Michael Nagle

Icahn Enterprises L.P. (NASDAQ:IEP) reported mixed quarterly results last week. They had strong results from energy with increased product crack spreads that resulted in refining margins of $26.10 per barrel, but they also had a net loss of $459 million from investment activities for the quarter. IEP reported a $0.41 loss per unit for the quarter. Looking back very long-term, Icahn’s IEP total return has outperformed Buffett’s Berkshire Hathaway (BRK.A) for the last 20 years – 1,950% versus 520.5%.

Icahn Enterprises L.P. Business Model

I covered the complexities of Icahn Enterprises in a prior article, but just as brief reminder, IEP is a limited partnership that is 86% owned indirectly and directly by Carl Icahn. There are three areas: operations, investments/activism, and trading. At least 40% of their assets must be in their operations area to avoid being regulated as an investment company. IEP is taxed as a limited partnership, so IEP unitholders get K-1 Forms each year to be used when filing their tax returns. Currently, $2.00 is paid quarterly as a distribution to IEP unitholders. It is a distribution – not a dividend. Unitholders can elect to receive the $2.00 in cash or $2.00 worth of additional IEP units. Some consider that this $2.00 quarterly distribution results in a current “yield” of about 15%, but that is actually an improper use of the term “yield” because the $2.00 is just a return of assets. IEP units should not, in my opinion, be held in IRA accounts because of Unrelated Taxable Business Income-UBTI.

Second Quarter 2022 Results

Operating Businesses

The results for 2Q 2022 were great for energy and the rest were weak. Many investors focused on their 70.8% owned CVR Energy’s (CVI) very impressive $26.10 per barrel margin on their refinery operations that resulted in a EBITDA of $347 million in the 2Q compared to $33 million the same period in 2021. Nitrogen fertilizer had $147 million EBITDA vs. $51 million. The total net energy EBITDA for IEP for 2Q was $273 million compared to $49 million in 2Q 2021.

The other operating businesses, including automotive, food packaging, and home fashion, all had weak results because of costs/supply chain problems. These other areas are very small compared to energy with $35 million total EBITDA and $19 million net loss for the 2Q.

Investments/Activism

The area that often gets much of the media’s attention is Icahn’s investment and activism sector. During 2Q, IEP bought an additional 2,1991,027 shares of Southwest Gas Holdings (SWX) under a tender offer for $82.50 per share. This purchase price is somewhat higher than the current price of $78.17. In June, IEP sold $350 million Cheniere Energy shares back to the company at $130.52 per share, which is lower than the latest price of $148.50. As I covered in my prior article, Icahn sold Occidental Petroleum (OXY) shares at prices from $41.84 to $48.34 during 1Q 2022, compared to the latest price of $62.45. (I don’t want to criticize Icahn because I also like to book “nice” profits.)

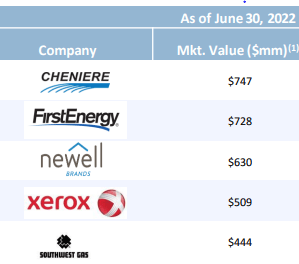

Below is a table of IEP’s largest investment holdings as of June 30.

Major Investment Holdings

IEP Major Investment Holdings (Seeking Alpha)

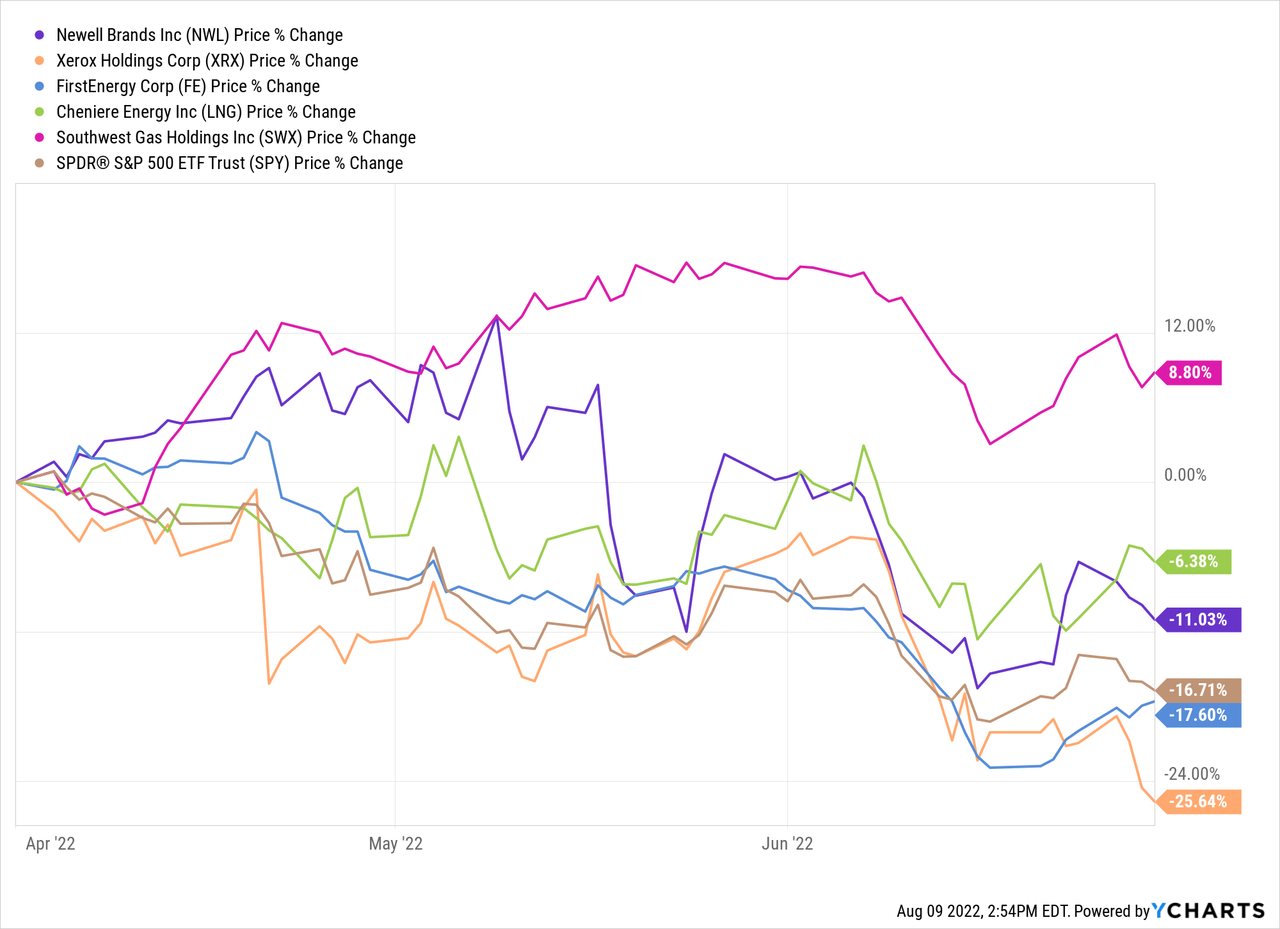

Below are 2Q stock price changes for the top five holdings by IEP

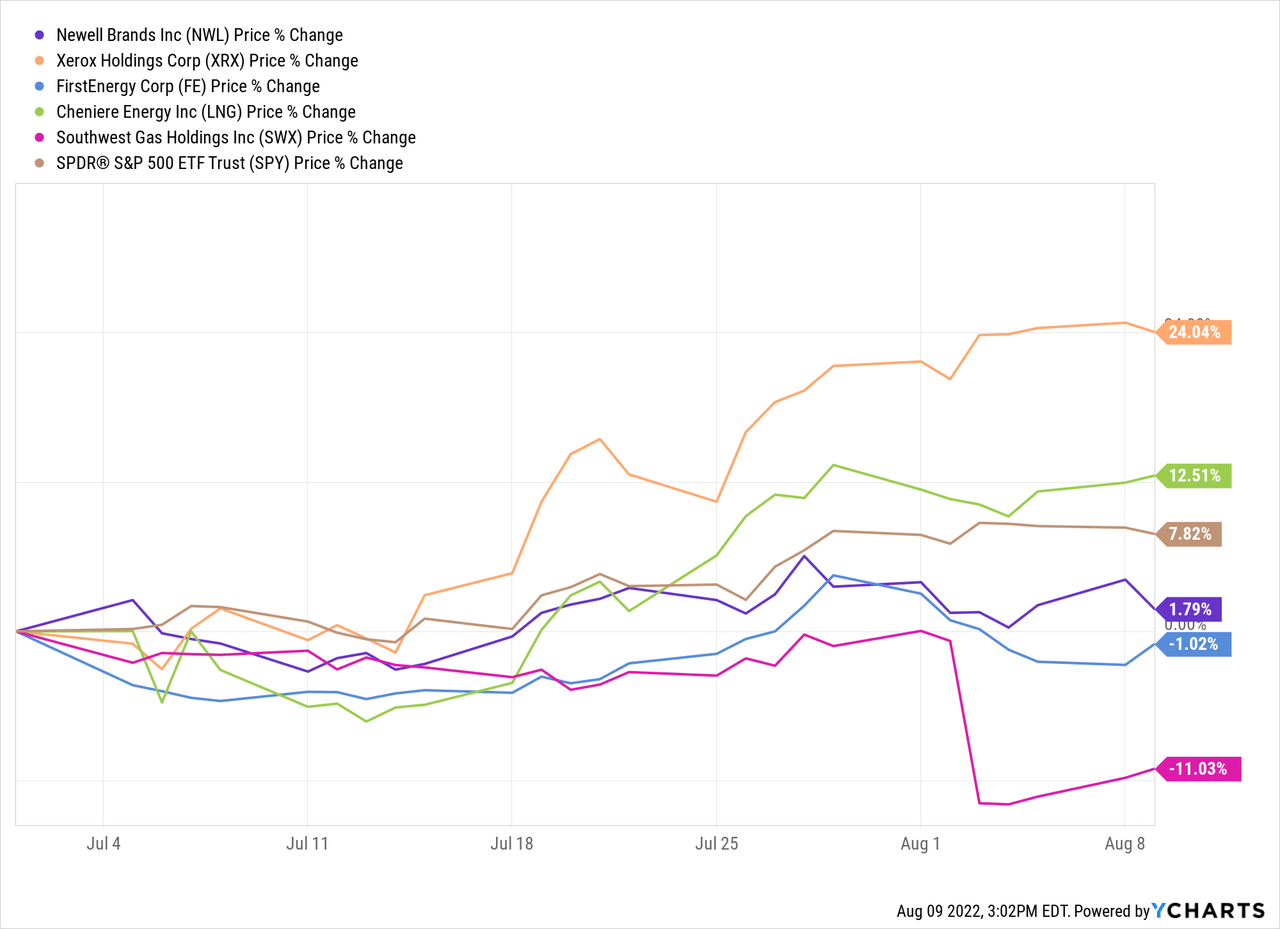

2Q was a bear market, but since July 1, the market has recovered some of the earlier losses. Using my calculations, the portfolio of IEP’s top five holdings has risen 8.7% so far this quarter, which is about the same as the rest of the market. Xerox (XRX) has done well, but SWX dropped sharply recently after the company said “it will continue strategic alternatives for MountainWest Pipeline Holdings Co”.

Third Quarter Price Changes to August 8

Trading Account

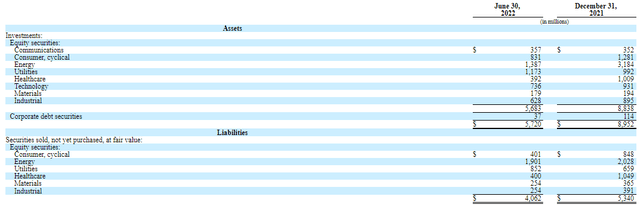

The third area is the IEP trading account which holds both long and short positions. They disclose long and short positions by industries, but not specific companies or specific derivatives. It is interesting to note that at the end of the 2Q, IEP had a net short energy industry position of $514 million, which could be very profitable given the weak performance of some energy companies so far in 3Q. This compares to their net long energy position of $1.056 billion at the end of 2021 during the middle of energy bull market. It is also interesting that they have a $736 million long technology holding with no short positions in that industry. At the end of 2021, they were long $931 million in technology and again no shorts. Most of the Tech industry was a disaster earlier this year, but it has recovered somewhat the last few weeks. (I wish I could see their specific Tech company holdings because I do not like Tech.)

Long and Short Trading Account Positions by Industry

Trading Investment Portfolio (sec.gov)

For 2Q 2022, IEP made $1.298 billion (+16.1%) on their shorts and lost $1.783 billion (-20.8%) on their longs. The total trading account was down $493 million (-4.8%) for the quarter. For the first six months of 2022, IEP made $402 million (+4.3%) on their trading account, which is much better than most of the various stock indices.

Carl Icahn v. Warren Buffett

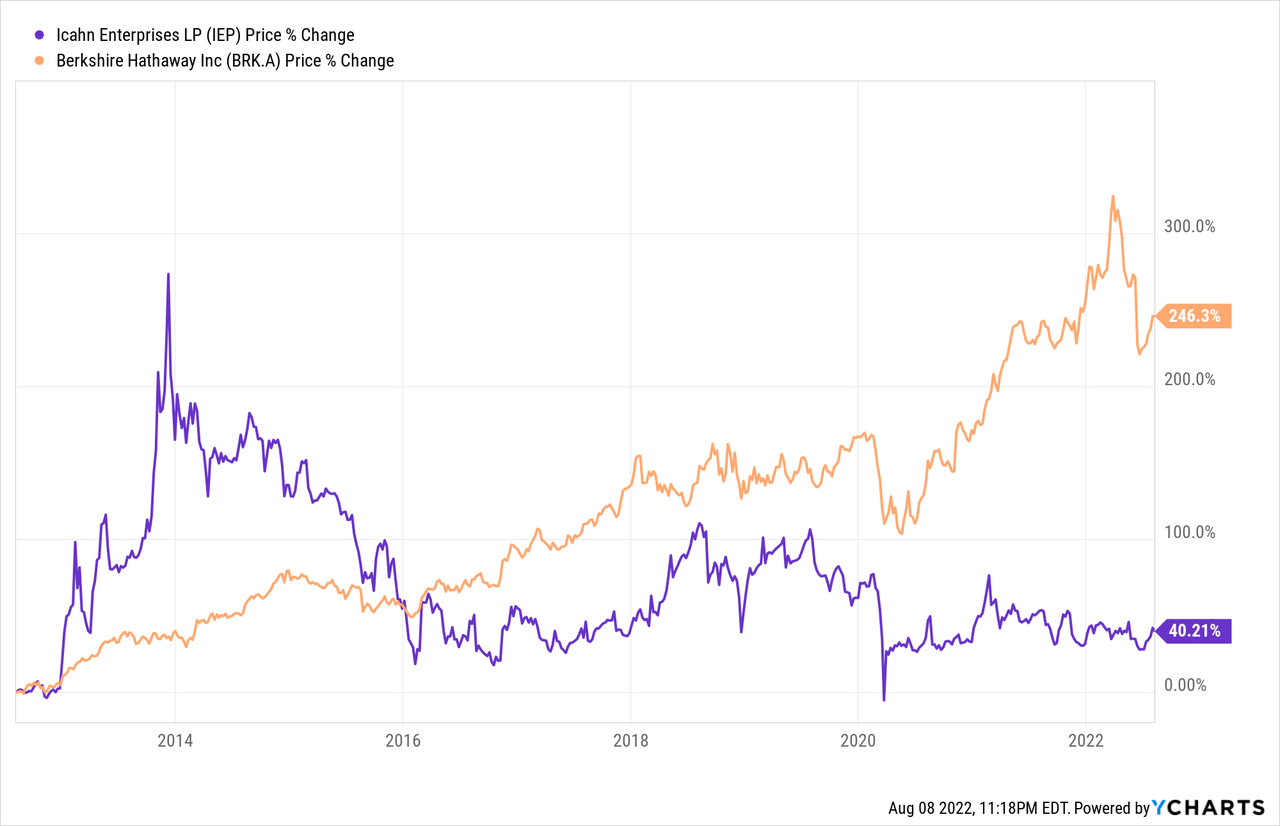

Many investors like to discuss the difference between Carl Icahn and Warren Buffett’s investment performances. Warren invests mostly very long-term, and Carl sometimes has a short-term approach for part of his portfolio. Looking just at stock price percent changes for the last 10 years for IEP and BRK.A, it seems that Warren has significantly out-performed Carl.

10 Year Price Percent Change IEP and BRK.A

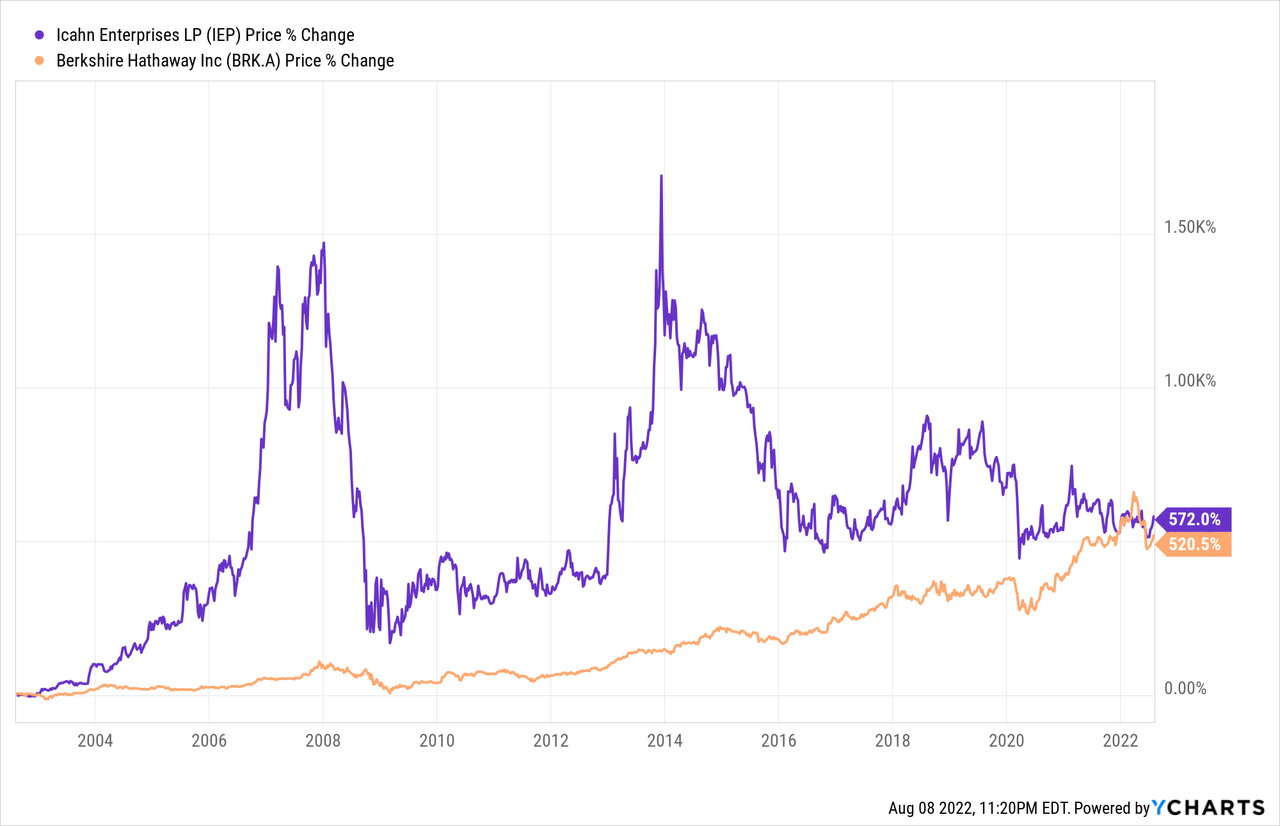

If, however, you look back for the last 20 years for just stock price percent changes, Carl (572%) slightly outperforms Warren (520.5%).

20 Year Price Percent Change IEP and BRK.A

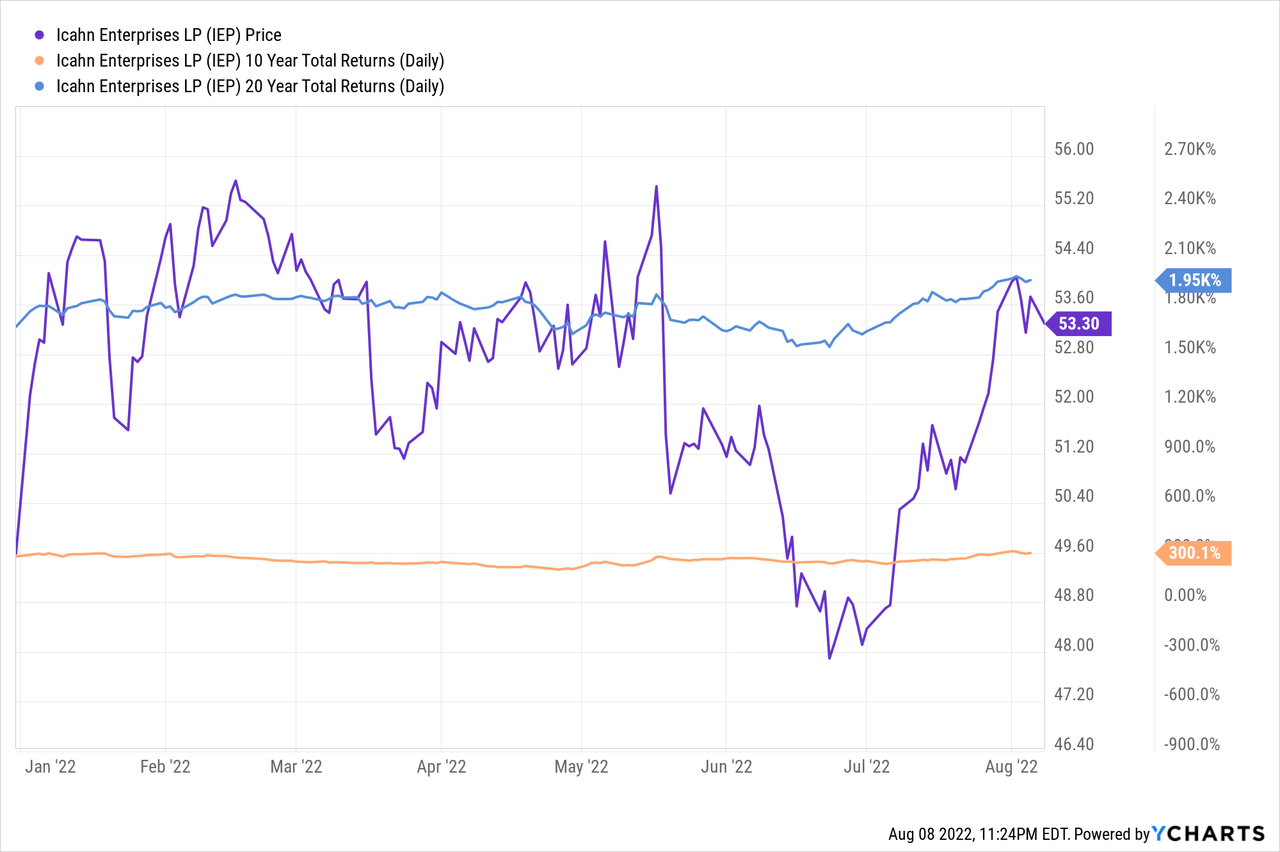

Since BRK.A has not paid a dividend, the stock price changes reflect the total return for shareholders for both 10 and 20 years. IEP had significant distributions over the years. It is open to debate how these distributions should be factored into total returns because they are not actually dividends. I am letting YCharts settle this argument and I am using their methodology to determine IEP’s total return. The 10-year total return of 300.1% for IEP beats 246.3% for BRK.A, which again is just the stock price change, and IEP’s 20-year return of 1,950% beats BRK.A return of 520.5%.

IEP YTD Stock Price

IEP 10 Year Total Return and 20 Year Total Return

(Note: In order to show total return figures, I had to include some stock price period using YCharts.)

Conclusion

IEP had 322.8 million units outstanding as of June 30 and according to their August Investor Presentation, their total net asset value is $6.579 billion. This implies a net asset value of $28.37 per unit. The problem is that some of these assets are valued at actual market prices and others are just accounting book values. With a current IEP price of $53.88, the units are trading at almost 90% above net asset value. Even if one makes some type of adjustment for book values of operating assets, it seems that IEP is trading above its true value. Because of the attractive “yield” of almost 15%, many investors just focus on the quarterly distributions and not the underlying value.

2Q results were mixed and were mostly driven by profits from energy, which may not continue in the future. At least their trading account has performed much better than the rest of the market so far this year. While Carl has performed better than Warren over the last 20 years, I think there might be better places to invest than IEP. For those investors looking for a very high level of cash distribution on their investment, IEP might be a rational investment, but not in an IRA account. I continue to rate IEP units neutral/hold.

Be the first to comment