Getty Images

Introduction

As a dividend growth investor, I constantly seek opportunities to increase my dividend income. I purchase income-producing assets, mainly stocks. Sometimes I add to my existing positions when I believe stocks are attractive. On other occasions, I initiate new positions in companies that can help me increase my diversification and have decent valuation.

The financial sector is a sector where I currently lack exposure. I own shares in banks, insurance companies, and asset managers. Another segment that I have exposure to through my banking holdings is investment banking. I recently analyzed Goldman Sachs (GS), and I will examine Morgan Stanley (NYSE:MS) in this article.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Morgan Stanley, a financial holding company, provides various financial products and services to corporations, governments, financial institutions, and individuals in the Americas, Europe, the Middle East, Africa, and Asia. It operates through Institutional Securities, Wealth Management, and Investment Management segments. Morgan Stanley was founded in 1924 and is headquartered in New York, New York.

Fundamentals

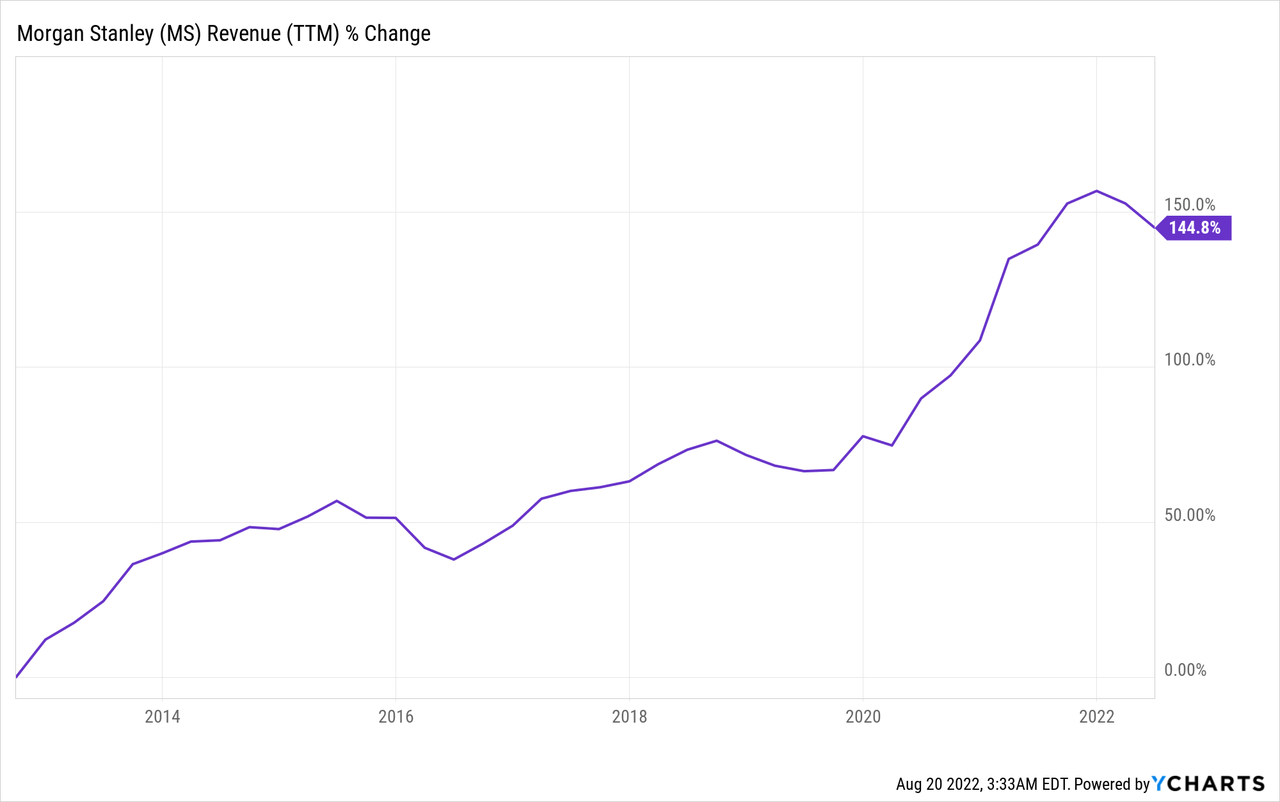

The graph below shows that revenues increased nearly 150% in the last decade. Morgan Stanley grew sales both organically and organically using acquisitions like the acquisitions of Eaton Vance and E-Trade. In 2022, the company will deal with lower sales as the stock market volatility is higher. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Morgan Stanley to keep growing sales at an annual rate of ~1% in the medium term.

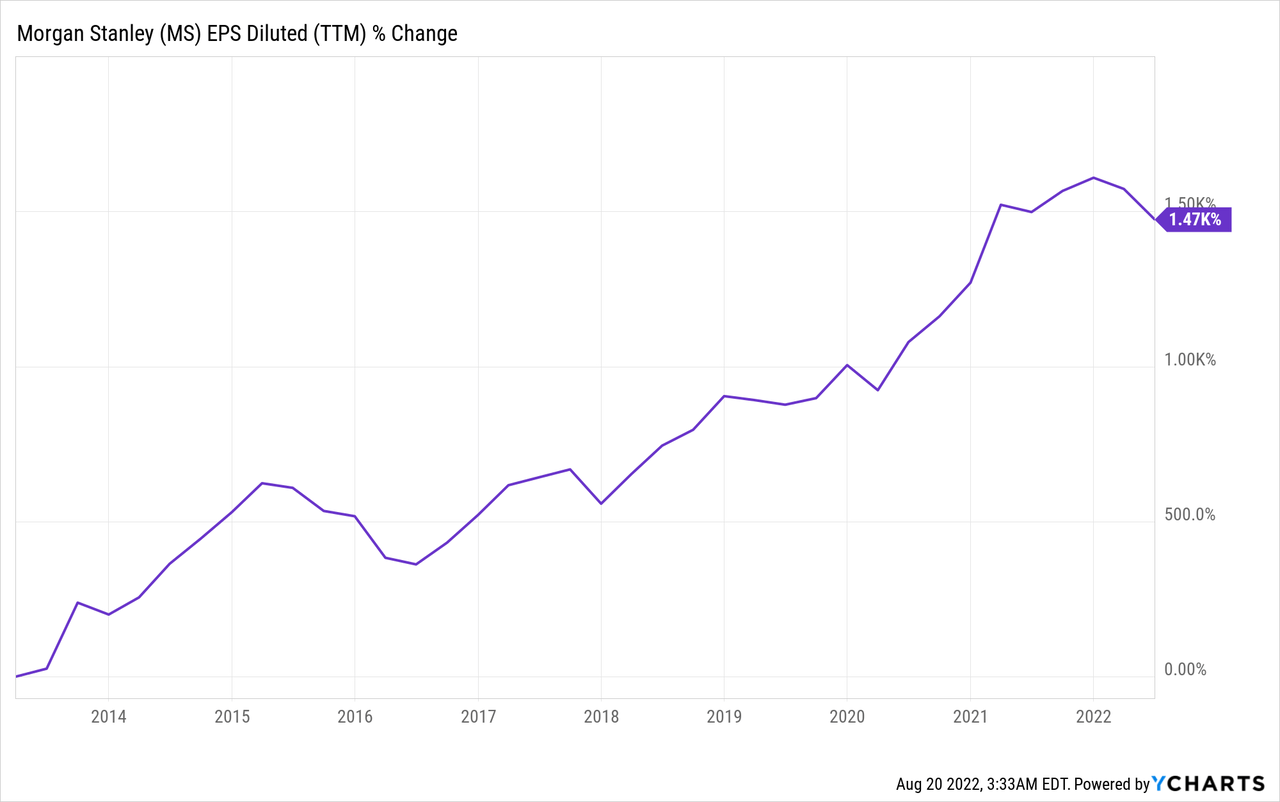

The EPS (earnings per share) has grown much faster. The reason for that was the challenging situation banks dealt with following the recession of 2008-9. Therefore, the company had a shallow starting point. Even using non-GAAP EPS, the EPS has increased more than fivefold. It supplemented revenue growth with higher margins and some buybacks. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Morgan Stanley to keep growing EPS at an annual rate of ~3% in the medium term.

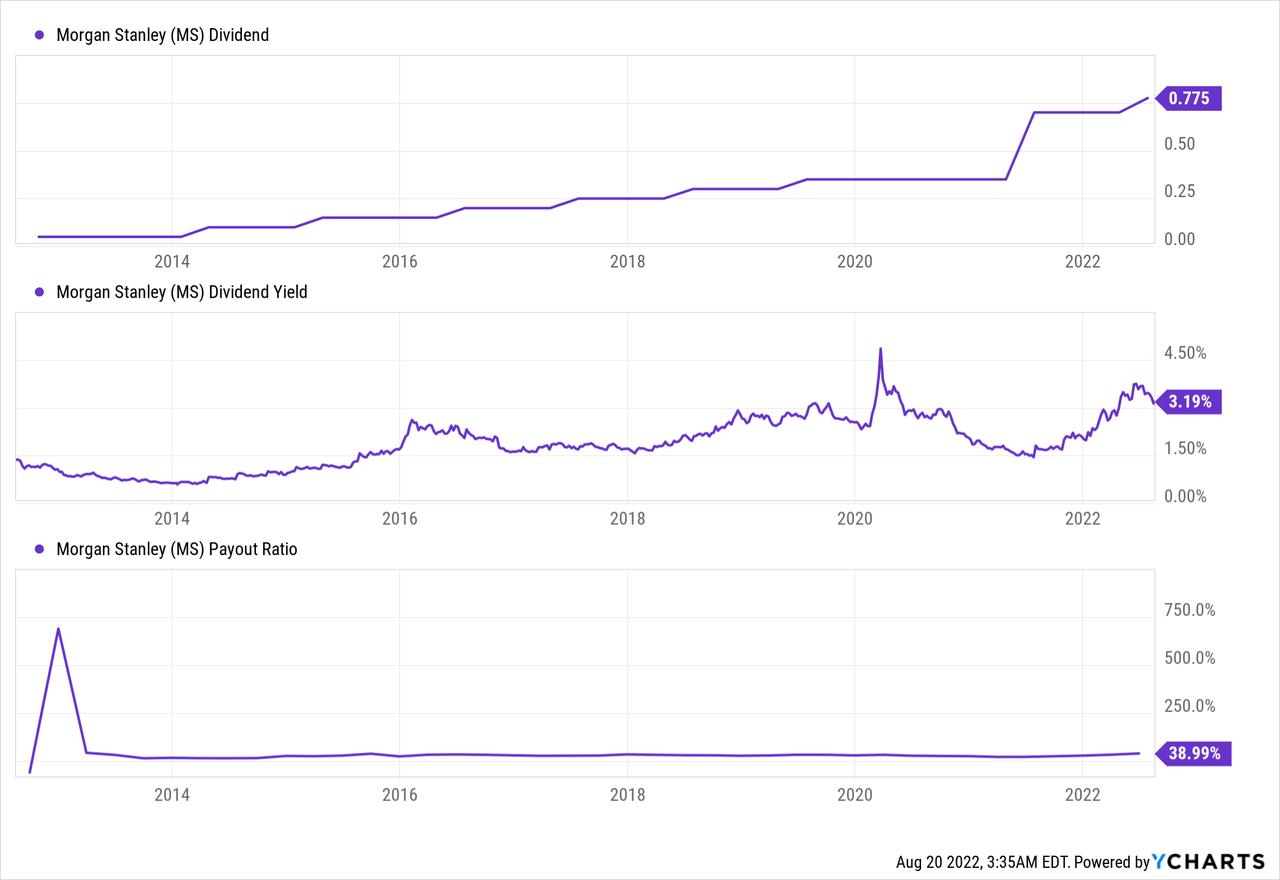

The dividend is a prominent reason to invest in Morgan Stanley. The company pays a 3.5% yield dividend. The payment seems safe as the payout ratio is below 40%. The company recently increased the amount by 10% following the stress test, yet investors should expect slower raises due to slower growth in the volatile market. Still, Morgan Stanley looks promising, with a dividend growth streak of 8 years and a higher payment than before the financial crisis.

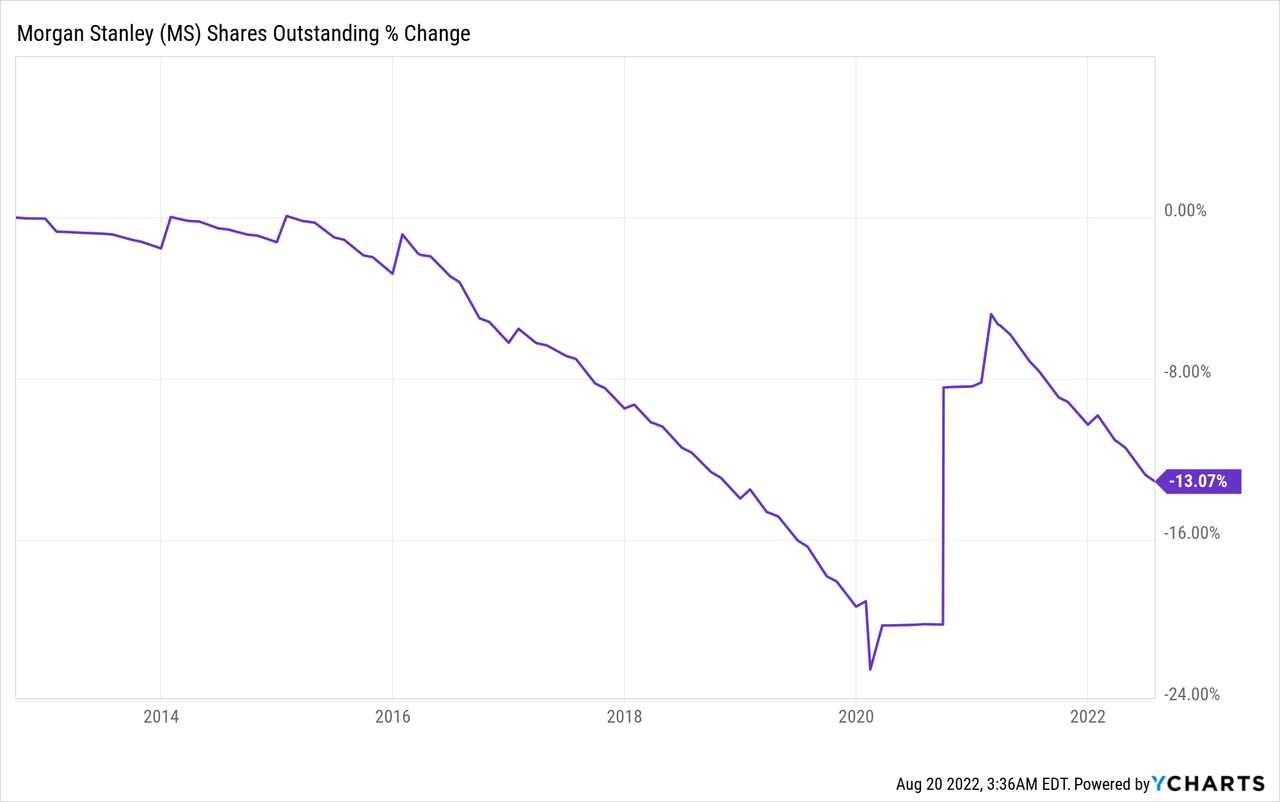

In addition to dividends, Morgan Stanley returns capital to shareholders via buybacks. Buybacks are a great way to return money to shareholders, significantly when the company is growing. Over the last decade, Morgan Stanley bought back more than 13% of its shares. The company bought more than that yet issued shares, mainly to fund its acquisitions.

Valuation

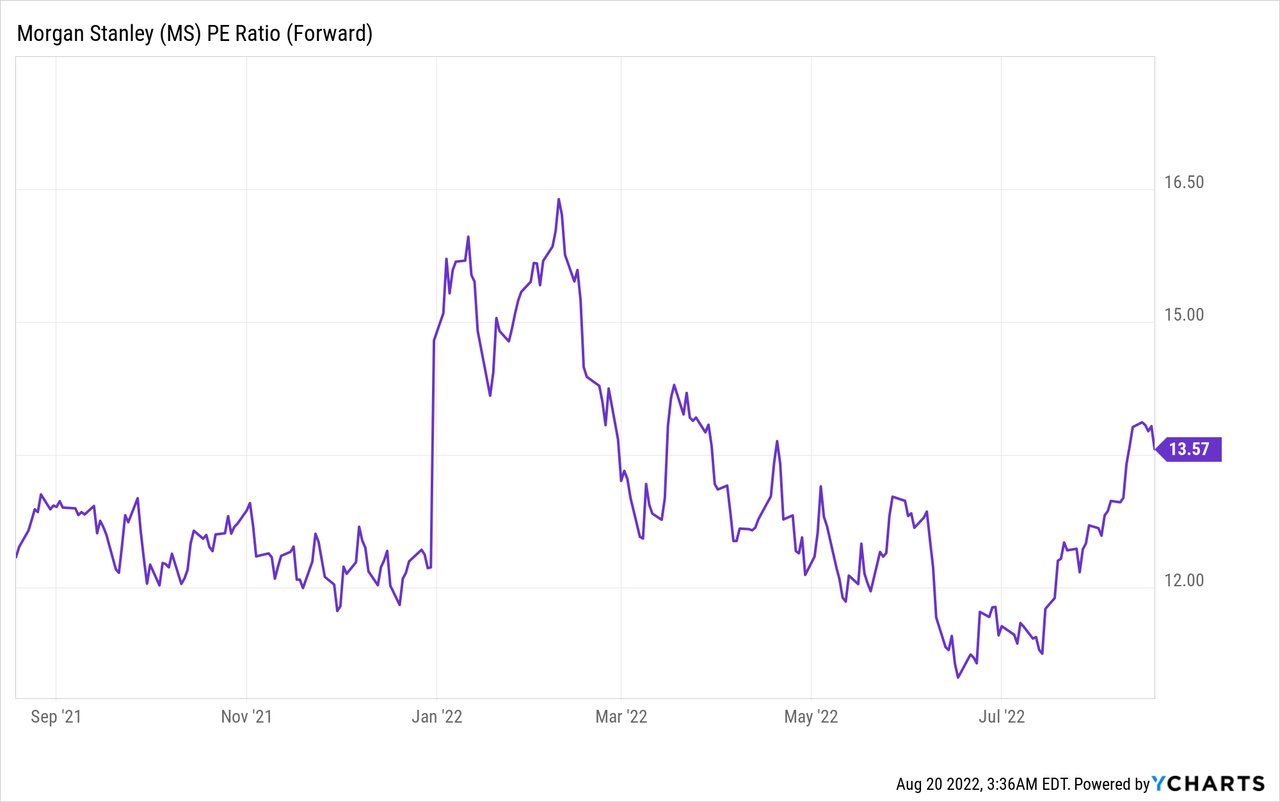

The company’s P/E (price to earnings) ratio, considering the forecasted earnings for 2022, is 13.6. The current valuation is in line with the valuation we have seen in the last twelve months. The P/E ratio ranged between 11-16.5. I think paying 13.5 times earnings for a company that is likely to grow again in 2023 seems reasonable.

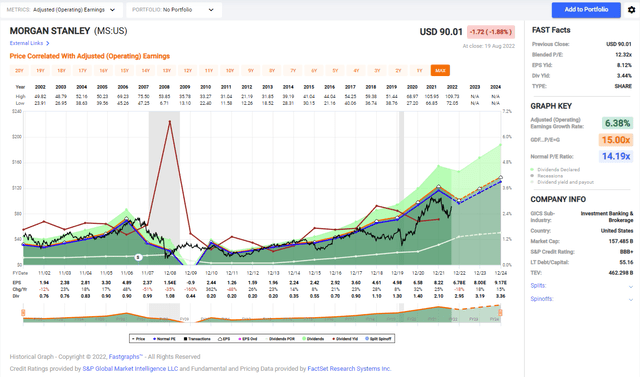

The graph below from FAST Graphs also shows that Morgan Stanley is an attractive investment in the current market. The company’s average P/E ratio in the last two decades was 14.2, which is lower than the current P/E ratio. Moreover, following the challenge of 2022, the expected growth rate will be higher than the growth rate we have seen in the last two decades. Therefore, from the valuation perspective, Morgan Stanley is looking good.

To conclude, Morgan Stanley shows strong fundamentals. The company is growing sales and EPS. It acquires peers to increase its scale and uses its excess cash to return capital to shareholders. The company aims to continue to return money to shareholders through buybacks and dividends. It also trades for what I believe to be a decent valuation making it a good package.

Opportunities

The company is listening to the demand coming from its clients. It launched ESG (environmental, social, and corporate governance) through its acquired Eaton Vance business. These ETFs will help Morgan Stanley reach more clients who seek ETFs and are highly interested in ESG investments. It also acquired E-Trade to offer investors a low-cost opportunity to invest in equity.

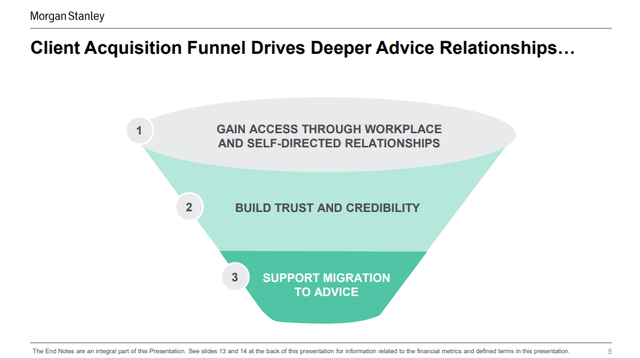

Morgan Stanley’s business from the new ETFs and the self-directed low-cost account is also part of its grand strategy. The company has a client acquisition funnel. It eventually wants to increase the number of clients using its advisory and wealth management services. Therefore, it attracts them with low-cost products, builds the needed trust, and offers them high-end services.

Morgan Stanley Q2 Presentation

Moreover, Morgan Stanley has the needed capabilities to succeed in this strategy. It has a well-known brand and a long-term history of success. A famous brand will make building significant trust easier and shift more clients from low-cost to premium services. It will also allow Morgan Stanley to attract more clients to its low-cost services as clients know the name and prefer stability regarding money.

Risks

The most significant risk is the recession, which may force Morgan Stanley to scale back its growth. The company needs a favorable market environment with attractive stock market returns to grow. A recession means that people have less capital to invest, and their returns and willingness to pay for these returns are lower. Therefore, a recession may hinder the growth rate for 2023, and it will change the perception regarding the valuation.

The competition is another risk for Morgan Stanley. The company competes with asset managers, investment banking, and fintech solutions that offer cheap self-directed investment solutions. The company is well positioned to deal with the competition due to its brand and scale. Still, this is a challenge for Morgan Stanley as it tries to grow and improve margins.

The low-cost trend is the most significant challenge that Morgan Stanley deals with on the competition front. The competition is challenging because there is an increasing demand for low-cost ETFs as investors prefer to mimic the index. Investors also buy stocks and ETFs, as the new brokers offer a straightforward user interface. Therefore, Morgan Stanley has to offer even more alpha and services.

Conclusions

Morgan Stanley is an excellent company with a long track record, a decent growth story, and a strategy. The company enjoys solid fundamentals across the board-top-line, bottom-line, dividend, and buyback growth. When considering the risks and opportunities, the current valuation seems reasonable.

What I like the most about the company is its coherent growth strategy, which makes a lot of sense. The acquisitions have made Morgan Stanley better suited to compete with the low-cost competitors, and the clients will be able to grow with Morgan Stanley and transfer to the wealth management sector. Therefore, I believe that the shares of Morgan Stanley are a buy at the current price.

Be the first to comment