Just_Super

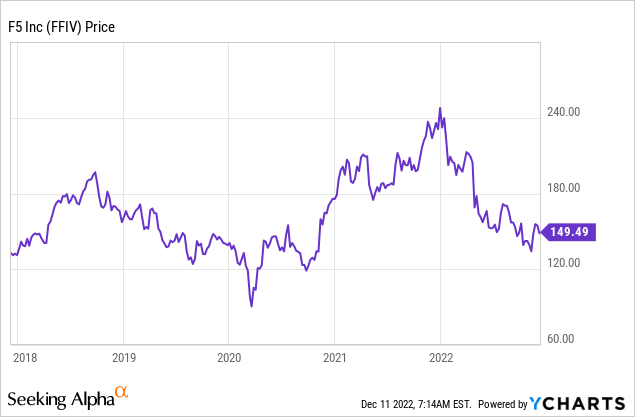

F5 (NASDAQ:FFIV) is a best-in-class technology company that truly does provide a key solution for organizations to improve both their Security and application performance. F5 serves 48 of Fortune 50 companies and is poised to benefit from growth trends in cybersecurity, the hybrid cloud, and vendor security stack consolidation. The cybersecurity industry alone was valued at $156 billion in 2022 and is forecasted to be worth $376 billion by 2029, clocking up a 13.4% compounded annual growth rate. In this post, I’m going to break down F5’s business model, financials, and valuation, let’s dive.

Business Model Recap

In my previous post on F5 I covered the business model in more detail, here is a quick recap. F5 is a leading IT and Cybersecurity company that focuses on Application performance monitoring, through the usage of ADCs or Application Delivery Controllers.

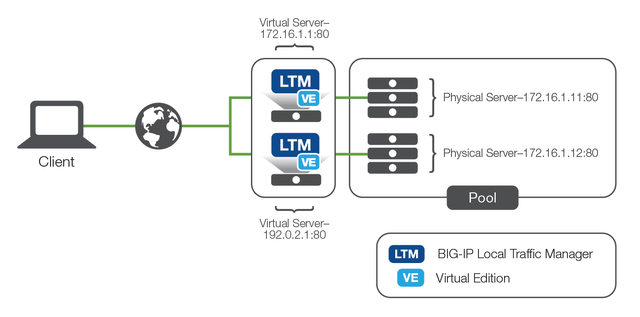

As ADC is basically a load balancer that manages traffic between different servers to avoid overload and keep IT systems working at top speed. As you can see from the graphic below, ADCs use a “Virtual Server” in between the physical servers to act as a buffer for traffic. In this case, LTM stands for F5’s flagship ADC, the BIG-IP local traffic manager. Gartner customer reviews rate this product second in the list with 4.5 out of 5 stars, the same as Route 53 by Amazon Web Services [AWS], the leader in cloud infrastructure.

Application Delivery Controller (F5)

These systems are vital for application performance and also cybersecurity. For example, in a “Slow Loris” attack, a hacker sends an initial request to a server and then goes silent part way through, delaying the flow of traffic.

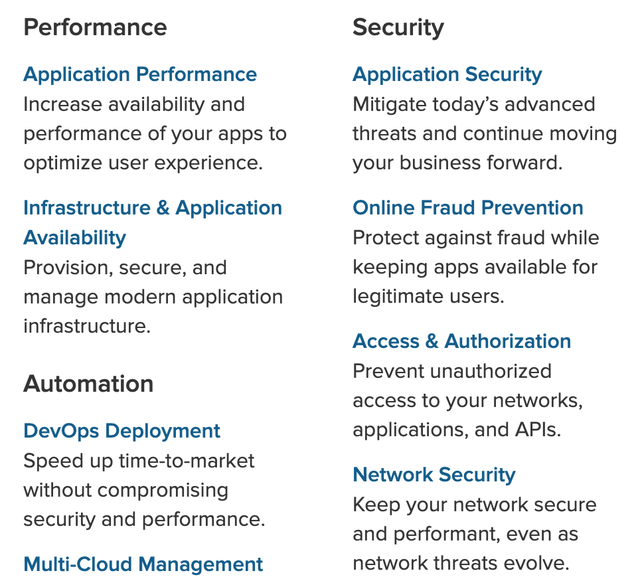

The company also offers products that protect against online fraud, unauthorized access and can even automate development cycles. Multicloud management is also a key solution, given the growth in the hybrid cloud and the number of companies using multi-cloud infrastructure providers. The international hybrid cloud industry was $71.23 Billion in 2021 and is forecasted to grow at a rapid 18.4% compounded annual growth rate [CAGR].

F5 Products by use case (F5 Website)

Stable Financials

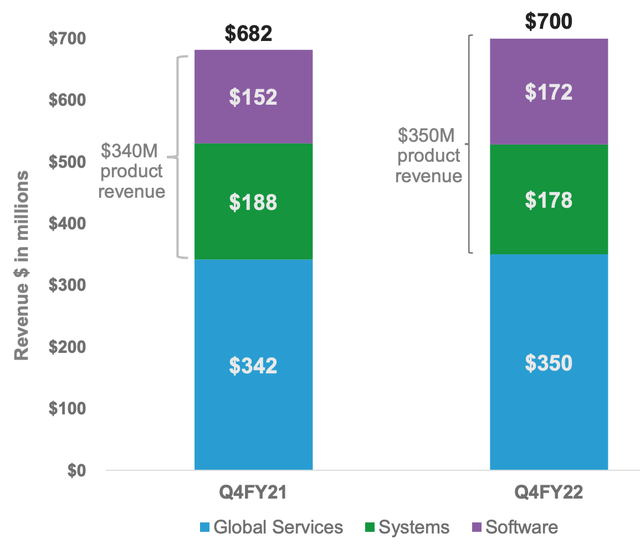

F5 reported solid financial results for the fourth quarter of fiscal year 2022. Revenue was $700 million which increased by 3% year over year, with 3% product revenue growth and 2% global service growth. This growth may not seem very fast, but it did beat analyst estimates by $8.25 million. Management noted that some of its customers paused digital transformation projects due to the macroeconomic uncertainty which impacted revenue.

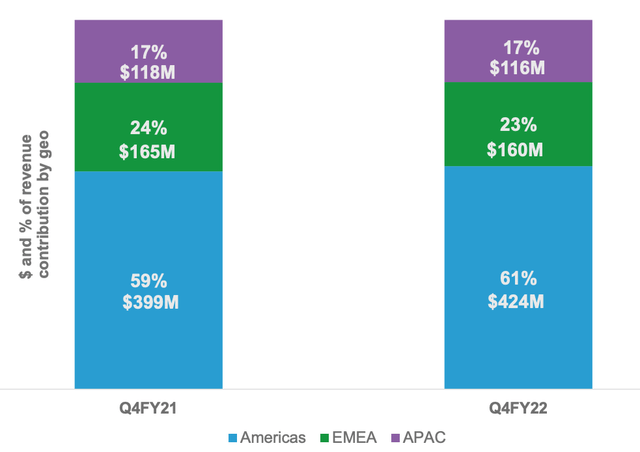

Breaking revenue down by region, the company reported headwinds from a strong U.S dollar which impacted international revenue. EMEA revenue contributed to 23% of total revenue and declined by 3%. APAC revenue contributed to 17% of total revenue and declined by 2%. However, the Americas continued to deliver strong growth of 6% year over year and contributed to 61% of the total. Nobody knows how long foreign exchange rates will remain as they are, but historically the currency markets have moved in cycles. In addition, companies can hedge currencies or even keep currency in its local denomination to avoid unfavorable exchange rates. However, F5 didn’t elaborate on whether this was a strategy.

Breaking revenue down by type, Product revenue contributed to 50% of total revenue and consists of software and systems-derived revenue. Its software revenue continued to grow strong increasing by 13% year over year to $172 million. The majority (76%) of its software revenue is derived from subscription-based sales. SaaS is my favorite type of business model as it generally has high operating leverage, is easily scalable and products can be upsold easily.

Revenue by type (Q4,FY22 report)

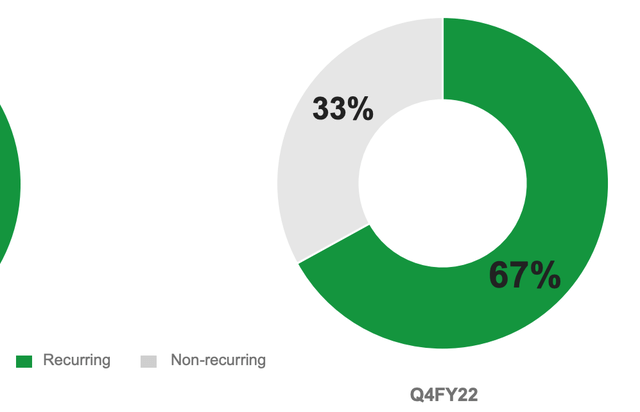

The company had a solid pipeline of multiyear subscriptions heading into the fourth quarter but did notice longer sales cycles and lower close rates on new deals. This was driven by the uncertainty around the macroeconomic environment, which has caused increased budget scrutiny. Overall, I believe this is a cyclical short-term issue and if a customer has a real pain point they will purchase overtime. Rounding out, the rest of the business revenue, Global Service revenue contributed $350 million up 2.3% year over year While Systems revenue was $178 million, down 5% year over year. A positive is the company generates 67% of its revenue from a recurring revenue model, which should offer consistency, despite economic uncertainty.

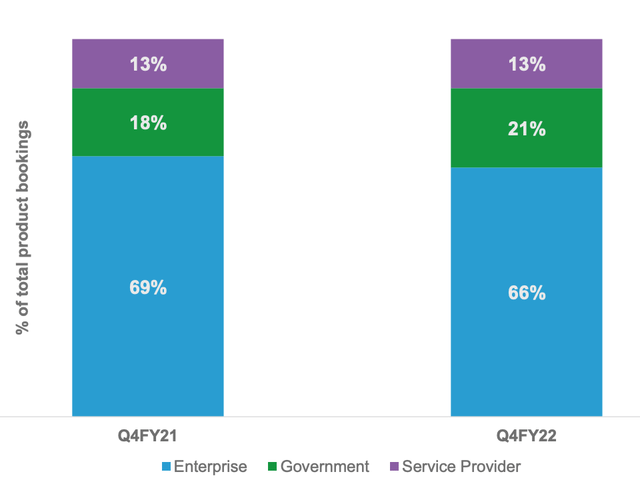

Another positive for F5 is the majority of its product customers (66%) are large Enterprises. These types of organizations generally have more consistent revenue, larger budgets, and a greater number of upsell opportunities overtime. For example, in the fourth quarter, a global retailer expanded its existing F5 (BIG IP hardware) with scalable BIG IP software for the cloud. This was complemented by the automation of the F5 tech stack, which helped to make the developer’s life easier. As an extra point, Government agencies represented 21% of F5’s enterprise customers, which is another positive point for consistency and upsell potential.

Revenue by Customer type (Q4,FY22 report)

A notable customer win in the quarter was a global transport company with its roots in South America. The business wanted to adopt a multi-cloud security solution as it digitally transformed its business. The customer purchased five cloud services from F5 which covered a web application firewall, API security, DDoS protection and more. The key selling point of F5 is it offers a “one-stop” solution for organizations. Historically, companies had to purchase multiple single-point cybersecurity solutions from providers which can be costly and time-consuming to manage. Therefore F5 is poised to benefit from two key trends, hybrid cloud, and vendor security stack consolidation.

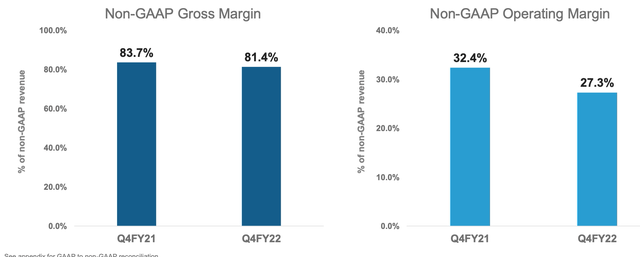

Moving onto profitability and margins, F5 reported a gross margin of 78.9% or 81.4% on a non-GAAP basis. This was slightly below management guidance of between 82% and 83%, which was a result of a higher systems revenue mix, and higher procurement costs.

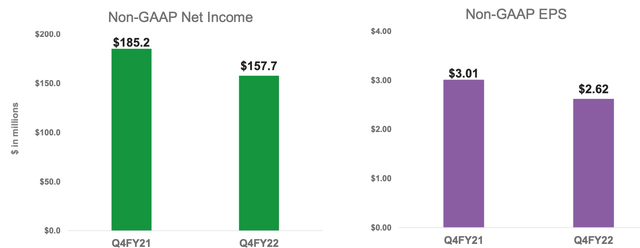

The company also reported a non-GAAP operating margin of 27.3% which was down from 32.4% in the prior year. This was driven by $379 million in Non-GAAP operating expenses which was higher than the prior year but in line with management’s estimates. The company also reported non-GAAP Earnings Per Share of $2.62 which beat analyst estimates by $0.11.

F5 has a strong balance sheet with cash and short-term investments of ~$894 million. In addition, the company has $350 million in debt which management plans to pay down in Q1,23. Moving forward in FY23, the company also plans to return 50% of free cash flow to shareholders via an extensive share buyback scheme and identify M&A opportunities.

Advanced Valuation

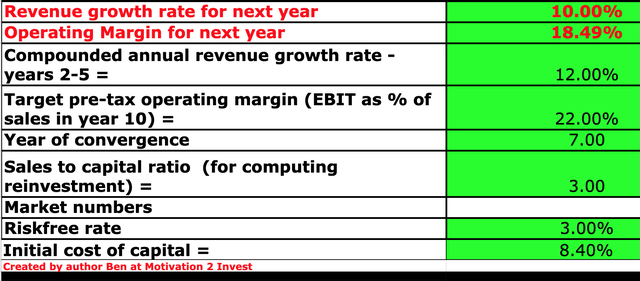

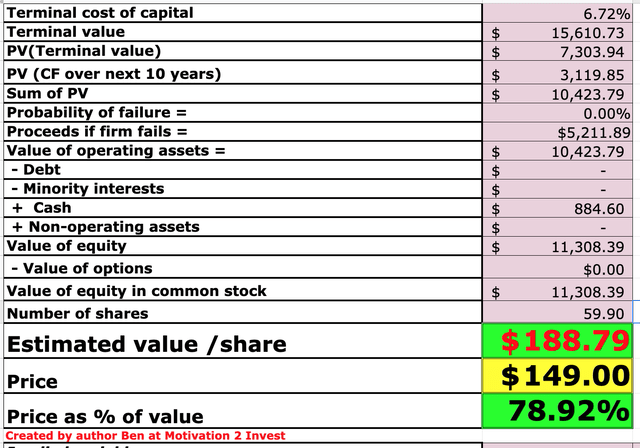

In order to value F5, I have plugged the latest financial data into my discounted cash flow model. I have forecasted 10% revenue growth for next year and 12% revenue growth over the next 2 to 5 years. This is aligned with management estimates for next year. In addition, I am forecasting revenue growth to accelerate in years 2 to 5 as economic conditions are likely to improve.

F5 stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation I have also capitalized R&D expenses, which has lifted the net income margin slightly. In addition, I am forecasting a continual increase in operating margin to 22% in 7 years, driven by increasing upsells, and more sales of higher-margin software.

F5 Stock valuation 2 (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of $188 per share, the stock is trading at $149 per share at the time of writing and thus is 22% undervalued.

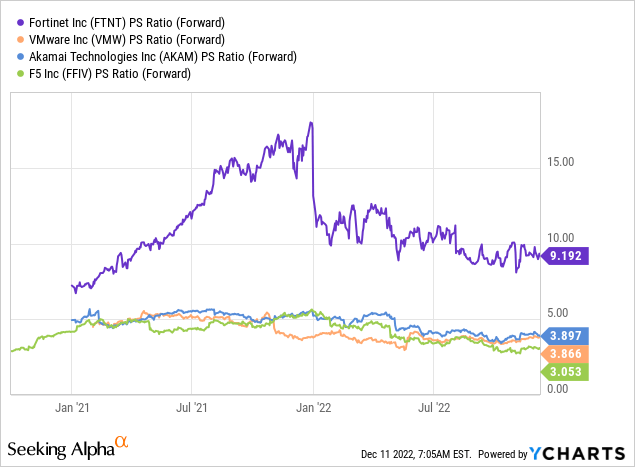

As an extra data point, F5 trades at a forward Non-GAAP PE ratio = 13.9 which is 20% cheaper than its 5-year average. Its price-to-sales ratio = 3, which is 25% cheaper than its 5-year average and cheaper than industry peers.

Risks

Longer Sales Cycles/Recession

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. We are already seeing the dynamics of this play out with longer sales cycles and lower close rates reported by F5. I forecast this trend to continue in the first half of next year, but over the next coming years, the pressure should start to ease as economic conditions improve.

Final Thoughts

F5 offers top-level security and application performance solutions and is ready to benefit from growth in the hybrid cloud and increasing traffic throughput. The company’s large enterprise customer base and growing subscription business model mean it has a lot of consistency baked into the business. F5 is facing headwinds from the macroeconomic environment was has stricken fear into organizational decision-makers. However, the stock is undervalued at the time of writing and thus could be a great long-term investment.

Be the first to comment