HowLettery/iStock via Getty Images

A Quick Take On Coveo Solutions

Coveo Solutions Inc. (TSX:CVO:CA) went public on the Toronto Stock Exchange in November 2021, raising C$215.1 million in gross proceeds in an IPO that priced at C$15.00 per subordinate voting share.

The firm provides AI/ML-enhanced software solutions to enterprises seeking to improve their customer and stakeholder experiences.

While patient value investors may look at Coveo’s current valuation as a potential buying opportunity, I’m more conservative and will wait until later in 2022 before considering Coveo.

I’m on Hold for the stock in the near term.

Coveo Overview

Montreal, Canada-based Coveo sells its Coveo Relevance Cloud AI-enhanced system to improve enterprise search and provide recommendations and personalization capabilities to increase customer and stakeholder engagement.

The company is headed by Chairman and CEO Louis Tetu, who has been on the board of directors at Couche-Tard – CircleK, iA Financial Group and PetalMD.

The firm operates as a SaaS (Subscription as a Service) revenue model and generates revenue from subscriptions as well as from related services.

The company’s primary offerings include:

-

Coveo Relevance Cloud

-

Ecommerce

-

Service & Support

-

Website

-

Workplace

The firm acquires customers via direct sales as well as through a partner network that also includes system integrators, consultancy firms and digital agencies.

CVO says it has over 150 partners that assist it in the six primary industry verticals of high tech, financial services, manufacturing, healthcare, telecommunications and retail.

Coveo’s Market & Competition

I view Coveo as primarily a customer experience management software company.

According to a 2018 market research report by Research and Markets, the global customer experience management market is projected to grow to $21.3 billion by 2024, representing a very strong CAGR of 22% during the period between 2018 and 2024.

The main factor driving market growth is the increasing need for personalized customer experience.

Major competitors that provide or are developing customer experience management services include:

-

Qualtrics

-

Adobe

-

Avaya

-

CA Technologies

-

IBM

-

Medallia

-

Aon Hewitt

-

Towers Watson

-

SurveyMonkey

Coveo’s Recent Financial Performance

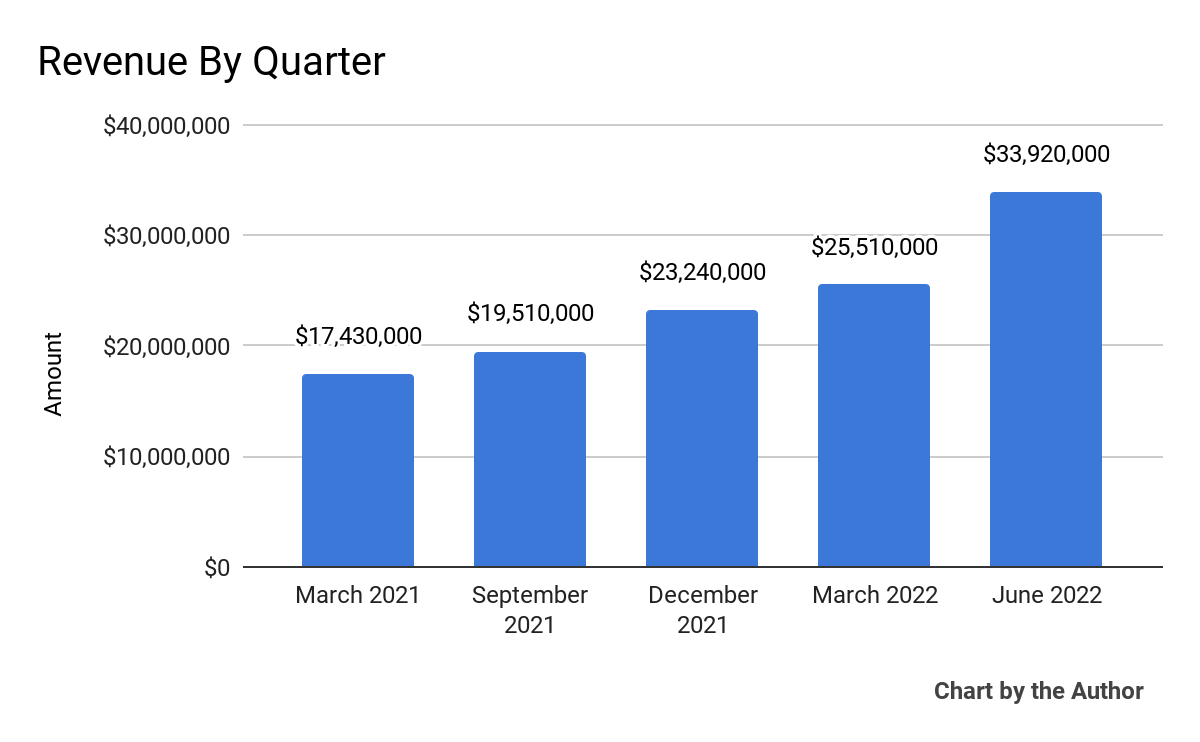

- Total revenue by quarter has grown over the past 5 reported quarters:

5 Quarter Total Revenue (Seeking Alpha)

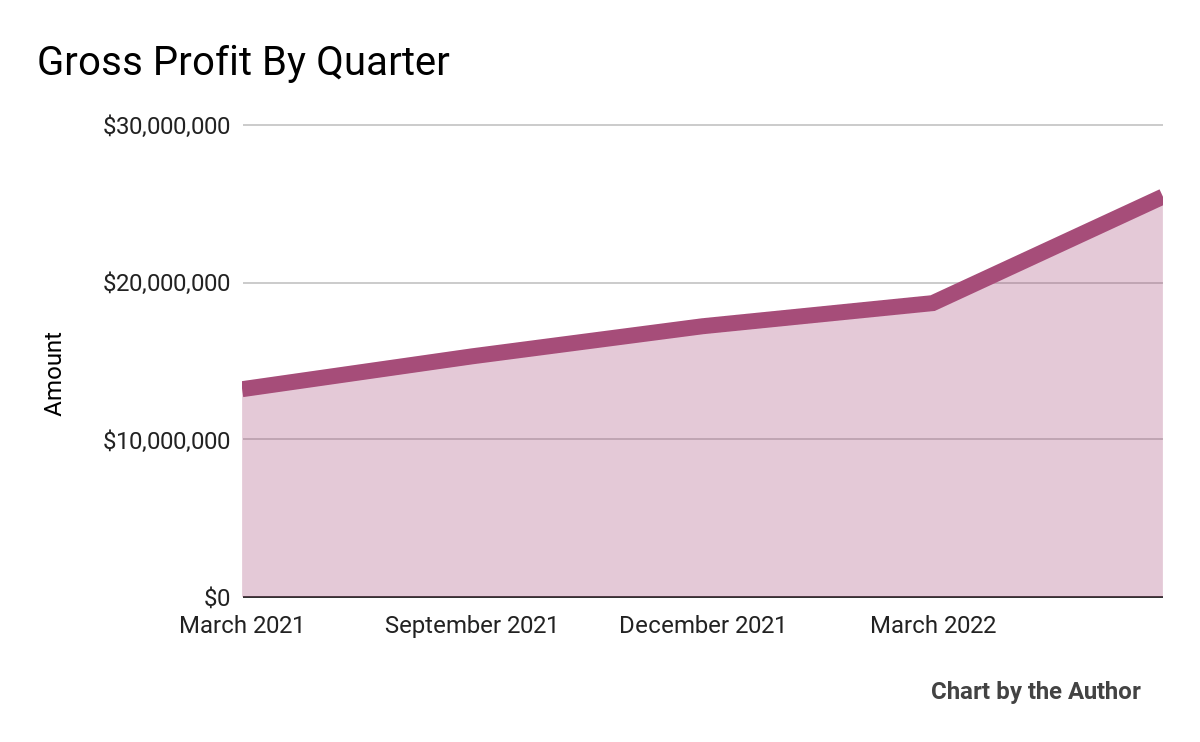

- Gross profit by quarter has also grown at an impressive rate:

5 Quarter Gross Profit (Seeking Alpha)

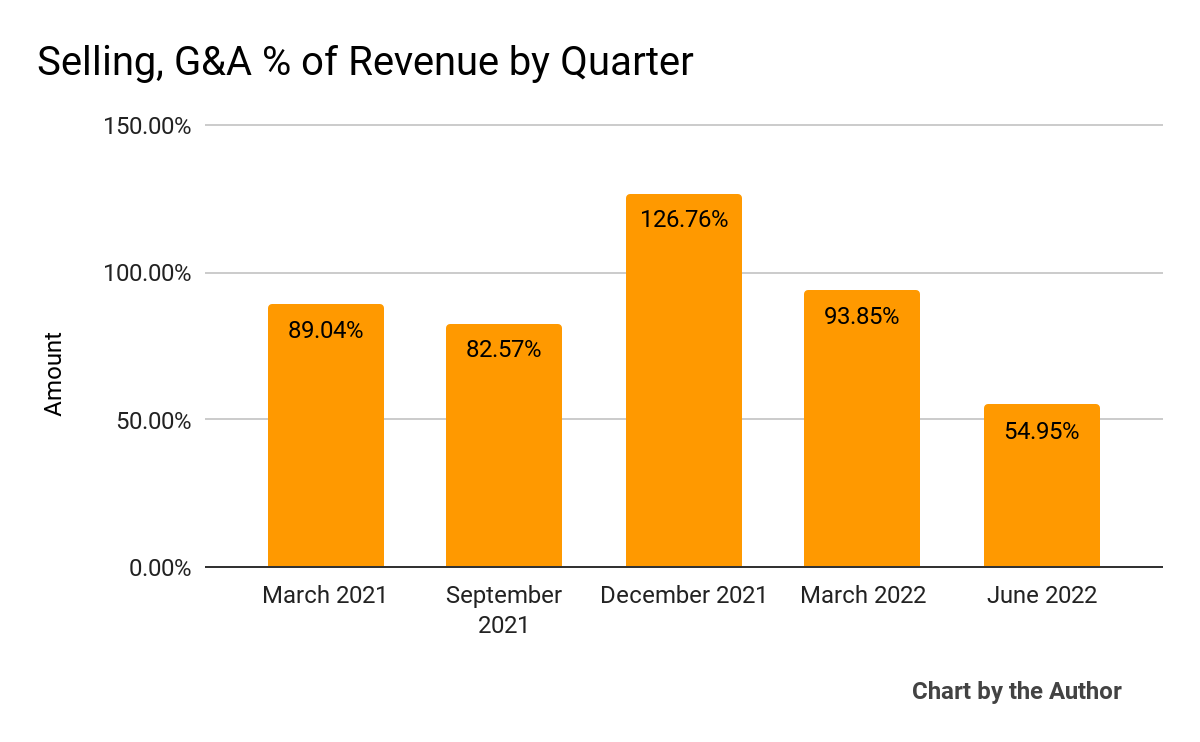

- Selling, G&A expenses as a percentage of total revenue by quarter have trended higher in recent quarters, a negative signal:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

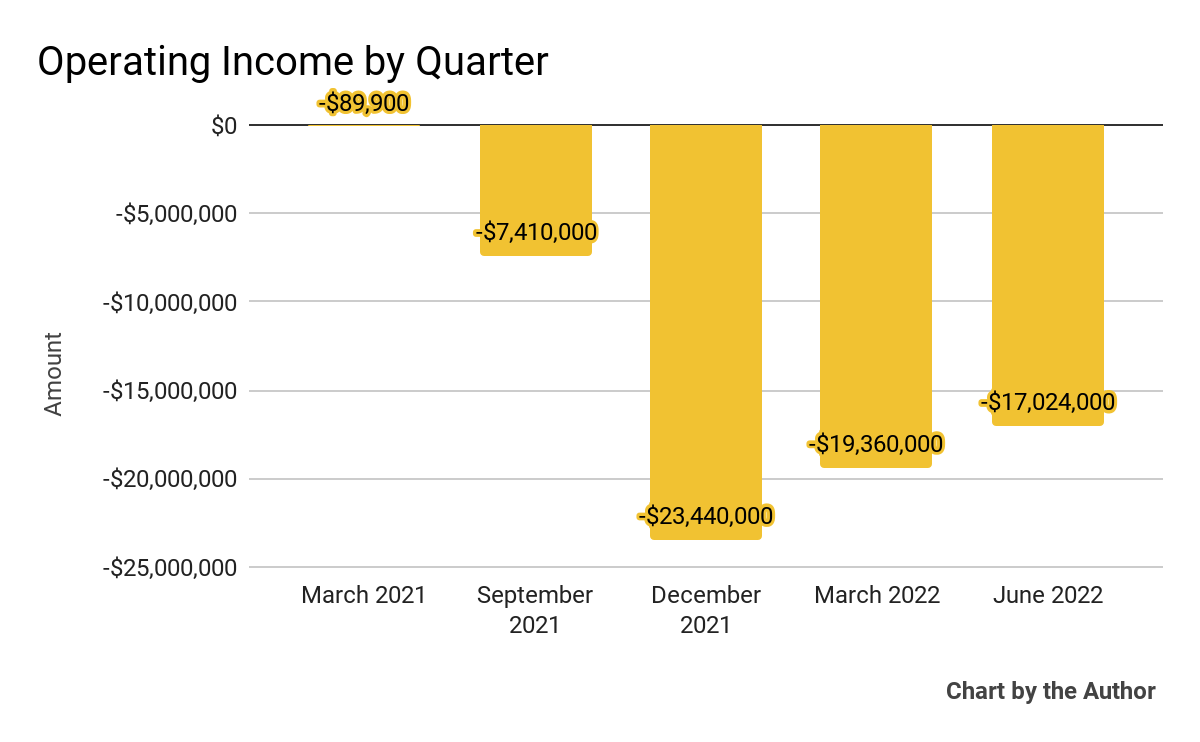

- Operating losses by quarter have worsened in the three most recent quarters:

5 Quarter Operating Income (Seeking Alpha)

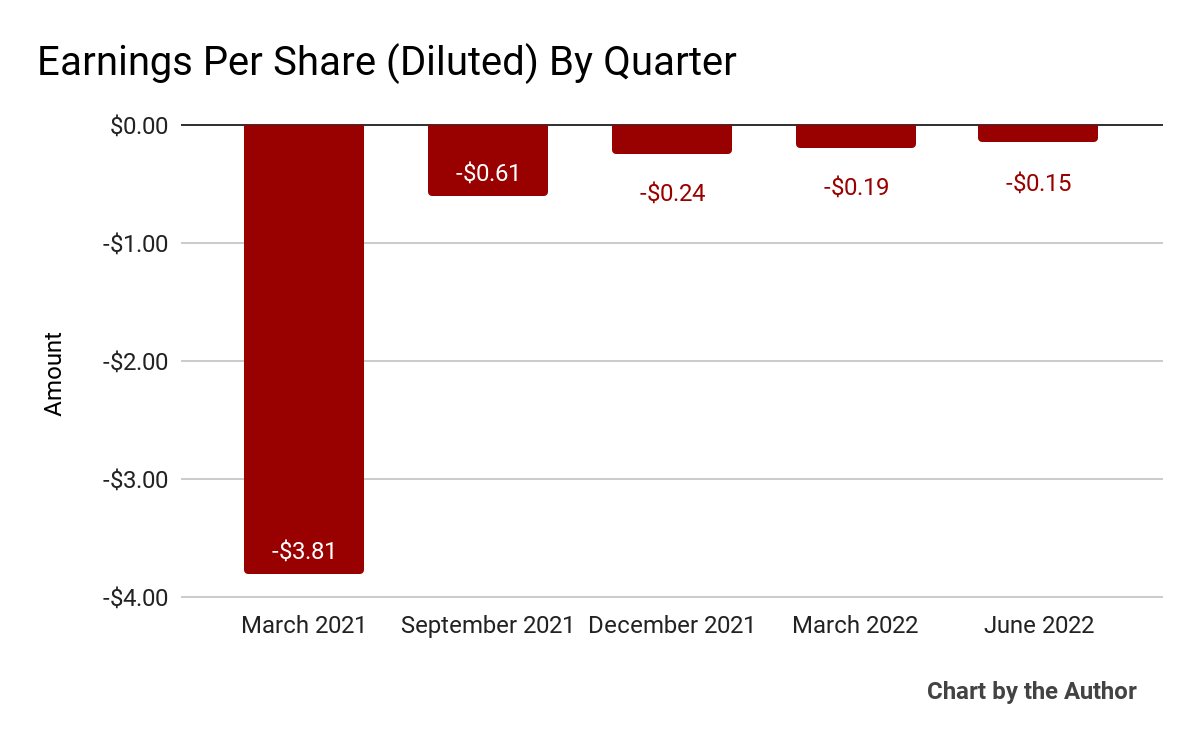

- Earnings per share (Diluted) have remained significantly negative in recent quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(Above data is IFRS only and presented in CAD)

Since its Canada IPO in November, 2021, CVO:CA’s stock price has dropped around 61.1 percent vs. the U.S. S&P 500 index’ drop of around 12 percent, as the chart below indicates:

Coveo Stock Price Chart (Seeking Alpha)

Valuation Metrics For Coveo

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount [CAD] |

|

Market Capitalization |

$611,910,000 |

|

Enterprise Value |

$347,550,000 |

|

Enterprise Value / Sales [TTM] |

3.21 |

|

Operating Cash Flow [TTM] |

-$35,400,000 |

|

Revenue Growth Rate [TTM] |

33.35% |

|

Earnings Per Share |

-$1.16 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Qualtrics (XM); shown below is a comparison of various metrics:

|

Metric |

Qualtrics |

Coveo Solutions |

Variance |

|

Enterprise Value / Sales [TTM] |

5.91 |

3.21 |

-45.7% |

|

Operating Cash Flow [TTM] |

$37,240,000 |

-$27,600,000 [USD] |

— |

|

Revenue Growth Rate |

43.1% |

33.4% |

-22.6% |

(Source – Seeking Alpha)

Commentary On Coveo

In its last earnings announcement (Source – Coveo Solutions), covering FQ1 2023’s results, management highlighted the continued “strong demand” it saw for its Relevance Cloud platform in the market.

Management published its “net expansion rate” as 112%, which indicates negative net churn and positive revenue growth from the same cohort of customers. A figure above 100% shows that the company’s services have good product market fit and that its cross-selling and upselling efforts are effective.

As to its financial results, total revenue grew 45% year over year while subscription revenue grew by 47%.

SG&A costs have remained high in recent quarters and the firm’s operating losses have been significantly worse in the last three quarters, although trending in a positive direction.

Looking ahead, management guided full fiscal year 2023 total revenue at CAD130.5 million at the midpoint of the range and non-IFRS Adjusted operating loss of around CAD41.6 million at the midpoint. Typically, IFRS-compliant figures are less favorable.

Cash flow from operations during the quarter was CAD1.79 million and the company ended the quarter with CAD279 million of cash and equivalents

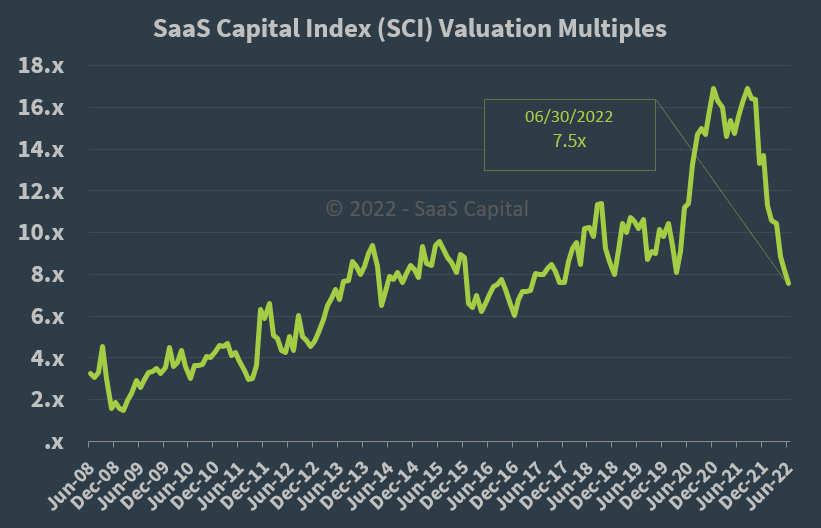

Regarding valuation, the market is valuing CVO’s stock at an EV/Revenue multiple of around 3.2x, which is well below the average presented by the SaaS Capital Index of publicly held SaaS software companies, which showed an average forward EV/Revenue multiple of around 7.5x at May 31, 2022:

SaaS Capital Index (SaaS Capital)

So, by comparison, (CVO:CA) is a relative bargain at forward EV/Revenue of around 2.42x.

But, the primary risk to the company’s outlook is slowing growth from a U.S. recession impacting sales cycles and potentially reducing revenue growth.

Also, technology companies with substantial operating losses have been harshly penalized in the current rising interest rate environment, as the cost of capital has risen.

An upside catalyst potential could be a reduction in interest rate hikes by the U.S. Federal Reserve in response to a slowing economy, although my base case is that this will not happen until Q3/Q4 2022 at the earliest.

Consequently, while patient value investors may look at Coveo’s current valuation as a potential buying opportunity, I’m more conservative and will wait until later in 2022 before considering Coveo.

I’m on Hold for the stock in the near term.

Be the first to comment