Robert Way

Even though Alibaba (NYSE:BABA) has been under severe scrutiny over the past few years, along with most, if not all, other prominent Chinese tech stocks, it has successfully survived a tsunami of negative events (US-China trade war, COVID-19, Chinese government’s tech crackdown, etc.) virtually unscathed in terms of the metrics that really matter, namely: 1) underlying cash flow generation and 2) balance sheet strength.

Alibaba recently reported stable Q2 2022 results, despite challenges posed by the COVID-19 resurgence (April and May were relatively slow and there were signs of recovery in June). Revenue came in at $30.7 billion but remained pretty much flat year-over-year, primarily due to a decline in China commerce segment revenue by 1% which was offset by revenue growth of Cloud segment by 10%. That said, the headline numbers, based on a year-over-year comparison, were very disappointing. After all, we are accustomed to impressive growth results, across the board, when it comes to tech behemoths such as Alibaba. Specifically, Q2 2022 results were as follows:

- Income from operations decreased 19%

- Adjusted EBITA decreased 18%

- Non-GAAP net income decreased 30% (mainly due to a decrease in adjusted EBITA, as mentioned above, and a decrease in share of results of equity method investees)

- Non-GAAP diluted earnings per ADS decreased 29%

The optics are terrible, just terrible. Most investors will run away when seeing a company registering double-digit percentage declines in EBITA or EPS. Also, scary headlines such as high-profile investors like SoftBank are selling their shares of Alibaba don’t really help.

Or even worse, Alibaba is trimming its workforce by 10,000 employees as sales are slowing down:

So, if one stops the analysis here, it seems that Alibaba is ready to collapse. Hence, one would naively justify the intense selling pressure on the share price over the past few quarters. That said, even though the optics look awful, results handily beat Wall Street’s estimates. But this was not enough to prevent the share price from falling further.

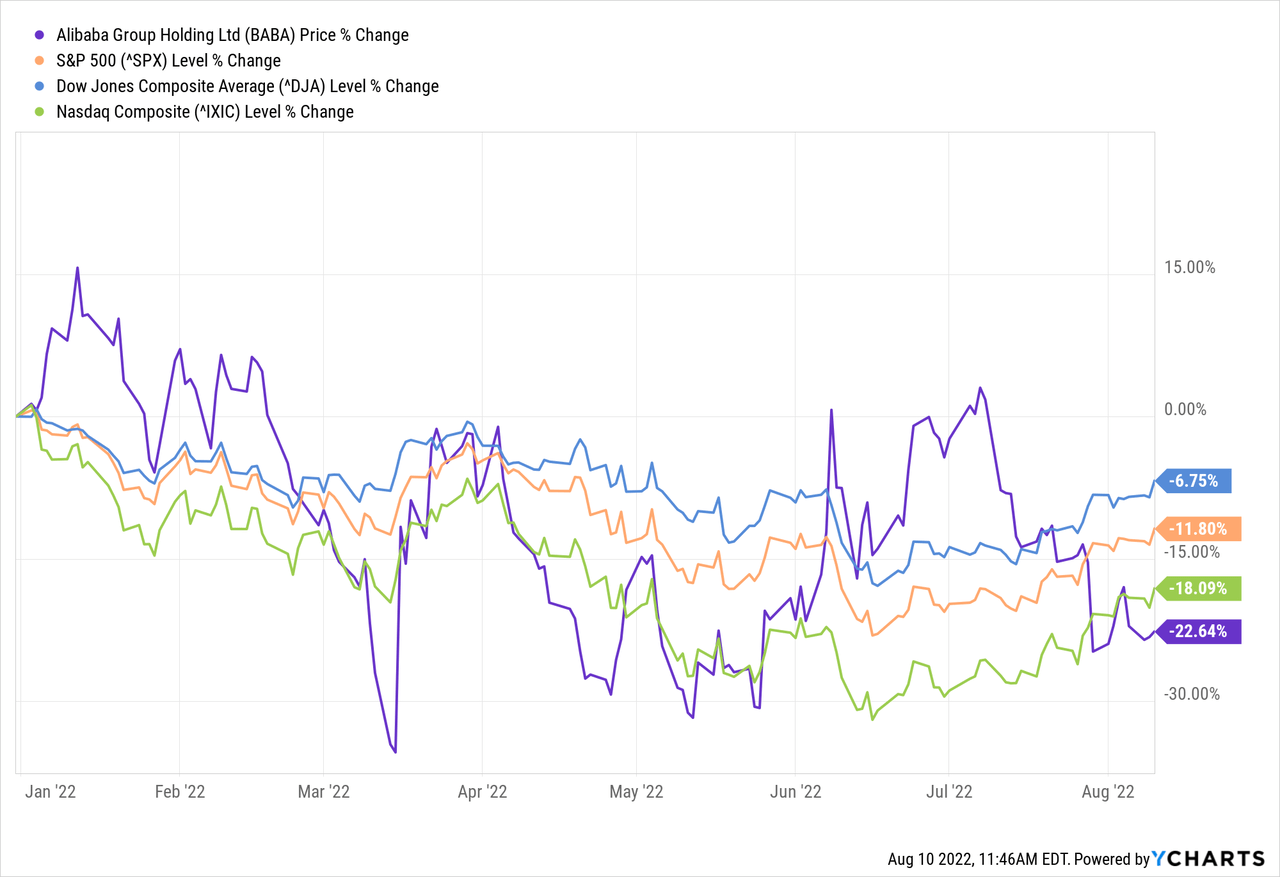

So far this year, it is no secret that the general market indices are under pressure. But things are somewhat improving, especially after today’s news that U.S. inflation somewhat eased in July. Earlier this year, mostly in the first quarter and in late June/early July, Alibaba was faring way better than the general U.S. indices, in part due to the gradual easing of the Chinese tech crackdown. However, things are looking gloomy again, especially after Pelosi’s visit in Taiwan, which will add further pressure to the already strained US-Chinese relations. Consequently, on a year-to-date basis, Alibaba is underperforming most major U.S. indices by a very wide margin. Specifically, Alibaba is down 22.64%, somewhat underperforming the tech-heavy Nasdaq, which is down 18.09%, and substantially underperforming the S&P 500 and Dow Jones, which are ‘only’ down 11.80% and 6.75%, respectively.

That said, one needs to dig deeper. In the beginning of this article, I mentioned that Alibaba has survived a tsunami of negative events, virtually unscathed, in terms of the metrics that really matter; underlying cash flow generation and balance sheet strength. The good news is that this continues to be the case even with the not-so-exciting Q2 2022 results. In fact, this has been a pleasant theme since going public (more on this below). Regarding the Q2 2022 results, even though income from operations, Adjusted EBITA, Non-GAAP net income and Non-GAAP diluted earnings per ADS decreased by 19%, 18%, 30% and 29%, respectively, as outlined above, that was not the case with net cash provided by operating activities and the cash balance. Specifically,

- Net cash provided by operating activities was $5.1 billion, an increase of 1% compared to the same quarter of 2021.

- Free cash flow was $3.3 billion, an increase of 7% compared to the same quarter of 2021.

- Cash on the balance sheet remained healthy at $69.1 billion, more or less flat compared to the previous quarter, and a less than 8% decrease compared to the same quarter of 2021.

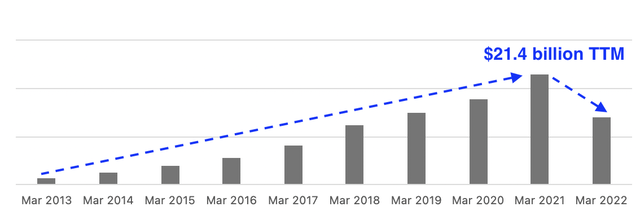

Stellar performance in growing both operating cash flow and cash balance has been the norm since Alibaba’s IPO in 2014. Despite this, Alibaba has given up all of its gains since going public, essentially being ‘dead money’ for almost a decade. Again, just like with the Q2 2022 results, without digging deeper, one would naively assume that the company is performing poorly (e.g., facing cash flow issues, balance sheet troubles, rapidly losing market share, etc). However, unlike its share price, Alibaba has made tremendous progress. It has transformed into a massive cash flow machine, with operating cash flow increasing 10 times since IPO. This in turn has led to a dramatic increase in the cash balance, which has also increased dramatically, more than 10 times since IPO. In short, Alibaba is a much stronger company, at least financially, compared to its IPO days. I think we can all agree on this. Of importance, annual operating cash flow surpassed the $20 billion mark in 2018 and has remained above that level ever since. On a TTM basis, cash flow came in at $21.4 billion.

Alibaba’s Cash from Operations since IPO:

To put things into context, Alibaba reached peak annual cash from operations in 2021, surpassing $35 billion. In contrast, annual operating cash flow was below $2.5 billion in 2013. This alone says it all. Admittedly, cash flow has taken a hit recently, but we are well on track to once again surpass the $20 billion mark. Eventually, growth will resume and Alibaba will be producing stronger cash flows over the next decade. And, looking at things even more long term, I have little doubt that we will be breaking new records. In any event, it is fair to say that the progress made over the past decade has been remarkable. What is also remarkable is the growing cash balance, which is just under $70 billion, based on Q2 2022 results, also hovering around record high levels.

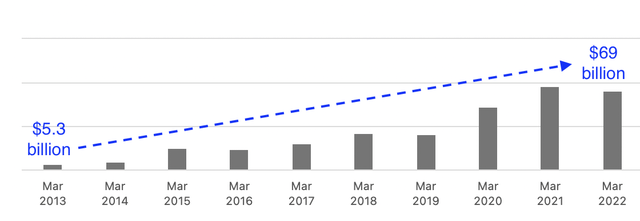

Alibaba’s Cash and Cash Equivalents since IPO:

The cash balance was ‘only’ $5.3 billion in 2013 and surpassed $70 billion in 2021, largely due to strong operating cash flow generation. Currently, the cash balance stands at $69 billion. This is a great position to be in. The massive cash balance provides a strong margin of safety as well as tremendous financial flexibility to go on “offense mode” should opportunities present themselves. Despite the outstanding overall progress since IPO, and the fact that both operating cash flow and the cash balance remain resilient despite disappointing Q2 2022 results, as discussed above, the market cap has fallen to just $250 billion. Looking at it differently, Alibaba’s cash position now reflects ~27% of its market cap. In other words, Alibaba is cheap. This is an unprecedented situation that cannot last forever.

Many will wonder why is this happening? Why is Alibaba in severely distressed territory? The good news is that it has to do with negative sentiment relating to macro events, not company-specific issues (it is important to emphasize, once again, that despite disappointing Q2 2022 results, operating cash flow and the balance sheet were not affected). One of the main reasons has to do with the so-called ‘China’s tech crackdown’. The good news is that this crackdown seems to be easing, as already discussed. In fact, given the ongoing tensions with the U.S., I don’t think the Chinese government will deliberately hurt its crown jewel companies. Another reason is the US-China trade war, started by President Trump, which also created fears of possible delistings of Chinese companies from the US capital markets. Even though the Biden Administration seems to be more flexible to find solutions with China, things will get tough on this front due to Pelosi’s visit in Taiwan, which will add further strain to the US-Chinese relations. The good news is that Alibaba is taking precautionary measures. The company recently shared its plan to add Hong Kong as another primary listing venue. By becoming primarily listed on both Hong Kong and New York stock exchanges, Alibaba aims to further expand and diversify its investor base. In the event that Alibaba ever delists from the US markets, everything will get transferred to Hong Kong. And this will not be the end of the world. I acknowledge this suppresses market sentiment, but it doesn’t fundamentally affect Alibaba. Let’s not forget that Alibaba raised more than $11 billion in a landmark listing in Hong Kong in 2019. The Hong Kong market is liquid and can serve the company well (i.e., to raise capital). This is what really matters.

As discussed above, as per the latest earnings release, Alibaba’s financial performance remains stable, despite COVID-19 outbreaks and logistics/supply chain disruptions at its core e-commerce platforms (Tmall & Taobao). Eventually, COVID-19 lockdowns and supply chain disruptions will ease. And when then macro environment improves (eventually it will), Alibaba’s growth will most likely accelerate. That said, it won’t be smooth sailing. After all, market sentiment is terrible right now, and for good reasons. In addition to high inflation, interest rate hikes, supply chain disruptions, war in Ukraine, and COVID-19, we also have concerns about Taiwan, which will most certainly deteriorate US-Chinese relations further. However, it is important that Alibaba is choosing the Hong Kong exchange as a primary listing. After all, Alibaba is an Asian company, Asia is earth’s largest and most populous continent, and having a primarily listing close to home makes total sense. In any event, a value investor always looks for strong margin of safety. Alibaba’s depressed valuation, coupled with its fortress balance sheet (with the cash balance making up almost 30% of its market cap), makes Alibaba less risky. Importantly, as discussed multiple times in this article, Alibaba is generating substantial positive operating cash flows, enough to move the needle and further strengthen the balance sheet. Alibaba itself is also taking advantage of depressed valuation by going as far as to authorize the largest share buyback program in its history. In fact, Alibaba’s share price is so depressed right now, that, based on today’s valuation, the market actually assumes the company will start shrinking in a fairly rapid and material manner. This, in my view, seems too pessimistic – more like a doom and gloom scenario. I am not arguing that Alibaba cannot shrink, but it is still too cheap relative to its market cap and the fact that it is still producing more than $20 billion in annual operating cash flow. That’s a lot of money. This is important.

Lastly, it is important to note that even though Alibaba will continue to face various macro and regulatory headwinds, it remains one of the world’s leading and most recognizable brands, with more than 1 billion global, high-quality active consumer base (spread across many online brands).

That said, even in the extreme scenario that Alibaba doesn’t grow at all, or even shrinks, it still cheap today. I always like to stress test my investments, trying to be prudent. To this end, I assume the following scenario:

- 10-year investment horizon

- $20 billion average annual run rate in operating cash flow ($15 billion less than the 2021 peak level)

- static world: this means annual operating cash flow will remain constant at $20 billion, and this cashflow will not be reinvested, i.e., it will simply accumulate on the balance sheet (i.e., zero investments besides maintenance CAPEX, zero innovation, zero M&A, zero share buybacks, etc.)

In closing, I feel comfortable with Alibaba’s strong and resilient cash flow generation, which should translate into an ever-increasing cash position on the balance sheet. This will no doubt help the company, not just weather the storm, but also to thrive and go on offense. As such, I see the current situation as a big opportunity. It won’t last forever and patient investors stand to benefit tremendously. As the saying goes, “cash is king”, and Alibaba has a massive cash balance and, more importantly, the ability to produce even more game-changing cash flows.

Be the first to comment