Khanchit Khirisutchalual/iStock via Getty Images

With the direction of the market for the remainder of this year still unclear (will we continue seeing a correction, or is a rebound in store for us? Investors are divided into two camps here), it’s never a bad idea to remain partial to value stocks. The correction in the tech sector that we’ve seen over the past two quarters has certainly turned a lot more growth stocks into value names as well, but that doesn’t make any less attractive the value stocks that have been quietly chugging along and putting up solid numbers despite getting very little attention from most investors.

Model N (NYSE:MODN) falls into this category. Model N, for investors who are unfamiliar with the name, is a revenue management software company. It is what we would consider a “verticalized” play, as it does business exclusively with life sciences and technology companies. Though a seemingly small market, Model N has continued to achieve strong >20% y/y revenue growth through both organic expansion and acquisitions, in particular by absorbing a Business Services unit from Deloitte to expand its professional services practice and more seamlessly onboard clients.

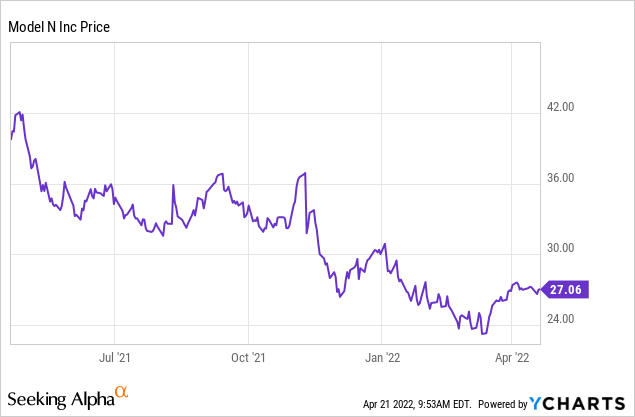

Year to date, shares of Model N are down -11%, which is a more modest loss than most growth stock peers. Since mid-March, however, the stock has been in an uptrend, indicating potential room for a further rebound:

I will admit that directly versus last year, I am less enthusiastic about Model N’s prospects versus other value stocks. So many other SaaS companies have become drop-dead value names (a non-exhaustive list here includes Zoom (ZM), C3.ai (AI), and Twilio (TWLO) – all heavy-hitting investor favorites before 2022’s undue pessimism got in the way) that Model N’s relative uniqueness as a bargain-basement stock no longer stands out of the crowd. That being said, in a vacuum and in isolation, I am still bullish on Model N. This is a company that balances all the things safety-oriented investors want: consistent and reliable double-digit growth, recurring revenue, double-digit adjusted EBITDA margins, and attractive value.

For investors who are newer to this stock, here’s a recap of what I consider to be the bullish drivers for this company:

- More and more software companies are adopting a vertical playbook. Large portfolio software companies (the largest two are Salesforce.com (CRM) and Oracle (ORCL)) have adopted a strategy of building or acquiring vertical-specific clouds in recent years to distinguish themselves from competitors. Companies in the life sciences and semiconductor sectors have specific requirements, and Model N’s mindshare in that space gives it an edge over more generic software products.

- Model N serves growth industries. Needless to say, Model N’s growth is largely predicated on the attractiveness and growth prospects of its end-markets, and luckily for Model N, its clients are all innovation-sector companies that should exhibit the strongest growth of any other industry.

- The interest in verticalized software may lead to an M&A exit for Model N. Sitting at such a small market cap, Model N is the perfect bolt-on acquisition for a larger software company looking to gain an edge in its industries. For example, a few years back Salesforce bought a company called Steelbrick for $360 million to increase its footprint in heavy manufacturing clients. These types of acquisitions make sense for a company like Salesforce because it can lead new prospects with the vertical-specific product, and later on, cross-sell something else from its vast portfolio.

- Building up a subscription base. Model N is becoming a more reliable, SaaS-driven business. In its most recent quarter, Model N achieved 21% year-over-year growth in subscription revenue, which is quite an incredible achievement for a company with such a low profile and valuation. It has a target of continuing to grow ARR at a 20% y/y pace through 2022.

- Large-cap client focus. Despite being little known to the average person, Model N’s client base includes some of the most recognizable companies in the industries it serves.

- Profitability. Model N has notched an adjusted EBITDA margin in the mid-teens, which is also an anomaly for software companies of its relatively small scale.

A quick checkup on valuation: at current share prices near $27, Model N trades at a market cap of just $1.00 billion. After netting off the $155 million of cash and $127 million of debt on the company’s most recent balance sheet, its resulting enterprise value is $972 million.

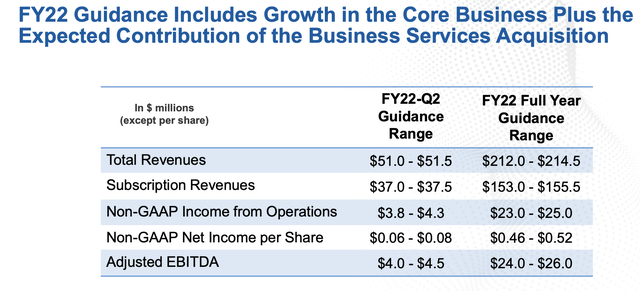

Meanwhile, for the current fiscal year FY22, the company has guided to $212-$214.5 million in revenue:

Model N FY22 outlook (Model N Q1 investor presentation)

Against this outlook, Model N trades at 4.6x EV/FY22 revenue – a cheap, low-single digit revenue multiple that should leave quite a bit of room for upside.

The bottom line here: no, Model N is not the most exciting software stock in the market, especially since so many former high-fliers have joined it in the value camp. That being said, Model N is still a proven quantity with solid execution and cheap value, so staying long here doesn’t hurt.

Q1 download

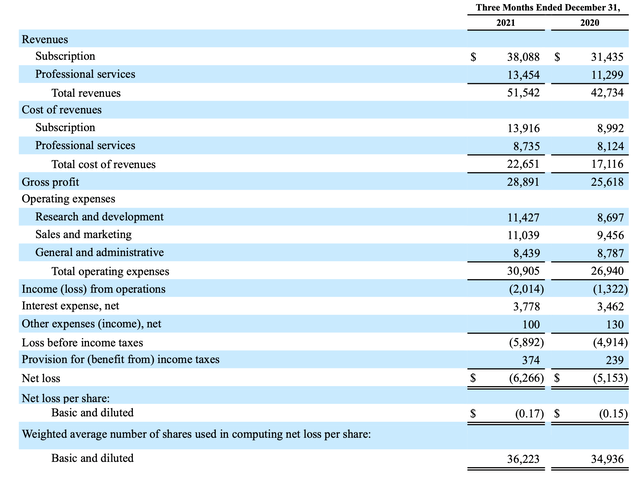

Let’s now discuss Model N’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Model N Q1 results (Model N Q1 earnings release)

Model N’s overall revenue grew 22% y/y in the quarter to $51.5 million, beating Wall Street’s expectations of $49.9 million (+17% y/y) by an impressive five-point margin. We do note, however, that revenue growth did decelerate two points versus 24% y/y growth in Q4.

The company characterized Q1 as the strongest quarter for bookings in its history, while it also made progress toward its goal of migrating more legacy on-prem customers to the cloud. Here’s some helpful go-to-market results commentary from CEO Jason Blessing’s prepared remarks on the Q1 earnings call:

Q1 was the best gross bookings quarter in the Company’s history. As we’ve noted over the past few quarters, we have a strong pipeline and this is encouraging to see this convert to booked business.

All of our growth levers contributed to our strong quarter as well as continued growth in pipelines. To recap, our strategic growth levers are SaaS transitions that occur as we move our on premise customers to the cloud, cross-selling up-sell to our existing customers, new logo acquisition and finally international expansion.

In short, we had a great start and we feel good about the year ahead. A few months, we’ve closed four SaaS transitions. As discussed on the last call, we expect this to be a pivotal year as we start projects to move a substantial part of our remaining on premise customers to the cloud […]

Q1 demonstrates continued momentum in our SaaS business. Given the success we are seeing with SaaS transitions, we also continue to see our maintenance declined at an accelerating rate compared to recent levels. We view this as a positive as it is evidence that our strategy to recast Model N as a cloud company is working.”

The company also noted that it achieved a 119% net revenue retention rate in the trailing twelve months, versus a target of ~110% (which would be in line with most software peers). This indicates that the average customer is expanding their spend on Model N by 19% in the following year, suggesting strong traction in upsells – a core strength indicator for SaaS businesses. Model N also reiterated its target of continuing to grow ARR by ~20% y/y, driven by expansion, new logo adds, and converting clients to cloud.

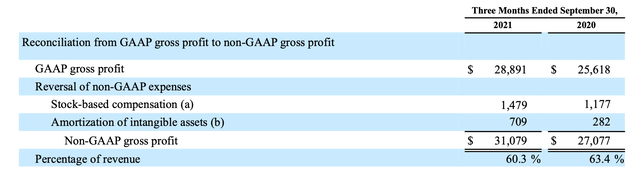

One black eye in the quarter was gross margin, which fell 300bps from 63.4% in the year-ago quarter to 60.3% in the current quarter:

Model N gross margins (Model N Q1 earnings release)

The company blamed revenue mix here, with the contribution from Deloitte’s business services coming in at a lower gross margin than its core software products, which are still generating mid-70s gross margins. The one positive note here is that professional services margins, which many software companies perform at a loss, saw improved gross margins to 39.7%, roughly six points better than the year-ago quarter.

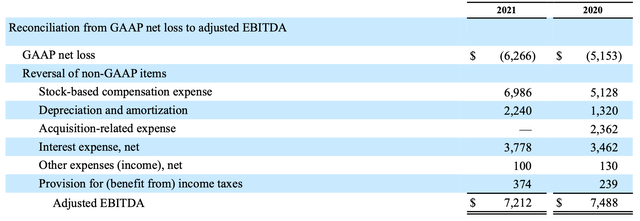

Similarly, Model N’s adjusted EBITDA was approximately flat y/y in dollar terms, but the $7.2 million in adjusted EBITDA this quarter represents a weaker 14.0% margin, versus 17.5% in the year-ago quarter.

Model N adjusted EBITDA (Model N Q1 earnings release)

Key takeaways

With consistent growth, the tailwind of a SaaS transition underneath it, positive adjusted EBITDA, and upbeat commentary about sales momentum so far for the start of FY22, there’s no reason not to stay invested in Model N at a <5x forward revenue multiple. I continue to believe this stock is worth a small long position, though I will say that I’d focus larger chunks of my portfolio on the more beaten-down SaaS names like Zoom.

Be the first to comment