Thomas Barwick/DigitalVision via Getty Images

While it would be great to see investments pay off in a very short period of time, the sad truth is that investing often requires a great deal of waiting. This is especially true during these uncertain times. Because although a company might continue to boast strong performance, negative investor sentiment could push shares down further. But for those who are bullish about companies like that, this could represent a good buying opportunity.

One great example of this playing out so far has been Caleres (NYSE:CAL), a specialty retailer in the footwear market. Even though the past couple of months have been less than ideal, the firm continues to generate strong performance and shares continue to trade at attractive levels. So long as this picture doesn’t change for the worse, I could see additional upside on the horizon.

Caleres: A nice fit

Back in July of this year, I wrote a follow-up article about Caleres wherein I expressed enthusiasm at how well the company had done over the prior couple of months. This strong share price performance at a time when the broader market was declining was driven by robust fundamentals. Admittedly, I did say that the long-term picture for the company was not as clear because of its declining physical footprint.

But with how cheap shares were at that time, I had no choice but to rate the company a ‘buy’, reflecting my belief that it would likely outperform the broader market for the foreseeable future. Since the publication of that article, shares have dropped by 4.4%. That’s only slightly better than the 5.5% decline experienced by the S&P 500 over the same window of time. However, from my first article on the company in March, shares are up by 22.3% compared to the 18.6% drop experienced by the S&P 500.

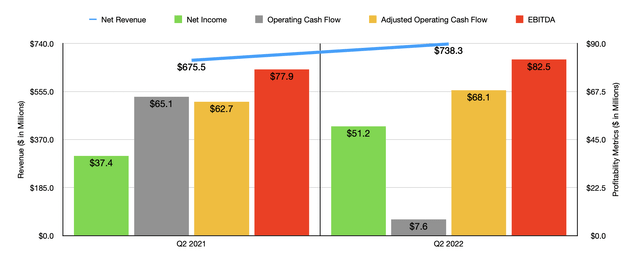

To understand why shares of Caleres have generally fared well this year, we need only look at the most recent data made available to us. This would be the second quarter of the 2022 fiscal year, the only quarter for which new data is available that was not available when I last wrote about the firm. Sales during that time came in strong at $738.3 million. That’s 9.3% higher than the $675.5 million generated the same time one year earlier.

Interestingly, this improvement came even as the number of stores the company operates dropped, falling from 999 in the second quarter of 2021 to 966 in the second quarter of this year. The company also saw same-store sales at its Famous Footwear Locations drop by 3.3% year over year. The real driver for the company, then, came from the Brand Portfolio portion of the firm, with revenue shooting up by 35.6% from $239 million to $324.1 million. This increase came even as the number of stores in operation dropped by two from 87 to 85. The drive, then, came from a 23.5% increase in same-store sales.

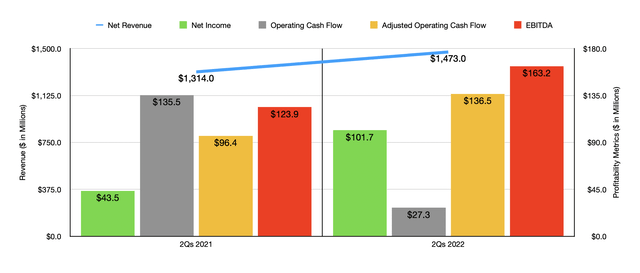

This strong performance from a sales perspective also helped to push up profitability. Net income rose from $37.4 million in the second quarter of 2021 to $51.2 million the same time this year. Operating cash flow did fall, dropping from $65.1 million to $7.6 million. But if we adjust for changes in working capital, it would have risen from $62.7 million to $68.1 million. We also saw a nice improvement when it came to EBITDA, with the metric climbing from $77.9 million to $82.5 million. It should be mentioned that the performance seen during this latest quarter was not a one-time thing. Similar performance occurred for the first half of the 2022 fiscal year as a whole relative to the same time last year. This can be seen in the chart above.

When it comes to the 2022 fiscal year as a whole, management is feeling a little more optimistic. Previously, they were forecasting revenue growth of between 2% and 5%. Now, that has been increased to between 4% and 6%. The company is also forecasting earnings per share of between $4.20 and $4.40. At the midpoint, that would translate to net income of $152.6 million. No guidance was given when it came to other profitability metrics. But if we assume that they will increase at the same rate then net income is expected to, then we should anticipate adjusted operating cash flow of $204.3 million and EBITDA of $318.5 million.

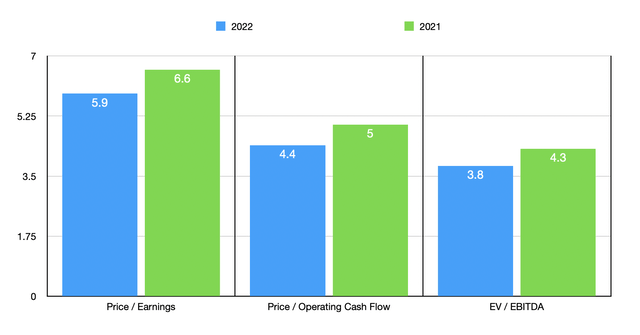

Based on these figures, we can calculate that the company is trading at a forward price-to-earnings multiple of 5.9. It’s trading at a forward price to adjusted operating cash flow multiple of 4.4, and at a forward EV to EBITDA multiple of 3.8. If, instead, we were to use data from the 2021 fiscal year, these multiples would be slightly higher at 6.6, 5 and 4.3, respectively. As part of my analysis, I also compared the company to five similar firms.

On a price-to-earnings basis, four of the companies had positive results, with multiples of between 7.9 and 21.6. In this case, Caleres was the cheapest of the group. Using the price to operating cash flow approach, the range was between 6.1 and 32.1, with our prospect once again being the cheapest. And when it comes to the EV to EBITDA approach, our target was again the cheapest compared to a range of between 4.4 and 13.9.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Caleres | 6.6 | 5.0 | 4.3 |

| Shoe Carnival (SCVL) | 7.9 | 6.1 | 4.4 |

| Boot Barn Holdings (BOOT) | 21.6 | 19.6 | 13.9 |

| Designer Brands (DBI) | N/A | 9.2 | 6.0 |

| Skechers USA (SKX) | 9.2 | 32.1 | 8.8 |

| Steven Madden (SHOO) | 19.9 | 23.8 | 13.5 |

Takeaway

Although the fashion space is incredibly competitive and might face some issues if broader economic concerns worsen, the overall financial picture for Caleres has been positive. The company is trading on the cheap, both on an absolute basis and relative to similar firms. Yes, I am worried some by weakness in the Famous Footwear unit and with the company’s continued declining store count. But even that is being made up for by strength elsewhere. Putting all of this together, I would make the case that Caleres still makes for an appealing opportunity at this time worthy of the ‘buy’ rating I had on it previously.

Be the first to comment