shaunl

Article Thesis

Global Ship Lease (NYSE:GSL) is a container shipowner that is generating highly attractive profits thanks to having locked in high charter rates during the pandemic. I think Global Ship Lease will easily earn more than the current share price over the next couple of years, and it offers a hefty dividend yield to investors at current prices that have fallen to a way-too-low level.

Company Overview

Global Ship Lease is a container shipowner. Unlike liners such as Maersk, ZIM Integrated Shipping (ZIM), and so on, it is not making money by moving containers from A to B (e.g., from China to the US West Coast). Instead, GSL’s business model is different. It owns ships that it charters to liners such as the aforementioned ones. Many of the charter contracts Global Ship Lease has agreed to are running for several years, thus there is high visibility when it comes to future revenue generation, which does not hold true for container liners that are way more dependent on (and exposed to) movements in container shipping rates in the near term. This means that Global Ship Lease’s business model is way less cyclical than that of ZIM, Maersk, and so on, generally making it more suitable for risk-averse investors that want a certain degree of visibility and consistency when it comes to future revenue generation.

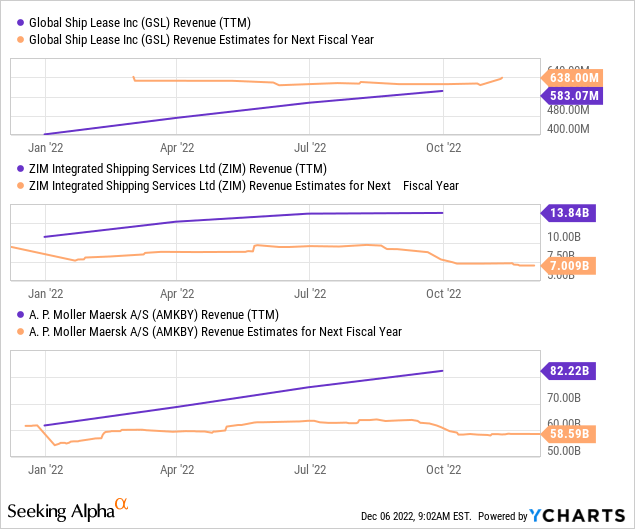

The nature of the business model is why Global Ship Lease is expected to generate stable or growing revenues for years to come, while container liners are expected to see their profits fall massively next year. Unlike the owners such as GSL, the liners didn’t lock in compelling revenues for years to come via long-term contracts:

Global Ship Lease is forecasted to see its revenue grow by around 10% next year, relative to the trailing twelve months period. That can be explained by the fact that already-locked-in contracts will provide higher rates next year, relative to the lower-rate contracts on some of GSL’s ships that were still in place over the last year. As those lower-rate contracts ran off, GSL was able to negotiate and lock in higher rates for 2023 and beyond on some of its ships.

Liners such as ZIM and Maersk, meanwhile, are forecasted to see their revenues fall by ~50% and ~30%, respectively, next year. There thus is a clear disconnect between the expected performance of a container shipowner such as GSL (the same holds true for Danaos (DAC) and others), and the expected performance of liners such as Maersk, ZIM, and so on. While the best times for liners have passed, for the time being, owners that have long-term leases in place are in a position where they will see their results improve going forward.

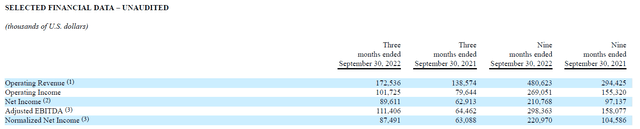

The impact of improving rates on GSL’s results are clearly visible in the following table from the company’s most recent quarterly earnings release:

Not only is the year-to-date period in 2022 a much stronger one than in 2021, as revenue, operating income, net income, and EBITDA are up meaningfully. But on top of that, the Q3 numbers are better than the Q1-Q3 average, suggesting that positive trends are still in place. When we annualize the Q3 normalized net income, for example, we get to more than $350 million (on a $605 million market capitalization company), while the Q1-Q3 numbers, annualized, result in $295 million of normalized net income. That would still be very strong for a company the size of Global Ship Lease, but the numbers are suggesting that ongoing improvements make the story even better over time.

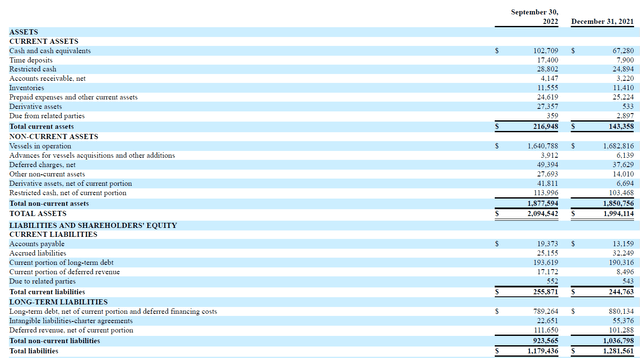

Looking into Global Ship Lease’s balance sheet, we see the following:

At the end of the third quarter, Global Ship Lease had a cash position of a little more than $100 million, which partially offset its existing indebtedness of $983 million, which includes short-term debt and long-term debt. Net debt thus stood at $880 million at the end of the period. When we annualize Q3’s EBITDA of $111.4 million, we get to a $445 million EBITDA run rate. The net debt to EBITDA ratio, or leverage ratio, thus stands at just below 2.0 right now. That is not a high leverage ratio, I believe, especially when we consider that GSL operates an asset-heavy business with long-living investments.

The balance sheet has improved meaningfully over the last year. At the end of the last fiscal year, net debt had still totaled a little more than $1 billion, while the EBITDA run rate was lower than. Thus, GSL has managed to improve its balance sheet and leverage even while rewarding shareholders handsomely this year, which gets us to the next point.

GSL Offers Hefty Shareholder Returns

Thanks to massive profits and cash flows, Global Ship Lease is in a position where it can offer a very nice yield to its owners. At the current run rate, Global Ship Lease is paying out $1.50 per year in dividends ($0.375 per share per quarter). With shares trading at $16 right now, that results in a dividend yield of 9.4%.

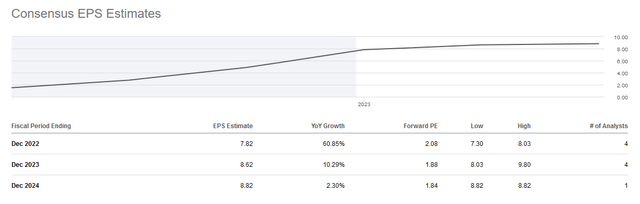

A dividend yield this high oftentimes gives investors pause, and rightfully so. Dividend yields this high can, after all, be the result of the market anticipating that a dividend cut is likely in the near term. But that will most likely not be the case with Global Ship Lease. Not only has the company easily covered its dividend in the most recent quarter – the $0.375 payout was covered 6.3x by its adjusted earnings per share of $2.38 – but the company will also easily cover its dividend in the foreseeable future. The following chart shows the company’s expected earnings per share for 2022, 2023, and 2024:

Not only is the company expected to generate positive earnings per share growth in the next two years, but the dividend coverage ratio is also excellent. With a $1.50 payout, the company will have massive surplus profits in the next two years. There is very little risk that the dividend will be cut through 2024, I believe, as the visibility of its future profits is high thanks to long-term contracts that are in place. Since GSL’s counterparties have earned record profits during the last two years, there is also little counterparty risk.

It will be important to see how GSL will use its surplus cash flows over the coming quarters and years. If analyst expectations are correct, the company will roughly earn around $19 to $20 per share by the end of 2024. Only around $3 of that will be paid out via dividends, unless there is a dividend increase down the road. The company could thus spend around $16 to $17 – roughly equal to the current share price – on other things. Further debt reduction will most likely be one item, but if GSL were to use all of its excess funds for debt reduction, it would reduce its net debt to just $200 million to $300 million or so. It is, I believe, unlikely that management will be that aggressive when it comes to reducing debt levels, as GSL already has a healthy balance sheet today.

Buybacks would be highly accretive and attractive, I believe, but it is not guaranteed that management will be spending heavily on buybacks. The company has increased its buybacks in recent quarters, but the pace is still far from high relative to what would be possible – the company has spent $10 million on buybacks in Q3, which is a little more than 10% of its normalized net profit. Still, even this moderate buyback spending results in an annualized share count reduction of ~7% with shares trading at $16, which is far from bad.

Growth spending is another option for management. Depending on what ships the company acquires, this could work out well, but bares the risk of overspending. I do believe that buybacks are more attractive than acquiring additional ships with shares trading at a very low valuation, but we’ll have to see whether management becomes more aggressive with buybacks or not.

Takeaway

Global Ship Lease is a container shipping company with a lot of visibility when it comes to profits and cash flow in the coming years. At current prices, its shares are very cheap – it is likely that profits through the end of 2024 will be higher than the current share price. Unless management squanders those profits, the current valuation thus makes shares look attractive for investment, I believe.

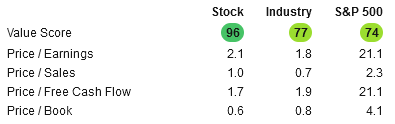

stockrover.com

The above chart shows that GSL is very inexpensive in absolute terms. Even relative to its industry, where some others had a record 2022, GSL is looking like a good value. The dividend yield of more than 9% that is well-covered is another nice reason to own a stake in GSL.

Be the first to comment