Olemedia

Our Original Work On GitLab

This will be the second installment of our work on GitLab. You may read our original work on the company via the following link:

A Trip Down Memory Lane

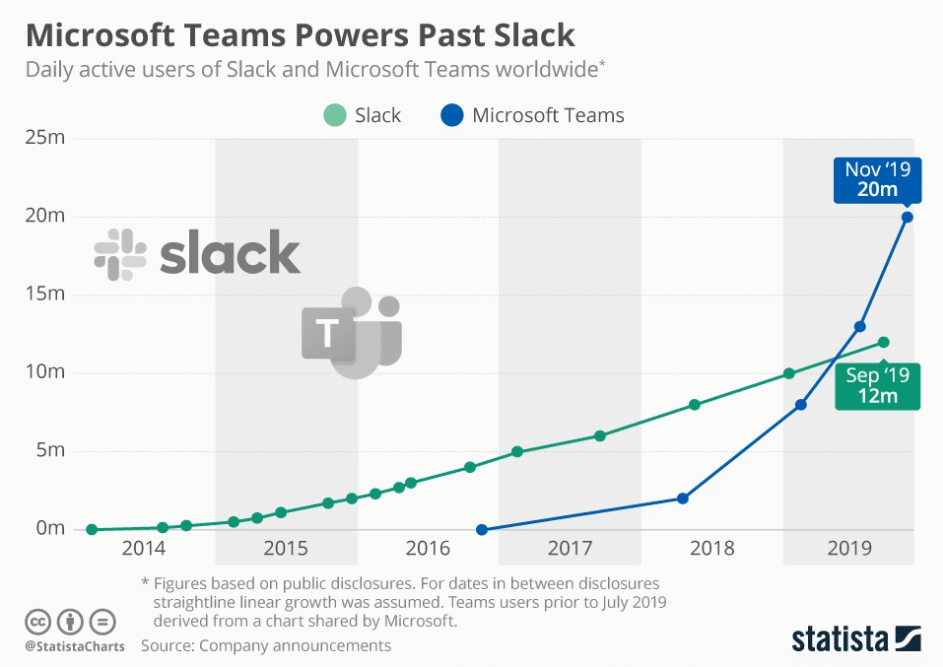

In mid to late 2020, I began acquiring shares of Slack (WORK) and continued acquiring shares as the F.U.D. related to Microsoft’s (MSFT) Teams product reached a fever pitch. To be sure, there was good cause for this concern, as the chart below illustrates:

Statista

This F.U.D. caused Slack’s share price to crater. At Slack’s lowest point, it traded in the high teens (down from $32/share where we originally bought the company). Not long after it traded into the teens, Salesforce (CRM) acquired Slack at ~$44/share, or $27B in market cap.

As we know, the central reason Slack traded to such low levels was competition from Microsoft Teams, which was fair, but perhaps a bit overblown.

As we’ve illustrated in the past, there are many reasons why an enterprise would not work with Microsoft, and, indeed, there is an exceptionally large cohort of companies on this earth that will choose not to do business with Microsoft or will choose not to become entirely dependent on Microsoft’s various platforms.

Additionally, from Intuit (INTU) to Google (GOOGL) (GOOG) to Slack, there have been many, many companies that have risen to prominence in the face of Microsoft offering a directly competing product.

And, today, we will consider yet another company embroiled in a head to head battle with Microsoft. While highlighting Intuit (early 1990s), Google (2000s), and Slack (2020) as examples of companies fending off Microsoft might be an example of survivorship bias, I do think it’s worth considering why these companies were able to, ultimately, create successful business outcomes in the face of almighty Microsoft competing with them directly.

In today’s exploration of GitLab, we will share why we believe GitLab will thrive despite Microsoft fielding an almost directly competing product.

So without further ado, let’s explore the business of Gitlab together today!

Introduction: What Is GitLab?

In short, GitLab empowers software engineers to manage the creation and deployment of the code that they write.

This act of writing code and deploying it into the real world is known as DevOps, which is a portmanteau of the words Development and Operations.

We believe in an innovative world powered by software. To realize this vision, we pioneered The DevOps Platform, a fundamentally new approach to DevOps consisting of a single codebase and interface with a unified data model. The DevOps Platform allows everyone to contribute to build better software rapidly, efficiently, and securely.

As conveyed above, in the software world, this process of writing, storing, and deploying code, and managing the process thereof, is known as DevOps, or Development Operations. This video illustrates the concept of DevOps and further contextualizes GitLab’s place within the DevOps ecosystem, though this place within the ecosystem evolves and expands by the day.

Now that we have some general understanding of GitLab’s business, let’s walk through a brief investment thesis; after which, we will consider GitLab through the lens of BTM’s Crucial Characteristics.

Bulleted Investment Thesis

- GitLab has verticalized the DevOps ecosystem, and, in the process, created a significantly better product for software engineers. GitLab has used this significantly better product to wedge itself into its customers’ businesses.

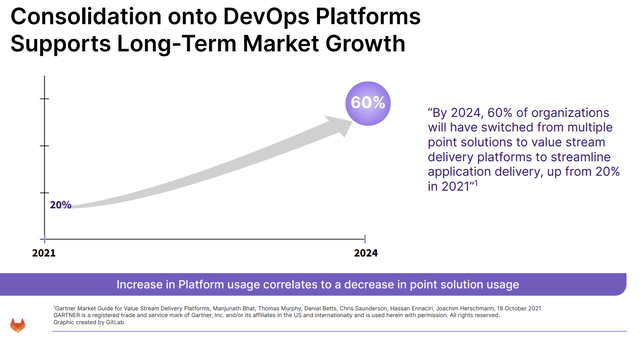

- At Beating The Market, we target companies that have built a 10x better product within a fragmented, low NPS industry, which we and GitLab believe has been the DevOps ecosystem in the past. Our Top Ideas are often companies that enter these fragmented (as in many competitors), low NPS industries and rapidly consume market share due to their 10x better product.

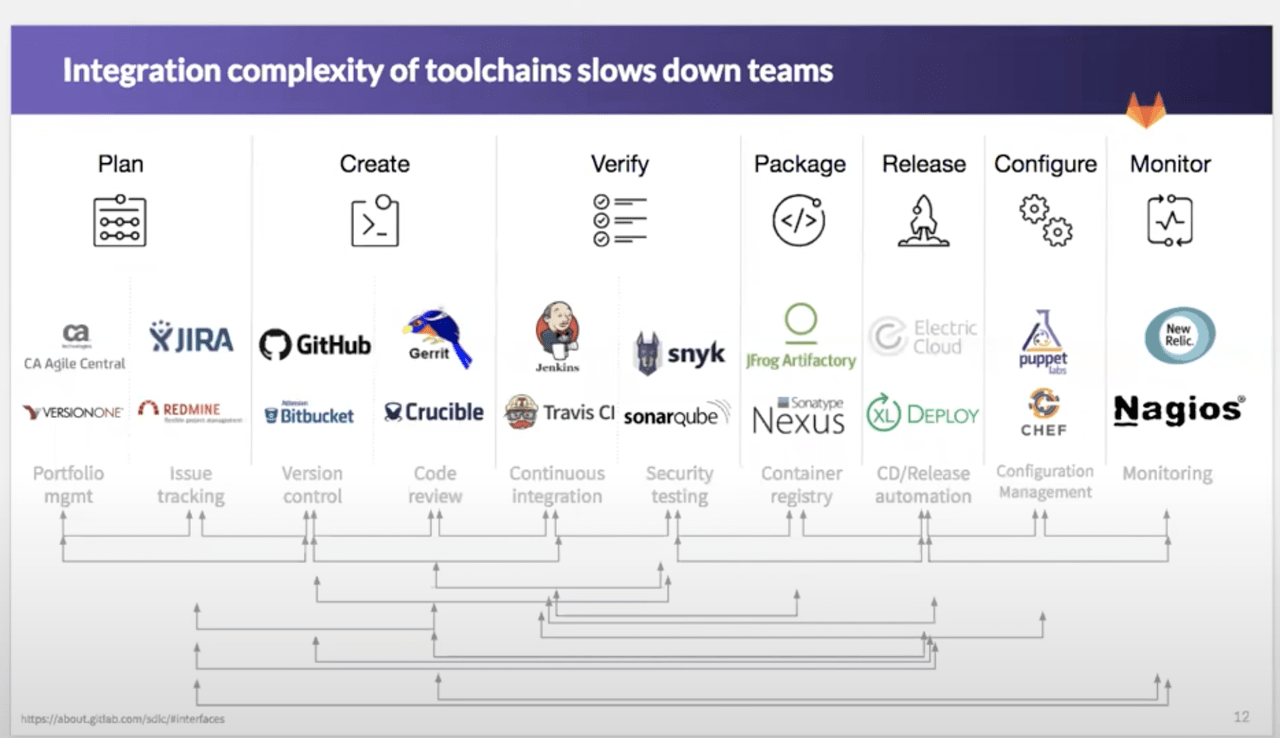

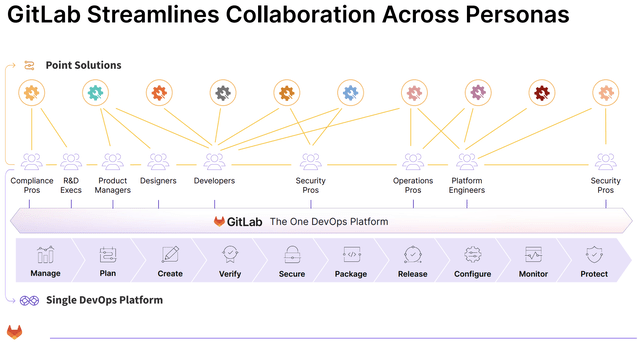

- At Beating The Market, we call these fragmented, low NPS industries “Inverse Bubbles”. We can see in the image below this fragmented ecosystem (which we’d call an Inverse Bubble; more on this in a bit):

GitLab Investor Relations

For those that understand the concept of Inverse Bubbles (resource below), we can imagine the above chart as a giant Total Addressable Market Bubble, with a $ value affixed to the bubble. From our original note on GitLab, we shared,

As per Gitlab’s IPO filing, its management believes that the addressable market opportunity for “The DevOps Platform” is ~$43B (expected to grow to $55B by 2024). Here’s what the company has said on its addressable market:

“Today, we believe the addressable market opportunity for the DevOps Platform is approximately $40 billion. To estimate our current addressable market, we have categorized companies of what we view as adequate scale into tiers based off of employee count as reported by S&P Global. We then multiply these cohorts by the average annual recurring revenue from the top 25% of customers in each of these categories as of January 31, 2021. We calculated these figures by determining the markets currently addressed by the most common use cases for our platform and summing their estimated sizes as reported by Gartner. Given the wide applicability of our platform, we believe we are well suited to grow our market opportunity over time.”

GitLab communicated the evolution from “no tools” to “fragmented tools” to “The DevOps Platform” in the following manner:

When DevOps started, each team bought their own tools in isolation, leading to a “Bring Your Own DevOps” environment. The next evolution was standardizing company-wide on the same tool for each stage across the DevOps lifecycle. However, these tools were not connected, leading to a “Best in Class DevOps” environment. Companies tried to remedy this fragmentation and inefficiency by manually integrating these DevOps point solutions together defining the next phase: “DIY DevOps.” 5 Table of Contents At the same time, the faster delivery of software required more DevOps tools per project. Increased adoption of a microservice architecture led to more projects. The combination caused an exponential increase in the number of tool-project integrations. This has often led to poor user experiences, higher costs, and increased time to deliver new software. As a result, business outcomes often failed and the potential for DevOps was never fully realized. In short, an entirely new platform for DevOps was needed. We pioneered The DevOps Platform to solve this problem.

- As can be seen above, in a world without GitLab, companies must piece together a handful, or more, solutions to write, deploy, and manage their code. A GitLab world “verticalizes” the entire ecosystem into one platform: The DevOps Platform, as GitLab calls it.

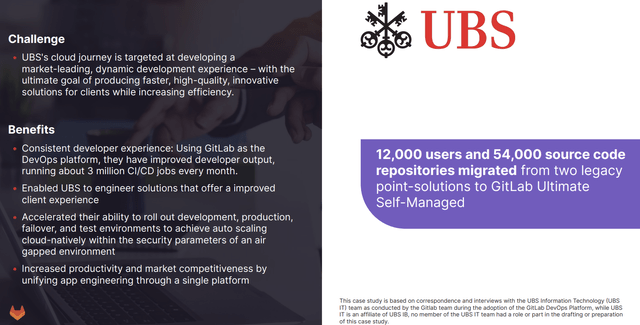

- The image below illustrates the many point solutions that create orchestration and execution headaches in the creation and deployment of code. At the bottom, we see The DevOps Platform, which “verticalizes” the entire stack of solutions into one, proprietary platform.

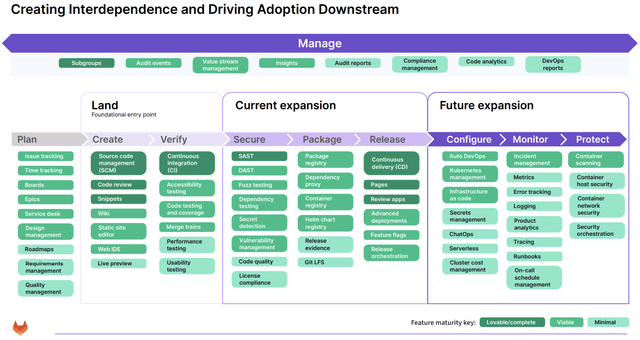

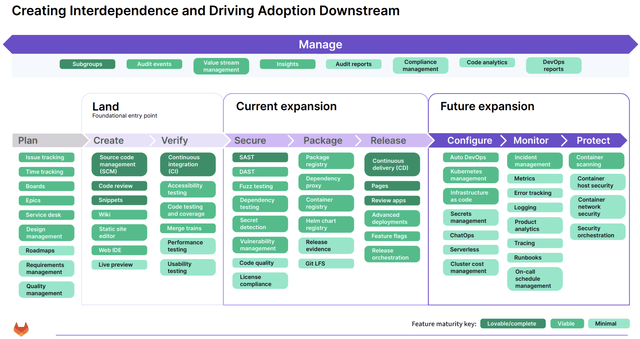

- And, as mentioned earlier, GitLab uses this 10x better, fully verticalized platform to wedge itself into its customers businesses, where it then upsells them on new features and products over time. We contend that GitLab will prove to be one of the most capable companies on earth in terms of creating new products, which GitLab can use to upsell existing customers (and thereby generate more revenue from their existing customer base). GitLab characterized this wedge strategy as follows:

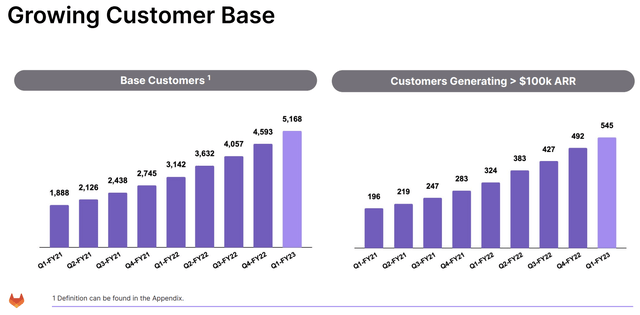

We employ a land-and-expand sales strategy (read: wedge). Our customer journey typically begins with developers and then expands to more teams and up to senior executive buyers. As of January 31, 2022 and 2021, our Dollar-Based Net Retention Rate was above 152% and above 145%, respectively. Our Base Customers grew to 4,593 as of January 31, 2022 from 2,745 as of January 31, 2021. Our cohort of customers generating $1.0 million or more in ARR grew to 39 as of January 31, 2022 from 20 as of January 31, 2021.

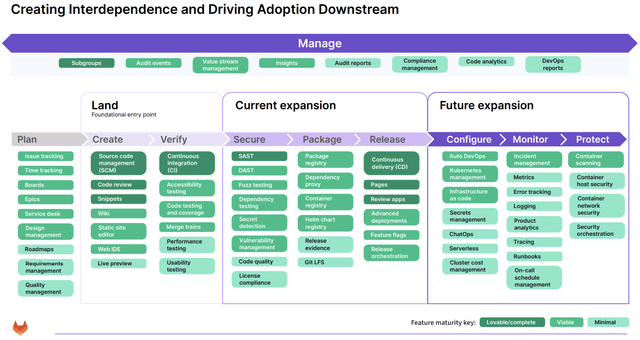

- We can see in the chart below that GitLab has a robust product roadmap still ahead, and as it executes on that product roadmap, it will upsell its current customers with those new products (and this drives elevated Net Retention Rate over time, which we’ve contended is the most important SaaS metric on earth).

- For those just joining us, some of the ideas presented above may sound a bit foreign. Here’s more resources to learn about those unique ideas:

- The DevOps Platform acts as a company’s system of record for all of the software written within the company. We can think of GitLab as the womb, in which new applications and new software-based infrastructure germinates and is born. It is the source of software life within an organization. This gives GitLab an incredibly privileged position and makes it absolutely mission critical, especially for companies that have adopted the full suite of products The DevOps Platform offers.

- Alongside this privileged position, GitLab operates somewhat duopolistically (there are other players, but GitHub and GitLab clearly dominate mindshare on the internet. For instance, if I search “github alternative”, GitLab is the #1 alternative in virtually every single search result), with its counterpart being GitHub, which Microsoft acquired in 2018.

- Some may contest this, but, from my research, GitLab and GitHub represent the two choices in the DevOps market.

- GitLab also satisfies everything we look for in a company:

- Founder-led (and Sid appears to be a highly competent founder who is liked within GitLab)

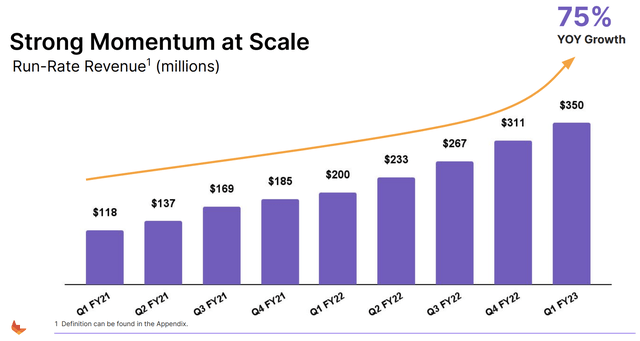

- Rapidly growing: GitLab recently posted ~75% year over year growth.

- Exceptional financials: ~$1B in net cash (the entire company is only worth about $11B as of today), high gross margins & positive unit economics, and, considering its rate of growth, relatively low cash burn presently.

- And, lastly, GitLab has an exceptional company culture, as measured by its Glassdoor ratings, of which there are many.

- So lots to love: tons of cash, rapid growth, founder-led; high quality culture, all while operating in what amounts to a mindshare duopoly with GitHub. Awesome! But it gets better:

- Alphabet recently began acquiring shares of GitLab, which has led me to believe that Alphabet may be interested in acquiring the company so as to better compete with Microsoft. AWS (AMZN) could certainly also be a suitor for GitLab. Additionally, insiders have been buying shares.

- With the Alphabet or potential AWS backstop, along with the huge cash hoard, rapid growth, clearly high quality culture, and 10x better, verticalized platform, there is just so much to love about GitLab.

- The one issue, as was the case in our original note on the company, is its valuation. With 191M shares outstanding (fully diluted), GitLab presently trades at about $11B in market cap. On an EV to fwd. 12 mo. sales basis, GitLab trades at about 19.7x EV/fwd. 12 mo. sales. This is very expensive. We will wait until $30/share to $35/share, which is where it touched recently.

- That said, when GitLab does find its way into our buy zone, we will buy with gusto, as GitLab is undoubtedly one of the most promising $10B and below market cap companies in the market at present.

With our concise investment thesis laid out, let’s now turn to BTM’s proprietary Crucial Characteristics!

BTM Crucial Characteristics

|

Crucial Characteristic |

Notes |

|

Zero to One Strategy |

We recently explored the concept of “going Zero to One” in the following note: In short, Zero to One is the process whereby a company evolves from a concept or idea to a business that produces highly defensible cash flows, protected by one of five moats: Embedding (Switching Costs), Scale, Network Effects, Brand, or Regulatory/Legislative moat. We believe that the understanding the concept of going from Zero to One is crucial for investing within Beating The Market’s coverage universe, and we do our best to describe the concept as often and as thoroughly as possible. A commodity product, such as a cup of coffee (BROS) (SBUX), can become a business that produces highly defensible cash flows, protected by its Brand, Scale, or Embedding (a physical building in a neighborhood is tough to move) moats. That is, anybody can go from Zero to One with the right values, mindset, and a bit of good fortune (which often follows the right values and mindset). In short, going from Zero to One refers to the idea that all businesses start as an idea with effectively no moats, and, for those that succeed, end with a business (a One) that has real moats, whether they be brand, network effects, scale, or embedding. We explored these moats in this note: The Only Two Ideas You Will Ever Need In Investing | Seeking Alpha Marketplace GitLab’s strategy to go from Zero to One entails creating The DevOps Platform, around which we find moats such as Brand (as we mentioned, GitLab operates in what amounts to a duopoly in terms of mindshare), Embedding (explored later), and Network Effects. One of the aspects of the Zero to One journey for GitLab, which I find most promising, is the idea that it is the software platform for creating software platforms; therefore, if it is really as great as it thinks it is, then it should, by the very nature of being the best, create the best DevOps platform. To wit:

Below, we can see Sid, founder and CEO, conveying this idea that companies need the best software development platform to execute a radically faster DevOps lifecycle. Considering GitLab is the platform for this job, GitLab itself should continue to experience rapid evolution and pristine execution.  GitLab Investor Presentation Gitlab communicated these aforementioned ideas in stating,

In short, GitLab’s Zero to One journey has already seen immense progress, but there’s still an incredible runway ahead for the company, which will be facilitated by their own, proprietary software development platform. |

|

The Time Is Now |

As we wrote in our original note on the company,

GitLab Investor Relations

GitLab Investor Relations And in moments such as these, and in light of the massive TAM that lies ahead of GitLab, we often turn to arguably one of the best investing videos of all times. As we heard from Peter Lynch, we can distill an investment down to a few very simple metrics. For GitLab, we should ask:

It’s a question we should ask for each of our companies, so as to get to the essence of the investment thesis. Considering its product roadmap and privileged position within organizations, we contend that it very well could achieve these milestones!  GitLab Investor Relations |

|

Long-Term Vision |

In the Beating The Market chats, we spent a great deal of time discussing GitLab’s long term vision, specifically in the observability, application performance monitoring, and log analytics space (where companies such as Splunk (SPLK) and Datadog (DDOG) operate). We can see below what a future GitLab will look like:  GitLab Investor Relations An interesting aspect of GitLab is that is strives to be radically transparent. It has laid out all of its plans and product roadmap for the world to see. As such, we have a great grasp of GitLab’s long term vision, which is to be The DevOps Platform that handles all of the Dev side and as much of the Ops side as possible, making the entire experience exponentially more seamless, secure, and efficient. |

|

Visionary Founder/CEO |

Sid is the visionary founder and CEO of GitLab, and, to this day, he remains at the helm. We can see on Glassdoor what his employees think of him: As can be seen, Sid has a 97% approval rating, which is incredibly high for Glassdoor (for context, Elon Musk has an 81% approval rating). As for Sid himself, I found the following interview to be one of his best for gaining insight into how he thinks about the platform of which he’s led the development. It’s also a great video for understanding GitLab as a business. |

|

Quality Board of Directors |

From our last note on the company: Gitlab’s BOD is chaired by Sid Sijbrandij, and it includes tech veterans like Sunny Bedi (Chief Information and Data Officer at Snowflake), Godfrey Sullivan (former CEO of Splunk), and Karen Blasing. More information for Gitlab’s BOD can be found here |

|

Proprietary Tech |

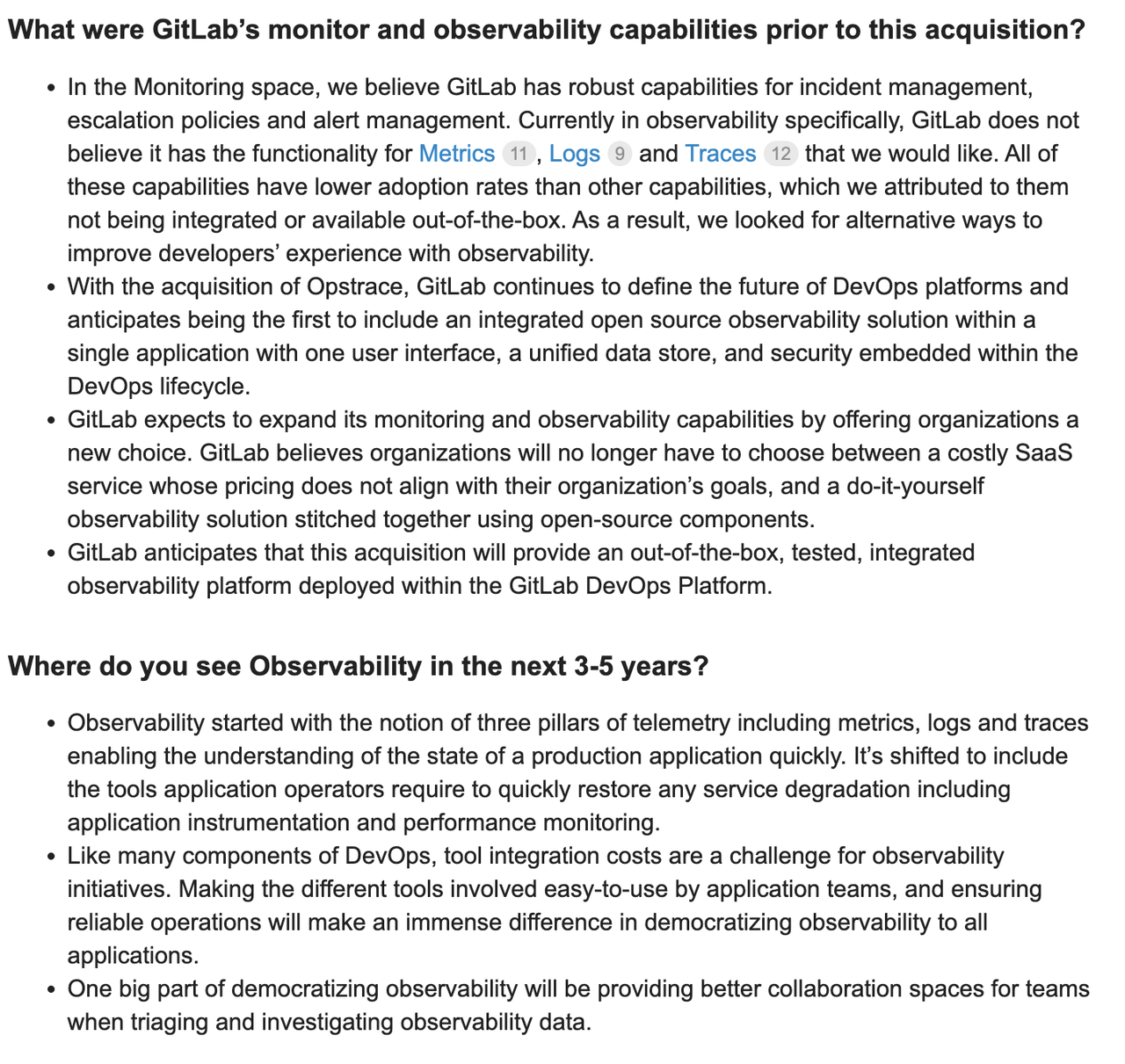

One of the most exciting aspects of GitLab is its developer culture, in which it does not need to acquire companies to innovate: it has the technological and software development prowess to evolve its platform. It is, after all, The DevOps Platform! So it stands to reason that it should be one of the most innovative companies on earth, considering that its platform facilitates innovation itself. In this vein, GitLab operates on a single codebase, which is entirely proprietary. The only acquisition I could find was a company called Opstrace, which, so it appears, will facilitate GitLab’s entrance into the observability, APM, and log analytics space. To wit:  GitLab.com |

|

Product Roadmap And Evolution |

This section is not always easy, but, in the case of GitLab, it could not be easier due to the company’s approach to radical transparency. Below, we see GitLab’s product roadmap.  GitLab Investor Relations Next, let’s begin exploring GitLab’s competitive advantages, or moats. |

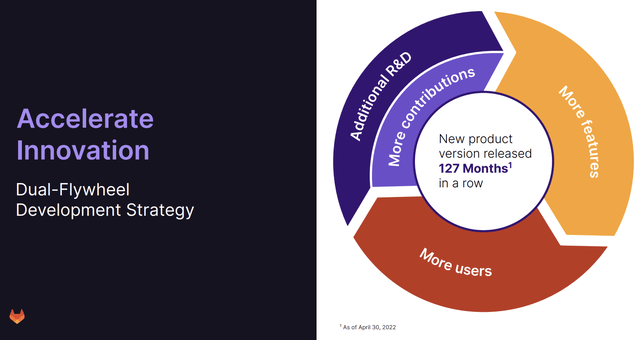

| Network Effects |

GitLab illustrated what it perceives to be its Network Effects in the following manner:

GitLab Investor Relations As can be seen above, the more they evolve the platform, the more GitLab will attract users. The more users they attract, the more GitLab can iterate and evolve based on contributions from users and the more they can spend on R&D to evolve the platform. Their product roadmap appears to be something of a pseudo-gantt chart for the community at large. They post this product roadmap so that the above contributors & users can voice their opinion about the future of the company. An interesting strategy to be sure! |

|

Branding |

GitLab’s brand acts as an essential component to the defensibility of GitLab’s business, and the future cash flows thereof. While BitBucket was a sometimes-mentioned competitor, GitHub and GitLab are indisputably the only real contenders in this space. GitHub and GitLab are synonymous with software development and DevOps. While some of our companies lack a brand moat early on, GitLab already has this moat in spades. |

|

Scale |

GitLab does not necessarily enjoy economies of scale, which is the standard definition of this section. That said, its “mindshare” scale has afforded it a rather significant moat. If GitLab can further build out its “Ops” business (the other side of Dev… DevOps), scale will certainly become a moat. It will simply be very challenging to garner software engineer mindshare and build out this very robust observability, log analytics, and APM platform. |

|

Embedding |

Embedding is arguably GitLab’s most important moat, and this will more and more become reality as it further builds out its product roadmap. To wit (from GitLab’s recent 10k):

As we wrote in our initial note on the company,

Once companies standardize both Dev and Ops on GitLab, the company will possess an exceptionally deep embedding (aka switching costs) moat. |

|

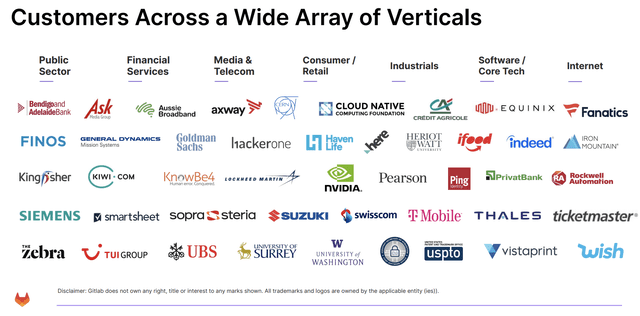

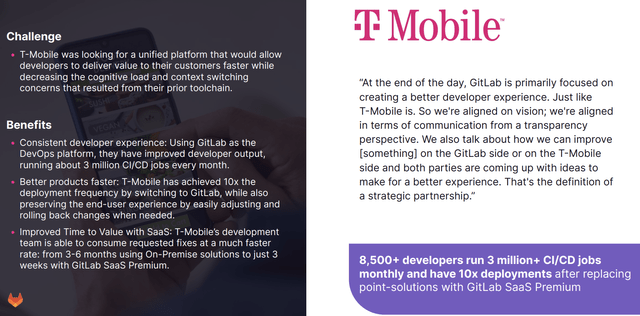

Net Promoter Score / Customer Satisfaction |

I could not find good data on GitLab’s net promoter score, but suffice to say that many enterprises of all sizes like and use the GitLab platform:  GitLab Investor Relations  GitLab Investor Relations  GitLab Investor Relations |

|

Powerful Secular Growth Trend |

By now, we all understand that GitHub and GitLab operate in something of a duopoly, and we understand that GitHub is owned by Microsoft. This is something with which we must be comfortable if we’re to own GitLab. To this end, I found Satya Nadella’s explanation of why they acquired GitHub and the powerful secular growth trends surrounding the company[s]. |

|

Total Addressable Market |

Gitlab’s open-source platform has 30M+ registered users, and 2600+ contributors, with just ~15K paid users, i.e., massive expansion opportunity within its customer base. According to Gartner, the global infrastructure software market is estimated to be worth ~$328B, of which, Gitlab’s offerings could address ~$43B (serviceable addressable market). Hence, Gitlab has a massive white space opportunity in front of itself. |

|

Market Share |

As of 2022, GitLab has ~30M registered users; whereas, GitHub has ~80M registered users. GitHub is undeniably the larger entity here, but, as we’ve shared often, this very, very likely will not preclude GitLab from capturing massive market share globally. |

|

Competitive Differentiation |

While some may disagree, in my research, I happened upon effectively only two solutions in the DevOps space: GitLab and GitHub, with the latter being the larger of the two. To this end, let’s review a comparison between GitLab and GitHub: GitLab vs GitHub – Comparison

As GitLab executes on its product roadmap, we contend that its differentiation relative to current peers will increase. |

|

Mergers & Acquisition Strategy |

As we’ve illustrated, GitLab has built its entire platform from a single source of code, which is something Adyen (ADYEY) has done as well, for which we’ve praised the company. We want to own companies that do not need to acquire to innovate or build new products because it illustrates the strength of their culture. A company that can build rapidly (using The DevOps Platform), as opposed to buy, avoids the cultural risks associated with acquisitions (Teladoc (TDOC) recently illustrated how significant these risks can be by way of its complete mismanagement of its Livongo). It also avoids the risks associated with merging technologies and the associated tech debt that can form. That said, GitLab has acquired one company thus far, and we’re very happy with the acquisition. We touched on it before, but here’s more information on the acquisition: “With the acquisition of Opstrace, GitLab continues to define the future of DevOps platforms and anticipates being the first to include an integrated open source observability solution within a single application with one user interface, a unified data store, and security embedded within the DevOps lifecycle.” Over time, GitLab will acquire companies (if it does not get acquired at some point itself), though we’re very happy with the company’s internal culture of innovation. |

|

International Expansion |

GitLab has explicitly stated that one of its growth objectives is to focus on international expansion. To wit: Expand our global footprint.

|

|

Sounds Financials |

GitLab has fantastic financials, all things considered, and the Part II of this note will explore them in greater depth. |

|

Liquidity or Bankruptcy Risk |

GitLab has effectively no bankruptcy risk, as it has nearly $1B in net cash, and is burning a rather negligible amount of cash per quarter as it rapidly scales its business. |

|

Shareholder Dilution Risk |

Because we’ve assessed GitLab using its fully diluted share count of ~191M, we see very minimal dilution risk beyond this fully diluted share count. We believe this to be the case because GitLab is exceptionally well-funded, with ~$1B in net cash, and, by the time it might need to further raise cash, it will be free cash flow positive. That said, because there’s a low likelihood that GitLab will need to raise cash again in the future, and because we’ve chosen to use its fully diluted share count, we see effectively zero shareholder dilution risk in the future. |

Concluding Thoughts

As of today, we plan to continue to monitor GitLab, as it reports the next few quarters.

We’re not in any rush to purchase the company because it presently trades at an EV/sales of 31x, which is incredibly expensive. On a forward 12 mo. basis, it trades at an EV/sales of about 18x, which is still incredibly expensive, considering GitLab will probably trade at 5x to 10x EV/sales over the long run. This implies that we will necessarily spend years waiting for GitLab’s growth to catch up to its sales. At its current valuation, there’s also very scantly a margin of safety, and, over the coming 6 months, I believe the market will price this reality in, bringing GitLab closer to $30/share, at which time we plan to happily buy the company.

Even with its incredible growth, GitLab still possesses a rather challenging valuation.

Should GitLab return to ~$30-$35/share, we will unequivocally place a bet on the company. For now, we simply plan to monitor its quarterly reports as it grows into its valuation. Barring further rampant speculation by the market (highly, highly unlikely), GitLab will not be ascending into the heavens any time soon; therefore, we have time to observe its reports and begin accumulating shares of this incredibly promising and mission critical platform.

Thank you for reading, and have a great day!

Be the first to comment