ablokhin/iStock Editorial via Getty Images

The fear factor.

I’ve written a number of articles for Seeking Alpha on homebuilders, focusing on Pulte (NYSE:PHM), Hovnanian (HOV) and M/I Homes (MHO). But because KB Homes (KBH) reported its fiscal Q1 results last week, I’ll use it to illustrate the serious fear factor investors have about homebuilders.

As Seeking Alpha noted, “KB Home GAAP EPS of $1.47 misses by $0.07, revenue of $1.4B misses by $90M.”

KB explained the miss in its press release: “…As the quarter progressed, supply chain issues intensified and an already-constrained construction labor force was further stressed, which extended our build times and delayed completions and planned deliveries.”

But KB also said that:

“We are reaffirming our revenue guidance for the year, with 30% growth to $7.4 billion, and modestly increasing both our operating margin and return on equity expectations to over 16% and 27%, respectively.”

“Ending backlog value grew 55% to $5.7 billion, the Company’s highest first-quarter level since 2007.”

“Net order value [in Q1] expanded by $285 million, or 15%, to $2.2 billion.”

Wall Street analysts interpret KB Homes’ guidance as generating $10.28 in EPS this year (Seeking Alpha). Further, the analysts expect its EPS to increase to $11.39 in fiscal ’23 and remain roughly the same in ’24.

I reviewed these details with a hedge fund manager friend of mine who has not paid recent attention to the builders. I asked him what he thought KB was trading at. He said “$70”. He was startled to learn that the actual price is $34.

That’s right, $34. Or a 3 P/E ratio. Or about the earnings Wall Street expects KB to generate during just the next 3 years. Or equal to KB’s current $35.50 book value.

The $34 current price can only be explained by investors’ serious fear for the builders’ long-term EPS potential. The prime worry is obviously interest rates. The mortgage rate is now over 4.5%, well up from 2.7% at the start of last year. Combined with a roughly 20% increase in home prices, that means a 50% increase in the required mortgage payment since the beginning of ’21. Is this another housing bubble like ’02-’06 that decimated homebuilders for the following five years?

I propose courage in the face of fear.

The value of a stock is not just earnings next quarter, or this year. It is the present value of all future earnings. So yes, housing is certainly entering an adjustment period of slower sales and probably lower home prices over the next year or even two. But the long-term fundamentals for housing are healthy. So the present value of future EPS for homebuilders is far greater than their current stock prices.

As investors eventually accept those fundamentals, the relative stock performance of homebuilders should be dramatically better than the S&P 500. Outside of an economic depression, homebuilder stocks should double over the next five years, and triples are possible. I reiterate my Strong Buy ratings on Pulte, Hovnanian and M/I Homes. But this is an industry call, so buy a different builder if you have a preference. I recently bought a few others myself last week.

My confidence is based on six fundamental drivers. Let’s get to them.

Homebuilding long-term driver #1: The U.S. has a housing shortage.

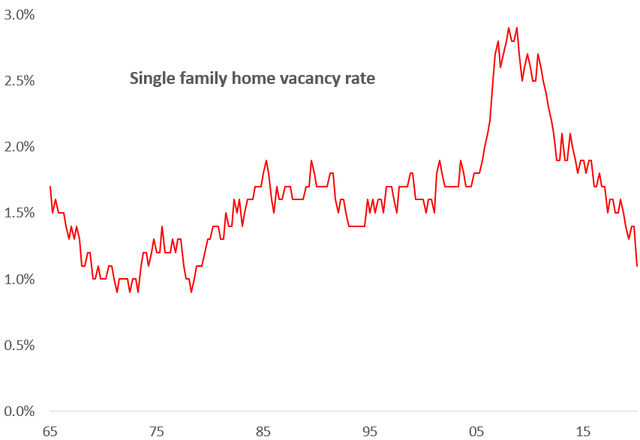

Hopefully we can all agree that people like to live in homes, rather than on the street or in the metaverse. The key demand question for homebuilders, then, is “Is the existing housing stock too little or too much?” That question is addressed by calculating a housing vacancy rate. Here is the single-family home vacancy rate history:

Vacancies are at their lowest rate in five decades. That suggests the builders need to build more, not fewer homes. Higher interest rates can delay home construction, but the demand will eventually be filled.

Homebuilding long-term driver #2: Mortgage loan quality is excellent, and should loosen to help homebuyers.

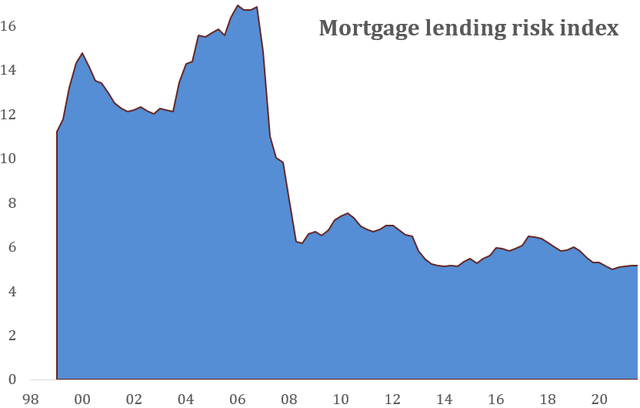

The critical characteristic of the ’02-’06 housing bubble was extremely loose lending standards. Was that also the secret sauce behind the recent boom? This chart of a mortgage credit risk index (the higher the riskier) answers that question:

Mortgage lending standards remained very conservative over the past two years, so new home demand wasn’t artificially goosed. For example, KB Homes said that recent buyers had average 730 credit scores.

Regulators are discussing ways for Fannie Mae and Freddie Mac to ease lending standards modestly to help first-time buyers, which of course will aid homebuilders.

Homebuilding long-term driver #3: The labor shortage supports homebuying.

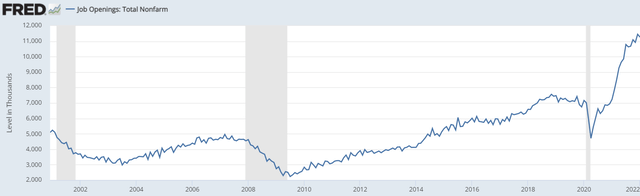

Homebuilders need more working families to create demand for their product. I expect that growth to come from two sources. One is current business demand, as clearly illustrated by this chart, which shows a history of job openings:

Job openings are currently more than 5 million above normal. Even a modest recession may not dent the unemployment rate.

Another job creator should be onshoring. Many in business and government have become concerned about the risks of imports, due to practical issues (supply disruptions) and political issues (Russia and China). Bringing the production of those products back to the U.S. will add jobs and probably require easing immigration restrictions.

Homebuilding long-term driver #4: The U.S. has too much debt to afford much higher interest rates for too long.

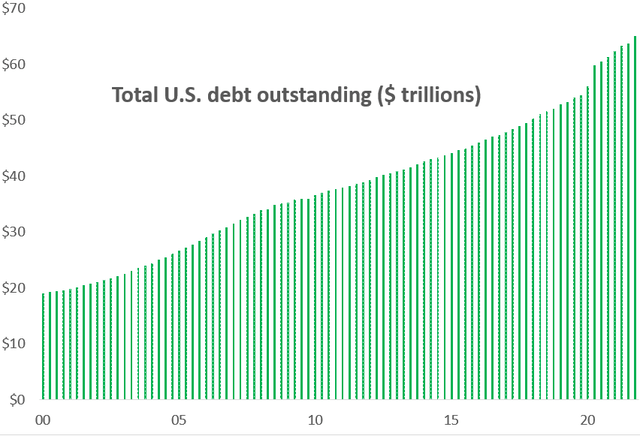

Yes, the Federal Reserve is determined to raise interest rates to fight inflation. But the Fed has another problem – a debt mountain. This chart shows a history of total outstanding U.S. debt – private and government:

Raising interest rates means raising borrowing costs. It is one thing to raise borrowing costs when you owe $20 trillion, like back in 2000. It is another thing when borrowing costs are $65 trillion and increasing by $3+ trillion a year. A one percentage point rise in interest rates increases U.S. debt service costs by $650 billion a year, or 3% of GDP. A three percentage point rise adds a whopping $2 trillion to debt service costs, or nearly 10% of GDP. How high can the Fed afford to raise rates, and for how long?

Yes, housing will get wounded by higher interest rates in the short term, but the pain will ease in the long term.

Homebuilding long-term driver #5: Homebuilders can take advantage of their lower stock prices.

How? By buying back their stock. Pulte has been an excellent buyback story. Over the past nine years Pulte invested $4.0 billion in its own stock, including $897 million last year. As a result, its share count declined by 35%, a huge benefit to remaining shareholders. I expect Pulte to invest another roughly $4 billion in its stock over the next four years. At the current stock price of $44, that would mean another 35% share reduction. Even if Pulte’s stock price doubles over the next year, it could reduce shares outstanding by over 20%. So Pulte could earn 25% less four years from now and its EPS would remain the same.

The other two homebuilders are in different situations. Hovnanian’s cash flow over the next four years will go to reducing its sizable current debt load to the industry norm. M/I is in the middle; I expect its share count to decline by 10-15% over the next four years. In both cases, EPS is materially benefitted.

Homebuilding long-term driver #6: EPS will be more than enough to justify higher stock prices.

Let’s say that investors have got it right. Homebuilder P/E ratios have averaged around 8 historically. So Pulte, trading at $44, should be earning about $5 a share. Throwing a bit of a wrench in this thesis is the Wall Street view (Seeking Alpha data) that Pulte will earn $10.31 this year, $11.58 next year and $12.40 in ’24. But what do those guys know, right? Another wrench is that stock buyback thing I noted above. To get to $5 a share by ’25, I need to make two estimates. First, that national housing starts decline from ’21 by 40% to 700,000, which is barely above the level they bottomed out at after the ’02-’06 bubble. Second, that Pulte’s gross margin drops to 20% from 28% this year, which again is close to housing bust levels.

Can this dire scenario occur when:

- There is a significant housing shortage?

- Mortgage lending standards can only ease?

- The U.S. has a labor shortage that may only be eased by increased immigration?

- The Fed has practical limits as to how much it can raise interest rates?

- Pulte and other builders have the capacity to buy back large amounts of stock?

Summing up. Homebuilder stocks are dirt cheap. Dare to buy when others are panic selling.

I can’t resist, one more thing to highlight how whacky valuations have gotten. Wall Street expects Pulte to earn $2.5 billion this year. It expects AMC to lose $400 million. As I write this, Pulte’s market cap is $10 billion. AMC’s is $15 billion. Buy some Pulte.

Be the first to comment