naphtalina/iStock via Getty Images

Gold Fields Limited (NYSE:GFI) is one of the most storied names in the gold mining industry. It is perhaps one of the best investments you can make in the industry at a time when gold miners have become more attractive, thanks to improved capital discipline, and a declining gold price. The company’s sharply growing free cash flow is trading at very attractive rates.

The Case for Gold Miners

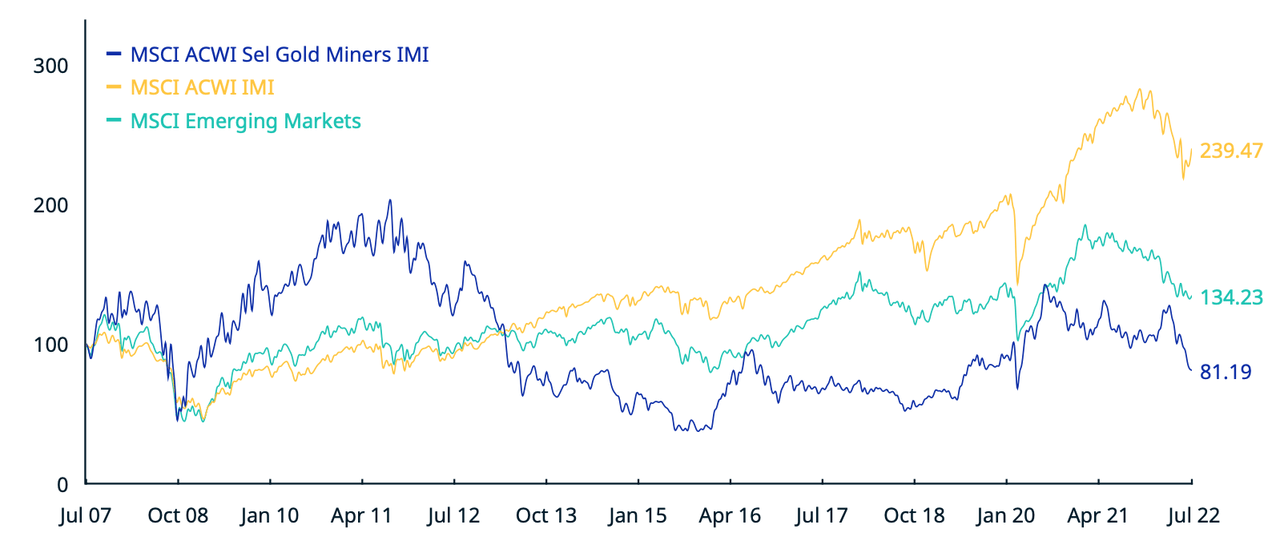

Gold firms have been a disastrous investment over the last decade. Over the last decade, the MSCI ACWI Select Gold Miners IMI Index has returned just -4.47% per year, compared to 9.88% for the MSCI ACWI IMI and 3.21% for the MSCI Emerging Markets.

Source: MSCI

Furthermore, the MSCI World Index has risen by 10.21% per year.

Gold miners have been pulled down by the gravitational forces of the capital cycle. Commodity firms essentially follow the cobweb model, in which there is a time lag between supply decisions and price changes. Miners are especially subject to this. Management observes a boom in pricing, and takes decisions to raise capital to fund a wave of capital expenditure. This process results in an excess of supply, upon which the bubble bursts, prices collapse, miners are suddenly forced to clean up their balance sheets, with many forced into bankruptcy, and others forced down the M&A route, until profitability returns to the market. This leads to a boom and bust cycle that makes the industry very dangerous to invest in. So what we have is an inverse relationship between asset growth and future returns, or what is known as the asset growth effect.

Investors like to think of gold miners as an option on gold, but it isn’t that. If you want to invest in gold, invest in gold. Investing in gold miners is a very different proposition. Gold miners have, in the past, tended to have very poor capital discipline. No gold miner, not even one as big as Gold Fields, has the market share to influence the price of gold. As price takers, they have to act in ways that appear irrational at the macro level but which are rational at the micro level. That means ramping up production when the price goes up, even when history says the price of gold will pop, and it’s better to keep production down. The result is that gold miners have traditionally done a great job at destroying shareholder capital.

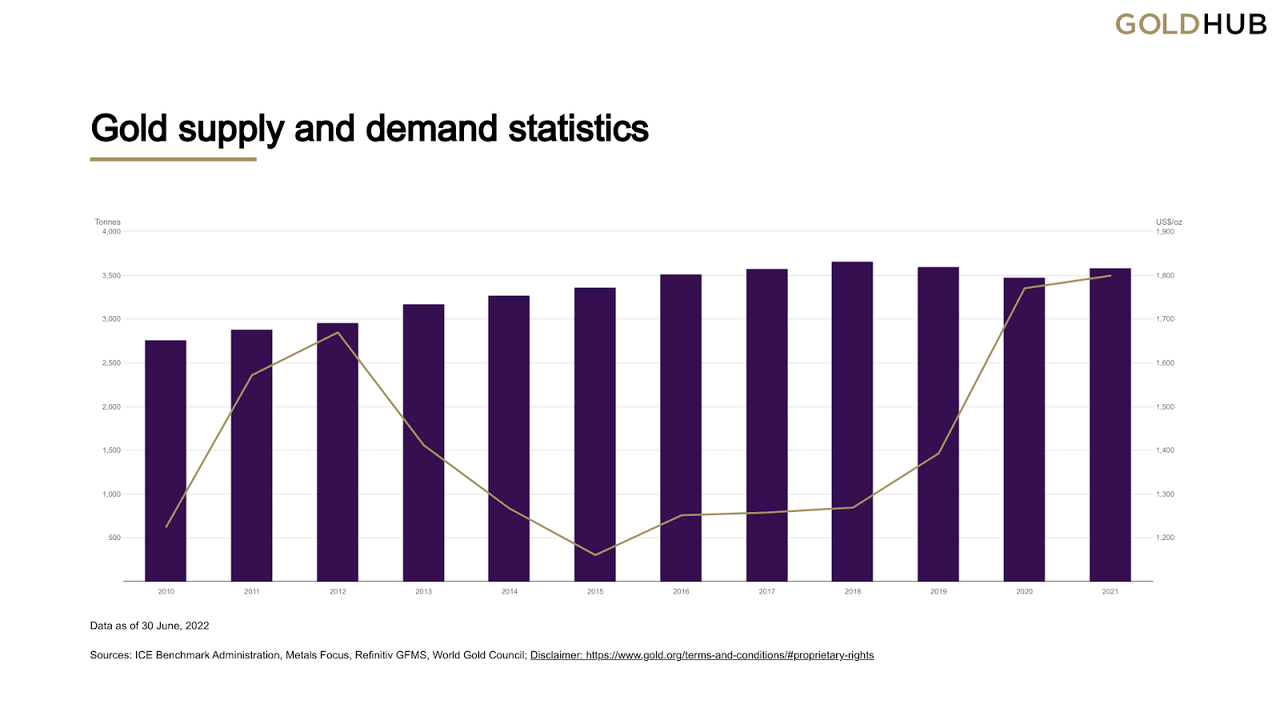

Yet, in the last decade, gold miners have actually become more conservative, with mine production of gold rising moderately.

Source: World Gold Council

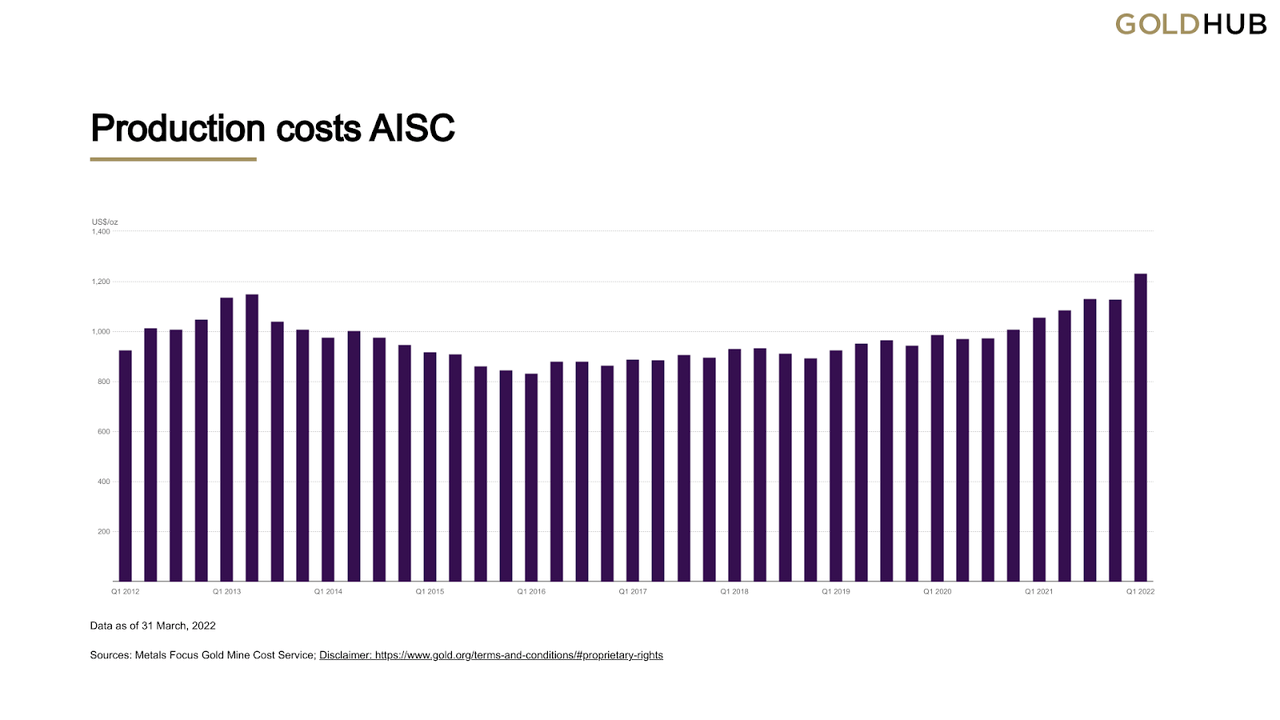

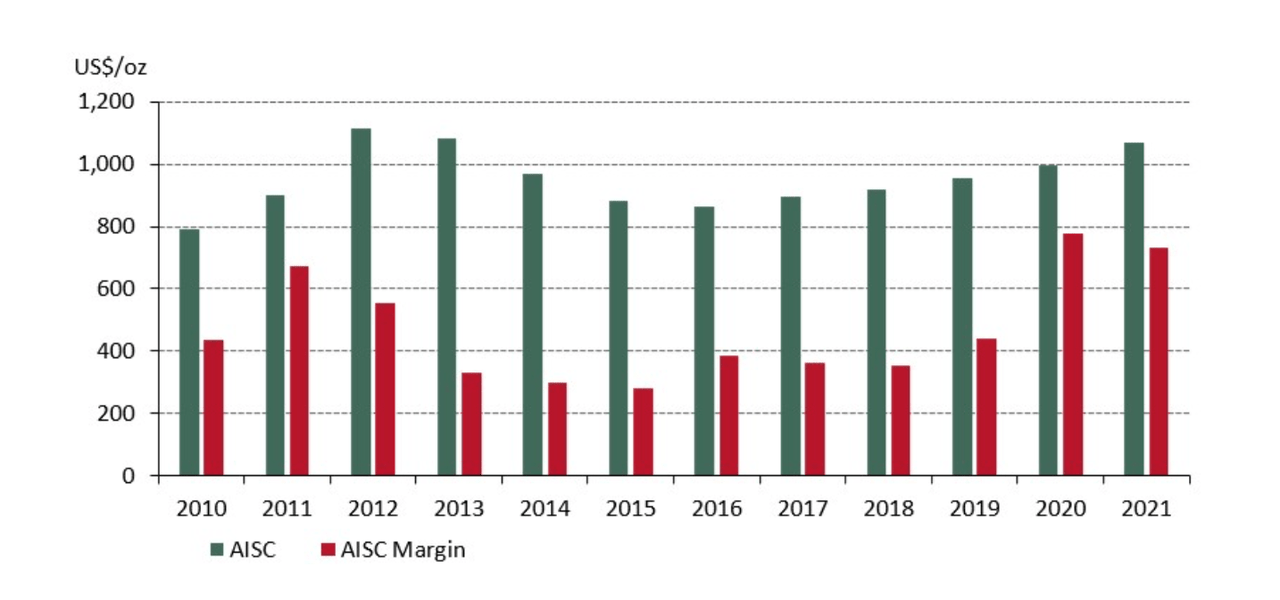

In addition, the industry has managed to control its production costs over the last decade, with costs rising since the pandemic largely due to supply chain disruption, and inflationary prices.

Source: World Gold Council

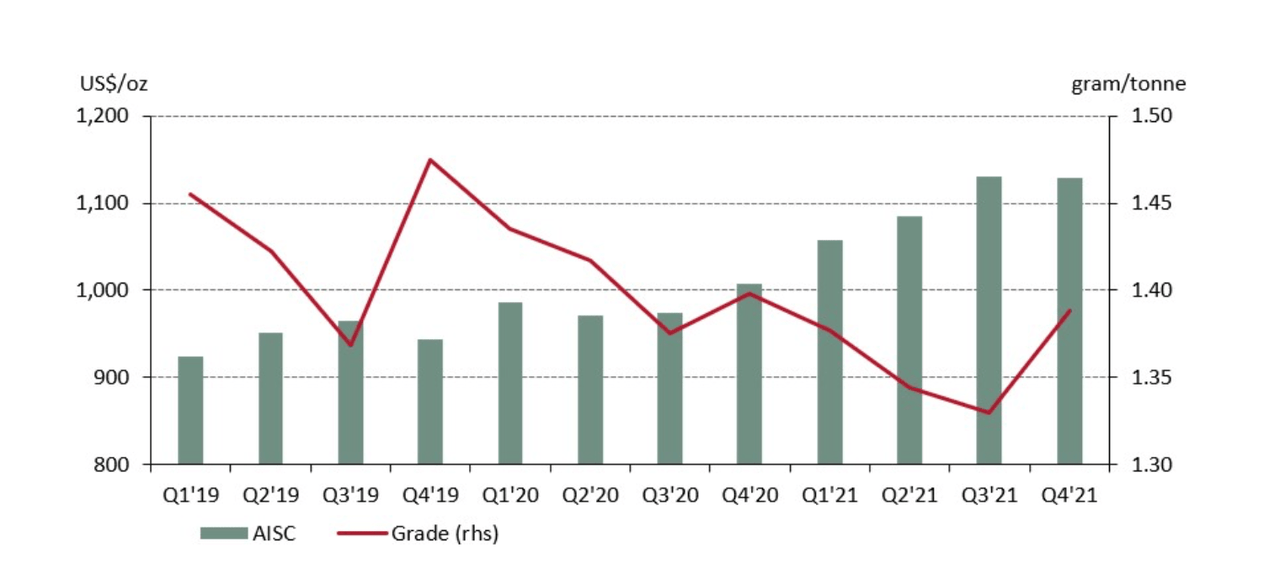

Nevertheless, those inflationary pressures have been offset by rising grades.

Source: World Gold Council

These factors have allowed gold miners to enjoy historically high All-in Sustaining Costs (AISC) margins.

Source: World Gold Council

Gold Fields’ AISC are in line with industry numbers, with the company indicating that production for the second half of the year will be between 2.25 million and 2.29 million ounces (OZ) with AISC at between $1,140/oz and $1,180/oz, for the group minus their holdings in Ghanaian gold miner, Asanko Gold. In the first half of the year, the company produced 1.2 million oz, 9% higher than for the same period last year, with an AISC of $1,148/oz, itself 5% higher than the year prior.

So essentially, we can conclude that despite decades of capital indiscipline, gold miners, due to industry consolidation, and better capital allocation prices. Now, those investors who think of gold miners as an option on gold should flip the script and see gold’s poor performance over the last year as a plus.

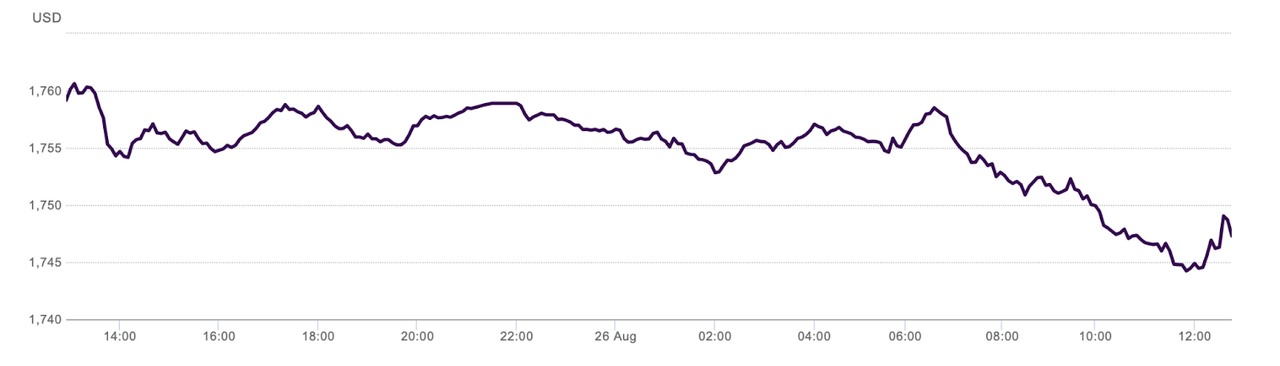

Source: World Gold Council

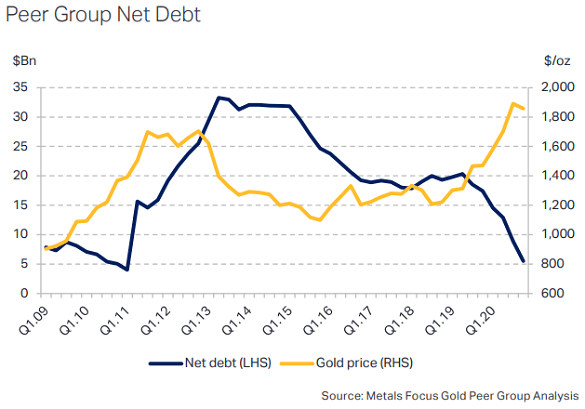

Gold’s failure to live up to its billing as a hedge against inflation is good news for investors because it means that gold miners will be forced to remain restrained and exercise more prudent capital allocation policies. In fact, debt levels for the industry are at decade lows.

Source: Bullion Vault

Remember, in commodity markets, there is an inverse relationship between asset growth and future returns. So falling or tepid gold prices act as a break on stupid capital allocation policies. That means that investors can invest in the industry with a view to accessing the rich dividends that gold miners will provide, at a time when gold miners are trading at cheap valuations. Gold Fields is, for me, one of the best ways to expose yourself to this great opportunity.

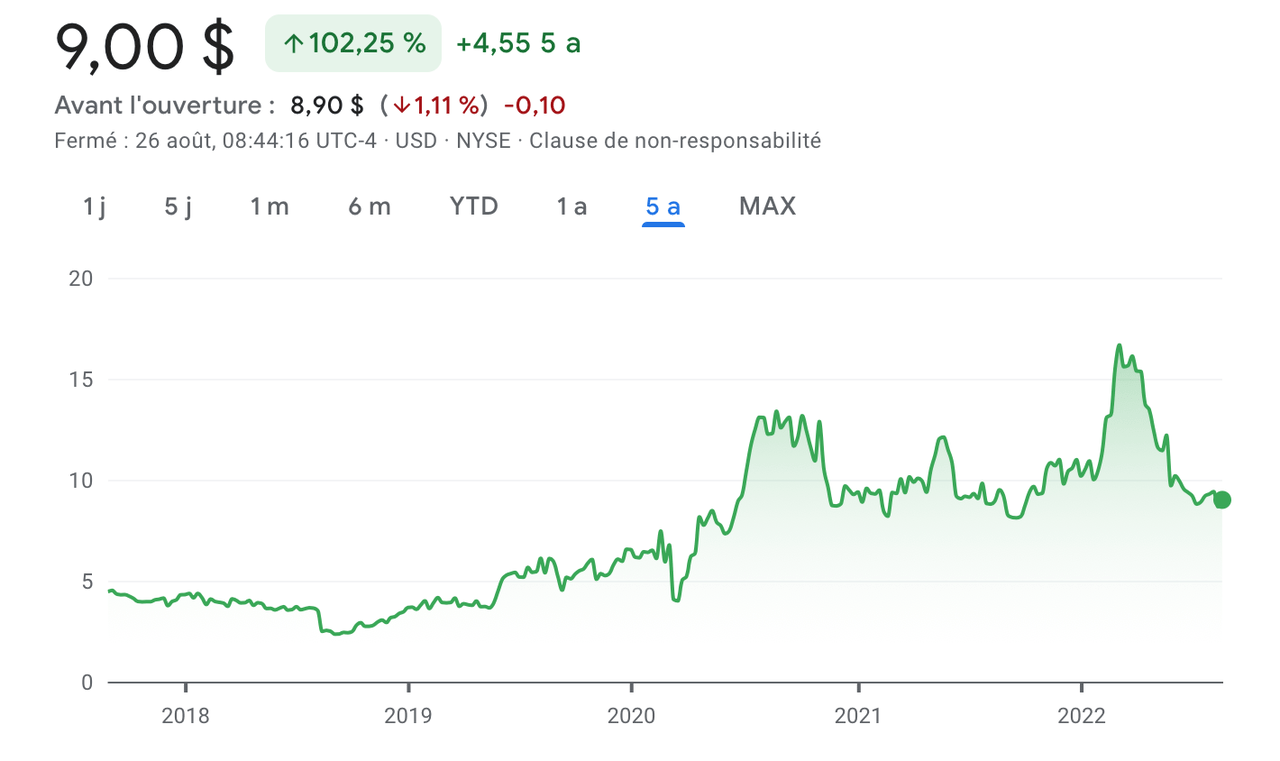

Strong Stock Performance

Despite a troubled Salares Norte project, the market has understood the merits of investing in Gold Fields, with the stock price up over 100% over the last five years..

Google Finance

Impressive Financial Performance

Gold Fields revenue has grown modestly in the last decade, from over $3.5 billion in 2012, to nearly $4.2 billion in 2021. Profitability has improved, with gross profits rising from nearly $1.7 billion to over $1.8 billion and net income from over $654 million to more than $789 in the same period. in the first

The company’s free cash flow (FCF) has grown dramatically, from $217 million in 2012, to $1.23 billion in 2021, compounding at 18.94% per year in that decade. FCF margins have grown from 6.2% to 29.3% in that time.

As we discussed above, asset growth is inversely related to future stock performance, and Gold Fields’ balance sheet is a dream for the insightful investor. Total assets have declined by a compound annual growth rate of -3.64% per year, from over $10.648 billion in 2012, to nearly $7.35 billion in 2021. In the gold business, you want a miner that is reducing the size of its balance sheet. Asset growth is not a good thing.

In the last decade, Gold Fields has reduced its debt level from a decade high of over $2.36 billion in 2012 to nearly $1.5 billion in 2021. According to the company’s 2021 Form 20 F, its net debt to EBITDA ratio peaked in 2018 at 1.45x, but, despite the troubles with the Salares Norte project, that has been reduced to its lowest level in a decade: 0.4x.

The company’s capital allocation policies have allowed it to have a very much supportable dividend policy. Gold Fields is committed to giving shareholders between 25% and 35% or its normalized earnings, with the payout in 2021 being 30% of normalized earnings. In the first half of the year, normalized earnings rose by 16%, according to the company’s H1 2022 results, with the company declaring an interim dividend 43% higher than for the same period last year.

Gold Fields’ improvement in returns on invested capital (ROIC) from 11.2% to 17.4%, is testament to the company’s excellent capital allocation policies.

Valuation

With $1.23 billion in free cash flow (“FCF”) in the trailing twelve months (TTF) period, and an enterprise value of $8.67 billion, Gold Fields has an FCF yield of nearly 14.19%. This shows that the company’s growing FCF is still undervalued by the market, that the company’s dividend policy is supportable, and that its future stock performance will be strong. Gold Fields’ FCF yield compares favorably with the average FCF yield of the S&P 500, at 2.05% according to New Constructs.

Conclusion

Investing in gold mining is all about understanding the macro picture because you are dealing with price takers in a market driven by the cobweb model. The underlying economics of the gold mining industry are very favorable, especially in a context in which the gold price is down for the year. This will place positive constraints on behavior. Gold Fields has already shown itself to be a well run company that has followed excellent capital allocation policies on the way to reducing debt, its assets, and improving profitability. With FCF trading at very attractive rates, the company is a strong buy.

Be the first to comment