JHVEPhoto

Thesis

Leading medical technology and device maker Medtronic plc (NYSE:MDT) heads into its highly anticipated FQ1’23 earnings release on August 23. In July, we discussed in a technical analysis piece urging investors to buy its bottom aggressively.

We are pleased to share that MDT has likely bottomed out in the medium term in July, and therefore we postulate that downside should be limited from its July lows. Moreover, while MDT has slightly underperformed the market in its recent recovery, we are confident it should get re-rated, as the company laps highly challenging comps from its previous fiscal year.

Given the recent volatility in the market, MDT could also face near-term downside. Notwithstanding, we encourage investors to leverage any likely weakness as an opportunity to add exposure to a highly profitable med-tech company.

Accordingly, we reiterate our Buy rating on MDT as we head into its earnings card.

FY22 Was Tough, But Investors Need To Look Ahead

MDT fell more than 36% from its September 2021 highs to its recent July lows. Therefore, we postulate that the pummeling in MDT to de-risk its near-term headwinds has likely been completed. As a reminder, the company highlighted “acute” supply chain headwinds in its FQ4’22 earnings card, compounded by the COVID lockdowns in China.

However, investors should note that China has since opened up from the worst of its lockdowns, even though the economy is still struggling to meet its targeted GDP growth rate. Still, we are confident that it should help lift the positive sentiments in MDT, as it expects to emerge from the worst of its near-term challenges. CEO Geoff Martha articulated in a recent June conference:

Q4 was obviously impacted. I mean going into Q4, a lot of our safety stock was depleted because of the ongoing chip issue and resins. But in Q4, like midway through, things got much more acute, especially for our Surgical Innovations business. And then you had China shut down in the month of April and into May. So we’re seeing the resin issue get better. We’re seeing the packaging issue get better. It’s going to still take some time, and we factored that in. So we have line of sight to these things abating, especially by the second half of our fiscal year. (Goldman Sachs Global Healthcare Conference)

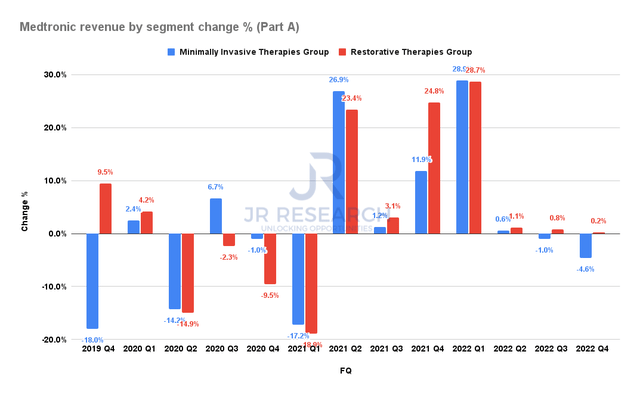

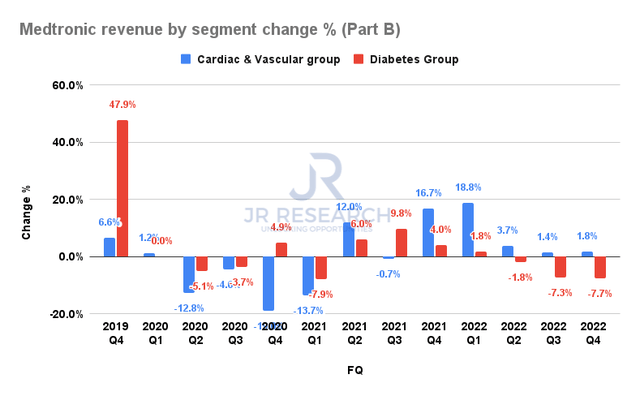

Medtronic revenue by segment change % (Part A) (Company filings) Medtronic revenue by segment change % (Part B) (Company filings)

As seen above, Medtronic’s key revenue segments have been impacted markedly towards the end of FY22. In addition, the robust recovery in FY21 has set the stage for much more difficult comps for the company to outperform in H2’22. However, given the less onerous comps through FY23, we are confident that Medtronic’s commitment to its revenue and EPS growth guidance should help buyers return to support its reasonable valuation. Martha accentuated:

Starting our fiscal ’23 Q2, you start to have some much easier comps. In FY22, we were 2.6% in Q2, 1.6% in Q3, 1.4% in Q4. So the back half of FY23 has easier comps. We’re starting with a lower base. We’re committed to the 5-plus top line and the 8%-plus EPS growth. And that’s where we want to get [for] FY23. And you have a healthy and growing dividend, which we just had another 8% increase in that last quarter. (Medtronic earnings)

MDT’s Valuation Remains Reasonable

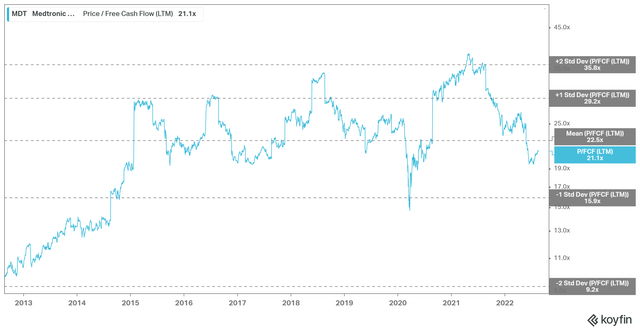

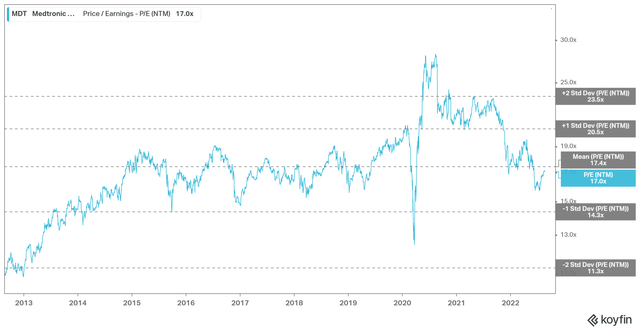

MDT TTM P/FCF valuation trend (koyfin) MDT NTM normalized P/E valuation trend (koyfin)

As seen above, MDT’s valuations have recovered toward its 10Y mean from its July lows. In addition, we observed similar changes in its NTM earnings and free cash flow (FCF) multiples. Therefore, while MDT may not be considered significantly undervalued, we are confident that a medium-term re-rating is on the cards if its operating performance improves further with easier comps.

Is MDT Stock A Buy, Sell, Or Hold?

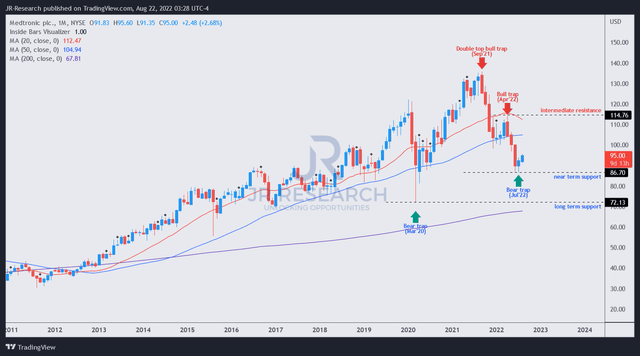

MDT price chart (monthly) (TradingView)

MDT has recovered from its July bottom, as we posited. However, its valuation is still reasonable; therefore, we are confident that the downside should remain limited even from the current levels.

Hence, we urge investors to continue adding positions at the current levels. Furthermore, investors can use potential near-term downside volatility to add more positions as the market digests some of its recent gains from July.

Accordingly, we reiterate our Buy rating on MDT.

Be the first to comment