alainfinger

There is a predicament in sailing which is the epitome of a navigational nightmare called “being caught in irons”. “Being caught in irons” happens when the boat is turning from one tack direction to another and momentarily is pointing straight into the wind. When a sailing vessel points directly in the wind with no momentum to either side, the boat will become motionless and dead in the water. The largest US dredging company, Great Lakes Dredge & Dock (NASDAQ:GLDD) is currently “caught in irons” with an abundance of transient issues stalling its business and share price. While most problems could be considered as fleeting, there is one major structural issue that is inherent with its business model.

First off, I am biased towards Great Lakes Dredge & Dock as a long-term speculative capital gains investment. I initiated a position in Sept 2019 and added to position between March and April 2020. As a shareholder, I appreciate the uniqueness of both the company and its market. As the only publicly traded US dredging firm, peer comparisons are most difficult at best.

Background

Dredging is the mechanical and physical movement of the sea bottom from one place to another. The natural migration of the sea bottom and sand over time usually clogs channels and harbors, creating the need to re-dredge navigable waterways. Coastal storms and hurricanes speed up the natural migration process and adds the effects of coastal erosion to the mix. As coastal storms increase in intensity and frequency, so does the need for coastal restoration. In addition, as ocean-going ships increase in size and depth, ports, harbors, and waterways need to be expanded to accommodate larger ships. New LNG export terminals usually require channel modifications and dredging services.

The US dredging market is mainly controlled by the US federal government through contracts from the US Army Corps of Engineers USACE, augmented by annual disbursements from the Harbor Maintenance Trust Fund HMTF. The USCE contracts for maintenance dredging of navigable waterways to remove the natural movement of seabed materials, waterways capital improvements such as deepening of harbor channels to accommodate larger ocean-going vessels, and coastal replenishment of barrier islands and beaches. 2022 expenditures by USACE and HMTF combined are more than $5.4 billion: $2.3 billion for harbor and waterways capital improvements and $3.1 billion for maintenance. In addition, the USACE included $3.1 billion in the budget for flood control and coastal improvements. These projects are usually categorized as coastal and inland. Adding to the annual USACE budget, the 2021 Infrastructure Bill granted an additional $11.6 billion in funding to improve the nation’s resilience to the effects of climate change, including flood control and waterway dredging.

Great Lakes Dredge & Dock specializes in coastal and harbor projects, which are awarded based on a contract bid process. Most contracts are usually completed in under 12 months with larger projects usually contracted for, and completed, in stages. For example, a multi-phase, $365.7 million project will deepen the Port of Mobile’s bar channel, bay reach and river channels bar. Due for completion in 2025, GLDD was awarded Phase 3 in 2021. The shorter-term USACE contracts become both a gift and a curse. The gift with shorter-term contracts is the ability to quickly complete the assignment and get paid. The curse is shorter-term contracts are most usually fixed-rate bids.

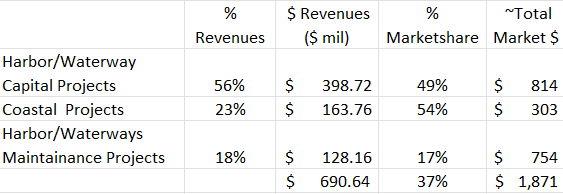

Using the latest investors presentation as a source, the table below outlines TTM Sept 2022 results for GLDD’s market share. The table lists percent of TTM revenue, estimated revenue, stated market share, and estimated total bid market by project type. TTM revenues were $712 million.

GLDD Presentation, Author

Overall, 50% of TTM revenues are from capital and improvement projects and 50% from recurring maintenance projects. In 2021, ~78% of GLDD’s dredging revenues were generated from 47 different contracts with federal agencies, or third parties operating under contracts with federal agencies.

The Issues

Before 2022, Great Lakes Dredge & Dock was on a nice trajectory of expansion after a restructuring in 2017. However, in the 2 nd quarter 2022, GLDD ran aground with several negative factors affecting their performance, some of which have been resolved and some will have lingering effects. Combined, these issues have caused GLDD to post negative earnings, and are outlined below:

Inflation: Due to the usually short timeframe for project completions, the industry standard is to bid fixed rate contracts. With the unprecedented rise in operating costs, GLDD has been unable to realize its expected profit. According to Dredgewire.com reports, the USACE has decided against awarding contracts for several dredging projects after the bid prices were higher than expected. For example, fuel costs often account for nearly half of the price of a dredging project, and diesel expenses are 85% higher than in early 2021. The report stated that specific projects expected to cost just under $50 million in 2021, now cost $62 million after going out to bid. Dredgewire.com estimates the average cost of dredging proposal bids rose nearly 50% over USACE projections. High inflation impacts GLDD in two ways. First, increasing project costs are not covered by fixed rate contracts, creating the potential for an operating loss on the project. Labor and material supplies are most affected by rising inflation, but the impact on dry dockage and ship maintenance costs should not be ignored. As new USACE bids and awards more accurately reflect current costs, the negative impact of inflation should mitigate its impact on profitability over time.

Lower USACE Bid Opportunities: In the 3 rd qtr. conference call, management explained that year-to-date USACE awards are down by at least 10% from 2021 levels. This includes a 47% decline in the value of beach restoration awards. While the bid market is currently improving, the decline in awards during the first half of 2022 negatively impacted GLDD’s vessel utilization. As an offset to merely idling vessels, management chose to drydock more ships, moving forward maintenance expenditures. The interesting principle of these lower bid levels is there both ample funding and ample need. The slowdown in USACE 2022 bids should be seen by investors as a temporary situation which is in the process of correcting itself.

Severe Weather: In the second quarter, numerous storms caused unsafe conditions for various Great Lakes Dredge & Dock vessels, forcing them to find a safe port to ride out the weather. Severe weather-related safe harbor disruptions are both very temporary and unusual. However, the disruptions lengthened the time for completion of some projects and caused a domino effect in delaying the start of others. These severe weather costs are temporary and seem to be extreme this year. In reviewing management’s quarterly comments since 2018, I have not seen weather-related ship relocations being mentioned as an issue.

Combined, these factors are reflected in lower revenues and operating profit margins. Gross profit margin percentages declined to 7% in the second quarter and declined further to 2.4% in the third quarter, down from 13.5% and 21.5% in the same periods in 2021, respectfully. GLDD had 9 dredges either idle or in dry-dock during September 2022 compared to just one idle dredge in September 2021.

Commentary

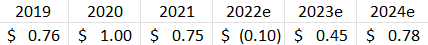

Great Lakes Dredge & Dock should be able to right their listing corporate ship. By nature, most dredging companies get caught with unreimbursed inflationary costs, but the relatively short contract timeframes should allow GLDD to begin recouping higher industry operating costs, generally within 12 months. If inflationary pressures begin to ease in 2023, as I expect, GLDD profitability should begin to return as well. This is reflected in the few earnings estimates offered for 2023 and 2024. The table below outlines earnings per share from 2019 to 2024, from marketscreener.com and S&P Global Market Intelligence:

Marketscreener.com

Management succinctly outlined their corporate priorities a few years back. The top two are fleet refreshment and improvements and selective expansion into associated industries. To this end, GLDD just took delivery of a large new hopper dredge, the Galveston Island. The newest vessel is EPA Tier-4 compliant engines and has the ability of running on biofuel to minimize costs and environmental impact. The Tier 4-compliant engines significantly reduces the vessel’s climate footprint, while other features minimize operational turbidity and marine species entrainment. The vessel is replacing a retiring hopper dredge with 43 years of service. In addition, management is expecting delivery of a sister hopper dredge in 2025, adding to the efficiency of GLDD’s fleet.

A few years ago, management identified underwater rock foundation work for wind turbine installations as an excellent extension of its current services. To this end, GLDD has a specialized vessel on order to offer offshore wind turbine tower foundation and dredging services, with the option for delivery of a second ship. The first ship will be delivered in late-2024. These will be the only Jones Act compliant vessels available for this specialized segment of offshore windfarm construction. GLDD has already been awarded a “large contract”, in consortium with European marine construction firm Van Oord, to perform undersea rock installation work for the Empire Wind I and II wind farms. The project timeline is 2025 to 2026. Empire Wind is one of 15 offshore wind projects proposed from Nantucket Sound to North Carolina’s outer banks. GLDD has five additional bids tendered for offshore wind projects and anticipate adding to offshore wind project backlogs during 2023. I have not seen any projections of the increase in revenues this new endeavor will generate for GLDD, but the number of individual tower installations from just the current 15 proposed offshore projects could exceed 1,500.

Current stock valuations seem attractive, once operating conditions improve. Share prices are trading at 0.66x TTM revenues, compared to a range of 0.60x in 2018 and 1.50x in 2021. It could take upwards of 12 – 18 months for investors to believe a turnaround is eminent and to reward investors with a PE closer to 15x, or a valuation of $~13. Such is the life of a “Missouri Stock”, or one whose management needs to prove themselves again. GLDD is definitely a 2023 Missouri Stock.

I initiated a Great Lakes Dredge & Dock position in late Sept 2019 and added between March and May 2020. Last year, GLDD reached my price target of $16, and I maintained the overall position believing better performance lay ahead. However, the current operating loss has rightfully spooked investors and share prices have dropped to below $7. On its way down, I made a very minor purchase at $9.75. Currently, I would put a Hold recommendation on the stock, except for the most speculative of investors. I see a return of share prices to the mid-teens but improving quarterly results will be the only catalyst to a sustained rally. While I believe GLDD could be a great candidate for a “January Bounce” after year-end tax loss selling abates, I plan on watching the stock movements vs its moving averages. The current 75-day MA for GLDD is $7.95 and its 200-day MA is $11.34, both demonstrating a declining slope. I will probably nibble on more when GLDD crosses these two downward trending lines.

I like Great Lakes Dredge & Dock’s new descriptive tag lines: “Mitigating the effects of climate change” and “It all starts with dredging®”.

Author’s Note: The physics of sailing is much like aeronautics where air pressure differential on each side of the sail creates the impetus of forward movement, much like that of a wing of an airplane. “Being caught in irons” happens when the boat is turning from one tack direction to another and momentarily is pointing straight into the wind. If the momentum of the bow (front) is insufficient to swing the boat around from, say, a left-hand direction to a right-hand direction, the boat could end up dead in the water, pointing directly into the wind. In this position, the wind is of equal pressure and strength on both sides of the sail, and the sail just flaps in the oncoming breeze. The boat merely drifts backwards until the captain can move the bow to one side or the other of the direction of the wind, filling the sails once again. The term dates from when criminals aboard old sailing ships were secured to the deck with leg-irons, unable to move. And, yes, I have been caught in irons a few more times than I would like to comfortably admit.

Be the first to comment