bjdlzx

A Quick Take On Trio Petroleum Corp.

Trio Petroleum Corp. (TPET) has filed to raise an undisclosed amount in an IPO of its common stock, according to an S-1 registration statement.

The firm operates as an oil & gas exploration firm with leasehold interests in Monterey County, California.

When we learn more details about the IPO from management, I’ll provide a final opinion.

Trio Overview

Danville, California-based Trio was founded to develop oil & gas properties in Monterey County, California, which it refers to as the South Salinas Project.

Management is headed by Chief Executive Officer Frank C. Ingriselli, who has been with the firm since February 2022 and was previously president of Indonesia Energy Corp. (INDO), which recently went public in the U.S.

Management believes the South Salinas Project has the potential of up to ’39 million barrels of oil plus 40 billion cubic feet of gas.’ (P2 Probable)

The company aims to develop its existing leasehold and possibly acquire ‘other opportunities for oil and gas production in California.’

As of April 30, 2022, Trio has booked fair market value investment of approximately $10 million in equity and debt as of April 30, 2022, from investors including Elpis Capital, Gencap Fund, Primal Nutrition and others.

Trio’s Market & Competition

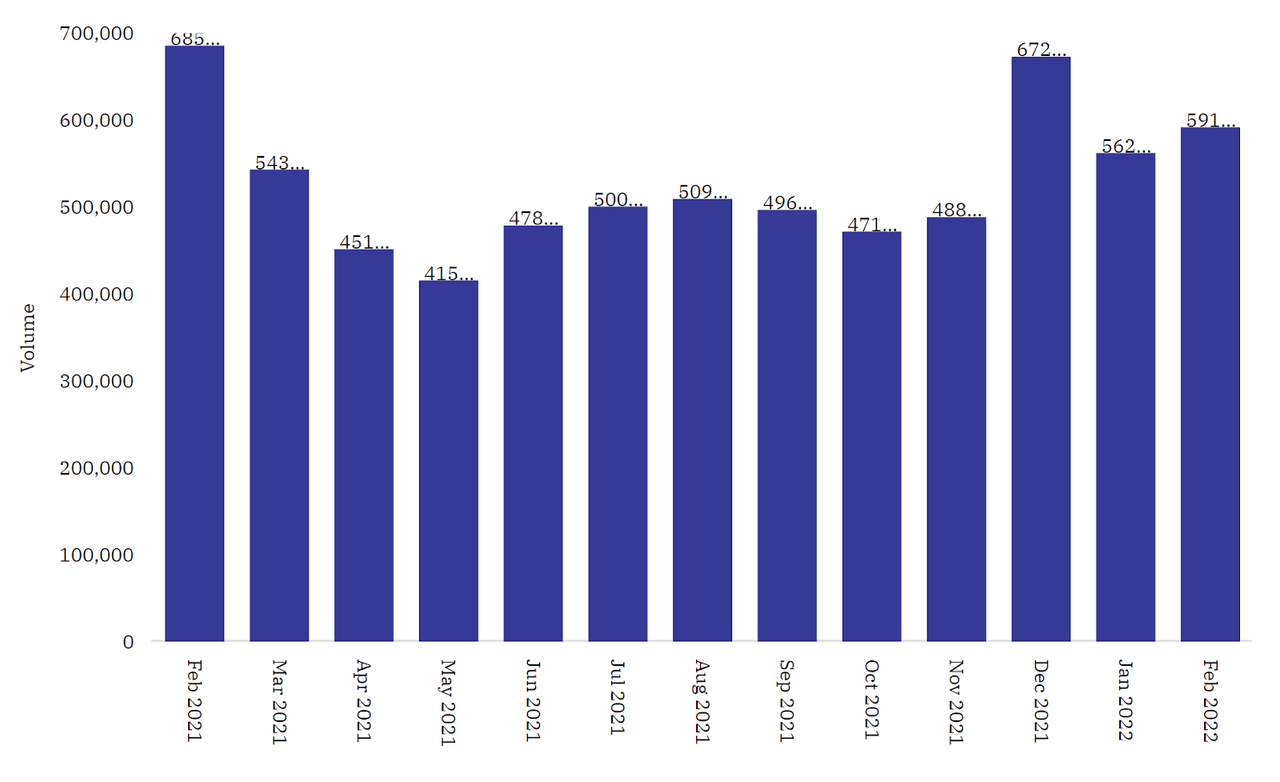

According to a 2022 market research report by Offshore Technology, California’s oil and gas production rose 5.27% month-over-month to 592,000 barrels per day in February 2022, but declined year-over-year by 13.7%

The following chart shows oil production in California by month for the twelve months ended February 2022:

California Oil Production (Offshore Technology)

While California regulators have been increasingly restrictive against fossil fuel operations, the state continues to need a significant increase in energy due to greater severity of climate events in recent years amid a drop in energy plant capacity.

Major competitive or other industry participants include:

-

California Resources

-

Exxon Mobil

-

Chevron

-

Sentinel Peak Resources California

-

Berry Petroleum

-

Sempra Energy

-

Buckeye Partners

-

Niska Gas Storage Partners

-

Pacific Gas & Electric

-

Others

Trio Petroleum Corp. Financial Performance

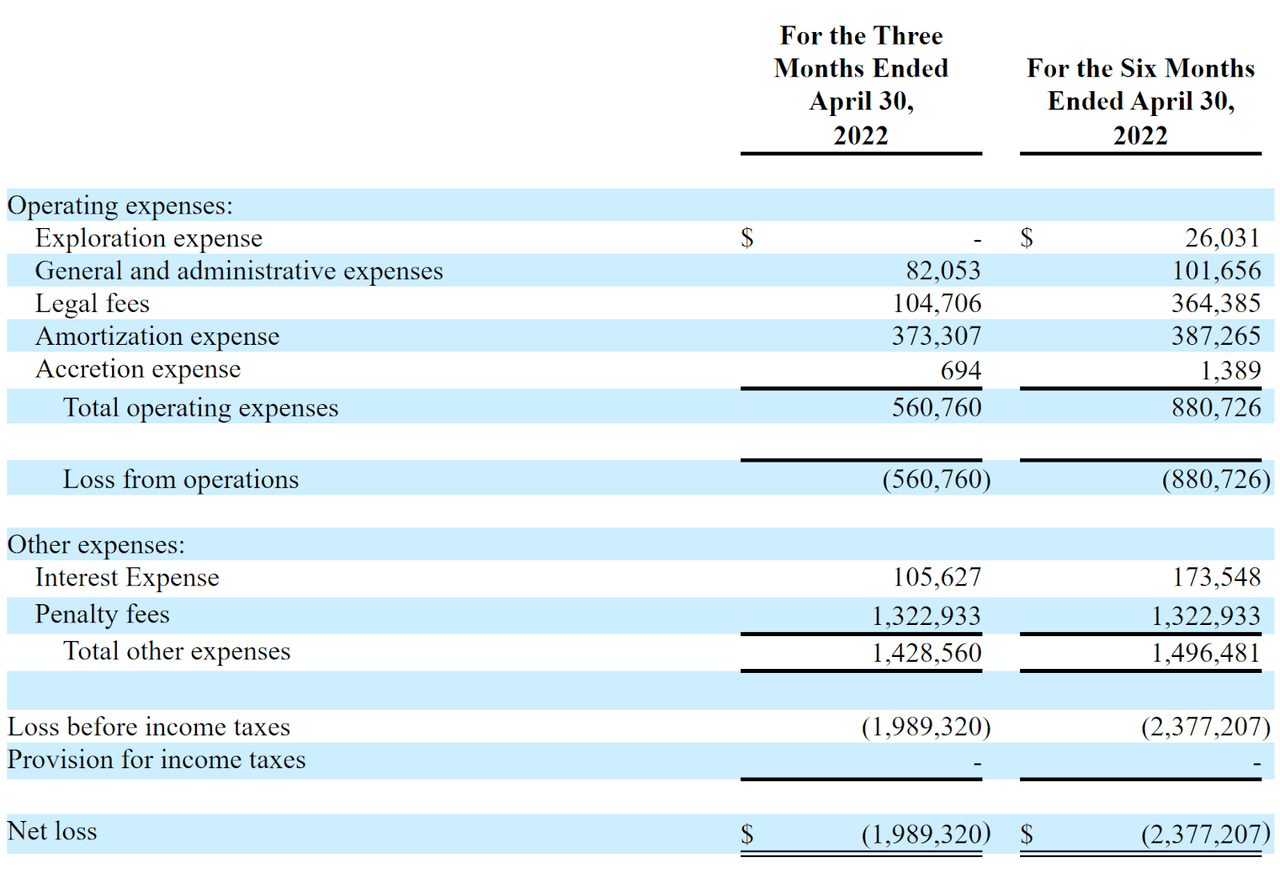

Below are relevant financial results derived from the firm’s registration statement:

Statement Of Operations (SEC EDGAR)

As of April 30, 2022, Trio had $249,711 in cash and $4.6 million in total liabilities.

Trio IPO Details & Commentary

Trio intends to raise an undisclosed amount in gross proceeds from an IPO of its common stock.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management has not indicated exactly how it will use the net proceeds from the IPO but has generally said that it will seek to develop its existing leaseholds and potentially acquire and develop additional resources in the Monterey region.

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says there are no legal proceedings to which the firm is a party that would have a material adverse effect on it.

The sole listed bookrunner of the IPO is Spartan Capital Securities.

The company’s financials show no revenue and some expenses associated with its initial operations.

The firm currently plans to pay no dividends and to retain future earnings for reinvestment back into the company’s operations and growth initiatives.

The market opportunity for developing oil & gas resources in California is significant, but the firm faces competition from major oil & gas producers and the state regulatory bodies are highly restrictive.

Spartan Capital Securities is the sole underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (74.4%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risks to the company’s outlook are its asset-light, thinly capitalized status and lack of revenue history.

When we learn more details about the IPO from management, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment