m-gucci/iStock via Getty Images

The NightShares 500 ETF (NYSEARCA:NSPY) offers a novel strategy, attempting to capture the well-known ‘Night Effect’. At the moment, I find the fund too small and performance results too brief for me to invest. However, I will definitely keep it on my radar.

Overview

The NightShares 500 ETF is an ETF that aims to deliver the returns of the S&P 500 Index in the overnight session. It is a new strategy, having only been launched since June 29, 2022.

Strategy

The main premise of NSPY is allow investors to:

…capture the “Night Effect”, a historical source of differentiated returns and volatility within equities. The Night Effect is captured by separating out the risk and return differences between trading when markets are open (the “day”) and when they are closed (the “night”). An extensive body of research over many years has shown that investors frequently benefit from avoiding the volatile day sessions and investing in the period between market close and market open.

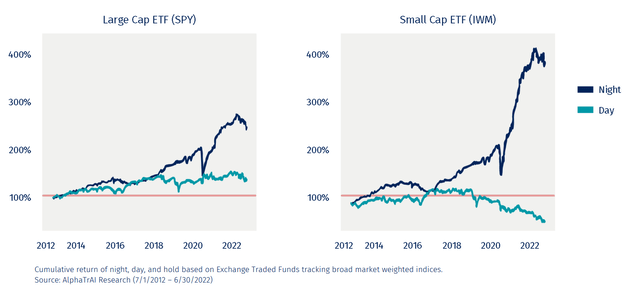

According to NightShares, this ‘Night Effect’ can be very substantial, as shown in Figure 1. Although the S&P 500 has returned over 250% in the past decade, the vast majority of the returns can be attributed to the overnight session. The effect is even more pronounced in small caps, where the cumulative daytime returns of the Russell 2000 is actually negative.

Figure 1 – Differentiated return profile between night and day (NightShares marketing material)

Although NightShares discovered this effect independently, they were not the first ones to identify it. NightShares references three academic papers that studied this effect.

The first paper was published in 2008 by a team of professors from Virginia Tech, the University of Utah, and Purdue University. In the paper, the team found that “the day and night effect holds for individual stocks, equity indexes, and futures contracts on equity indexes and is robust across the NYSE, AMEX, Nasdaq, and Chicago Mercantile Exchange“, which suggest the effect is not the result of a particular market structure. The second paper is from the Federal Reserve Bank of New York and documents an ‘overnight drift’ that averages 3.70% on an annualized basis on the S&P500 between the hours of 2-3am ET. Finally, the third paper from professors at the University of Illinois, Chicago and Michigan State University found that the “four hours around European open account for the entire average market return” of the S&P500, with the other 20 hours averaging zero.

There are various hypotheses and explanations for this effect, with the most common being liquidity premiums, the timing of information flow, and risk management practices. For example, most day traders prefer to ‘flatten their books’ at the end of the trading day. However, somebody must hold the risk on their balance sheets. The market makers who decide to hold overnight risk must be compensated for the illiquidity of the overnight session, hence the average overnight returns are skewed higher.

Fees

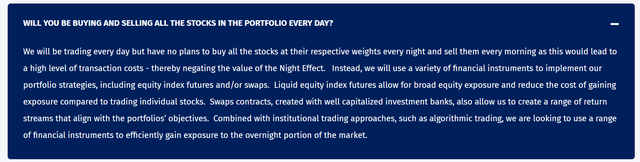

While the strategy sounds interesting, the implementation does not come cheaply. NSPY is a relatively expensive fund, charging a 0.55% management fee versus the SPDR S&P 500 Trust ETF (SPY) that charges 0.09%. Furthermore, as NSPY plans to actively trade every day (Figure 2), investors should expect the total expense ratio to be fairly high. The total expense ratio is not yet available, since the fund is so young. Will fees eat up most or all of the ‘Night Effect’ remains to be seen.

Figure 2 – NSPY active trading (NSPY website)

Dividend & Yield

The Fund has not paid a distribution since inception, although the prospectus does mention dividends from net investment income, as well as realized capital gains, will be paid to shareholders annually.

Portfolio Composition

The fund portfolio holdings is fairly simple (Figure 3). NSPY holds S&P 500 EMINI futures and cash. Presumably, the futures are sold just before the day session starts and are bought just as the night session begins.

Figure 3 – NSPY holdings (NSPY website)

Fund Returns

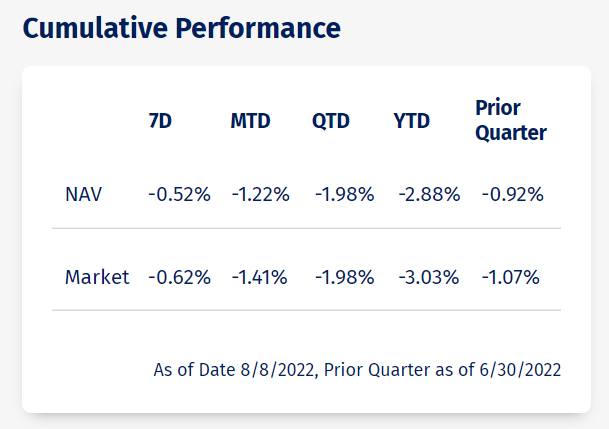

The fund returns are also fairly straightforward (Figure 4). As NSPY has only been in operation for a little over a month, its performance is almost identical to the market. I would expect this performance to diverge in the coming quarters and years if NSPY is able to capture the ‘Night Effect’ premium without slippage (transaction costs, manage fees, etc.).

Figure 4 – NSPY returns similar to the market (NSPY website)

Key Risks

There are several risks with the NSPY ETF. First, assuming the ‘Night Effect’ is real, the ETF might not be able to deliver it due to slippage. For example, the ETF charges 0.55% management fees. Also, NSPY plans to trade every day, which will result in transaction costs.

Secondly, while historically, there may have been a ‘Night Effect’, there is no guarantee that the effect will be there going forward. History is replete with trading effects that disappear once it’s well known and exploited (for example, the small firm effect says that small firms tend to outperform; however, the last decade has seen the S&P 500 outperform the Russell 2000 by over 50%).

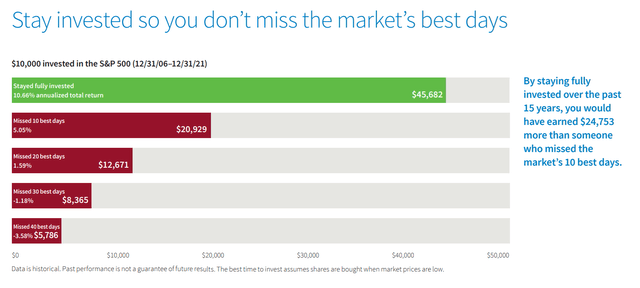

Furthermore, on a day-to-day basis, significant events can have a large impact to the day or night session. According to Putnam Investments, missing the 10 best days can have a large impact to the cumulative returns of a buy-and-hold strategy (Figure 5).

Figure 5 – significant underperformance from missing best days (Putnam Investments)

Finally, NSPY is being managed by AlphaTrAI Funds, Inc., a firm with only 2 funds under management (the NSPY and its sister fund, the NIWM) with a combined $9 million in AUM. It is unclear how well capitalized AlphaTrAI Funds is, and whether they have the wherewithal to sustain operations until the funds are large enough to generate meaningful revenues.

Conclusion

The NightShares 500 ETF is certainly a novel strategy, attempting to capture the ‘Night Effect’. At the moment, I find the fund too small and performance results too lacking for me to invest. However, I will definitely keep it on my radar.

Be the first to comment