Kameleon007/E+ via Getty Images

It’s that time again: time for a monthly dividend-paying real estate investment trust (“REIT”) article.

Admittedly, it’s only been a month or so since the last writeup I published about them. But considering how this year is going, I don’t think I’m jumping the gun.

Let me explain, starting with my last intro on the subject:

“Monthly or quarterly? Which do you prefer?

“It seems that whenever I write about stocks that pay monthly dividends, there are always folks that swarm to read (my article) like bees [to] azaleas.

“Alternatively, there are others who couldn’t care less if the dividend is paid monthly.”

For those who love ‘em, there are a few different reasons:

“First off, some companies allow investors to use their dividends to buy additional shares through a dividend reinvestment plan… With a DRIP, you can use dividends to purchase full or fractional shares of the same company.”

And you can accrue more money over time that way from monthly reinvestments.

Other reasons? Those include receiving regular income “you can live off… to buy groceries, grow your savings, buy the grandkids braces, or invest through an IRA or college savings account.”

Which is precisely why I’m writing about monthly paying dividends REITs again so soon.

A Lot of Negative Headlines

Here’s another part of my last monthly paying dividend article:

“I can tell you that, after 10+ years of writing articles on Seeking Alpha, there are many loyal monthly dividend investors who are passionate about owning these frequent payers…”

And considering the following recent headlines, I imagine that number is growing:

- “Rising Fuel Costs Are a Massive Problem for Business and Consumers…” – CNBC

- “The Next Shock for Homeowners: Surging Property Tax Assessments” – CBS News

- “Retail: ‘It’s a Horribly Challenging Environment,’ Expert Says” – Yahoo Finance

Supporting that last sentiment, TheStreet published “Here’s Why Harley-Davidson Is Pausing All Production,” which begins with:

“Harley-Davidson (HOG)… bikes are known for being loud and intense. But supply chain issues are forcing the company to go quiet for the next two weeks.

“… it will suspend all vehicle assembly and shipments, excluding its electric vehicle line LiveWire.”

Between those shortages… inflation increasingly hitting luxuries and necessities alike… and gas prices that could hit $6 this summer…

We get other stories like:

- “U.S. ‘Heading Into a Very Serious Recession’ Later This Year, Venture Capitalist Warns.” – Fox Business

- “Wells Fargo’s CEO Says There Is ‘No Question’ That the U.S. Is Heading Into a Downturn, and It Will Be Hard to Avoid Recession.” – Business Insider

Here’s some of that last one:

“Speaking to The Wall Street Journal’s ‘Future of Everything Festival’ on Tuesday, Charlie Scharf said… businesses and consumers are still strong, but the world is reacting to the Federal Reserve as it raises interest rates to tame surging inflation…

“The fact that everyone is so strong going into this should hopefully provide a cushion such that whatever recession there is, if there is one, is short and not all that deep,’ he said.”

I know a whole lot of people who would disagree with that last part.

Monthly Paying Dividend REITs to the Rescue

It’s hard to accept such “bullish” assessments at face value considering this earnings season.

There have, of course, been some notable winners. But big names like Walmart (WMT) and Target (TGT), Amazon (AMZN), and Netflix (NFLX) alike have all intensely disappointed.

In which case, not all businesses are doing that great. And as for consumers, I’ll turn to a Fox Business headline this time: “U.S. ‘Heading Into a Very Serious Recession’ Later This Year, Venture Capitalist Warns.”

Said individual is Craft Ventures co-founder and general partner David Sacks, who spoke on Mornings With Maria on May 19:

“The reason why sentiment is so negative is because the market has sort of collectively realized that the highs that we saw last year were artificial. They were the result of the Fed and Congress and the administration pumping $10 trillion of liquidity into the marketplace.

“That resulted in inflation, and now the Fed has to raise interest rates.”

Moreover:

“Wages are not keeping up with inflation, and so consumers do not feel as flush, and you are starting to see that in quarterly reports.””

That seems to be the more logical conclusion. And that’s why I’m running with monthly dividend-paying REITs again.

Going back to my previously mentioned article, “Having that extra income stream can… make budgeting and planning for short- or long-term financial goals easier.” Even during an economic downturn.

Or a flat-out recession.

So for those of you who didn’t read “Why Don’t More REITs Pay Monthly Dividends?” in April, or who need to hear this message again even though they did…

Let’s discuss some stocks that can help put you in a better money frame of mind.

7 Monthly-Paying REITs to Buy

As iREIT on Alpha members know, our service provides more than just articles, we offer our customers a wide range of data-driven tools and resources.

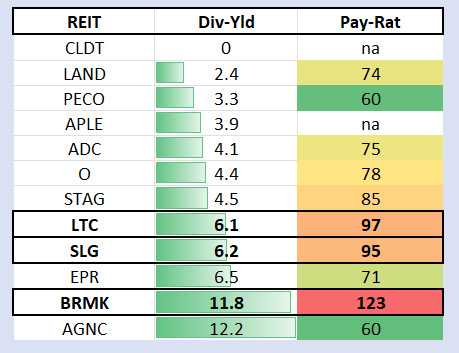

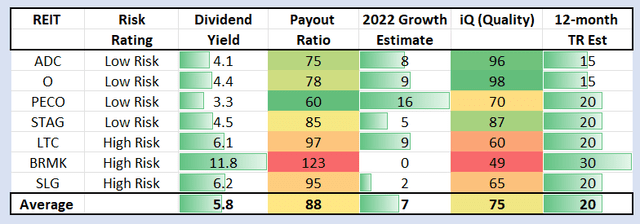

For example, we can screen for monthly dividend paying REITs using metrics such as dividend yield and the payout ratio:

iREIT on Alpha

As you can see (above), we track a dozen REITs ranging from 0% yield to as high as 12.2%. However, we pay close attention to payout ratios, because that signals danger when the dividend is not covered by earnings (or AFFO per share in the equity REIT sector).

Note: LTC Properties, Inc. (LTC), SL Green Realty Corp. (SLG), and Broadmark Realty Capital Inc. are all at risk of a dividend cut.

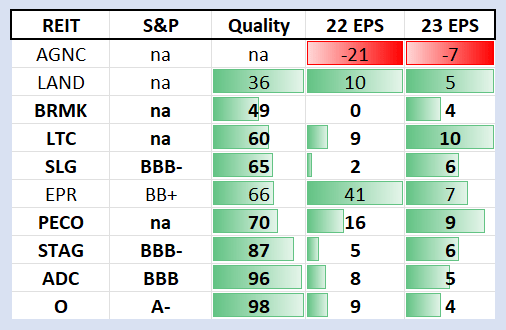

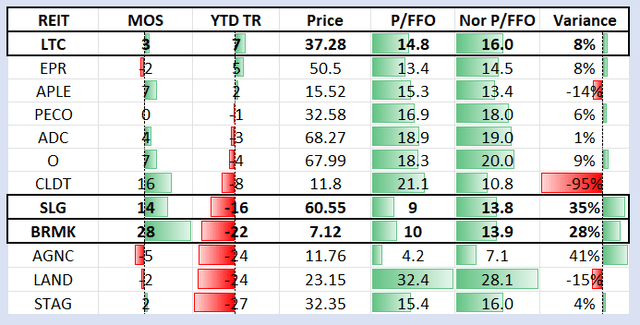

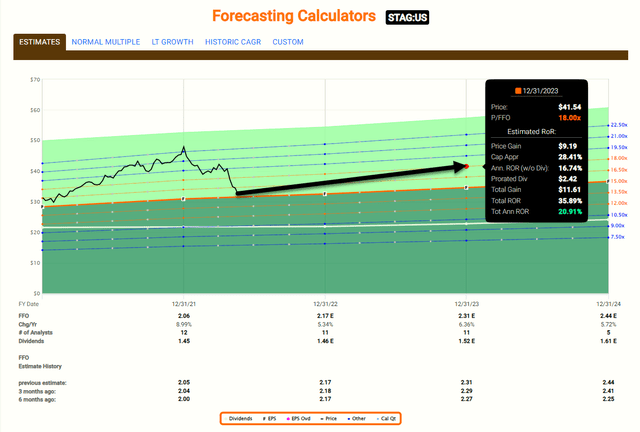

Another way we screen for REITs is by using our own “margin of safety” (or MOS) tool that is the variance between the REITs current price and our buy target. We also like comparing the current P/FFO (or EPS for mREITs) with the normal trading range.

As you can see (above), the worst-performing monthly-payers year-to-date are as follows:

- STAG Industrial (STAG) -27%

- Gladstone Land (LAND) -24%

- AGNC Investment (AGNC) -24%

- Broadmark Realty -22%

- SL Green -16%

Although most own monthly-paying REITs for income, we also insist on owning shares in companies that are growing their dividend. Clearly the higher risk REITs I mentioned – LTC, SLG, and BRMK – are not in a position to grow their dividend; however, we like to screen for consensus estimates so we can get a picture of the total return prospects of the company.

iREIT on Alpha

With that in mind, let’s take a look at seven REITs on this list that we’re recommending, and I will start with the higher risk REITs.

Higher Risk Recommendations

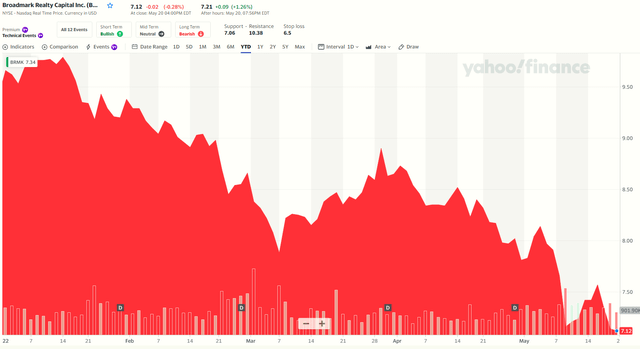

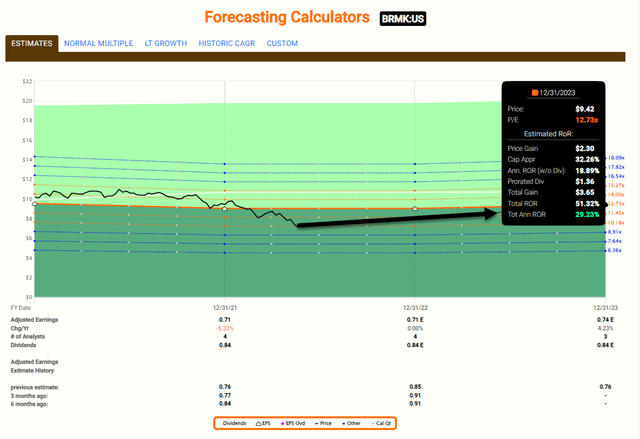

Broadmark Realty (BRMK) is a commercial mortgage REIT that we began covering in September 2019, as the company was in the process of merging with special purpose acquisition company, or SPAC, Trinity Merger Corp.

We have grown to really like this specialized lender that focuses primarily on residential “construction loans designed for real estate investors and developers who require quick closings, outside-the-box thinking, a high loan-to-value, and the utmost professional service.” As you can see below, shares have taken a beating YTD:

BRMK’s payout ratio is now around 123% (in Q1-22) as a result of around $.04 per share related to $.04 per share earnings drag for non-accruals.

BRMK owns a diversified loan portfolio consisting of $1.5 billion in total commitments (including principal outstanding, interest reserve and construction holdbacks) with a weighted average LTV of 59.1% (on active loan portfolio). I spoke with the CEO, Brain Ward, last week and he explained,

“I can’t emphasize enough the power of having a low-levered balance sheet, because I don’t have to look over my shoulder right now and worry about rising rates and margin calls. I can go do my thing, do what I need to do, and play this market however it comes to me. And if you look at my history, Brad, I love multiple exit strategies. And I say that not only in terms of the business but also in terms of our assets.”

Ward is a new CEO, and this means that he has inherited a platform with high defaults and low leverage. While Mr. Market has priced in a possible dividend cut, it appears that Ward is not tipping his hat with regard to right-sizing the dividend. He said,

“That type of disruption ultimately, really plays to the strength of a Broadmark. And so being a balance sheet lender, being very, very low leveraged, that gives us sort of room to move where other competitors would be way more constrained because of too much leverage, because of margin calls, rising rates, and all of the challenges that they face.”

We’re sticking with this Buy recommendation; with, of course, the disclaimer that the dividend is not covered. I think it’s critical for investors to recognize that this is a higher-risk pick that could become a winner if Ward can execute on his plan. Possible upside: 30% annual return target.

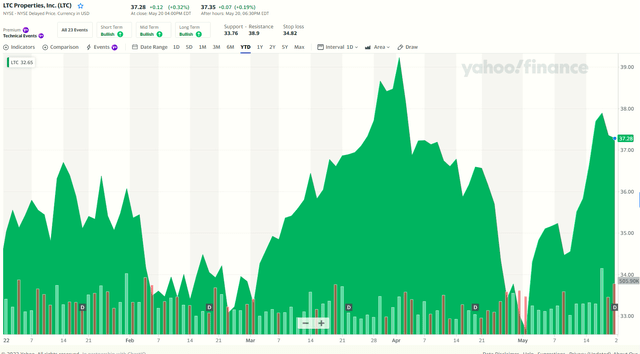

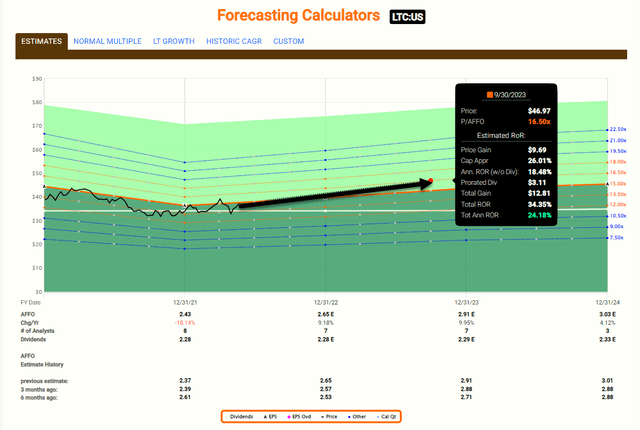

LTC Properties is a healthcare REIT that owns 193 properties in 28 states. Its skilled nursing portfolio takes up 47.2% of its holdings, while assisted living facilities account for 51.4%.

The company has always maintained a solid balance sheet, which – despite its continuing woes – helped it keep a $0.19 monthly dividend during Q1-22. As referenced earlier, the payout ratio is 97%, which does not provide much cushion. As you can see below, shares have performed well YTD +(+9.2%):

LTC is in the higher risk classification because the payout ratio is elevated – around 97% based on AFFO.

However, occupancy is increasing in several markets while health agency utilization appears to be dropping. Several of LTC’s private pay operators have implemented rent hikes to offset higher labor and supply costs, and none has reported pushback from residents or their families.

It appears that the skilled nursing sector is steadily moving toward a pre-pandemic environment. While the payout ratio is high, LTC was successful in maintaining its $0.19 per share monthly dividend during the quarter, with a payout to shareholders of $22.5 million (the FAD payout ratio decreased from Q4)

Based on LTC’s recent investment activity and assumed rent payments from the former Senior Care and Senior Lifestyle portfolios, the company expects the FAD payout ratio to continue to decline during 2022 and approach the target of 80% by the end of this year.

Assuming the payout ratio continues to fall, iREIT will adjust its quality score and risk score accordingly.

We have always been impressed with LTC’s balance sheet discipline, with no significant long-term debt maturities over the next five years. At the end of Q1-22, LTC’s credit metrics remain solid, with a debt-to-annualize adjusted EBITDA of 6.1x, an annualized adjusted fixed charge coverage ratio of 4.4x, and a debt-to-enterprise value of 33%.

We maintain a BUY on LTC shares, as we consider the 6.1% dividend attractive as well as the 9% growth estimate for 2022. Our total 12-month total return target is ~20%.

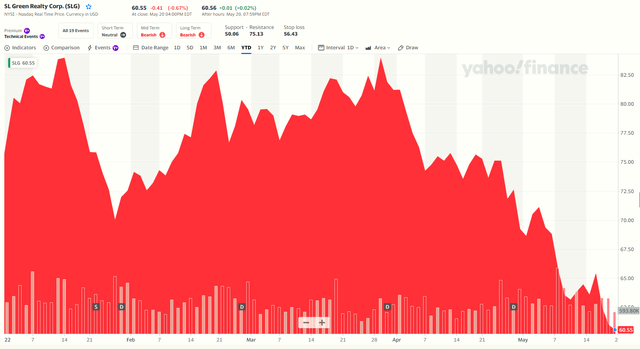

SL Green is an office REIT (focused on Manhattan) with significant development underway. Recently, the company completed One Vanderbilt (One Vandy), and as the CEO explained (Q3-21 earnings call):

“One Vanderbilt with the most incredible and amplified views of New York City. The room is aptly named because everything we’ve done with this building has been about transcending limits, and pushing boundaries.

He added,

“At the ribbon cutting ceremony I spoke about how One Vanderbilt is representative of what a true 21st century office tower can be. It redefines what it means to integrate excellence and design, efficiencies, sustainability, amenity, health, wellness and commutability.”

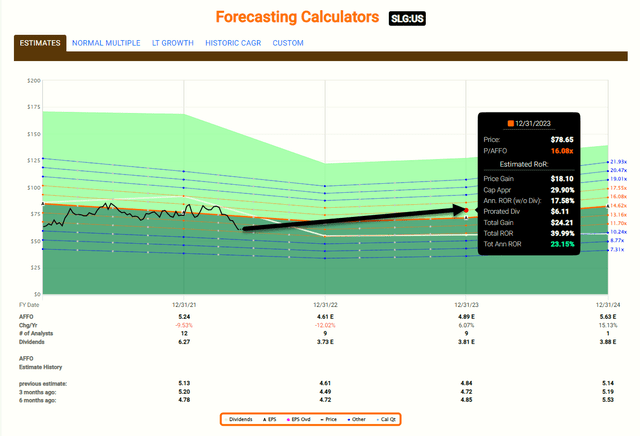

As seen below, SLG shares have dropped by ~18% year-to-date:

We previously discussed SLG at iREIT on Alpha, explaining that the company has made some “changes in strategy, some of them subtle, others more significant. Notably, SLG plans to evolve into more of a fund manager, maintaining management control of assets while enhancing ROE with higher fees.”

It appears SLG has shifted strategy that includes a goal of obtaining a NY casino license, which it plans to bring into Times Square (presumably 1515 Broadway) with Hard Rock as its operating partner, as I explained to iREIT members,

“We would be (positively) surprised if SLG wins the license given the potential earnings uplift. SLG also has focused operations on a concentrated portfolio (110 assets, 31.9 msf in 2018 to 62 assets, 27.2 msf today), and has dipped its toe into a crypto fund.”

During Q1-22, SLG’s leasing activity was significant, with 821.0k sf signed (vs. 482k sf LTM), highlighted by IBM’s 328k sf at One Madison. However, cash leasing spreads were the worst in at least a decade at -15.1% with an average lease term of 9.8 years.

Furthermore, SLG’s total concessions (including free rent) were ~27% and 17% for TIs/LCs alone — both above recent averages.

Note: TI = Tenant Improvement and LC = Leasing Commissions

Also, in Q1-22, SLG reported FFO per share of $1.65 (-4.6% y/y) vs. $1.64 for consensus. As seen in one of the charts above, analysts forecast AFFO per share of ~2% in 2022. As mentioned, SLG’s payout ratio is also elevated – at 95% based on AFFO – and it continues to decline.

The dividend yield is attractive (6.25) and we maintain a BUY rating with a target total return (over 12 months) of 20%+.

4 No-Brainer Buys

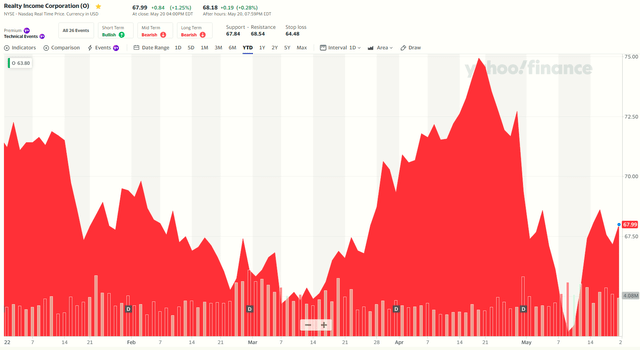

Now let’s move on to the safer monthly-paying buy list stating with Realty Income Corporation (O), a net lease REIT that owns over 11,000 properties in all 50 states and some scattered throughout western Europe.

Known for paying a monthly dividend, the company coined themselves “The Monthly Dividend Company.” Realty Income is one of the few REITs on the prestigious Dividend Aristocrats list due in part to the company paying an increasing dividend for 28 consecutive years.

The company has declared over 620 monthly dividends and increased the dividend for 98 consecutive quarters. As seen below, O shares have declined by ~5% year-to-date:

O is one of the overall safest REITs that I own, with a quality score of 98, just 2 points away from perfection (score of 100). The payout ratio is in the best shape ever (78% based on AFFO), and the growth pipeline is impressive.

In terms of the portfolio, O has a very diversified portfolio of tenants, and long-term leases that allow investors to better forecast future cash flows. The average initial lease term for the company is roughly 15 years, with the current average remaining lease term being 9 years.

The REIT is about as stable as they come, having generated positive earnings growth in 25 out of its 26 years as a public company. Also, the company has seen 5.1% median AFFO growth since 1996.

On top of all that, a strong portfolio with reliable (growing) results, the company has maintained a Fortress Balance Sheet. This has really been one of the key components as to why Realty Income has separated itself from other net lease REITs, making it a foundational REIT to consider for your portfolio.

O is trading at a 7% discount to our buy target, and the dividend yield is 4.4%. Analysts are forecasting around 9% growth (in AFFO) in 2022, which translates into a 12-month total return forecast of around 15%.

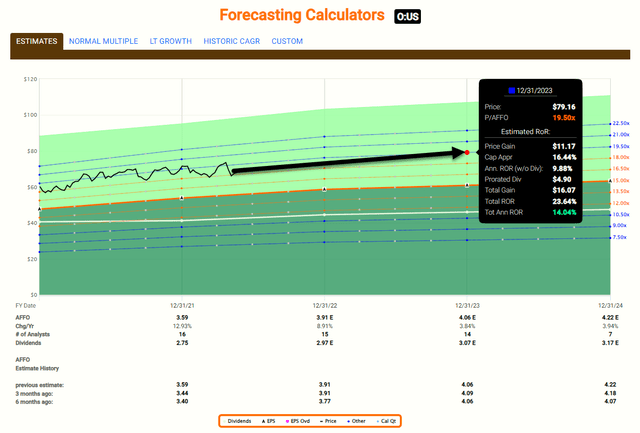

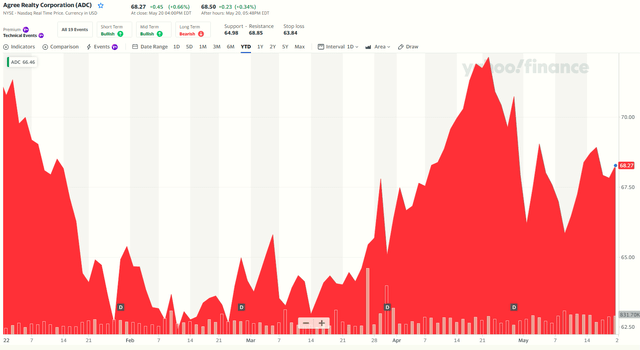

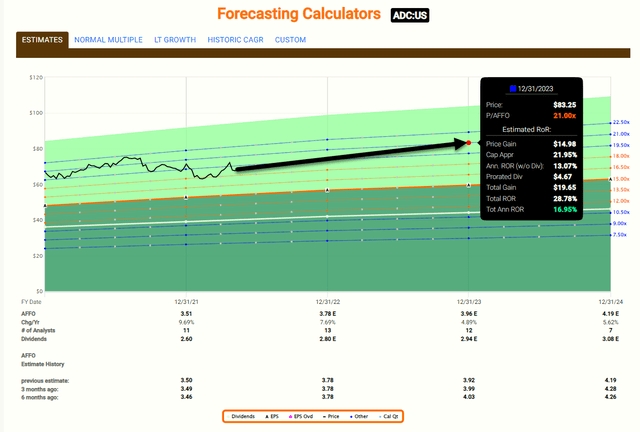

Agree Realty Corporation (ADC) is a net lease REIT with a portfolio that includes 1,404 properties in 47 states and was 99.5% leased (as of Q4-1). Top tenants include Walmart (6.6% of base rent), Tractor Supply (3.9%), and Dollar General (3.9%).

Diversification is much stronger these days, as ADC has added ground leases (182 properties) to the mix. They represent 14.3% of ABR (with a weighted average lease term of 12 years). As seen below, ADC shares have declined by ~4% year-to-date:

Last week, I interviewed ADC’s CEO, Joey Agree (for iREIT on Alpha members). He told me:

“Our dividend payout ratio has a stated policy of 75 to 85% of AFFO. We just raised the dividend; we grew the dividend just under 9% last year. Obviously, it’s a monthly dividend…

We’re at the very low end of that payout ratio, if not, we’re below 75%…I think the most important aspect of the dividend for individual shareholders especially is consistency, predictability, and transparency.”

Joey added,

“The balance sheet is rock solid, recently upgraded by Moody’s to BAA1, fixed-charge coverage at 5.2x. We entered the year with $600 million of forward equity…. and have a new $1 billion credit facility… And so we’re in a great position to continue to execute here with one of the strongest balance sheets in all of REITdom.”

Analysts are forecasting ~8% (‘AFFO’) growth in 2022, and the dividend yield is now 4.1%. iREIT forecasts shares to return ~15% over the next 12 months.

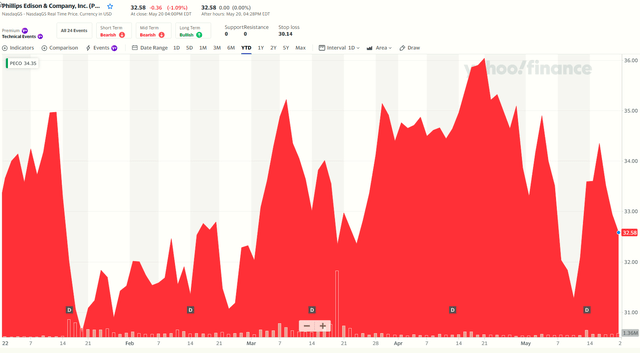

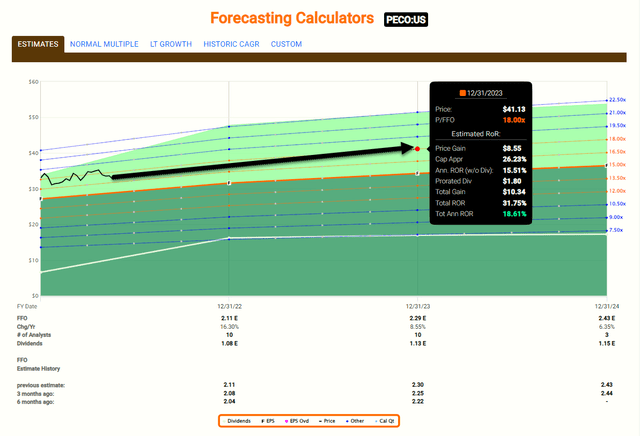

Phillips Edison & Company, Inc. (PECO) is a shopping center REIT that owns a portfolio of 290 properties (including 269 wholly owned) in 31 states. Around 96% of rents are from grocery-anchored centers and 72.5% are from necessity-based and service retailers. The portfolio is well-diversified by tenant and geography, with an approximate 50% exposure to the Sunbelt.

We really like PECO’s smaller, neighborhood-focused assets that have generated solid relative operating performance versus its peers – as well as robust rent collection. As seen below, PECO shares have declined 1.5% year-to-date:

PECO is enjoying a surge in demand for space not seen in over a decade (post-GFR), as greater work from home and suburban in-migration have driven incremental traffic and sales to neighborhood shopping centers.

This improved demand is translating into higher occupancy and retention (~89% in Q1-22), supporting stronger pricing power, as seen in robust new and renewal leasing spreads for PECO.

In Q1-22 PECO generated 14.6% blended spread growth (new and renewal rent spreads of 34.0% / 14.7%), respectively, generally in line with peers and well above its 7-9% levels in Q2-21 – Q4-21.

PECO’s updated same-center NOI is now 3.25% to 4% (vs 3-4% prior), while core FFO guidance is now $2.18-2.24/sh (vs $2.16-2.24 prior), +1c at midpoint.

PECO’s balance sheet is in good shape, it ended Q1-22 with $560 million of liquidity and debt/EBITDA at 5.7x (vs 5.6x at Q4-21). PECO expects to maintain sub-6x debt/EBITDA and has no $0M of maturities through YE23. Also, PECO has just ~$400 million of exposure to rising rates.

The dividend yield is 3.3%, and PECO has the lowest payout ratio in the shopping center sector. PECO remains a top 2022 pick (in the shopping center sector) based upon its overall risk profile. Shares are trading at 4% below our Buy target, and we estimate shares could return ~15% to 20% over the next 12-months.

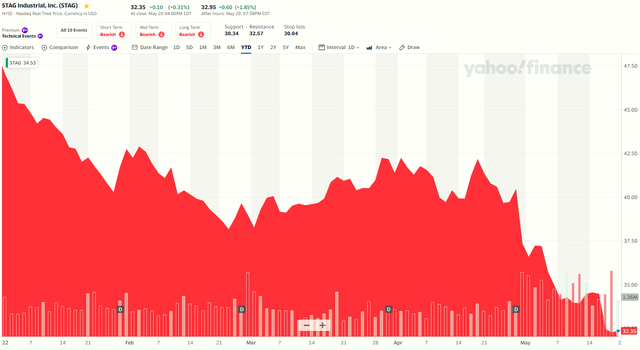

Last but not least, we have STAG Industrial, Inc., a REIT that owns 551 properties in 40 states. STAG’s portfolio spans 60+ markets and the largest market exposure is less than 8% of AB. STAG’s portfolio includes exposure to 45+ industries, with the largest tenant less than 4% of ABR. As seen below, shares have dropped by over 32% year-to-date:

On the recant (Q1-22) earnings call STAG’s CEO, Ben Butcher explained,

“To say the least, we live in interesting times. The daily headlines are dominated by the ongoing and escalating geopolitical turmoil, many inflation and firmly entrenched political polarization. The Fed has a long less committed to a rising interest rate cycle and a post-pandemic new normal continues to evolve. None of this is dampened the viable demand for industrial real estate.”

He went on to explain,

“The recently announced cooling off by Amazon (AMZN) is only a small part of the overall strong demand story. A variety of other market participants are aggressively pursuing additional space. New supply though elevated and continues to struggle to keep up with this continued heightened level of demand, good news for owners of this asset class.

These dynamics are reflected in the results from our operating portfolio. We continue to experience significant proactive commitment to our spaces from new and current tenants. This has allowed us to achieve greater rental growth and secure record levels of contractual rental escalations.”

In Q1-22, STAG’s FFO per share was $0.53, an 8.2% increase over the prior year (same-store NOI was a big contributor of this growth). Acquisition volume totaled $166.4 million (eight buildings), with stabilized cash and straight-line cap rates of 5% and 5.2%, respectively.

In March, STAG acquired two properties in my hometown of Greeneville, SC – a 156,000 square foot warehouse distribution facility for $16.4 million at a 4.6% stabilized cash cap rate and leased to an investment-grade tenant, and a 289,000 square foot warehouse distribution facility for $28.3 million at a 5.7% stabilized cash cap rate that’s 78% leased to three credit tenants (ability to add value through lease-up).

STAG has always maintained discipline. Cash available for distribution in Q1-22 totaled $82.4 million, an increase of 13.8% as compared to the prior period. Leverage was near the low end of the range, with net debt to run rate adjusted EBITDA equal to 5.1x.

STAG guided core FFO per share to a range of $2.16 to $2.20 per share, an increase to the midpoint of $0.01, and increased same-store guidance to be between 4% and 4.5% for the year, an increase in the midpoint of 75 basis points.

STAG has recently dropped into our Buy zone, as shares now trade at 15.4x P/AFFO (normal is 16.0x), with a dividend yield of 4.5%. The payout ratio has fallen over the years and is now 85% (based on AFFO). Analysts forecast 5% growth in 2022, which translates into a 12-month total return target of 20%.

Who Wants Monthly Mailbox Money?

In closing, I know many of you are getting nervous about inflation and rising rates, so I thought it would be helpful if I provided you with a snapshot of these 7 REIT recommendations. Here’s the recap:

Assuming an equal-weight allocation to these 7 REITs, the portfolio would generate an average dividend yield of 5.8%, with average growth (in 2022) of 7%. The average total return forecast (12-months) is 20%.

Once again, each investor should consider his or her unique risk profile characteristics, as BRMK, LTC, and SLG are considered higher risk REITs because of their elevated payout ratio.

I hope you enjoyed this edition of Monthly Mailbox Mojo…

Be the first to comment