bluebay2014/iStock via Getty Images

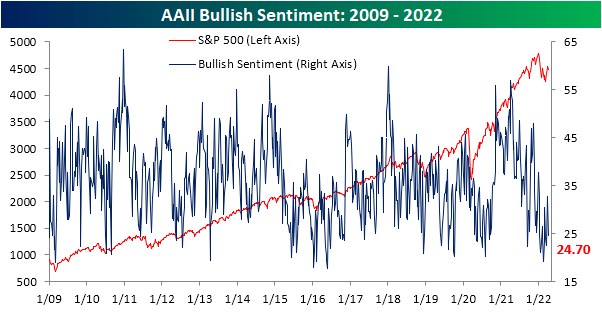

After peaking at 32.8% two weeks ago, bullish sentiment continues to roll over as the S&P 500 has erased some of the March gains this week. After this week’s decline of 7.2 percentage points in bullish sentiment, less than a quarter of respondents reported as bullish. While low, that is still a few percentage points above the weaker levels from February.

AAII Bullish Sentiment (Author)

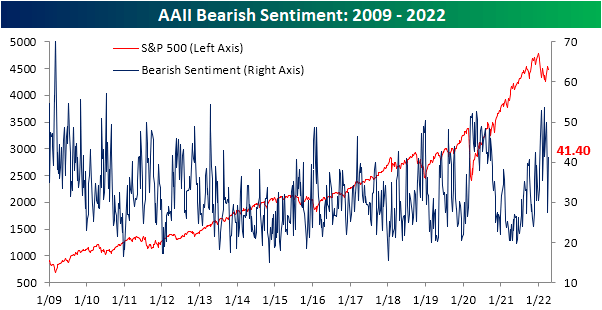

Bearish sentiment in turn rose 13.9 percentage points which was the biggest one-week uptick since August 2019 when it rose 24.14 percentage points. At 41.4%, bearish sentiment is now at the highest level since the week of March 17th.

That is an elevated reading and a big move week over week, but it is also well off recent highs from the past few months that were more than 10 percentage points higher.

AAII Bearish Sentiment (Author)

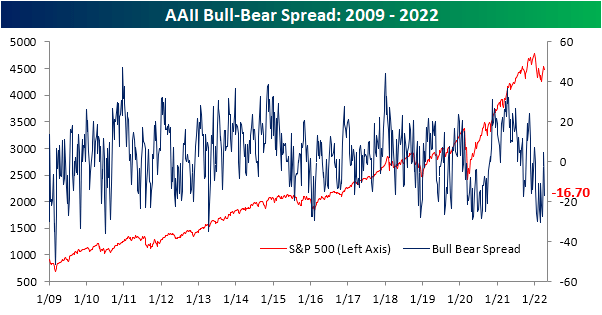

The bull-bear spread tipped into positive territory for the first time in 2022 last week, but the big inverse moves between bulls and bears erased much of the past few weeks’ moves. The spread is down to -16.7 which is still 13.6 points above the late February low of -30.3.

AAII Bull-Bear Spread (Author)

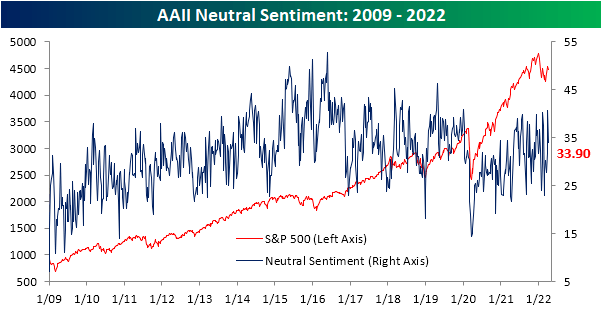

The big pickup in the number of respondents reporting as bearish didn’t entirely come from the bullish camp. Neutral sentiment also shed a significant amount falling from 40.6% last week to 33.9%. That is essentially mean reversion as neutral sentiment now sits only a couple of points above the historical average.

AAII Neutral Sentiment (Author)

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment