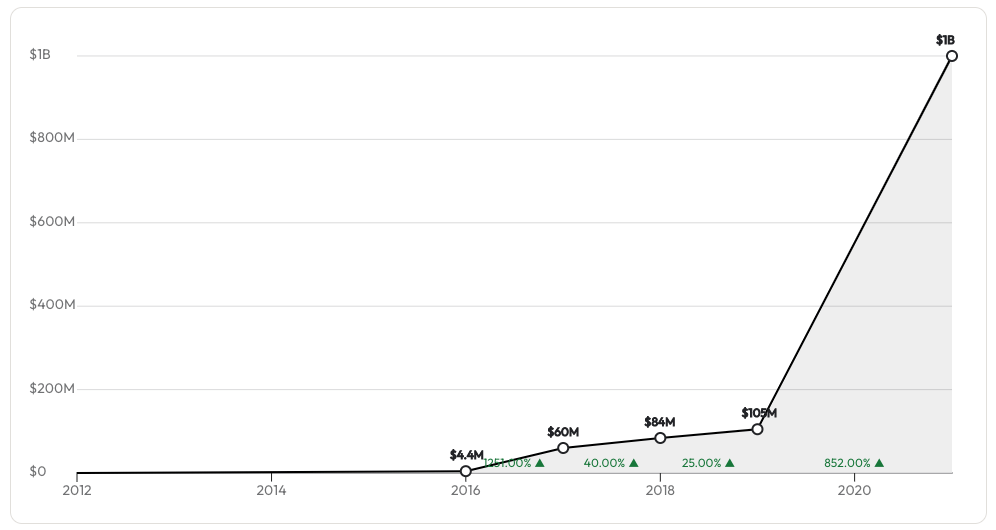

Canva was born in 2012 to meet these needs, but it has only recently achieved the necessary scale to draw the big guys’ attention:

Getlatka

With an estimated revenue of $1 billion and an estimated valuation of $40 billion in 2021, Canva has piqued the interest of investors and potential competitors, flooding the industry with additional investments. So, how will the competitive landscape evolve after the launch of Adobe Express and Microsoft Designer? Let’s take a look.

Microsoft coming into the industry – what it means

As Adobe shareholders, we must admit that Microsoft’s inroads into the industry pose a significant challenge, but they also confirm a significant opportunity. We believe monetization in the non-professional space will be very tough, especially if these products are not part of a bigger goal.

Microsoft’s strategy will rely on integrating its Create offering into Microsoft 365, giving the company a head start thanks to its vast installed base. It’s unlikely Microsoft will charge for these products independently because the company’s strategy has typically relied on bundling and then setting a higher price for the bundle. There will be indirect monetization, but it’ll be challenging to understand for how much of the increase in price in Microsoft 365 will Create be responsible for.

For non-Microsoft 365 users, there will be a free offering available that follows a similar monetization model to Canva.

Regarding Adobe, Express is also a part of a larger goal. The company has openly discussed the strategy behind this product. The goal is to substantially increase the top of the funnel and upsell the creative cloud:

So first of all, in terms of on-ramping people, we really believe very strongly about bringing them into the product that makes sense for them and then sort of driving them up. So I think we can say that for communicators and consumers, that is largely going to be bringing them in through Express and or the single app. But even sometimes Pros, especially earlier in career pros, we’ll start with a single app and then work their way up. We certainly see this dynamic where someone that comes in as a videographer, is going to maybe just get Premier, and then they say they want to add Photoshop.

So we see these dynamics playing out. And so everyone that’s coming in through this category, we have the opportunity to upsell.

Source: David Wadhwani (Head of Digital Media at Adobe) during Analyst Day

Adobe will also leverage its huge installed base and deep customer relationships to roll out Express. While it has taken Canva 10 years to reach 100 million users, Express has reached 40 million users in a couple of months.

The strategies of the “big guys” are starting to shape what will most likely be a highly competitive industry with intense competition on price and tough customer retention, at least over the coming years.

Price competition will be intense because Adobe and Microsoft will not rely on these products’ monetization. Instead, both are using it as value additive to a larger goal. Canva (which is still privately held) can’t say the same.

In terms of user retention, all players focus on ease of use, significantly reducing the switching costs that a learning curve might bring. If the objective is to start designing in a couple of minutes, what will stop a user from going to a competing product?

It’s still soon to know how the industry will evolve and how these players will build their competitive positions, but it promises to be an exciting battle.

Conclusion

The creator economy is bringing millions of inexperienced digital content creators to the market, building a whole new creative sub-market. The stakes are high but competition is also shaping up to be competitive. Giants as Microsoft and Adobe have started investing significantly in the space to beat the incumbent: Canva. It will be interesting how it plays out, but it’ll surely be a tough market to build a durable competitive position in.

In the meantime, keep growing!

Be the first to comment