peshkov/iStock via Getty Images

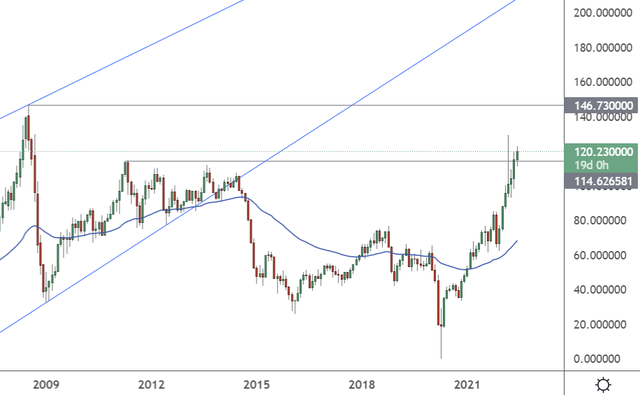

The CEO of Trafigura recently warned of parabolic oil prices due to imbalances in the market. Goldman Sachs also see oil prices hitting $140. I recently told my marketplace subscribers that oil was going back above $114 and we now trade at $120. I feel that oil will test its all-time high at $148 and there is clear space above there for the real parabolic move.

Trafigura and Goldman Sachs see oil at $140 or more

The CEO of Trafigura Group, Jeremy Weir, recently warned that oil prices could go “parabolic” in the future.

“We have got a critical situation. I really think we have a problem for the next six months. … Once it gets to these parabolic states, markets can move and they can spike quite a lot,” Weir said.

“If we see very high energy prices for a period of time, we will eventually see demand destruction,” he added. “It will be problematic to sustain these levels and continue global growth.”

JPMorgan (JPM) CEO Jamie Dimon joined the chorus of doom last week with a warning of an economic “hurricane.”

Dimon said that in the market, we “have unintended consequences, and this happens to be within the commodity markets of the world wheat, oil, gas and stuff like that, which, in my view, will continue. We’re not taking the proper actions to protect Europe from what’s going to happen in oil in the short run, and we’re not taking the proper actions to protect you all. … It almost has to go up in price.”

Goldman Sachs have also said in a recent investment report that they see Brent crude oil prices at $140.

“A large spike in prices remains quite possible this summer,” Goldman Sachs strategists said.

I actually believe we will see higher prices as the all-time high in crude was at $148 in 2007. If prices get to $140, which looks likely on current technical analysis, then they will almost certainly test the $148 level and the price has the potential to create its parabolic squeeze above that level.

Oil was rejected at the $120 spike high but soon settled below $114 and I told subscribers to prepare for the next move higher. When a market fails to correct from that type of rejection it shows clear buy support.

Jeremy Weir of Trafigura is correct. We face a critical situation over the next months and I expect to see oil hit the previous highs sometime this year. The technical projections above show that $200 is an easy target and that resistance moves slightly higher through 2023.

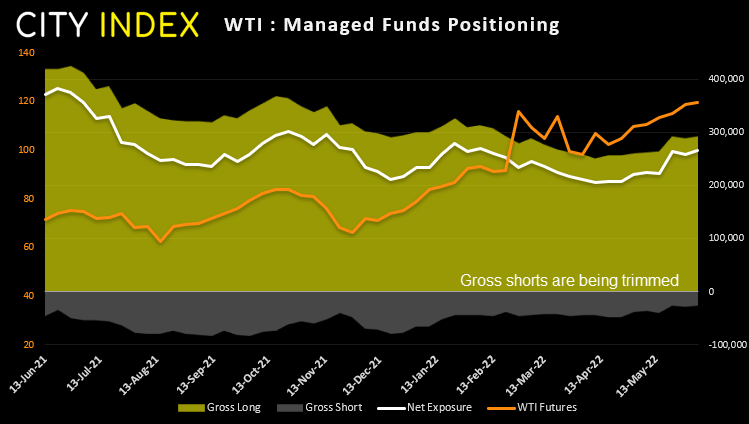

Oil Futures Positioning (City Index)

Oil futures positioning also shows that shorts are being trimmed so maybe the path overhead will have little resistance.

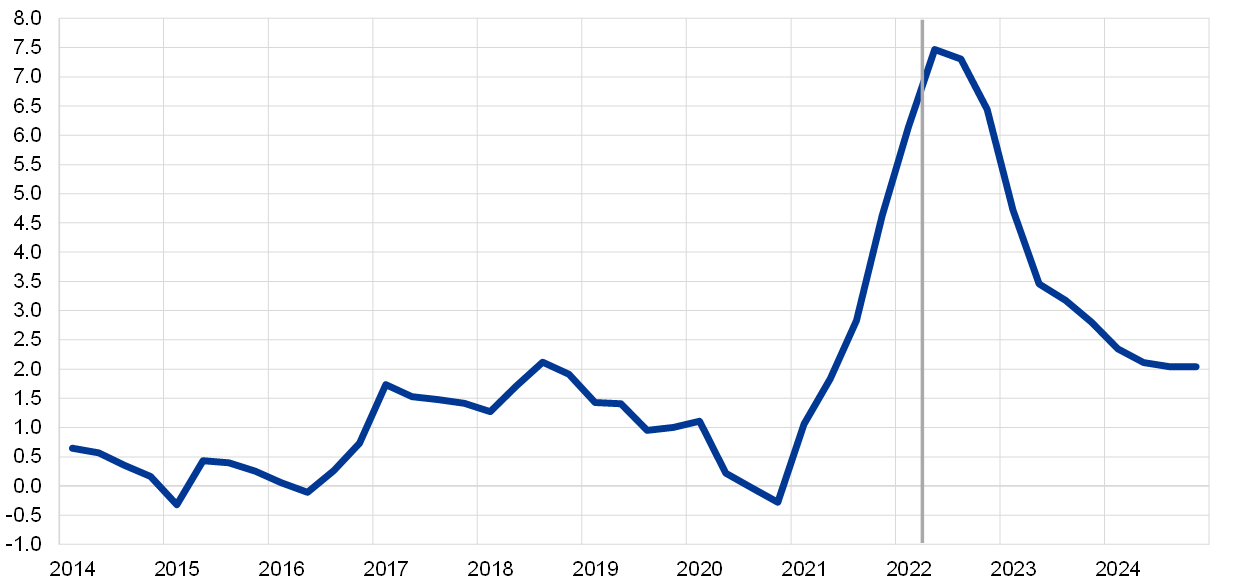

Central bank projections are more rosy

The European Central Bank outlined its rate hike path this week to deal with soaring inflation and the bank’s projections are once again out of touch with reality.

Inflation in the eurozone is projected to be 6.8% this year, with a prediction for the rate to slide to 3.5% in March before, miraculously, falling to 2.1% 2023. That is conveniently 0.1% above the bank’s target rate and the numbers seem more like an attempt to reduce the level of criticism being levelled at policymakers. The ECB also expects to achieve that end result with a 0.25% interest rate hike in July, followed by a potential 0.25% or 0.5% hike in September. The banks are so far behind the curve compared to other banks and recently we have seen spreads blow out against German bonds for the troubled states of Greece and Italy.

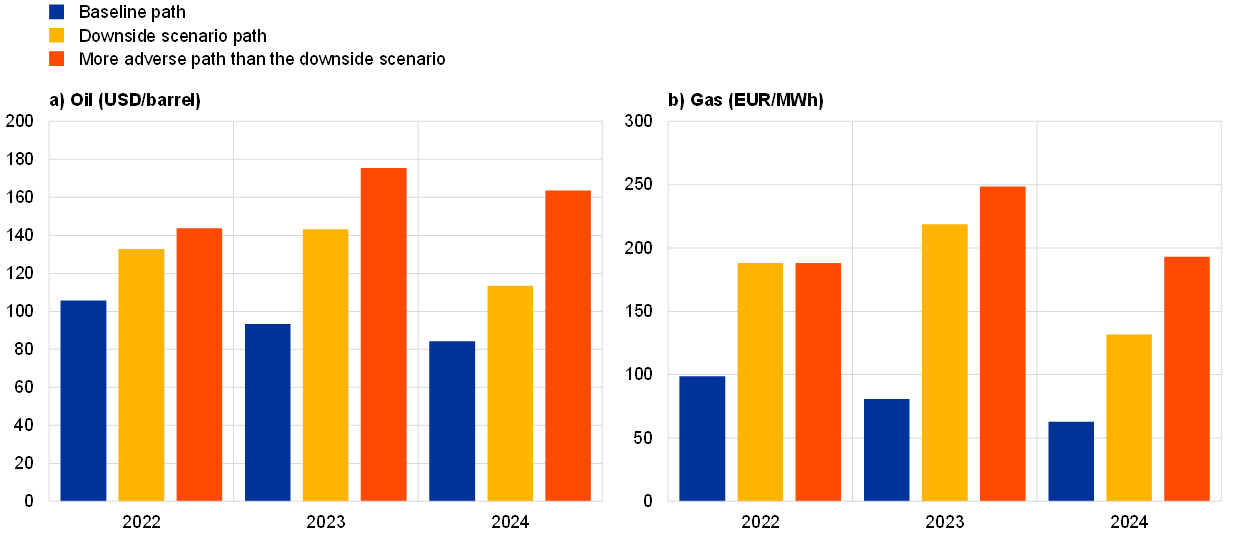

Painfully, the ECB also admits that energy prices are the key driver to inflation, so their projections are obviously based on a return to the historical averages in oil.

“Energy inflation is projected to start receding notably towards the end of 2022 owing to negative base effects and assumptions of a downward-sloping oil price futures curve,” the ECB said in its recent June macroeconomic projections.

Inflation could hit 15% in the US; ECB wrong again

The former Chief Economist at the ECB, Otmar Issing said in a recent article that the central banks were still “waiting for Godot” and had made, “probably one of the biggest forecast errors made since the 1970s,” in its forecast for transitory inflation and a move back below 2%.

The Central Bank still thinks that the current problems are somewhat transitory and Issing added:

“The pandemic, as a combination of supply and demand shock, entails a persistent negative shock on output potential and is a major source of structural problems,” and that, ” traditional models are unable to take substantial structural changes into account.”

That is why the central banks are getting it wrong on inflation and will be hurt in the coming year. Using their best and worst case scenarios, the European Central Bank sees a worst case oil price of around $170 in 2023 and $165 in 2024.

Oil and Gas Price Predictions (ECB)

The European Central Bank posted a beautiful chart in its recent projections which highlight inflation falling off a cliff from their current parabolic rise.

ECB Inflation Projection (ECB)

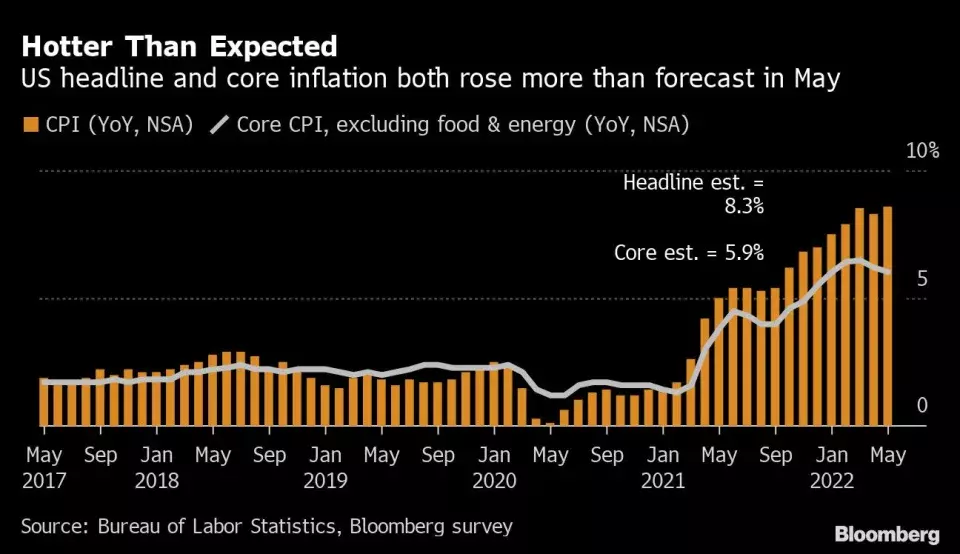

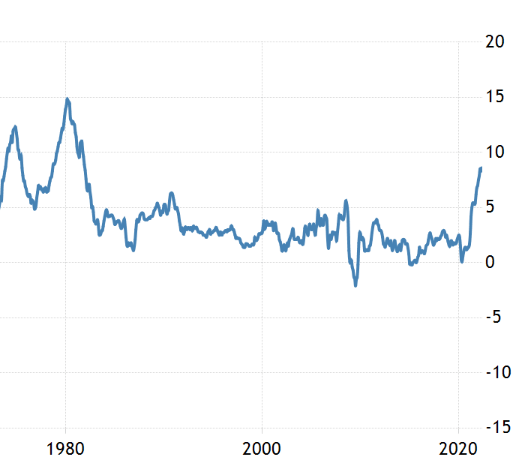

In the United States, the latest inflation forecast hit 8.6% for the highest level in 40 years.

US Inflation (Bloomberg)

If we go further back on a technical basis to late 1979 we can see resistance around the $10 level but inflation could go to 15% with the current headwinds.

US Inflation Rate (Trading Economics)

The Federal Reserve is expected to hike by 50bps at their next meetings in order to tackle the situation as food prices and wage growth are starting to make the problem worse.

Moody’s Analytics economist Mark Zandi drew a line in the sand at $150 oil for the US economy, saying:

“If oil prices go to $150, we are going into recession. There is no way out.”

US inventories highlight a supply crunch

The latest inventories data from the US shows that crude and gasoline levels had dropped. Cushing inventories fell by 1.59 million barrels last week, according to the EIA. Gasoline demand is also rising despite prices in the US hitting a record of $5 per gallon. The EU ban on refined petroleum products from Russia is leading to a supply squeeze on diesel.

The market has also been spooked by a proposed EU ban on refined products out of Russia and that could be the driver for a parabolic move higher in energy prices.

“The possibility that these sanctions or other potential future sanctions reduce Russia’s oil production by more than expected creates upward risks for crude oil prices during the forecast period,” according to the EIA.

Russia currently supplies 7 million barrels of oil per day from the global demand of almost 100 million barrels daily. So, 7-10% of daily consumption will need to find a new seller and that would worsen the current squeeze.

Last week saw OPEC lifting its production levels but countries are struggling to meet their targets. OPEC said it will raise output by 648,000 barrels a day in July and August. The group says that it cannot supply anything more after taking Russian production out of the equation.

Conclusion

Markets hoped that May had signaled the peak in inflation but they were wrong. All signs now point to higher inflation into the year-end with a potential 15% in the United States if oil spikes higher into 2023. Central bank projections for the EU see a worst case oil price of $170 in 2023 and $165 in 2024, but the CEO of Trafigura has warned of the risk of a parabolic spike higher. As OPEC fails to add production, and US supplies are tight, Europe could drop a sledgehammer on the market with an embargo on Russian oil imports and that could be the driver for oil to reach the previous highs at $148. As shorts are being reduced there is likely little resistance to stop a test of $150 and a move above that level will bring the parabolic risk.

Be the first to comment