peshkov

A Conversation Between Jeff Schulze, Chris Eades and Adam Meyers

Energy has been the best-performing sector in the market year-to-date and over the trailing 12 months, boosted by a spike in crude oil and natural gas prices due to a myriad of economic and geopolitical factors. With oil prices down 20% over the last three months and global recession risks increasing, what will it take for energy stocks to regain their momentum? ClearBridge Investment Strategist Jeff Schulze, CFA, recently sat down with Portfolio Manager Chris Eades and Energy Analyst Adam Meyers to discuss catalysts and risks in the sector.

Jeff Schulze (JS): Energy prices have come down recently. Do you see the downward trend continuing or are other factors at play?

Adam Meyers (AM): I believe there is asymmetric upside not only to gasoline prices, but also crude. The oil market continues to be very tight from a supply standpoint. OPEC has very little spare capacity and there is still a lot of demand offline that could potentially recover. China, for example, has a million plus barrels per day of consumption expected to come back as COVID-19 lockdowns unwind. International travel continues to recover. Given how tight we are from a global supply and demand dynamic, any kind of minor disruption could send prices quickly back to $130 per barrel.

Chris Eades (CE): If demand surprises to the upside in any region of the world, it is very unclear where the supply is going to come from to meet that incremental demand.

It is not likely going to come from OPEC+. The U.S. is already struggling to meet demand, so much so that the government has had to release 150 million barrels of oil from the strategic petroleum reserve (SPR) since September of last year. And those barrels have to be put back into the SPR at some point. So while we are supplying the market today, we are also creating demand in the market for oil in late 2023 and early 2024 to replace those barrels back into the SPR, which could be another positive catalyst for demand.

JS: Given this backdrop, what could incentivize domestic producers to bring more oil online?

CE: The signal to the oil and natural gas producers to either drill or not to drill is the price of the commodity. If that reaches a certain point, the returns are there to justify incremental drilling or putting more rigs to work. For oil, based on the reports and our own analysis, you need roughly $50 a barrel looking at the forward curve for oil, looking over the next two years, to ensure a return that meets your cost of capital.

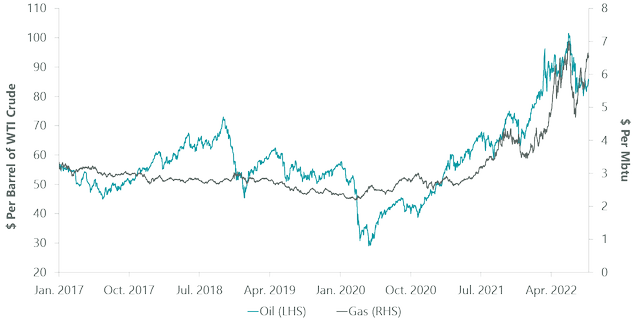

The forward two-year curve for oil is sitting in the $80s right now. So we are well above that despite the fact that oil prices have pulled back here over the last four to six weeks (Exhibit 1). For natural gas, you need something in the $3.00/Mbtu to $3.50/Mbtu range, and the forward curve right now is over $6.00/Mbtu.

Exhibit 1: Oil and Natural Gas Two-Year Forward Curves

As of Aug. 25, 2022. ClearBridge Investments, Bloomberg Finance.

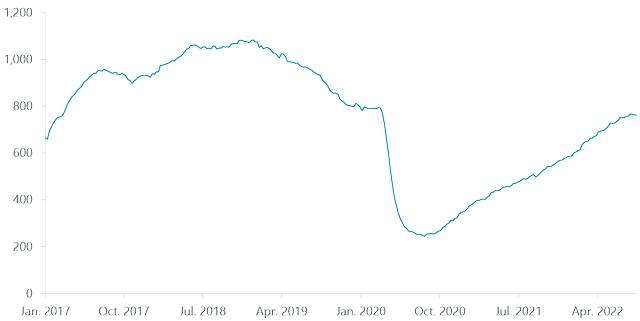

And because of those price levels and the returns that are definitely there, the rig counts are rebounding (Exhibit 2). They are not surging the way we might have seen in prior energy cycles, but they are definitely increasing. Natural gas is an even more positive story. We are seeing natural gas production levels today that are actually higher than what we saw before the pandemic began.

JS: But what about the financial prudence we have been hearing about from E&P and service companies, will that be a headwind to higher production?

AM: There is a difference between the publics and the privates. If we think about the public E&Ps, they continue to voice support for the capital discipline model – free cash flows, cash returns to shareholders, keeping production growth in the mid-single digits.

The privates meanwhile should be growing double digits, getting that outsize return because the publics are essentially stuck to their differentiated stories.

With that said, the ability to grow production is actually pretty restricted here. If we think about oil field service companies, unlike prior cycles, they are not adding capacity to the same degree. Because of that, lead times to get new equipment in some cases is in excess of a year. So, even if investors blessed more production growth, even if they were looking to increase double digits, their ability to do so, especially quickly, is restrained.

Exhibit 2: U.S. Rig Count

As of Aug. 25, 2022. ClearBridge Investments, Bloomberg Finance.

CE: The key word here – whether for upstream, midstream or downstream energy companies – is free cash flow. And that is a very different dynamic than what we have seen in prior cycles. Energy companies are actually in a position now to either reduce debt, increase their payouts to investors and execute share buybacks. That is a very different dynamic for the energy sector.

Before the pandemic, midstream companies that transport, store and process crude oil and natural gas products were barely earning their dividends or distributions to investors and had high levels of leverage. When the pandemic hit, they suddenly had to slash their dividends and the focus quickly became on debt reduction.

Roll the calendar forward almost three years, they have reduced their balance sheets enormously. They are more than 2x earning the dividends or distributions to investors, and they are now starting to execute share buybacks and increase their dividends or distributions again.

It is a very different business model, and it is all centered around free cash flow.

JS: If more wells are drilled, will there be more volume going through the pipes of midstream companies to boost the industry even more from a free cash flow generation standpoint?

CE: Yes. Publicly traded oil and gas production companies are only around 40% of the market, while 60% of the market are private operators. Looking at the entirety of upstream, not just the publicly traded companies, and drilling activity is increasing steadily, as are production volumes for all three of the primary energy commodities: oil, natural gas and natural gas liquids (‘LNG’). There is pretty good visibility into production growth, at least extending through 2023, and perhaps longer, depending on the demand recovery with all the variables going on with the war, with Europe and China as well.

I believe energy volumes are going to continue to increase in the U.S. The real question is: where does the incremental barrel of oil come from to meet incremental demand on a global basis? It almost by definition has to be a U.S. barrel. OPEC does not have the spare capacity they are advertising to the market. That means in any sort of a further demand recovery U.S. oil is going to be in demand. That should only further motivate public and private producers to continue allocating capital to the space.

JS: What else makes you optimistic about midstream and upstream energy stocks?

CE: What’s interesting about midstream is production volumes are increasing, but there’s not a lot of large need to spend capital to facilitate moving or processing these growing barrels of oil. So, oil was at 13 million barrels a day before the pandemic, it currently sits at 12 million. The U.S. infrastructure system is set up to handle 15 million barrels a day of oil. So, there’s not a lot of capital that needs to be spent for the midstream companies to see surging cash flows. In fact, capital spending from midstream companies on pipelines, processing plants and similar infrastructure stood around $45 million to $50 million a year for three or four years before the pandemic. It’s currently sitting around $20 million to $25 million this year, a level that will likely hold going forward.

Limited capital spending with growing volumes equals growing cash flows, which equals growing free cash flows, which should be the key driver for these stocks to make another move higher beyond how well they have performed recently.

AM: If we think about global supply, one key difference this time around is that over 60% of the overall supply chain is linked to short-cycle, high-decline barrels. Before 2010 this was less than 40%. What does that mean? Obviously, recession concerns. Look what happened in 2020. You had U.S. production fall off a cliff from 13 million barrels, and it has yet to recover.

If the U.S. entered a similar recessionary scenario, all of that production may not come back, so it becomes a self-fulfilling prophecy that more capital will need to be allocated to oil and gas to ultimately meet demand, which has yet to peak globally.

JS: Natural gas prices in Europe are about 10x as high as we have here in the U.S. There is clearly a shortage. Is that a big opportunity for U.S energy providers and what kind of players are lined up to benefit from this?

AM: It is a huge opportunity for the U.S. natural gas players, for two reasons. We put out a paper recently showing just how competitive the Marcellus is from a cost of supply standpoint versus the rest of the globe. Break-evens as low as $2/Mbtu, lower in some cases versus the rest of the globe. So, these wells pay back very quickly. And the other caveat here is from an emissions standpoint, they are better than Russia, Qatar, the UAE and Saudi Arabia. That’s important because LNG buyers have made it clear they care about the emissions profile of the commodity they are buying. We believe there will be a big U.S. LNG build-out, and companies such as EQT, Chesapeake, which have deep inventories in the Marcellus Shale Basin in Pennsylvania, as well as the Haynesville, will be able to support that build-out.

CE: This is a long-dated opportunity. This is not going to happen overnight. LNG facilities are multibillion-dollar projects that take many years to build and start delivering product. Producers are certainly going to benefit. But infrastructure companies will benefit as well. That gas has to be moved from the Marcellus to an LNG liquefaction plant before it is exported to Europe. Those are long-dated opportunities, but certainly, the longer-term outlook for U.S. natural gas on a global basis is perhaps as rosy as it has been over the course of my career.

JS: Is the Inflation Reduction Act ultimately a path to more oil and gas production in the U.S.?

AM: If we get the natural gas pipelines that ultimately unlock this low-cost natural gas resource up in Pennsylvania, I believe it could unlock more production growth that is blessed by investors of public equities. This is just due to the fact that it would be supporting the secure growth initiative as it pertains to LNG. Not only helping Europe displace Russian natural gas, but also, helping displace the globe’s reliance on coal. I think that you could ultimately see a dichotomy between the oil companies that are held to mid-single-digit growth and natural gas companies that could return arguably to even higher growth rates than that.

JS: Is there any concern that markets are starting to price in a potential U.S. recession? Are there other things that are driving prices lower from here?

CE: What has driven oil prices down recently is partly fears of recession and the demand impacts in China and in Europe. The other part of it is we are releasing almost a million barrels a day of oil from the SPR. And those barrels were intended to do exactly what’s happening: moderate the price of oil.

AM: If we focus just on the U.S. market, the Department of Energy numbers have been showing gasoline demand down 10% year over year. But there is a lot of discussion out there that that data could be inaccurate and subject to revision. If you look at alternative sources, such as GasBuddy, which tend to follow consumer behavior at the pump very closely, they are actually showing growth. Second, big U.S. refiners such as Valero are reporting with the recent earnings that they are not seeing any demand destruction yet. We could certainly see a positive revision to U.S. gasoline demand that quells some of the fears of recession.

CE: Outside of the pandemic – which is an outlier, hopefully – typically in a recession, oil demand on a global basis will decline by 0.5%-1.0%. The worst number on record was what happened in 2008 into 2009, and that was a 2% reduction. So, let’s be very pessimistic and say we are going to go through a 2008-2009 type of recession in terms of global oil demand, that would be roughly a 2 million barrel a day reduction in oil, on a daily basis, in terms of demand. We could more than offset half of that just by having to put oil back into the SPR. So there are some natural offsets as we look out over the next two to three years, and investors need to understand that recession doesn’t mean that oil demand falls off a cliff. And given the supply constraints we talked about before, I don’t think we’re setting ourselves up for an oil price collapse, even if we go through a recession over the coming quarters.

Be the first to comment