RapidEye

Less than 3 years after listing on the Nasdaq by way of a blank check merger, Glory Star New Media Group Holdings Ltd. (NASDAQ:GSMG) is going private. The company agreed in July to be acquired by a consortium led by Bing Zhang, GSMG’s founder, chairman, CEO and acting CFO, for $1.55/sh in cash consideration. The consideration price is an absolute steal given the company’s tremendous growth and strong financials.

Currently, a ~17% arbitrage opportunity exists in GSMG shares despite the high likelihood that the transaction closes by year-end. Therefore, speculative investors should definitely consider adding GSMG to the portfolio. Bear in mind, however, with average trading volume less than $500k/day, this opportunity is limited to micro-cap investors.

Overall, GSMG is a Strong Buy with a price target of $1.55/sh.

The Company

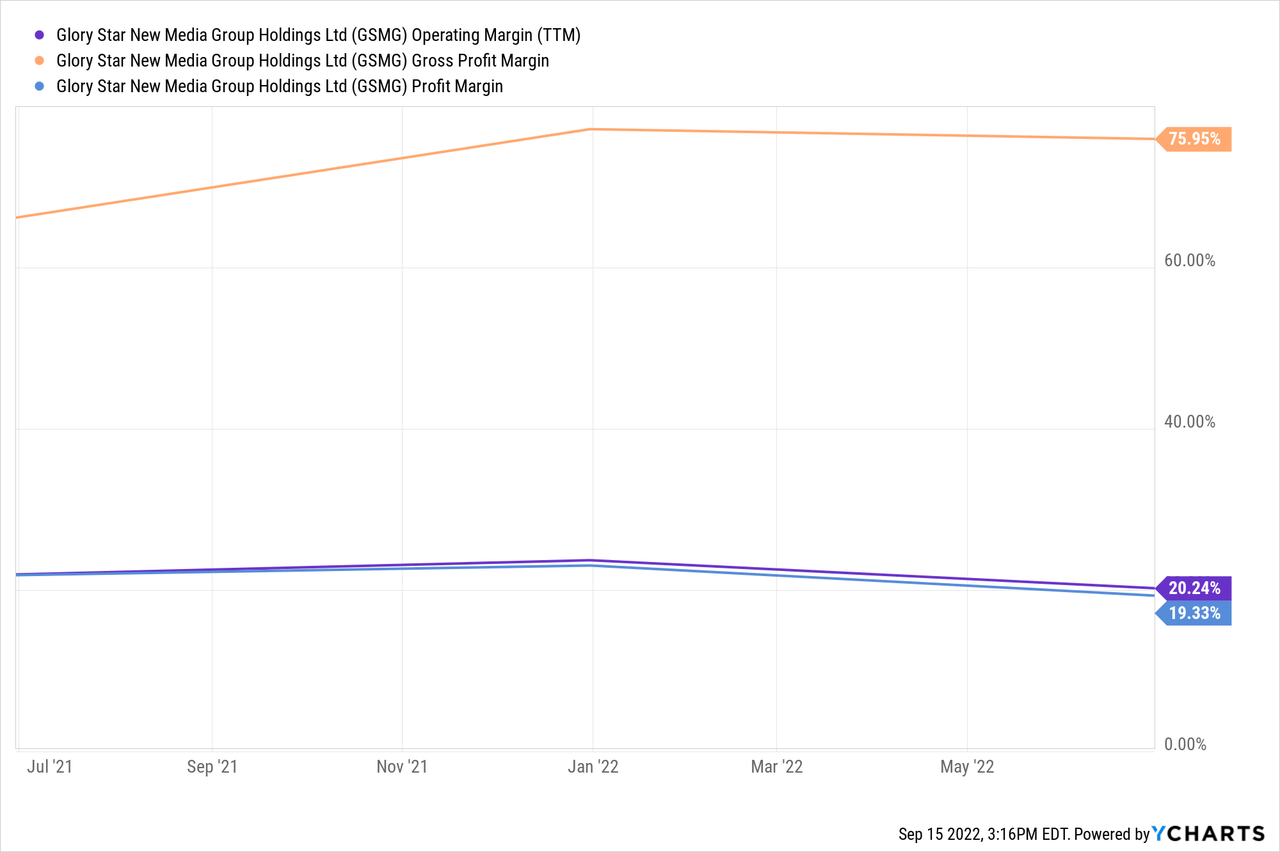

GSMG is a Chinese digital advertiser, content provider, and e-commerce platform operator. The company is currently experiencing exceptional demand for its services, with sales growing 128% from $66m in 2019 to $151m LTM. To boot, GSMG has an enviable margin profile:

In 2021, GSMG generated 56¢ EPS and 71¢/sh of FCF. On the balance sheet, GSMG has $39.2m of net cash and a book value of $2.38/sh.

At $1.55/sh, GSMG is being acquired at less than 3x ’21 EPS, less than 2.5x ’21 FCF, and only ~65% of MRQ BV.

In other words, GSMG is being taken private at an insanely cheap price.

The Transaction

There is really nothing stopping this merger from consummation except time. It has neither financing nor regulatory conditions necessary for closure; albeit, the transaction does require a shareholder vote, but the consortium has a controlling stake to guarantee approval.

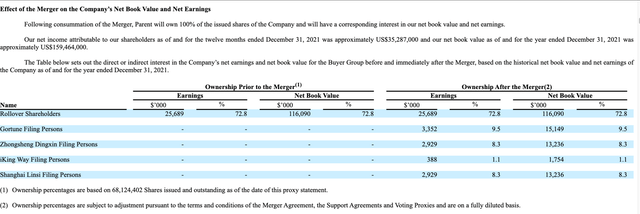

The consortium includes 13 unique rollover shareholders and 4 outside sponsors. The rollover shareholders control ~72.8% of GSMG’s 68m S/O and have entered into support agreements to vote all their respective shares in favor of the transaction. In addition, the 4 sponsors have committed equity in order to participate in the transaction.

Given the attractiveness of the buyout to the sponsors, it is unlikely that the deal breaks. Based on the consideration price, GSMG has an equity value of $105.6m. But because the rollover shares are not receiving consideration, the total cost to the consortium is only ~$31.5m (inclusive of transaction fees), which is slightly more than GSMG’s $29.2m LTM net income. The cost is being financed through equity committed by the sponsors.

The transaction’s allure to the sponsors is even more apparent when considering each member’s respective interests in GSMG post-merger:

GSMG Preliminary Proxy Statement

For example, Gortune Filing Persons, one of the 4 sponsors in the consortium, will own 9.5% of GSMG upon consummation of the buyout. Gortune committed $10m in equity to receive that ownership stake. Once the deal closes, Gortune’s $10m investment immediately translates into $15.1m of GSMG’s book value. Had Gortune owned that same sake at the beginning of 2021, it would have made a 34% return on investment in just one year. In other words, the economics of this deal are too good to walk away.

Currently, the parties are finalizing the Schedule 13E-3 and Proxy Statement with the SEC and will set a shareholder meeting date thereafter to approve the transaction. Per the proxy, the merger is expected to close by year-end 2022.

Risks

The chief risk to this transaction is for the consortium to seek a lower share price. This could occur for any number of reasons and, unfortunately, there is little minority investors could do about it, with the exception of litigation, exercising dissenter rights, or a combination of both. Although, these are costly undertakings and, in light of there presently being only ~$25m of outside capital invested in GSMG, the odds of a sizable shareholder shouldering the burden is low.

If the transaction were to break, it is likely shares would trade materially lower. GSMG traded for 88¢/sh unaffected, which suggests a 65% drop from today’s quotation. Odds are, however, unlikely for a deal break. Moreover, in the long run, GSMG has substantial upside if it were to continue trading on the NASDAQ, assuming management acts in the best interest of shareholders.

Conclusion

I rate GSMG a Strong Buy that should be considered by speculative investors.

Be the first to comment