FeelPic/iStock via Getty Images

If there’s one thing stock market bulls and bears can agree on is that the Fed made a big mistake back in 2021, dropping the ball with their inflation forecast and running the zero interest rate policy stance a bit too long. Many of the macro challenges today may likely have been avoided by hiking rates sooner in the cycle instead of the aggressive 225 basis point increase to the Fed Funds Rate just since March in an attempt to catch up to inflation as the CPI hit a forty-year high of 9.1% in June.

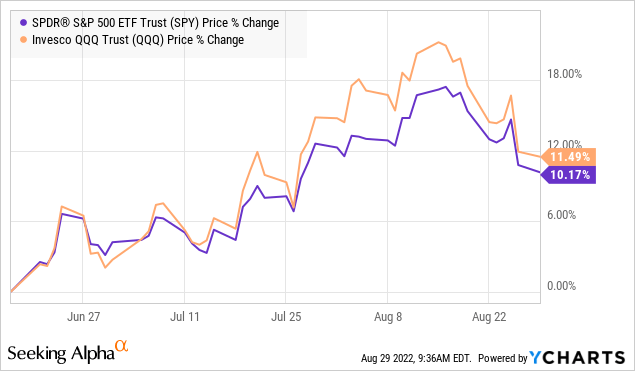

That was the setup for last week’s Jackson Hole Symposium where the Fed took the opportunity to reaffirm its commitment to stabilizing prices. Chairman Jerome Powell was blunt by suggesting further rate hikes will “bring some pain to households and businesses”. Those words were enough to send a shockwave into stocks as the S&P 500 (SPY) fell by more than 3% on the day. The Dow Jones Industrial Average (DIA) pulled back a painful 1000 points.

Under-Promise to Over-Deliver

We’ve been among the biggest bulls over the last several months and our take here is that the market has simply overreacted. The reality is that there were zero surprises in Powell’s speech and despite some harsh words, there was no reason to expect the messaging to be anything else. The last thing the Fed would want to do is to appear soft or jump the gun by even suggesting their strategy is showing signs of working. The way we see it is that Powell’s latest messaging is a case of under-promising to later over-deliver.

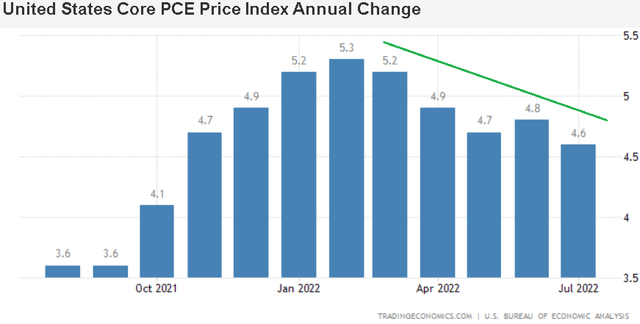

The reality is that macro conditions have improved significantly over the few months and a data-dependent Fed is on the side of stock market bulls. There is no “pivot” required here. A 50-75 basis point rate hike is nearly a lock for the September FOMC next month, but it gets more interesting looking out into 2023. All indications are that inflation has peaked and is set to trend lower going forward. A scenario where the CPI continues to cool and even surprise to the downside, as it did for the July data where it printed 8.5%, means the path for more and more aggressive rate hikes is unnecessary.

Last Friday, amid the Jackson Hole debacle, the July Core Personal Consumption Expenditure (PCE) Index came out at 4.6%, the lowest level since last October and down from a high of 5.3% in February. This alternative inflation index, which excludes the more volatile components of food and energy suggests the rate of change in underlying consumer prices including services is slowing.

Again, it would have been easy for Chairman Powell to highlight these developments as evidence the worst of inflation has already passed, but it was important to stick to the script. Yes, the job is not done yet, but there is light at the end of the tunnel.

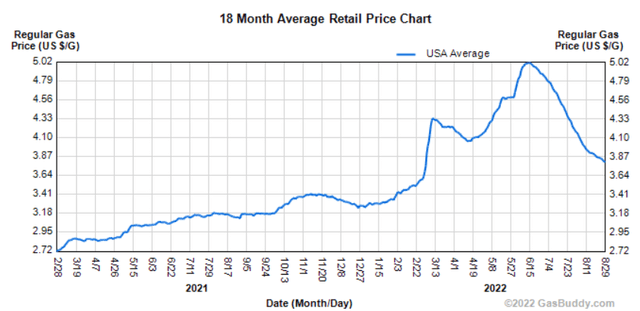

We can look forward to the August headline CPI report on September 13th as the next opportunity for the Fed to score some points with its strategy. The messaging can evolve alongside the data. In truth, the more encouraging trends against inflation have nothing to do with the Fed. U.S. gasoline prices and oil (USO) are down more than 25% from their peak. If Chairman Powell wants to talk about “pain” for consumers and businesses, that was back in June when the national average approached $5.00 a gallon.

Another dynamic that is helping to lower inflation is the reports of retailers moving forward with deep discounts to move excess merchandising inventory. We believe this will play into a surprise lower for the CPI over the next few months. The combination of easing supply chain disruptions including stabilizing food and commodity prices is doing some of the work to bring demand and supply into better balance on its own, beyond the impact of interest rates.

There Is No Economic Collapse

The hard pill for the bears to swallow is that the S&P 500 is still up over 10% from its June low. They’ve been on the wrong side of the trade for several months now by just rehashing talking points from Q1. It’s never going to be a straight line up or down, but if stocks never break that June bottom, the bears will be wrong- again.

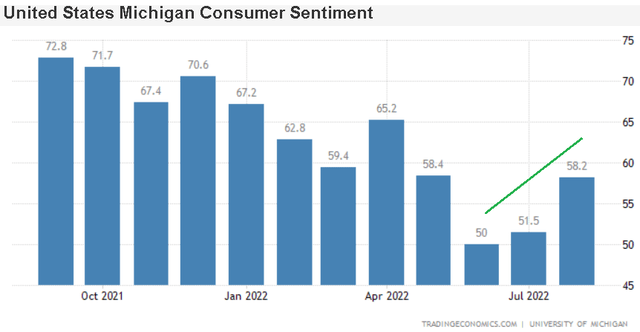

What the bulls have in their corner is a backdrop of an improving economic outlook, particularly against the deep fear and uncertainty from Q2. There were calls that the price of oil would surge to over $200 a barrel, and the Russia-Ukraine conflict might spiral into World War 3. While we can chalk those outcomes up as a tail-risk even still a remote possibility, the upside here is less uncertainty. We expect leading indicators like the Consumer Sentiment to get a boost over the coming months in line with slowing inflation.

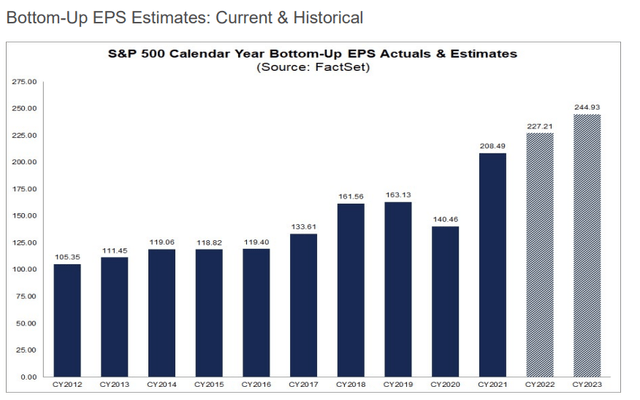

The other positive market tailwind has been the trend in corporate earnings, well-recognized as the most important factor determining equity share price performance. On this point, the outlook is for continued EPS growth. With Q2 earnings season effectively wrapped up, the data shows that companies by and large beat expectations. According to FactSet, 75% of S&P 500 reported earnings above the consensus which showed how resilient major corporations have been in dealing with the challenging economic environment.

For the full-year 2022, the consensus is for S&P 500 bottom-up EPS of $227.21 representing a 9% increase over 2021. Playing around with these numbers, the market forward P/E of 17.6x highlights what we see as a compelling valuation. For 2023, the market sees another 8% increase in earnings which would be supported by stabilizing macro conditions. Again, the bears sort of need these forecasts to end up drastically wrong which has not been the case.

Final Thoughts

There aren’t many certainties in life with death and taxes often cited as the only inevitable. We can throw in doom-and-gloom apocalyptic stock market warnings to that list with the daily calls for a looming “big crash lower” as predictable as the sunrise. Stocks don’t always go up, but if we look back at major historical market lows, there were always those convinced of even more downside which ended up being wrong.

In hindsight, March 6th 2009 when the S&P 500 hit 666, or even the pandemic crash low on March 24th, 2020 are dates that will forever be engrained in the minds of investors as representing generational buying opportunities. In our view, you can add June 17th 2022 when the S&P 500 hit 3,639 to that group as it may have very well marked the bottom in this cycle. That’s the only call that matters at this point. We are bullish here and view this latest pullback as a buying opportunity.

With the S&P 500 currently sitting around the 4,000 level, an important level of support will be down at 3,900. Holding this level over the next few weeks into the August CPI report can set up the next leg higher. This Friday, ahead of the Labor Day weekend there is the August non-farm payrolls report. We want to see a strong number, as an indication that the economy remains on a firm footing.

The bears will attempt to make some noise regarding the interest rate implications of a “good news” report. At this stage, we sense it’s more important to brush aside concerns of a deepening recession. The combination of a stronger than expected economy despite higher interest rates, all the while inflation is trending lower can be very positive for stocks through the end of the year.

Be the first to comment