grinvalds/iStock Editorial via Getty Images

September is always an important month for the market’s most powerful name. In most years, technology giant Apple (NASDAQ:AAPL) has a big event to launch the year’s new set of iPhones, and perhaps some other products and services. Last week, there was an interesting report released about the timing of this year’s big day, making me wonder if there is a bit of a sales problem for the company right now.

Mark Gurman, who covers Apple extensively for Bloomberg, reported last week that Apple is looking at September 7th for this year’s major product unveiling. The company is expected to unveil four new iPhones this year, along with three new versions of its smartwatch, with perhaps a chance for some other devices as well. Apple has not yet confirmed a date for the event.

The September 7th date strikes me as a very curious one. First, Apple usually tries to avoid holiday weeks, so holding the event just after Labor Day doesn’t jive with the usual pattern. It’s also a big back to school week in certain areas of the country, and the first week of NFL games, so media coverage might not be as focused on Apple as normal. This would also be a bit earlier than last year’s launch, which has some interesting financial implications. As a reminder, here’s what happened last year:

- Launch event on September 14th.

- Pre-orders began on September 17th.

- Phones officially released on September 24th.

- Fiscal Q4 ended on September 25th.

For the moment, let’s assume that the September 7th event date is correct for this year’s launch. That would likely mean that pre-orders for at least some (or all) of the four smartphones could start on the 9th, with the phones officially becoming available on the 16th. If this is truly the case, it would give Apple an extra week this year to sell the iPhone in its fiscal Q4 quarter, which is slated to end on September 24th.

This year’s iPhone line is expected to vary from previous years, which makes me wonder how strong sales will truly be. First, the cheaper SE model got a new version earlier this year, allowing consumers a more affordable option in this high inflation environment. At the same time, the non-Pro models are expected to not see the usual annual chipset upgrade, meaning they would have last year’s A15 chip or a modified version. Thus, these phones would not get the normal performance upgrade that the Pro models are expected to see with the A16 chipset. Apple is also likely to kill the iPhone mini line in favor of a larger, 6.7 inch screen, non-Pro model. There are also suggestions that pricing could receive a big boost, which is good for the average selling price metric, but a headwind for the number of phones sold.

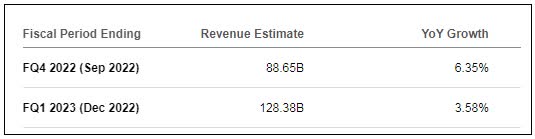

If there is a worry about iPhone sales this year, or perhaps Apple’s total sales in the quarter, an earlier than usual launch would certainly help out the company. You would have an extra week of new iPhone sales (and potentially other products) over the prior year period. That could be important, as the street is currently expecting more than 6.3% revenue growth for fiscal Q4 as the graphic below shows. Don’t forget, the stronger US dollar is providing an additional headwind for the company to overcome over prior year periods.

Apple Revenue Estimates (Seeking Alpha)

A worry about iPhone sales in the September period also is logical if you think about those lower growth expectations for the December fiscal Q1 period. Apple doesn’t have as high an estimate bar, so pulling even a billion or two of sales forward into the September period wouldn’t be as much of an issue. Also, as I’ve continued to point out, this year’s holiday period is likely to be 14 weeks instead of the usual 13 weeks because of how the calendar falls. Thus, Apple is already getting a little bit of growth help for fiscal Q1 as it will have some extra sales time in the period. When you combine lower expectations for December plus the extra sales time, pulling forward the iPhone launch starts to make more sense in the grand scheme of things.

I mention Apple trying to meet high expectations because of what has happened with its shares recently. As the chart below shows, the stock has gone basically straight up for the last two months, until pulling back a little at the end of last week. This is the most the stock has been above its 50-day moving average (purple line) in a while, which could mean a pullback is on the horizon. The stock also last week was the closest it has been to its average price target since early 2022, with Friday’s finish representing less than $10 of upside to the average street valuation.

Apple Last 12 Months (Yahoo! Finance)

In the end, last week’s report about Apple’s iPhone event launch timing may seem rather curious. The company appears to be moving things up a week this year, strangely holding its major showcase during a holiday week. Perhaps this is a sign that management is worried a little about revenue generation, as this early event would allow for extra device sales in the fiscal Q4 period where expectations are for more growth than the December period. Apple can afford to pull forward some sales this year, given the fiscal Q1 period is slated to be 14 weeks. With the stock near its all-time highs, investors are expecting big things, so it will be interesting to see if Apple can deliver this year as the iPhone might be a bit more expensive and non-Pro versions may not get the usual chipset boost.

Be the first to comment