jetcityimage

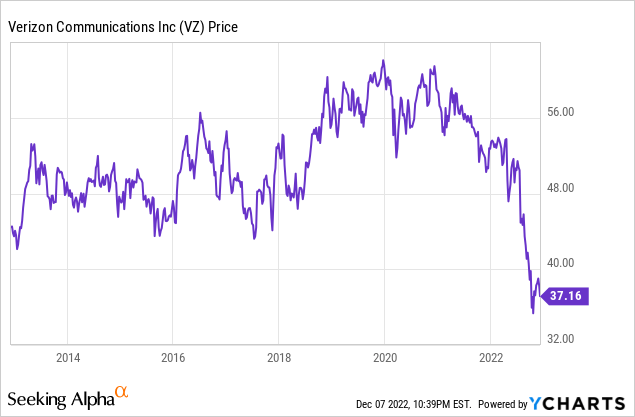

Verizon’s (NYSE:VZ) stock fell to $37 per share, a 12-year low, from its high of $60 per share in just two years. Nevertheless, as a sell-off often comes with an attractive buying opportunity, is VZ a BUY now?

[Share price: as of December 7th 2022]

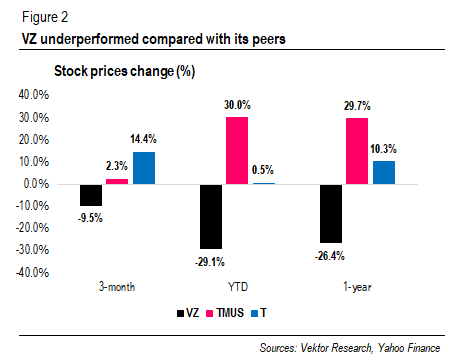

Stock price change (%) (Vektor Research, Yahoo Finance)

Easing Competition Is Out of Reach…

First, we should know why the stock declined in the first place. Besides the current macroeconomic pressures and rising interest rates, VZ reported soft operational results. In anticipation of the rising inflation, VZ decided to make fee “adjustments” and, like AT&T (T), raise older shared plans by $6 and $12 per month for single-line and multi-line phone accounts, respectively.

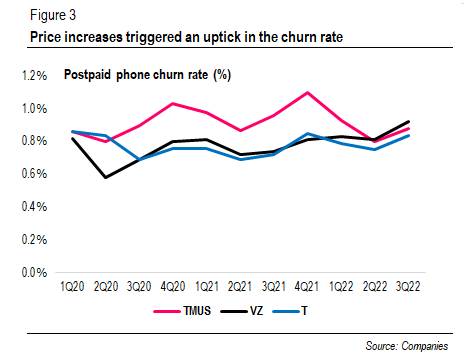

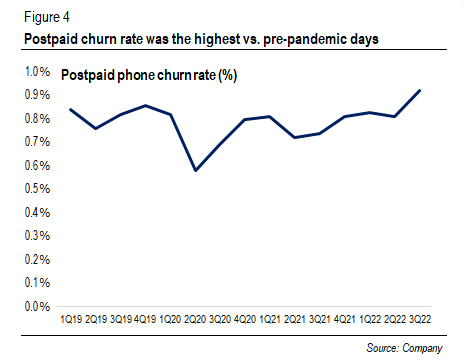

Price increases triggered an uptick in the churn rate, as customers are looking for cheaper options amid inflationary environments (see Figure 3). As for VZ, its postpaid churn rate hit 0.92%, higher than the rate during the pre-pandemic days at 0.8% (see Figure 4).

Postpaid phone churn rate (%) (Companies) VZ’s postpaid phone churn rate (%) (Company)

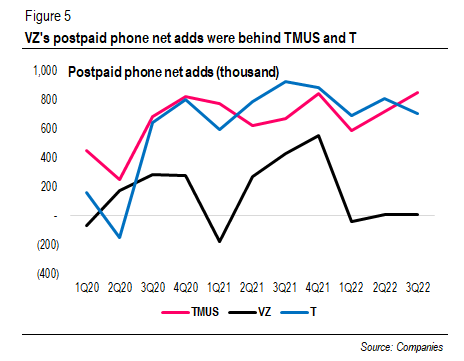

Furthermore, VZ recorded only 8,000 postpaid phone net adds in 3Q22, with the Consumer group reporting a total 189,000 net loss during the quarter. In addition to the price increases, the management mentioned that “intensified competition for consumer attention” was at least partially responsible for the soft phone gross adds.

VZ plans to retain its subscribers and encourage them to upgrade to the premium plan. While the company was losing phone subs, the strategy to upsell appears to be working. According to Hans Vestberg, 42% of its customer base subscribed to the unlimited premium plan. The number was over a third of the base a year earlier.

Recently, however, VZ introduced an entry-level Welcome Unlimited plan. But the idea remains the same: to “bring more customers into the door” and upsell them. The CEO expressed optimism that the company is “tracking” to report positive net adds in the Consumer group, especially after the holiday shopping season.

Postpaid phone net adds (thousand) (Companies)

Nevertheless, the highly competitive landscape is not going away anytime soon, as we briefly mentioned in our article on T-Mobile (NASDAQ:TMUS). DISH (NASDAQ:DISH) is launching its postpaid mobile service in the first quarter of next year. Additionally, research suggests that cable took a 31% share of the industry net adds last quarter. And new players, such as Cox Communications that settled an MVNO deal with VZ, are joining the bandwagon.

…But The Growth Story Remains

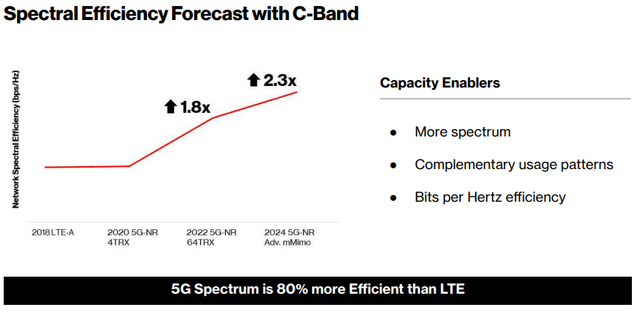

Yet the good news is that VZ is catching up with TMUS in the mid-band spectrum coverage. The company said that it has covered 160 million POPs by the end of 3Q22 and expected the figure to reach 200 million by 1Q23. In comparison, TMUS is looking to cover 260 million by the end of this year. Opensignal noted that the C-band spectrum deployment helped VZ and AT&T increase their 5G download speeds.

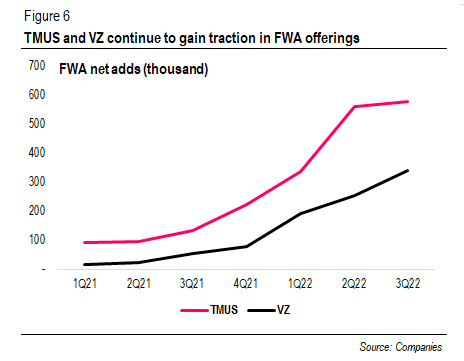

Second, the FWA’s success story is not over yet. VZ added 342,000 subscribers in 3Q22, reporting more than one million subscribers base during the quarter. Furthermore, the company expects to ramp up the figure to four to five million by 2025. VZ could use its FWA offerings to entice new wireless customers because about a third of its customers did not subscribe to VZ’s wireless services.

FWA net adds (Companies)

However, questions remain whether the network capacity is sufficient for further FWA growth since fixed broadband is estimated to consume 40 times higher than mobile, Analysys Mason’s estimate suggests.

Hans Vestberg reiterated that capacity was not an issue, mentioning that the company has only deployed an average of 60 MHz of C-band, compared with the available 160 MHz. Massive MIMO technology also helps improve spectral efficiency.

Spectral efficiency forecast with C-band (Company)

Yet, according to Recon Analytics founder Rogen Entner, the proliferation of fiber and multi-gig offerings could impact “the value proposition” of FWA services. We agree that the long-term opportunity for FWA offerings lies in areas where cable is unavailable. In addition, recent report from TMUS suggests that almost half of its FWA subs switched from non-cable customers (including satellite and DSL). In this case, TMUS has an advantage after acquiring 2.5GHz licenses, mainly in rural areas, in Auction 108.

On the other hand, a study, which is limited only to the mmWave service, suggests that VZ’s Ultra-Wideband FWA subs skewed towards urban. This makes sense since the mmWave band spectrum should be active in highly dense areas. While the company is deploying its C-band, Hans Vestberg confirmed that the build in rural areas “has not even started,” as the company is catching up with TMUS in mid-band coverage. Thus, its mid-band footprint expansion in rural areas could provide VZ with a competitive advantage, in our view.

Finally, VZ has been talking about the private network opportunity, saying it was “very bullish on the opportunity.” The company has several deals under its belt, including an agreement with the UK Port of Southampton that handles billions of pounds of exports annually. Moreover, we believe that VZ’s extensive mmWave band spectrum holdings can be a game changer when serving enterprises, which often require high bandwidth and low latency.

Additionally, the company expects the private 5G network to become a “gateway” to mobile edge computing (MEC) services as new sources of growth. Yet the management noted that revenue will start coming in in the second half of next year or 2024. During the last Investor Day, it reiterated an estimated $30 billion total addressable market by 2025.

Valuation

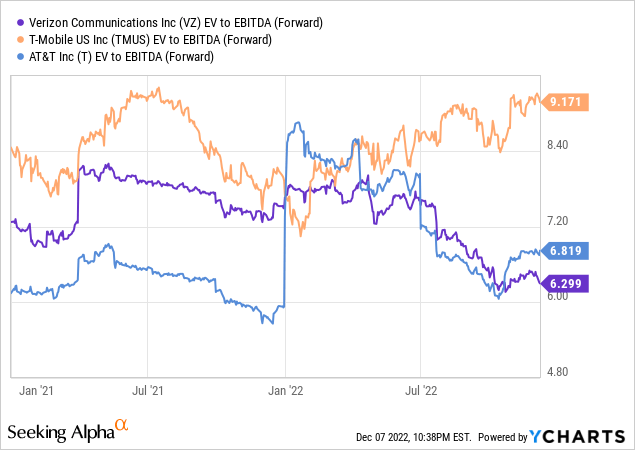

VZ is trading at 6.3x its forward EBITDA, lower than its peers. As mentioned before, we believe that macroeconomic pressures, rising interest rates, and soft operational results play a part in the sell-off, which has put the stock into a 12-year low. But the question is whether VZ’s fundamentals are significantly worse than those one year, five years, or ten years ago.

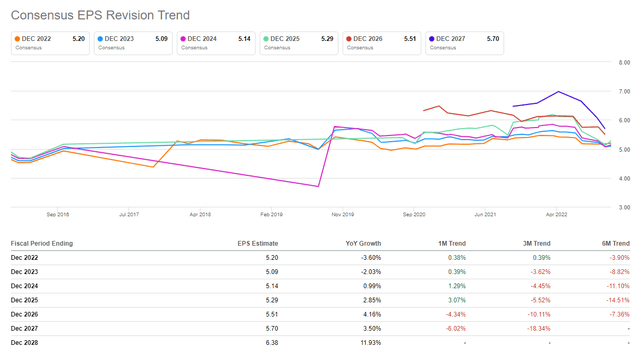

Consensus EPS revenue trend (Seeking Alpha)

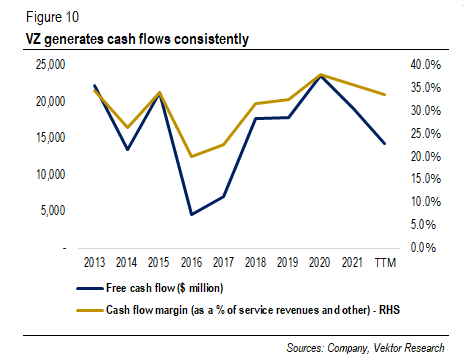

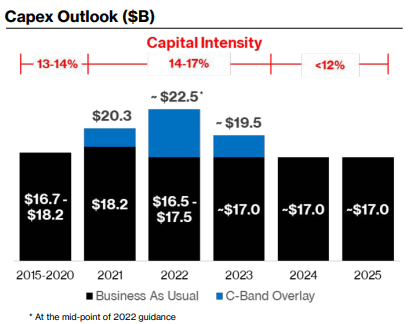

Although VZ’s free cash flow declined in the last twelve months, the cash flow margin remained strong at 34%, higher than the 10-year average of 31%. As expected, CapEx mushroomed because the company is deploying its C-band spectrum, allocating an incremental $10 billion until next year. But as we are heading toward the end of the elevated CapEx, the figure should be down to the Business as Usual (BAU) level at $17 billion.

VZ’s FCF and cash flow margins (Company) VZ’s CapEx outlook (Company)

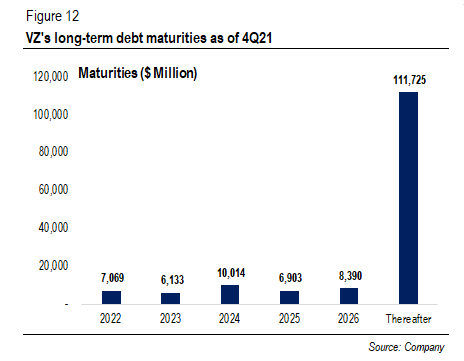

Investors have asked how VZ deals with its debt, and they correctly pointed it out. We previously wrote that it was unlikely to be a concern, as VZ generates free cash flows from $18 billion to $19 billion annually while the maturities range between $6 billion and $10 billion.

VZ’s debt maturities in 4Q21 (Company)

However, the recent 10-Q reveals that VZ will have to pay $15 billion for debt maturing in one year. We see that refinancing, which will come with higher rates, could be the case in an assumption that VZ will spend $20 billion CapEx and distribute about $10 billion in dividends next year.

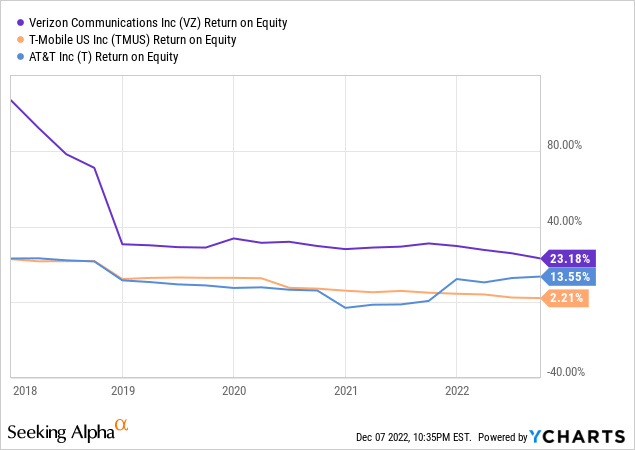

Lastly, VZ earns more than 20% of its equity, consistently higher than its peers.

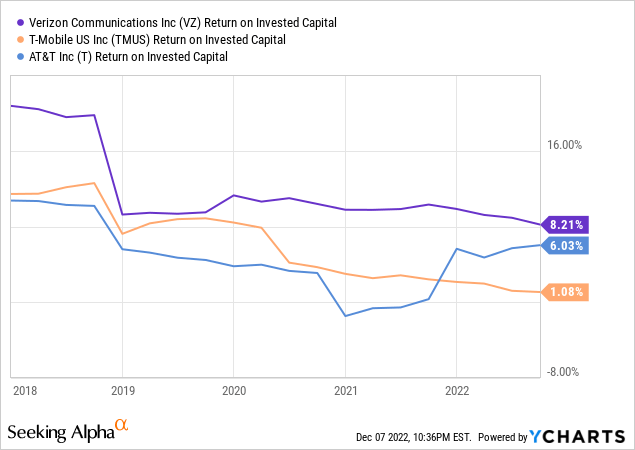

Return on invested capital, a metric that takes debt into account, shows a bigger picture. Morningstar data show that VZ’s 5-year average ROIC stands at 13%, higher than T (6.5%) and TMUS (7.5%).

Conclusion

All in all, does VZ offer a buying opportunity at the current price? Indeed, the mobile wireless market is getting more competitive. And risks stem from maturing debt that the company will likely have to refinance at higher rates. But we do not think that VZ’s fundamentals are significantly worse than those several years ago, although the stock is trading at a 12-year low. VZ is catching up with TMUS thanks to its C-band deployments, and its strategy to upsell its subscribers is working. Furthermore, the company’s aggressive holiday promotions could reverse the net postpaid phone loss trend.

Furthermore, the company generates cash consistently, runs at a respectable ROE, and is trading at an attractive valuation. In addition, its growth story stemming from the fixed-wireless broadband and the enterprise market remains. In conclusion, we believe that it is a good start at $37 per share. If you have any thoughts, please do not hesitate to comment below.

Be the first to comment