ipopba

A Quick Take On RADCOM

RADCOM Ltd. (NASDAQ:RDCM) recently reported its Q2 2022 financial results on August 11, 2022, beating expected revenue and EPS estimates.

The company provides network intelligence and service assurance software and services to communications service providers.

It recently announced a high visibility customer win in DISH’ 5G network launch and raised 2022 revenue guidance for a second time this year.

My outlook is a Buy for RDCM at around $11.60 per share on the strength of its prospects in the 5G space.

RADCOM Overview

Tel Aviv, Israel-based RADCOM Ltd. was founded in 1985 and provides a range of cloud-based, 5G standard-ready network intelligence and service assurance software solutions for communications service providers worldwide.

The firm is headed by Chief Executive Officer Eyal Harari, who was previously Software Group Manager at Tvuna.

The company’s primary offerings include:

-

Network Visibility

-

Service Assurance

-

Network Insights

The firm acquires customers via its direct sales and marketing efforts focused on a wide range of telecom service providers across all market tiers.

RADCOM’s Market & Competition

According to a 2022 market research report by MarketsAndMarkets, the market for telecom service assurance was an estimated $6.5 billion in 2021 and is forecast to reach $10.4 billion by 2026.

This represents a forecast CAGR of 9.9% from 2022 to 2026.

The main drivers for this expected growth are demand from communications service providers for products that detect and remediate network performance issues to reduce customer churn.

Also, large enterprise providers are expected to hold the largest market share within the vendor universe.

Major competitive or other industry participants include:

-

NEC

-

Ericsson

-

Amdocs

-

NETSCOUT

-

Broadcom

-

HPE

-

Accenture

-

Huawei

-

Spirent

-

TEOCO

-

EXFO

-

Infovista

-

SysMech

-

Anodot

-

Matellio

-

Stixis

-

Others

RADCOM’s Recent Financial Performance

-

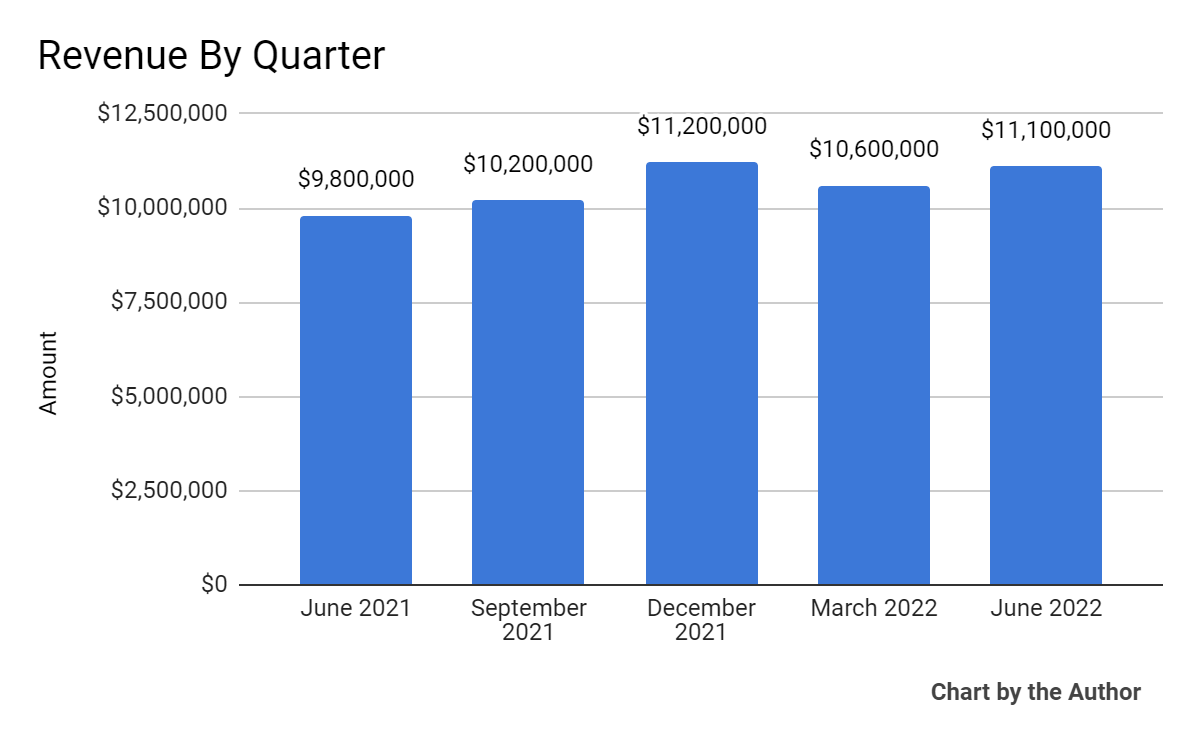

Total revenue by quarter has grown unevenly in the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

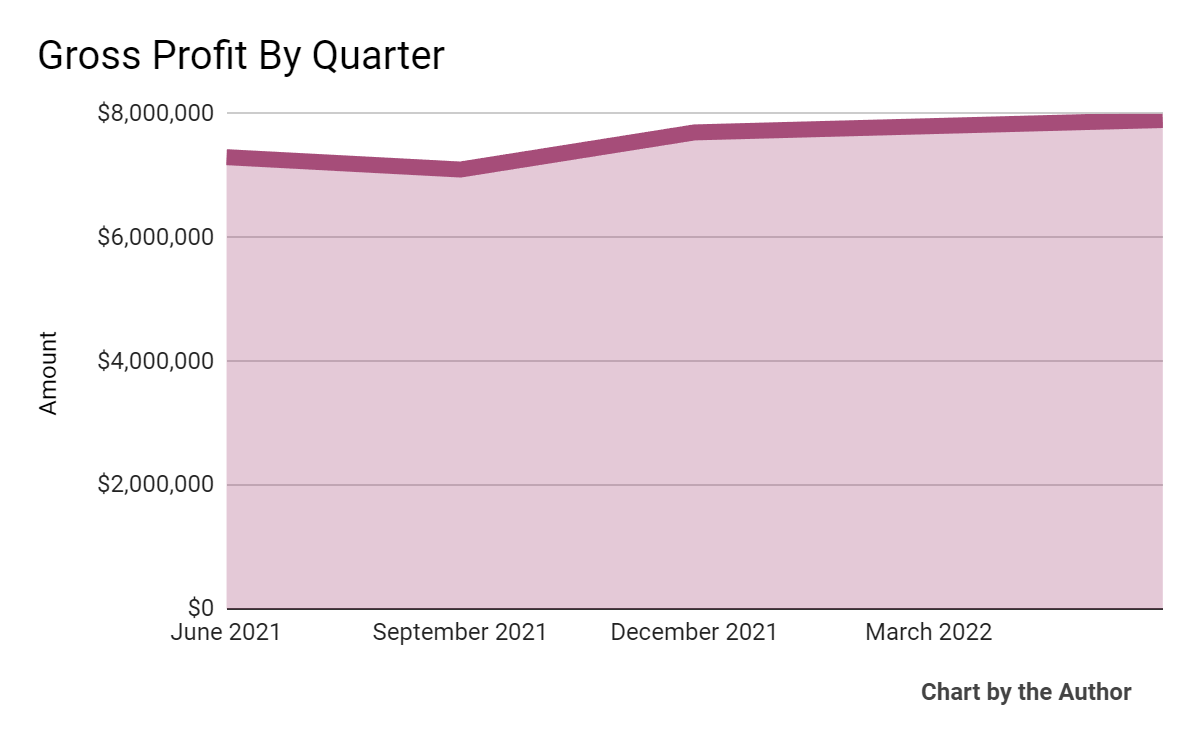

Gross profit by quarter has plateaued, as the chart shows here:

5 Quarter Gross Profit (Seeking Alpha)

-

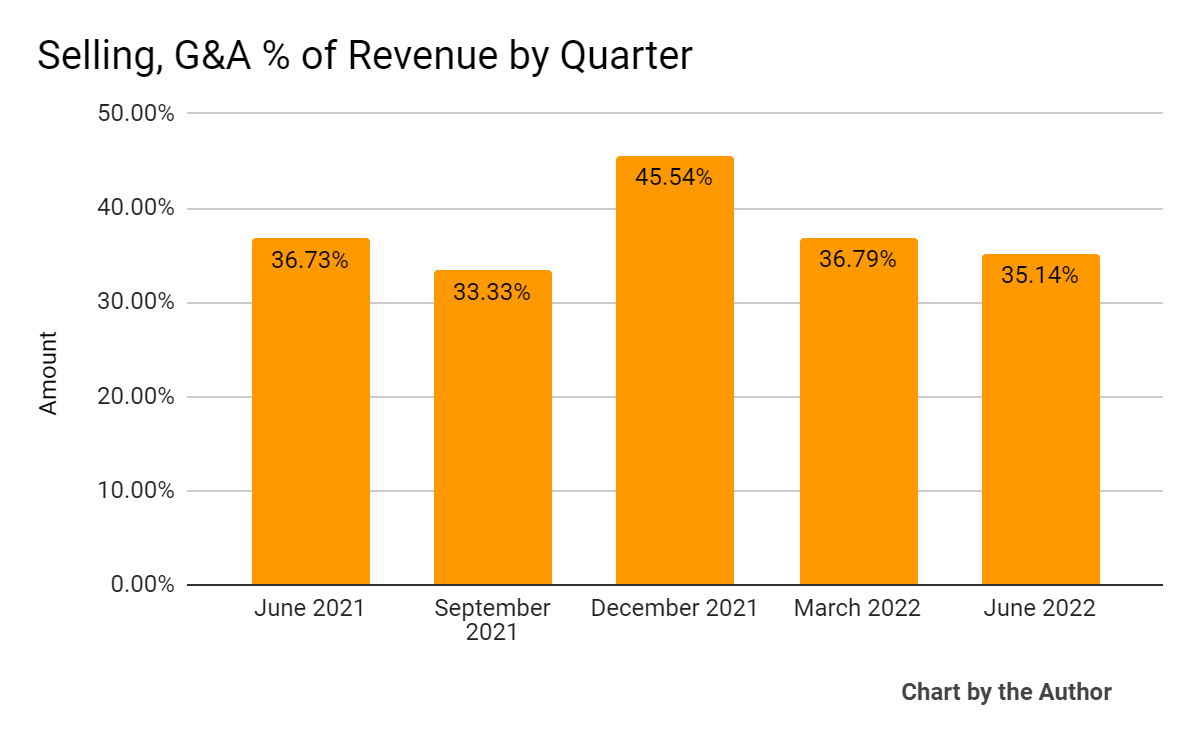

Selling, G&A expenses as a percentage of total revenue by quarter have fluctuated as follows:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

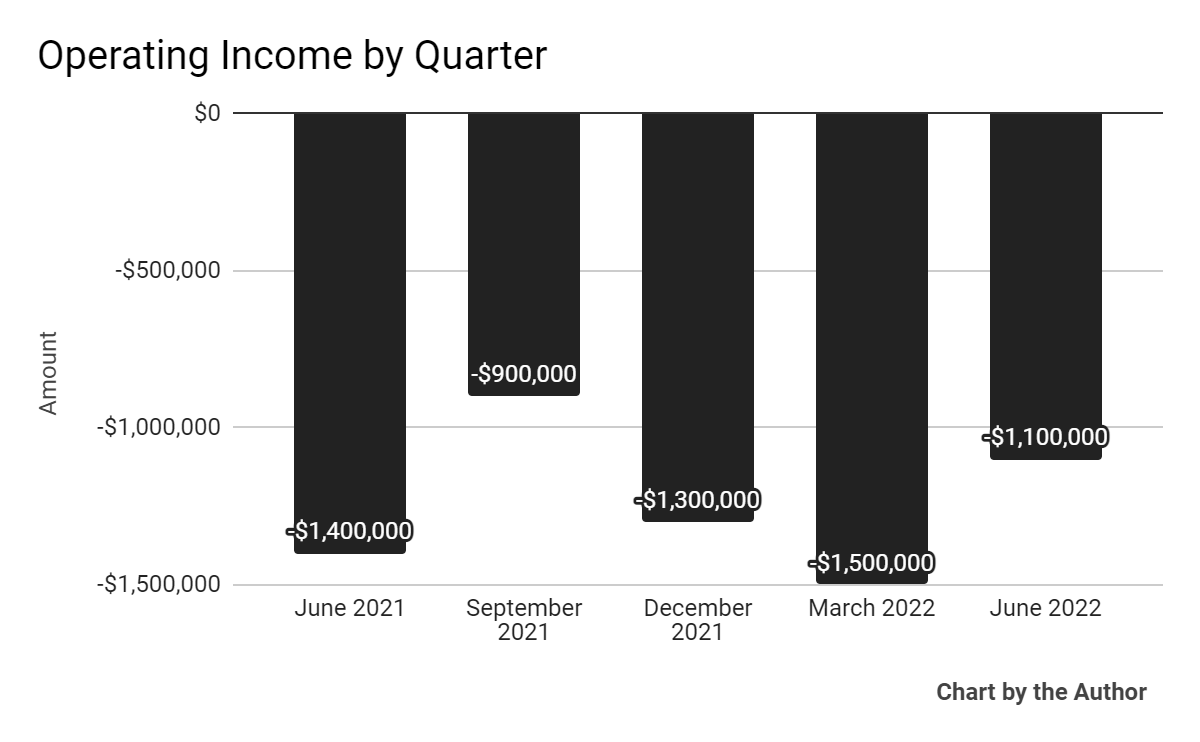

Operating income by quarter has remained negative in the past five quarters:

5 Quarter Operating Income (Seeking Alpha)

-

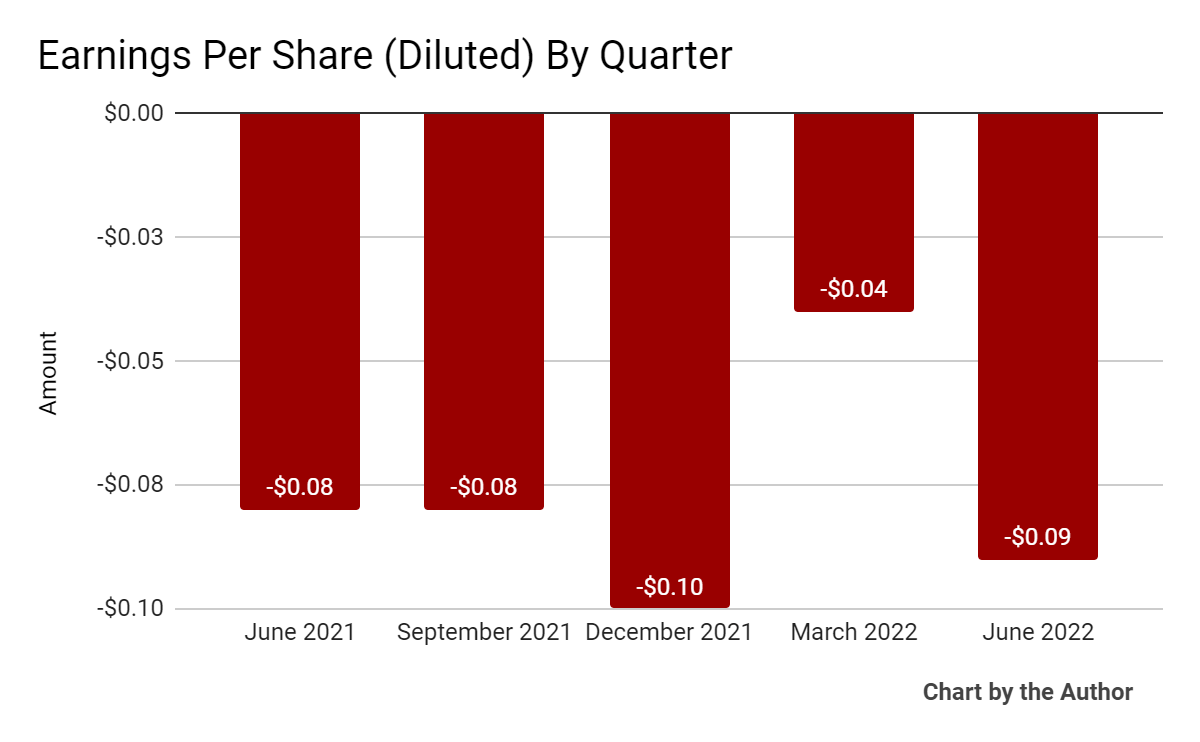

Earnings per share (Diluted) have remained negative recently as well:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

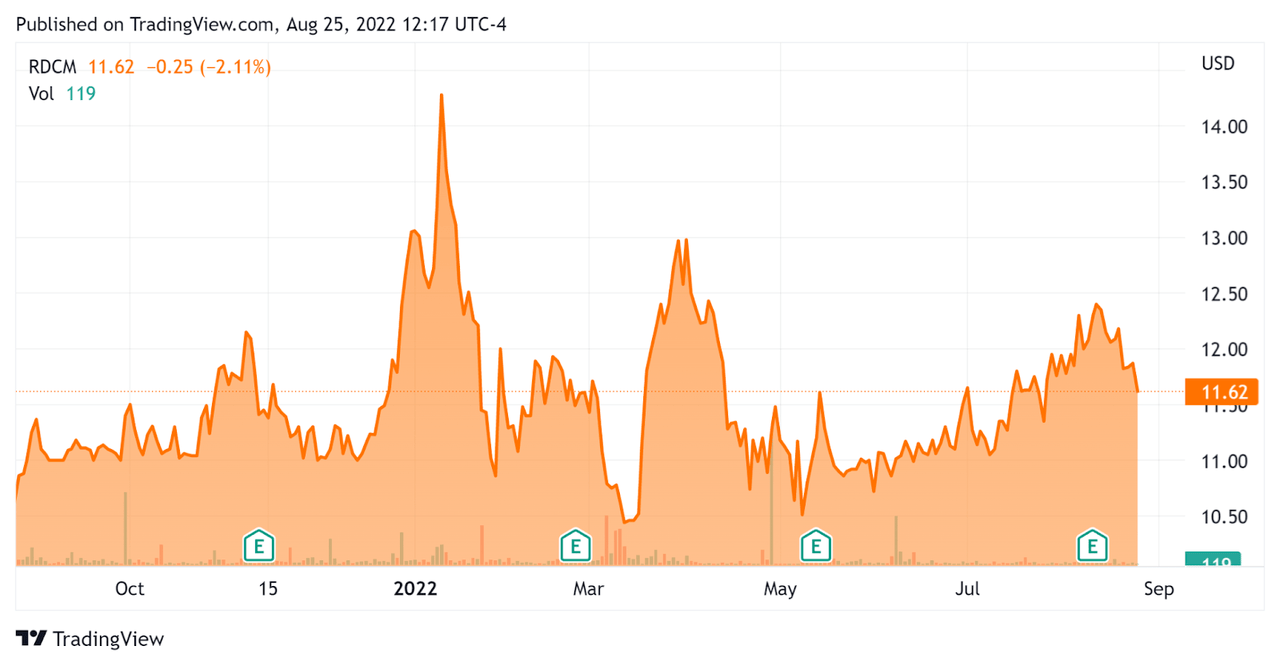

In the past 12 months, RDCM’s stock price has risen 9.2% vs. the U.S. S&P 500 index’ fall of around 7.3%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For RADCOM

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.31 |

|

Revenue Growth Rate |

10.7% |

|

Net Income Margin |

-9.9% |

|

GAAP EBITDA % |

-10.0% |

|

Market Capitalization |

$171,260,000 |

|

Enterprise Value |

$99,580,000 |

|

Operating Cash Flow |

$2,000,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.31 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

RDCM’s most recent GAAP Rule of 40 calculation was only 0.7% as of Q2 2022, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

10.7% |

|

GAAP EBITDA % |

-10.0% |

|

Total |

0.7% |

(Source – Seeking Alpha)

Commentary On RADCOM

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted recent customer wins in the 5G space as well as an extension of a multiyear deal with AT&T.

Management believes the ‘5G market is ramping up’, with DISH recently selecting the firm to monitor its 5G smart network launched for the Las Vegas market and expanding to more than 120 U.S. cities, or about 20% of the population.

The firm’s previous integration with AWS has enabled the DISH relationship to scale more automatically. Management is seeing increased collaboration between telecom firms and public cloud providers such as AWS.

As to its financial results, revenue rose by 14% year-over-year while non-GAAP gross margin was reported as 72%.

SG&A increased while gross R&D decreased. GAAP operating income remained negative as did earnings per share.

For the balance sheet, the company finished the quarter with cash, equivalents and short-term bank deposits of $73.1 million. The firm has used working capital of $9.1 million in the past 4 quarters.

Looking ahead, management doesn’t currently see any negative impact from current global economic changes as network operators seek to migrate their networks to 5G capabilities.

Management raised revenue guidance for 2022 to $46.5 million at the midpoint, its second guidance raise in 2022.

CEO Harari indicated that management has ‘very good visibility into 2023…I believe we can have double-digit growth already the visibility we have today.’

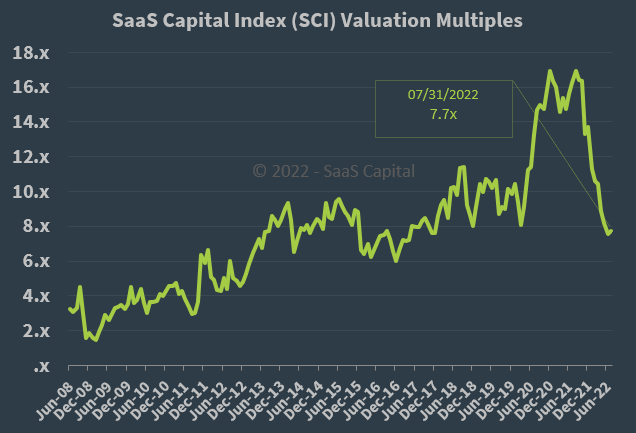

Regarding valuation, the market is valuing RDCM at an EV/Sales multiple of around 2.3x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.7x at July 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, although the comparison is not exact, RDCM is currently valued by the market at a significant discount to the SaaS Capital Index, at least as of July 31, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

The firm operates different revenue models for different customers. Some pay as they grow while some pay on a basis that is not dependent on the number of subscribers.

RDCM is still a small company, so the stock has the potential to rise quickly on the announcement of a major relationship win.

The firm’s hybrid revenue model approach results in flexibility for management, but may limit upside with major customers who can afford not to choose the ‘pay as you grow’ model.

Still, it is encouraging that management has raised revenue guidance a second time in 2022, so my outlook is a Buy for RDCM at around $11.60 per share on the strength of its 5G related business.

Be the first to comment