oxign/E+ via Getty Images

Hints of Durability

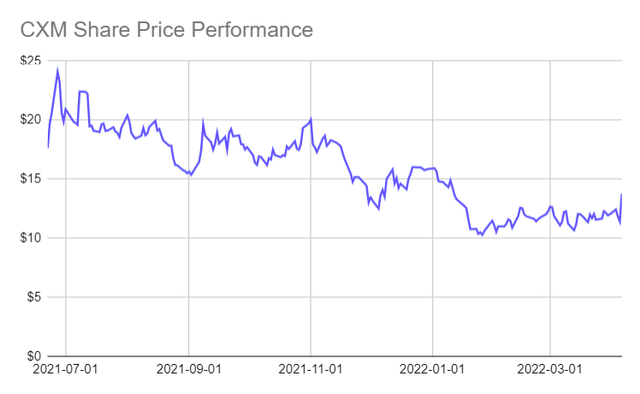

Sprinklr’s (NYSE:CXM) stock price took off like a rocket following its Q4 FY ’22 earnings release on April 6, 2022, after the market close. The stock was up over 20% today closing at $13.80 versus yesterday’s close of $11.39. The longer-term stock price picture is a bit more sobering however:

Figure 1: CXM Share Price Performance (Yves Sukhu)

Still, as a leader in the customer experience management market, there was a lot to like when parsing through the firm’s results, both for the quarter and for the full fiscal year, including:

- Total revenue up 27% and 32% for FY ’22 and Q4 FY ’22 respectively. CXM closed FY ’22 with $492.4M in total revenue versus $386.9M in the prior annual period. Total Q4 revenue stood at $135.7M versus $104.1M in the prior quarter.

- Subscription revenue up 25% and 31% for FY ’22 and Q4 FY ’22 respectively. Subscription revenue was $427.7M in FY ’22 versus $339.6M in the prior period; and $117.7M in the quarter versus $90.1M in the prior period.

- Total remaining performance obligations (“RPO”) of $586.4M at the end of Q4 FY ’22. The metric increased 36% versus the prior period.

- Q4 FY ’22 net dollar expansion rate (“NDE”) of 120%. NDE, as a measure of revenue expansion within the customer base, is quite healthy and a reasonably bullish indicator. The firm notes NDE “…is calculated by dividing (i) subscription revenue in the trailing 12-month period from those customers who were on our platform during the prior 12-month period by (ii) subscription revenue from the same customers in the prior 12-month period.”

- 26% increase in customers with $1M+ in subscription revenue. CXM recorded 82 customers at the end of FY ’22 at or above the $1M subscription revenue mark.

I noted another metric from the earnings call which I found rather bullish:

- Average revenue per customer per product suite is in the range of ~$100K-$150K.

I will come back to this point in a moment but suffice it to say that this figure perhaps hints at a product strategy and, more broadly, business model that could prove durable – a quality that I think many, if not most, “growth” companies in tech lack.

Solutions and a Sweet Spot

The market obviously reacted very favorably to CXM’s Q4 FY ’22 results. But, we shouldn’t overlook the financial realities of the firm’s current stage of development. Operating loss for the quarter was ($35.8M) versus ($8M) in the prior period. Doing some simple math, we can calculate that the firm lost ($0.26) for every $1 of sales in the fourth quarter versus a loss of ($0.08) for every $1 sales in the prior period.

Unsurprisingly, CXM’s investment in its sales organization largely contributed to the increased loss; and, it should be noted, the company recorded a one-time litigation expense of $12M in the quarter. If we back out the litigation charge, the operating loss for the period improves to ~($0.18) per $1 of sales. As I’ve expressed countless times before, I tend to be somewhat cautious when technology companies invest heavily in their sales organizations as I think these investments will, in quite a lot of cases, never pay off. However, CXM’s numbers and go-to-market strategy suggest they may be one of the (possibly rare) cases where a technology company’s field organization investment makes sense. Consider:

- CXM has a broad solution offering split across 4 main products categories: Modern Care, Modern Research, Social Engagement & Sales, Modern Marketing & Advertising. These product groups are underpinned by a set of platform technologies, inclusive of enabling artificial intelligence (“AI”) software, with the firm claiming that they offer “the only Unified-CXM platform.” My point here is that CXM, while providing individual products that support very specific use cases, appears to be successfully attacking the market with a solution-oriented approach. They don’t merely want to provide a given customer with the technologies to manage their various customer contact channels, they also want to be the chosen platform in the other strategic areas that they service (e.g. customer data insights, marketing campaign management). Of course, just about every other technology company will also claim that they are approaching the market in a solution-oriented way – selling across an enterprise, not just one-off product sales. But my key word above is “successfully”: based on the numbers, it seems that CXM is doing something right which must certainly be, in large part, a function of how the company has built out its product stack.

- The company notes in its most recent investor presentation that its average selling price per customer exceeds $350K. If an investor considers this data point in tandem with the earlier metric of average revenue per customer per product suite of ~$100K – $150K, he or she – in my opinion – should be justifiably bullish about the company’s prospects. These are numbers that lend support to management’s decision to invest in the field organization. After all, if the salesforce can largely focus on structuring large deals, and increase the average size of those deals over time, this is the ideal dynamic that tech investors want to see (or should want to see, but that is a whole other topic). It is suggestive of a field organization that can justify its own existence as opposed to simply burning through shareholders’ cash with wild abandon.

As other analysts and authors have pointed out, CXM’s go-to-market approach is something of a double-edged sword. While their solution-oriented model supports the rather large average deal size figures mentioned above, not every customer is looking to deploy such a large enterprise-scale offering. Accordingly, the firm may find it increasingly difficult to compete for smaller projects against competitors providing more niche-oriented offerings. On the other hand, large, legacy competitors like Oracle (ORCL) and Adobe (ADBE) have their own broad portfolio offerings in the customer experience management space. Such companies, undoubtedly, will pressure CXM when competing for enterprise-class deals. While it might seem the company is going to get squeezed on both sides, to the point of inhibiting their forward progress, my sense – grounded against their financial performance – is that CXM is in something of a “sweet spot” with a strong (or at least “good enough”) overall offering in the customer experience management space such that they are giving the legacy players “a run for their money”.

A Beaten Down But Worthy Gamble?

Prior to the Q4 FY ’22 earnings release, CXM’s share price performance was lackluster.

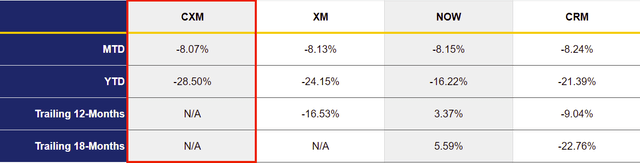

Figure 2: CXM and Selected Competitor Share Performance Comparison Prior to April 6, 2022 (Yves Sukhu)

Notes:

- Data as of market close April 5, 2022.

While today’s close of $13.80 in the context of CXM’s 52-week high of $24.01 might still seem like a relatively good entry point despite the recent run, bear in mind the price is still ~30% above the low.

For the reasons I laid out in the previous section, I am optimistic that CXM will churn out a strong FY ’23, which includes management guidance of:

- Subscription revenue between $536M and $544M.

- Total revenue between $607M and $615M.

- Non-GAAP operating loss between $44M and $48M.

I generally do not favor “growth” plays like CXM. Yet, I find myself leaning bullishly toward the company and the stock. I am inclined to let some of the enthusiasm accompanying Q4 FY ’22 results wear off, thereby attempting to gain a position in the company below where shares are trading now. Obviously, in contrast to my approach, a good number of investors feel like current share price levels offer a very reasonable entry point.

A Few Closing Words on AI

Admittedly, I was deliberate in only briefly mentioning CXM’s AI component with respect to their software stack. That was for two reasons: (1) I don’t think investors should jump on CXM’s stock (or any other “AI” stock) merely because they heard the phrase “artificial intelligence” and (2) I think CXM’s use of AI warrants a closer, more detailed analysis in a separate report. With that being said, their employment of text classification technology coupled with well-designed interfaces to exploit that technology could serve as an enduring key differentiator. However, to reiterate, I would urge investors to be cautious when companies (CXM or otherwise) tout their AI capabilities. AI is not magic, it’s math – which is to say that true differentiation in terms of any given AI capability can be difficult to achieve. Nonetheless, as I suggested earlier, perhaps CXM has found a “sweet spot” with their current capabilities; and it just might be a position they can occupy for a long time to come.

Be the first to comment