urbancow

Given how prevalent vehicles are across the globe, it stands to reason that there would be a massive network of industries that all cater to them. At the very core of the industry exists automotive parts distributors. These are companies that, through retail locations and distribution centers alike, make available to customers various automotive parts. One great firm in this market is Genuine Parts Company (NYSE:GPC), a rather large enterprise with a market capitalization of $22.28 billion as of this writing. The company also provides industrial parts and even offers services to equipment and machine companies across the industrial space. Recently, financial performance achieved by the company has been incredibly impressive. From a fundamental perspective, there is no denying that the company is a strong prospect that will likely fare well in the long run. Having said that, I also do believe that, between shares rising recently and changing market conditions, the truly easy money for investors has been made. While I am bullish on the business long term, I do think that a more appropriate rating for the company at this moment is a ‘hold’, reflecting my belief that it’s likely to generate returns that more or less match the broader market for the foreseeable future.

Great performance pushed shares higher

Back in early July of this year, I wrote a bullish article about Genuine Parts Company. In that article, I expressed how impressed I had been by how nice the company’s run had been over the prior months, with shares rising in response to strong fundamental performance. Even at that time, however, I did say that the easy money had already been made. But given how shares were priced, I did still believe that some upside potential was still on the table. This led me to reiterate my ‘buy’ rating on the company, reflecting my belief that it would likely still continue to outperform the broader market moving forward. Since then, the company has delivered, with shares generating a profit for investors of 14.3%. That’s at a time when the S&P 500 has been down by 4.8%. This is no doubt an impressive return. However, I did previously write an article about the company even before that, dated September 6th of 2021. In that article, I gave the company my initial ‘buy’ rating. From that date through today, shares have generated a profit for investors of 29.6% compared to the 19.8% drop the S&P 500 experienced.

This increase in share price has not been without cause. When I last wrote about the company, we had data covering through the first quarter of the firm’s 2021 fiscal year. Fast forward to today, and we now have data covering the second quarter as well. During that quarter, sales came in at $5.60 billion. That’s 17.1% higher than the $4.78 billion generated the same quarter just one year earlier. According to management, this increase in revenue was driven by a mixture of factors, including an 11.5% rise in comparable sales and an 8.8% benefit from acquisitions the company had made. Sales would have been higher had it not been for foreign currency fluctuations, something that offset sales to the tune of 3.2%. The Automotive Parts Group unit to the company salt revenue rise a more modest 8.5%, thanks largely to an 8.4% increase in comparable sales. Meanwhile, the Industrial Parts Group portion of the enterprise reported a 34.5% increase in revenue, driven by a 17.6% benefit from the acquisition of KDG and a 17.8% improvement in comparable sales.

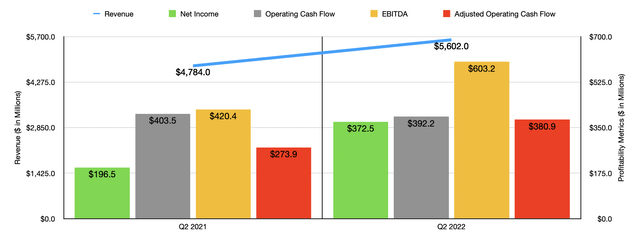

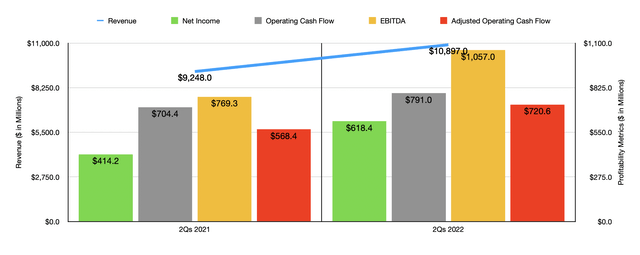

This strong increase in revenue brought with it great profitability. During the quarter, net income came in at $372.5 million. That dwarfs the $196.5 million reported in the second quarter of the 2021 fiscal year. This drastic improvement in profitability came even as the company’s gross profit margin declined from 35.3% to 35%. The real benefit then came from a decrease in operating expenses, which dropped from 29.9% of revenue to 25.9%. Other profitability metrics followed suit, with the exception of operating cash flow. This metric went from $403.5 million in the second quarter of 2021 to $392.2 million in the second quarter of this year. But if we adjust for changes in working capital, it would have risen from $273.9 million to $380.9 million. Meanwhile, EBITDA for the company also improved, jumping from $420.4 million to $603.2 million. As can be expected, this strong fundamental performance, on both the top and bottom lines, during the second quarter was instrumental in helping to push up total results for the entirety of the first half of 2022 relative to the 2021 fiscal year. These figures can be seen in the chart above.

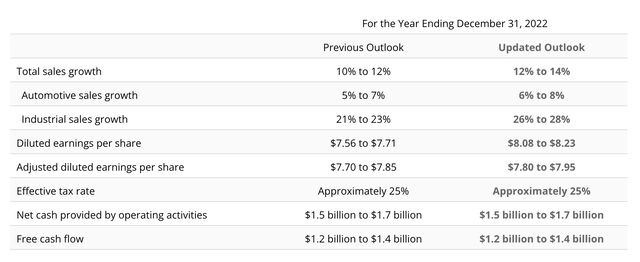

When it comes to the 2022 fiscal year as a whole, management has high hopes for the company. For instance, revenue is now forecasted to come in between 12% and 14% higher than it was in 2021. At the midpoint, that would translate to revenue of $21.32 billion. This is also higher than the 10% to 12% increase in sales management previously anticipated. Adjusted earnings per share should be between $7.80 and $7.95. Previously, that was forecasted to be between $7.70 and $7.85. At the midpoint, this would imply adjust to net income of $1.12 billion. Operating cash flow guidance has remained flat at between $1.5 billion and $1.7 billion. Unfortunately, no guidance was given when it came to EBITDA. But if we assume that it will increase at the same rate that operating cash flow should, then we should anticipate a reading of $1.86 billion for the year.

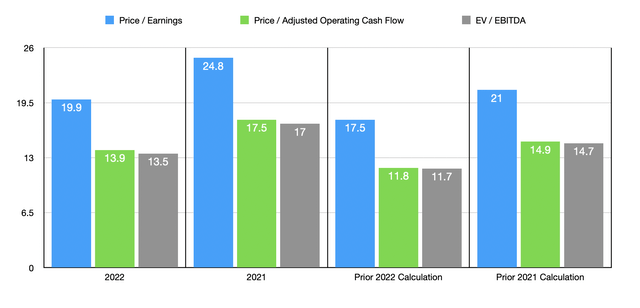

Given these figures, we can see that the company is trading at a forward price-to-earnings multiple of 19.9. On a forward price to adjusted operating cash flow basis, the multiple should be 13.9, while the EV to EBITDA multiple should come in at 13.5. If, instead, we were to rely on the data from the 2021 fiscal year, these multiples would be 24.8, 17.5, and 17, respectively. Irrespective of which year we rely on, shares do look more expensive than when I last wrote about the business, as can be seen in the chart above. As part of my analysis, I also compared the company to five similar firms. Using our 2021 data for comparison purposes, I calculated that these companies are trading at price-to-earnings multiples of between 16.4 and 26.1. Their price to operating cash flow multiples are between 12.9 and 28.9. In both scenarios, four of the five companies are cheaper than Genuine Parts Company. Using the EV to EBITDA approach, the range is between 11.3 and 16.5, with our prospect being the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Genuine Parts Company | 24.8 | 17.5 | 17.0 |

| AutoZone (AZO) | 20.4 | 12.9 | 13.6 |

| LKQ Corp (LKQ) | 16.4 | 13.1 | 11.3 |

| Advance Auto Parts (AAP) | 25.2 | 13.9 | 14.0 |

| O’Reilly Automotive (ORLY) | 22.7 | 15.3 | 15.6 |

| W.W. Grainger (GWW) | 26.1 | 28.9 | 16.5 |

Takeaway

Based on the data provided, it seems to me as though Genuine Parts Company has done a fantastic job recently and that the trend is likely to continue from a fundamental perspective for the foreseeable future. If we were in more normal market conditions, I would still keep my ‘buy’ rating on the company. But considering how things are at this moment, I do think that downgrading GPC stock to a ‘hold’ would be more appropriate.

Be the first to comment