Dphotographer/E+ via Getty Images

Introduction

The Global X MSCI Argentina ETF (NYSEARCA:ARGT) is a $34m valued ETF that tracks the MSCI All Argentina 25/50 Index, an index that offers access to the broad Argentina equity universe, represented by 25 odd stocks. Do note that the stocks that comprise this index don’t necessarily have to be domiciled or headquartered in Argentina, and the index also considers companies whose total revenue share from the Argentinian economy is greater than 10%. Separately, also consider that ARGT’s top holding- MercadoLibre Inc (MELI) with a 20% weight, actually derives over half its revenue from Brazil! So, it’s rather debatable if one gets focused access to the Argentinian economy via ARGT, but investors aren’t spoilt for choice here, as the other ETF tracking Argentinian equities- the iShares MSCI Argentina and Global Exposure ETF (AGT), also tracks the same index and is available at the same expense ratio of 0.59%.

The underlying conditions in Argentina

The general tailwinds in the commodity markets in 2022 have no doubt been very beneficial for the Argentinian economy which is noted for its expertise in cereal and grain exports, amongst others. As per the most recent reading, the merchandise trade balance improved sequentially from $0.3bn in Jan to $0.8bn in Feb, with the trailing 12-month figure currently hovering close to $14bn. It looks like we could see a trade surplus position for the next two years with around $12.2bn expected by the end of this year and $11.1bn in 2023. Even before the 2022 commodity boom, OECD had estimated (in Dec-2021) that net exports for Argentina could grow by 1.7% in FY22 (this was down -0.5% in FY20, and -1.2% in FY21). You would think there would be upside risks to that figure now.

Whilst the trade side of the Argentinian economy looks relatively encouraging, I worry about the other aspects of the economy, most notably inflation, political consensus, and discussions with IMF over its debt obligations.

For the uninitiated, the Alberto Fernandez administration was recently able to come to a $45bn Extended Fund Facility arrangement with the IMF which is essentially a rescheduling of the country’s debt that was part of the original IMF bailout in 2018. Under the new agreement, Argentina will get a 30-month extended fund facility with $9.8bn of inflows in the first tranche to help address the immediate economic challenges that are underway. Now, as part of the IMF deal, the Argentinian government was also given a certain inflation target of 38-48% (source: Bloomberg) but this looks increasingly unlikely to be fulfilled. In fact the March inflation reading which came out a few days back came in well above street estimates at 55% (February was 52.3%), also implying a 6.7% sequential increase (as against 4.7% in February). Economists now believe that inflation could actually rise by 60% this year! Clearly, in light of these new developments, the IMF and the Fernandez administration will have to recalibrate inflation expectations when they sit down for a formal review, expected to be held next month. Will there be a revision to the deal structure where things become more onerous?

I also remain rather skeptical of the ability to keep inflation in check particularly when you consider that one of the IMF’s requirements is that the fiscal deficit be curtailed by way of lower energy subsidies. If this is implemented, upside risks to inflation numbers will only gain pace on account of steeper electricity bills for the general populace. The IMF also calls for Argentina to maintain its FX reserves which will test the nation’s ability to fund a burgeoning import bill fuelled by headwinds in the global commodity space.

Finally, there’s also the matter of gaining ample political consensus to support some of the measures that the IMF is proposing. Recent reports coming out of Argentina point to several factions within the ruling coalition with the country’s Vice President- Cristina Fernández de Kirchner, seemingly at odds with some of the anti-inflationary measures proposed under this deal. Without support from members of the leftist coalition, there’s a great risk of this deal collapsing sometime down the line; that shouldn’t necessarily come as a great surprise for anyone who’s observed developments in Argentina over the last few decades. Most IMF-related financing programs here have rarely completed the stipulated time frame on account of a failure to meet certain requirements.

Closing thoughts

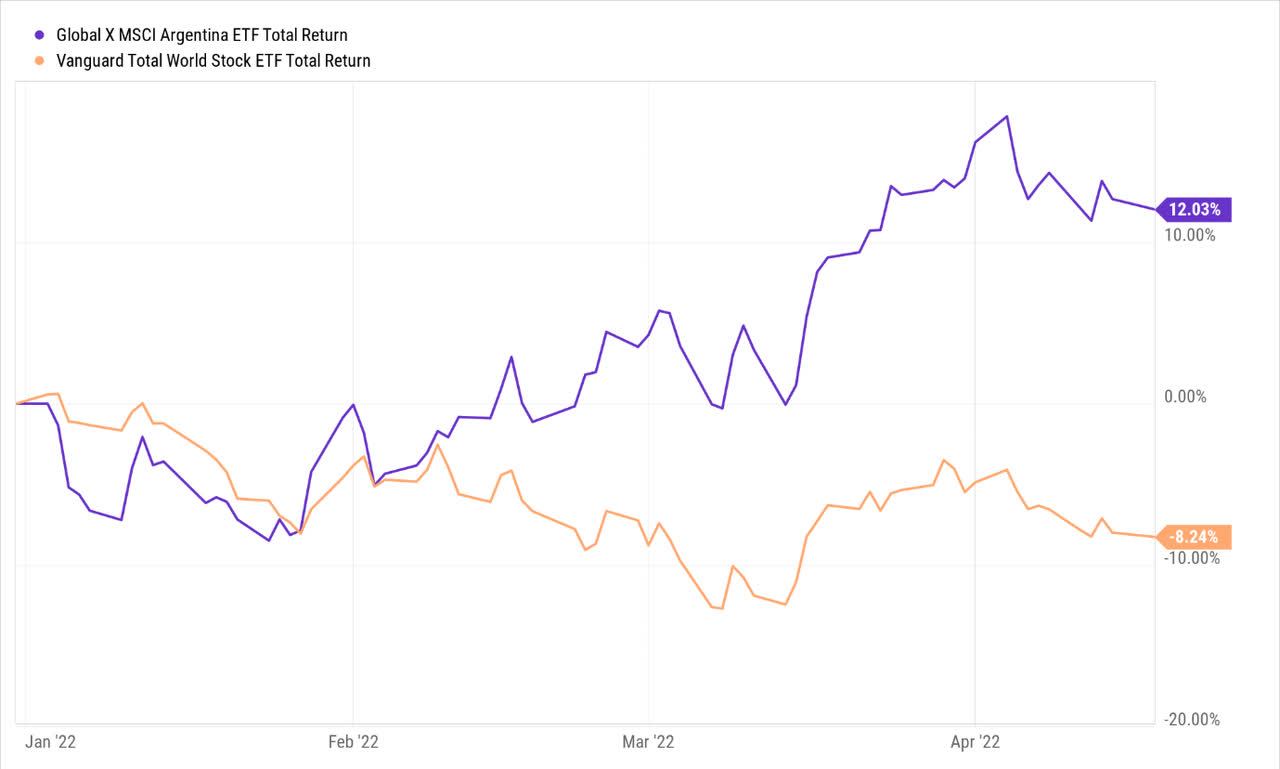

YCharts

Much like a lot of other Latam focused options, ARGT has enjoyed a solid 2022, delivering positive returns of 12% so far, comfortably outperforming global stocks which are down -8% (as represented by the Vanguard Total World Stock ETF). Having said that, if you’ve benefitted from the relative buoyancy this year, I’d reckon it would be prudent to tighten your seatbelts at this juncture, as the ETF is trading close to resistance levels that have traditionally proven to be difficult to overcome. Even though there are still around nine days of trading left this month, for now, it does appear as though April’s monthly candle may well be in the shape of a red-colored bearish shooting star pattern around these resistance levels.

Trading View

Even if you juxtapose ARGT against the Vanguard Total World Stock ETF (VT), note that this relative strength ratio has reached levels where the risk-reward for a long position does not look particularly great.

Stockcharts

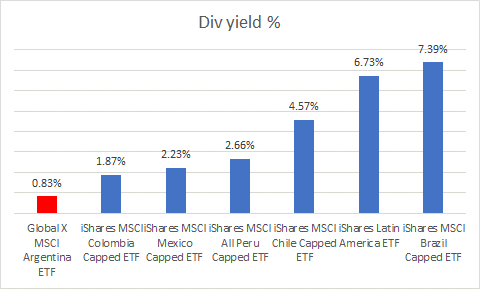

Then there’s the income angle of this ETF that comes across as rather unappealing, particularly when you consider what’s on offer in other territories around Latam; ARGT’s dividend yield of less than 1% is a long way from the regional average of 3.75% and is a pittance compared to the Brazilian centric option.

YCharts

YCharts

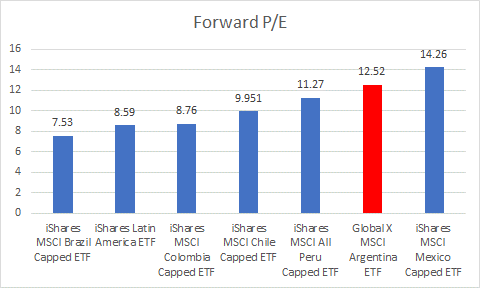

Finally, I’d also urge investors to consider the forward P/E valuations on offer where ARGT trades at a relatively pricey multiple of 12.5x; this represents a 20% premium over the average of the peer set, with only Mexico trading at a steeper multiple. Considering the risks surrounding the Argentinian economy, I’m not convinced it makes a great deal of sense to be paying this premium to own ARGT.

Be the first to comment