eternalcreative/iStock via Getty Images

Introduction

Warren Buffett bought Globe Life (NYSE:GL) (then Torchmark) for the first time since the fourth quarter of 2006 and has owned the stock ever since. He currently owns 6.4 million Globe Life shares, representing 6.6% of the total outstanding common shares. Insurance is a sector that Warren Buffett knows well, it is a non-cyclical sector with stable earnings over the years. The income is invested in a bond portfolio, which in turn generates more income.

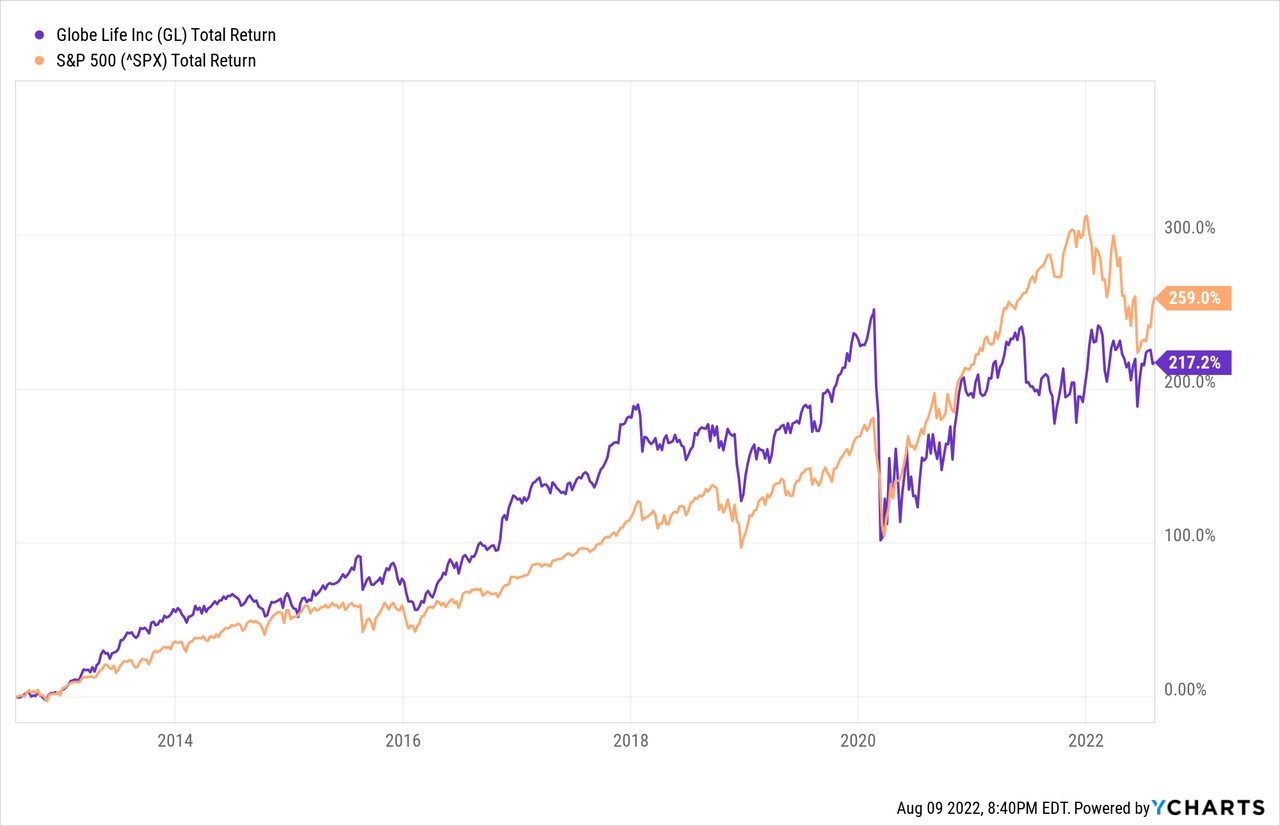

Life insurance isn’t the most exciting industry to invest in. So, what makes Globe Life interesting to invest in? First, let’s look at the stock chart compared to the S&P 500 chart.

Until 2020, Globe Life generally outperforms the market, but now it is slightly behind. Currently, Globe Life’s 10-year total return is 220% (annualized 12.3%) compared to the S&P 500’s 260% (annualized 13.7%). Globe Life is trading at a discount: The PE ratio is only 12 compared to the S&P 500’s PE ratio, which is 21. Globe Life is trading remarkably cheaply compared to the S&P 500.

Compared to its competitors, Globe Life has the most stable growth in written premiums and earnings per share. Management prefers to allocate capital to shareholders in the form of share repurchases rather than paying a large tax-inefficient dividend. As icing on the cake, the valuation is also favorable.

Globe Life is a strong buy given its strong growth, strong expectations, exceptional growth relative to competitors, shareholder-friendly management and because Warren Buffett has relied on it for over 16 years.

About The Company

Globe Life is an insurance holding company that provides life and supplemental health insurance and annuities to low- to middle-income households in the United States. Life insurance accounted for 70% of premium income and health insurance accounted for 30% of all premium income in 2021. Formerly known as Torchmark, the company changed its name to Globe Life in 2019 as part of a brand-alignment strategy. Co-CEOs Gary Coleman joined Globe Life in 1994 and Larry Hutchison joined Globe Life in 1997. Both have years of experience in their fields.

Globe Life Is A Stable Growing Company

Policyholders are satisfied with Globe Life’s insurance products. You will find many positive reviews on the second page of the Annual Report. The NAIC report shows that the company’s share of complaints is only 0.14%. Policyholders are satisfied and the renewal year lapse rate is only about 2.4%. Satisfied policyholders attract new policyholders, increasing written premiums.

The results of the second quarter of 2022 show that net operating income grew by 11.9% year-over-year. Net operating income as ROE was 12.6% for the same period. The company saw premium income from both life and health insurance grow by 4% and 8%, respectively. Overall, premium income growth was 5%.

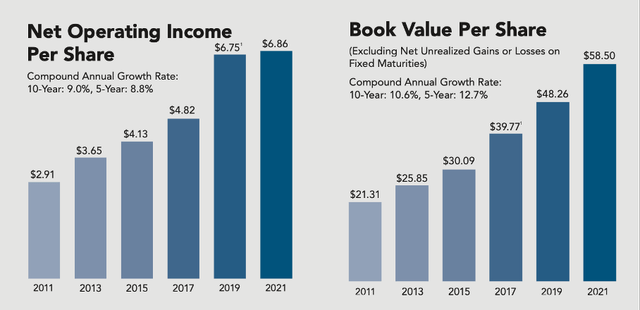

Annual Report 2021 (Globe Life Investor Relations)

Over the past 10 years, net operating income grew from $2.91 to $6.86 per share, an increase of 9.0% per year. Net operating income as return on equity, excluding net unrealized gains on fixed maturities, was 12.3% for 2021. Book value per share, excluding net unrealized gains or losses on fixed maturities, increased by 10.6% per annum over the same period. Growth in both net income and book value is quite stable and predictable. I prefer stocks with stable revenue growth and EPS growth because then the Black Swans events are more easily identifiable in earnings.

Rising Interest Rates Boost Profits

The investment portfolio mainly consists of corporate debt. The return on corporate debt is higher than that of government bonds, but the risk of default is also higher. Globe Life has included the list of bond exposures (amounts over $80 million) on their Investor Relations website. Most of the companies in the list have a decent Moody’s rating and there is a good mix of risk exposure. Globe Life does not intend to sell bonds before maturity, it creates more meaningful trends as it excludes fluctuations due to changing interest rates.

The company sees growing sales and profits as interest rates rise. But because the current bond portfolio is held for the long term, the average turnover for the next three years will be less than 2% per year. They won’t benefit as much from rising interest rates, but they won’t lose much from falling rates either.

Globe Life Is Sublime Compared To Competitors

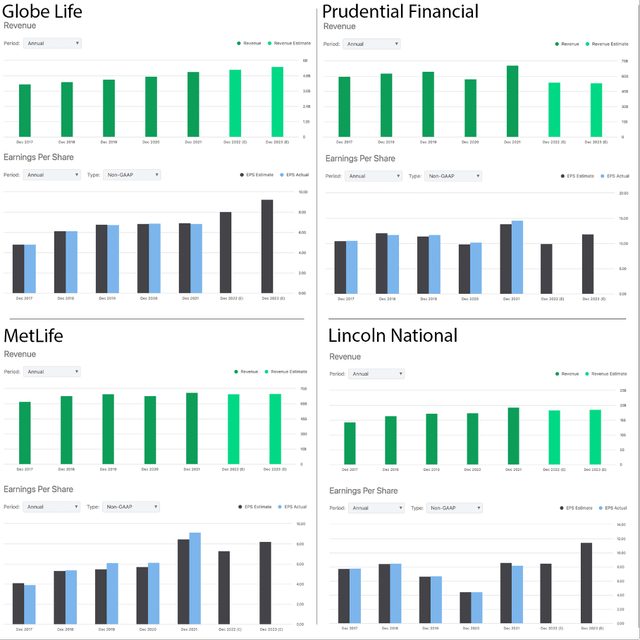

MetLife (MET), Prudential Financial (PRU) and Lincoln National (LNC) are also companies active in life and health insurance. I made a quick overview of the companies in revenue and non-GAAP EPS.

Globe Life, MetLife, Prudential Financial, and Lincoln National revenue and EPS (Seeking Alpha)

What the overview shows is that Globe Life is the most stable growing company in revenue and non-GAAP EPS. The outlook is also favorable, with a 15% growth in earnings per share expected in 2023. Other companies also expect earnings per share growth, but revenues are expected to decline.

Management Is Shareholder Friendly

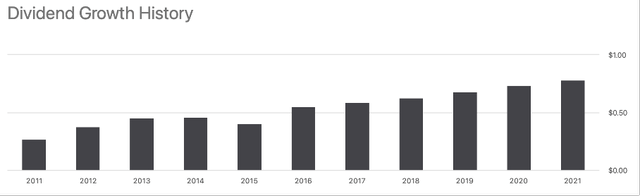

Since 1986, 70% of net income has been allocated through share repurchases and dividends. Globe Life allocates capital through share repurchases rather than paying a large tax-inefficient dividend. Share repurchases increase earnings per share, and because there is more demand, the share price rises. A small dividend of $0.83 will be paid, which has grown by an average of 11% over the past 10 years.

Dividend Growth of Globe Life (Seeking Alpha)

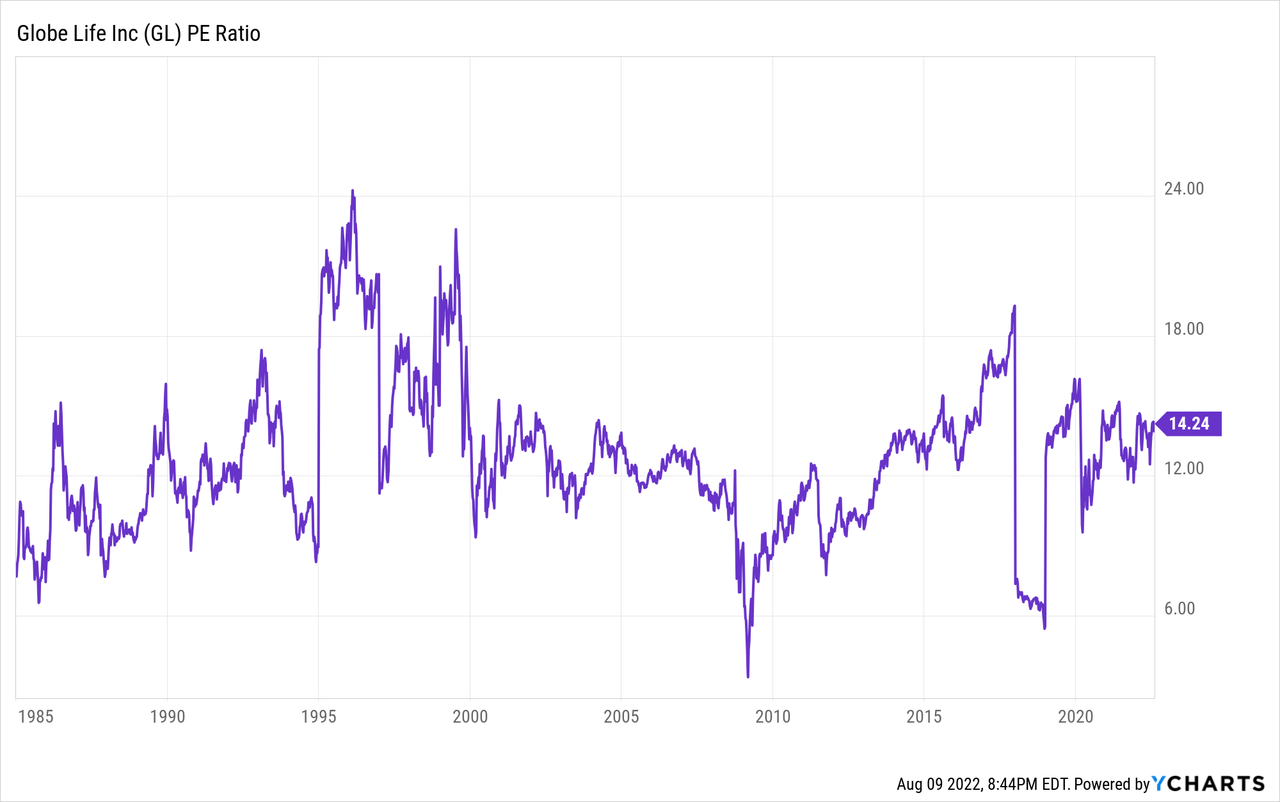

Globe Life’s earnings per share have grown steadily over the years, and so the current PE ratio can be compared to the historical average.

The average PE ratio is 13, so Globe Life is currently valued slightly more attractively than the historical average. For 2024, analysts expect Globe Life’s earnings per share to be $10 per share. At the average PE ratio, the stock price would be $130. The current share price is $100. Including dividends, one should expect a return of about 32% by the end of 2024.

Conclusion

Globe Life has outperformed the market through 2020. Currently, Globe Life shares are trading at a discount and lagging behind the returns of the S&P 500. Globe Life grew strongly over the past 10 years, net operating income increased by 9.0% annually. Over the same period, the book value per share excluding unrealized gains or losses from fixed maturities increased by 10.6% per annum.

Globe Life’s revenue and non-GAAP EPS growth is growing more steadily than competitors operating in the life and health insurance industry. While others see revenue and earnings per share decline in the coming years, Globe Life estimates are positive. For 2023, EPS growth of 15% is expected.

Rising interest rates should drive profits and thus the stock price but at a slow pace because the turnover of the bond portfolio is less than 2% yearly over the next three years.

The management is shareholder friendly; it prefers share repurchases rather than a tax-inefficient dividend. Share repurchases increase the share price because there is more demand. Analysts expect Globe Life’s earnings per share to reach $10 per share by 2024. At the average PE ratio, the stock price should reach $130 by the end of 2024. This represents a stock return of over 30%.

Warren Buffett has held shares of Globe Life (Torchmark) since the fourth quarter of 2006, the investment currently representing 6.6% of the total outstanding common shares of Globe Life. Warren Buffett invests in companies he understands and trusts management to take a shareholder-friendly approach. There are many reasons to be optimistic, and the future for Globe Life looks bright. The stock is a strong buy.

Be the first to comment