Oat_Phawat/iStock via Getty Images

There is increasing evidence of a copper supply squeeze in the works and we believe that copper prices could be on the verge of a forceful rebound. Copper miners are well-positioned to benefit from higher prices in the immediate term, while underinvestment in new mines and deteriorating mine yields mean that the supply shortfall could persist for an extended period of time. Investors may consider building a diversified exposure to copper miners through the Global X Copper Miners ETF (NYSEARCA:COPX) with a medium-to-long-term investment horizon.

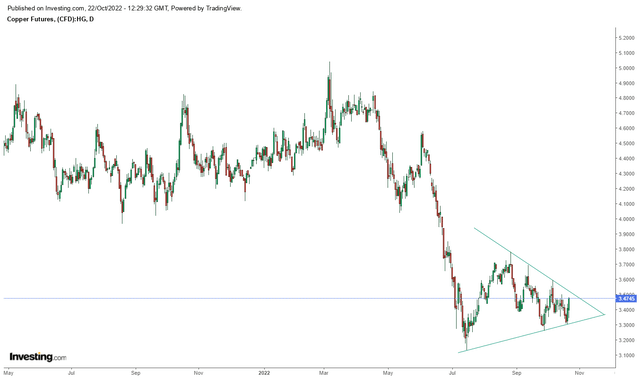

Overwhelming pessimism on the outlook for global economic growth and stalled real estate construction in China, have led to a -20% decline in copper prices year-to-date. When measured against its March 2022 peak, copper prices are down by around 30% at the time of writing.

Textbook economics would suggest that in well-functioning markets, the best cure for low prices is low prices itself. Low prices should supposedly stimulate demand while discouraging suppliers from increasing production.

Unfortunately, the real-world dynamics of the copper market are much more complicated. The extraction of copper typically involves large-scale mining operations with the use of advanced technologies that require long lead times before a mine is ready for production. Many industry experts claim that this lag could stretch from 5 years to as long as 10 years. Furthermore, low prices also do not necessarily stimulate demand for copper, especially when economic policy and market sentiment dictate industry behaviour.

Consensus May Be Right On Copper Fundamentals But Wrong On Timing

General consensus on the copper market has been short-term bearish and long-term bullish for quite some time. Analysts are broadly expecting copper demand to remain weak through 2023 as global economic growth cools from aggressive monetary tightening. According to the latest forecast published by the International Copper Study Group on 19 October 2022, the global copper market is expected to see a deficit of about 325,000 tonnes this year before running a small surplus of 155,000 tonnes in 2023.

On the other hand, industry observers have repeatedly warned that underinvestment in new mines and deteriorating ore grades mean we are hurtling towards a giant copper supply squeeze a few years down the road. Although we broadly agree with this assessment of the fundamentals driving copper demand and supply, we see increasing evidence that the industry may be caught on the wrong foot. We believe that the copper supply squeeze may be much closer than many think.

China Is Scrambling For Copper Again

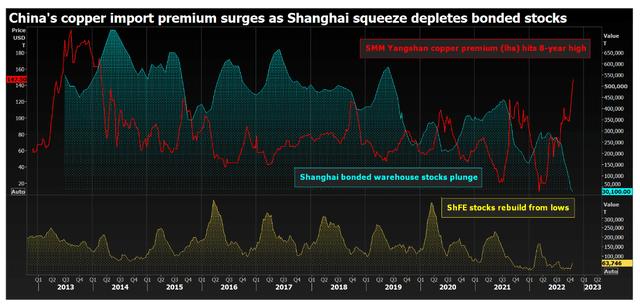

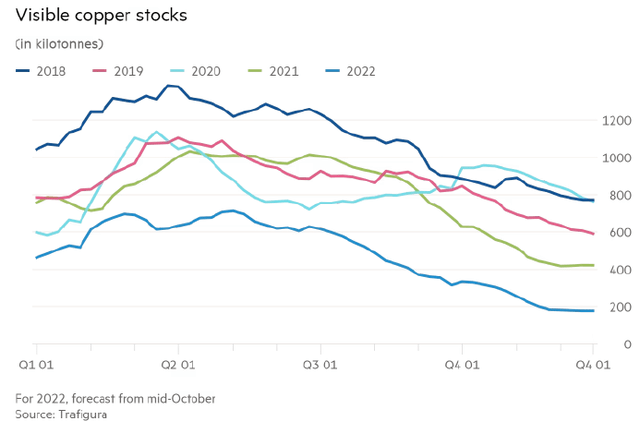

Copper inventories at warehouses tracked by the London Metals Exchange have plummeted over the past week as the copper market in Shanghai appears to have reached a breaking point. Bonded warehouse copper inventories tracked by local data provider Shanghai Metal Market have plunged to a new low as real estate construction in China was halted by Covid lockdowns while many real estate developers also had to delay projects due to a cash flow crisis. Meanwhile, a proxy for China’s demand for copper imports commonly referred to as the Yangshan copper premium has surged to around $147 per tonne above LME spot, a level not seen since 2013.

Shanghai Futures Exchange, Reuters

We suspect that the recent announcement by Chinese President Xi Jinping to reignite the economy with 6.8 trillion yuan worth of investments in infrastructure, followed by government support for real estate developers, may have triggered this scramble for copper. However, given that bonded warehouse inventories of copper were already low to begin with, this likely exacerbated the squeeze in China, which we think could soon spill over into global copper prices.

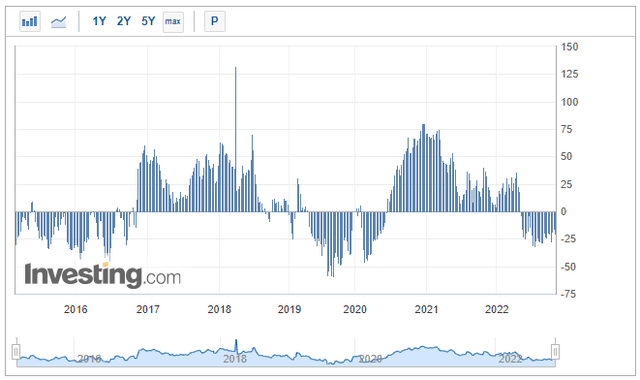

CFTC Copper Speculative Net Short Positioning

Latest data published by the Commodity Futures Trading Commission show that speculative positioning on copper has remained deeply net short since June 2022. This is in line with the bearish price action of copper we have seen in recent months.

Investing.com, Commodity Futures Trading Commission (CFTC)

Although current short positioning on copper has yet to reach the extreme levels last recorded in 2019, it nonetheless supports our thesis of an impending copper supply squeeze.

Long-Term Fundamentals Driving Demand

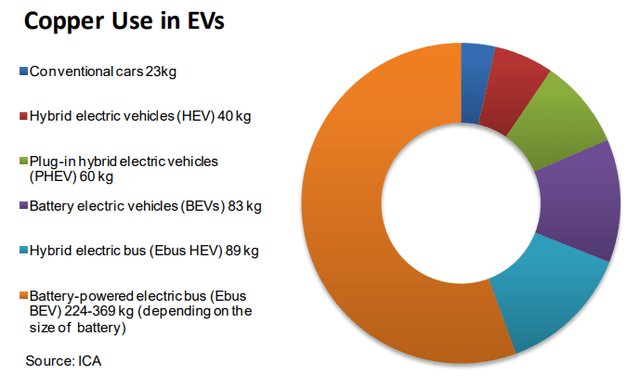

Even if our view of an impending copper short squeeze turns out to be a false alarm, copper miners would still qualify as an attractive investment due to favourable long-term fundamentals. Copper is an essential raw material input for the production of electric vehicles, high-speed trains, and infrastructure for renewable energy. Just focusing on the impact of electric vehicles on copper demand alone, we note that the usage of copper in electric vehicles is around four times more than in conventional cars.

World Copper Factbook 2022, ICA

The decarbonisation of developed nations especially in Europe and the U.S is another major factor that we think will underpin demand for copper in the coming decades. Developed nations’ commitment to meet their respective carbon-neutral targets also means that the electrification of the developed world’s infrastructure is already on a path that is only likely to accelerate as calls to fight climate change gather pace.

COPX: Cost-Effective Way To Add Copper Exposure

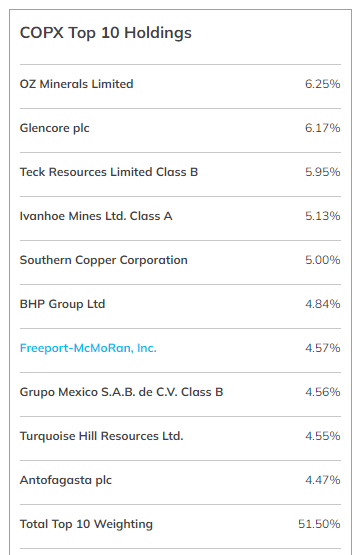

For investors looking to quickly add exposure to copper miners to capture this bullish view on copper, we think that the Global X Copper Miners ETF (COPX) could be a great choice.

Firstly, COPX has a geographically well-diversified mix of copper mining operations around the world with limited exposure to Chile, which is often plagued by social unrest, labour protests, and political uncertainties. COPX’s copper mining exposure spans across countries including Australia, the U.S, and China. COPX’s top ten holdings are also evenly weighted (4-6% portfolio weighting on each company) without excessive concentration on the largest copper mining companies.

etf.com

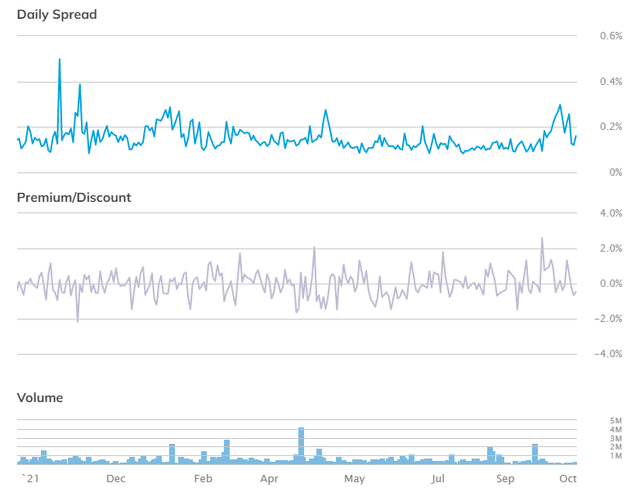

Secondly, companies held by COPX are also trading at compelling valuations, with the portfolio currently priced at around 6.8x P/E, 1.2x P/B, with a distribution yield of 3.9%. Trading of COPX has also been relatively stable with low daily spreads and healthy liquidity.

Finally, COPX has a low expense ratio of just 0.65%, providing a highly cost-effective way for investors to gain diversified exposure to copper miners.

In Conclusion

We believe that the copper market may be on the verge of a supply squeeze that could take copper prices higher in the coming months. Moreover, given that market sentiment is overwhelmingly bearish, we see the potential for a forceful rebound in copper miners as valuations have become very attractive.

Having said that, we acknowledge that copper demand remains heavily dependent on China’s economic outlook, and uncertainties surrounding the impact of China’s “Zero Covid” strategy as well as the unfolding real estate crisis could present significant downside risks to our view. As such, we deem it prudent to moderate our bullish view for a “Strong Buy”. Instead, we initiate our coverage of COPX with a “Buy” rating for now.

Be the first to comment