Khanchit Khirisutchalual/iStock via Getty Images

Investment Thesis: As life insurers may decide to increasingly avail of reinsurance policies to guard against further losses as well as attract further premiums by allowing customers to guard against the effects of inflation – Reinsurance Group of America seems in a good position to increase its net premiums under the current environment.

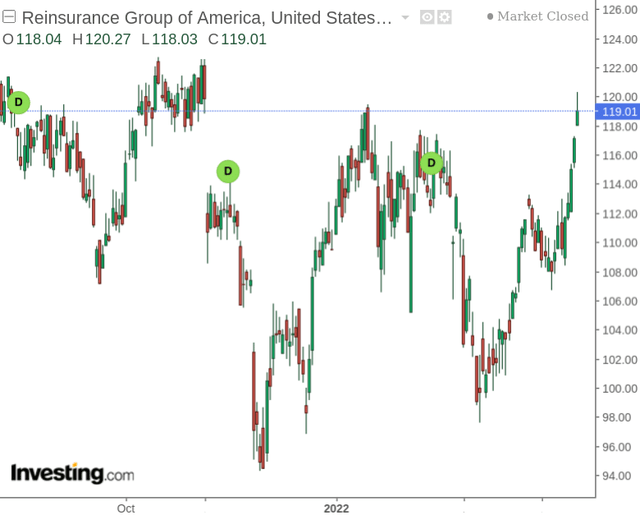

In a previous article last August, I made the argument that Reinsurance Group of America (NYSE:RGA) seemed to be fairly valued at a price of $120.

My reason for making this argument was that the stock seems to be trading at fair value on the basis of historical earnings growth, and that significant growth in earnings would need to occur to justify further upside.

Since then, we have seen the stock see some downside, but price has remained largely unchanged from levels seen last August:

The purpose of this article is to investigate whether the stock could see upside from here, taking into account both recent performance and the current inflationary environment.

Performance

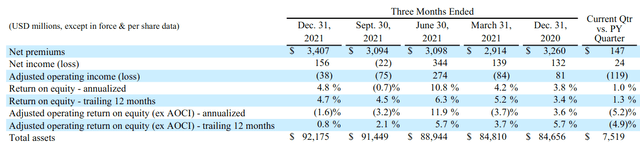

When looking at the most recent quarter, we can see that net premiums are up by nearly 5% from the same period last year:

Reinsurance Group of America: Fourth Quarter 2021

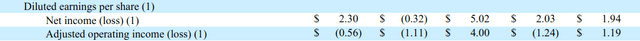

Additionally, diluted earnings per share is up to $2.30 from $1.94 in the previous year:

Reinsurance Group of America: Fourth Quarter 2021

From a balance sheet standpoint, the ratio of cash and cash equivalents to long-term debt was 0.95 in December 2020, while this ratio had decreased to 0.80 in December 2021. While the ratio has decreased – long term debt itself is up by just over 2% from the same period last year, so a slight decrease in the ratio is not especially concerning as the company still seems to be in a good position to cover its liabilities.

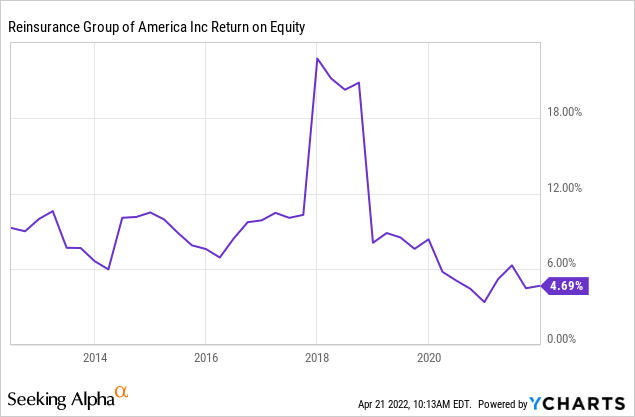

With that being said, the return on equity for Reinsurance Group of America is currently trading near a 10-year low:

ycharts.com

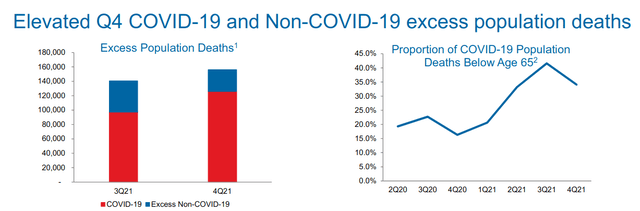

While excess deaths from COVID-19 understandably contributed to a larger degree of insurance payouts than usual – a rise in non-COVID death claims has also placed some pressure on the industry.

Reinsurance Group of America: 4Q21 Earnings Presentation

This may be a significant reason for the drop in return on equity – the company brought in less net income as a percentage of shareholder’s equity, as the former came under pressure as a result of increased claims.

Looking Forward

When considering the current inflationary environment and its effect on the life insurance industry – life insurers are generally more shielded from the effects of inflation as compared to insurance companies that specialize in other businesses.

The reason for this is that liabilities for life insurers are typically set in nominal terms – meaning that the costs of insuring claims in the future do not rise with inflation. However, the flip side of this is that rising medical costs could also increase competition in the marketplace by encouraging customers to switch provider more frequently in order to ensure that a policy can adequately cover medical costs in the future.

However, as a reinsurance company – Reinsurance Group of America helps life insurance companies to diversify their own risk by funding claims in return for premiums. In this regard, the company could be in a good position to benefit in an inflationary environment as life insurers may decide to increase their reinsurance policies to guard against losses from excess deaths in the future. This is especially the case if such companies decide to provide indexation options, whereby the life insurance company allows the policyholder to increase their cover in line with inflation in return for an increased premium.

However, since this increases the risk to the insurance company in terms of higher costs – reinsurance services allow the company to diversify that risk.

From this standpoint, Reinsurance Group of America could see itself thriving in an inflationary environment – provided that overall life insurance demand remains robust and excess deaths start to approach more normal levels post-COVID.

Conclusion

To conclude, Reinsurance Group of America has come under pressure over the past couple of years in significant part due to excess deaths caused by the COVID-19 pandemic. However, as life insurers may decide to increasingly avail of reinsurance policies to guard against further losses as well as attract further premiums by allowing customers to guard against the effects of inflation – Reinsurance Group of America seems in a good position to increase its net premiums under the current environment.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment