DNY59

Thesis

Nothing has been able to stand in the way of Fed Chair Jerome Powell’s hawkish stance over the past year, even for leading business development company Owl Rock Capital Corporation (NYSE:ORCC).

The market also went into a selling frenzy on ORCC over the past four weeks, breaking toward lows last seen in April 2020. However, we postulate the capitulation move has created an attractive reward-to-risk profile for investors able to tolerate near-term downside volatility.

Notwithstanding, the de-rating in ORCC is justified, as the market needs to factor in a worse-than-expected recession that could significantly impact the valuations of its portfolio companies. Owl Rock Capital maintains that its focus on non-cyclical portfolio companies should help mitigate the risk in the credit profiles through the cycle.

However, we don’t think any company can be immune to a global downturn. Therefore, the market is right to de-risk Owl Rock Capital’s execution risks through FY23, which could significantly impact its net asset value (NAV) per share.

Despite that, management is confident that its portfolio income would continue to be lifted by the Fed’s aggressive rate hikes cadence through 2023, which should mitigate the increase in its funding costs. However, its originations have slowed down markedly through Q2.

Moving forward, a further drop in its portfolio value could affect the company’s ability to recycle its capital into other investments as its repayments continue to be hampered by worsening macros. Hence, investors need to prepare for tepid growth in its net investment income (NII) per share through the cycle, as its portfolio companies would likely be looking at conserving capital, given the market dislocation in non-private debt financing.

Still, we like ORCC’s attractive valuations, coupled with constructive price action that suggests a potential consolidation zone following the recent capitulation.

We rate ORCC as a Buy and encourage investors to start layering in and ride through the downturn with Owl Rock Capital.

Preparing For A Global Recession Amid An Increasingly Hawkish Fed

In its Q2 earnings call, management accentuated that it has been preparing for an economic recession as a responsible manager of credit. Notwithstanding, the company is seeing more opportunities to invest through the cycle, as the non-private market debt financing was dislocated, given the recent market volatility.

Accordingly, its strong liquidity position ($1.7B), coupled with relatively low leverage (debt/equity: 1.2x), has allowed Owl Rock Capital to capitalize on higher spreads, driving its NII. However, the company also highlighted that further drops in valuations for its portfolio companies would impact its target leverage ratio, hampering its ability to make more accretive originations through the cycle.

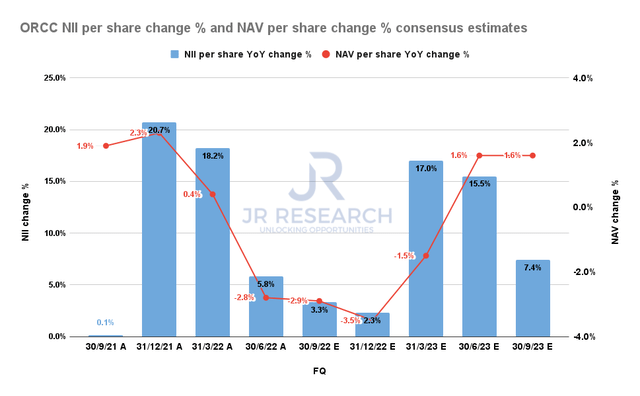

Owl Rock Capital NII per share change % and NAV per share change % consensus estimates (S&P Cap IQ)

Despite that, its ability to capitalize on the Fed’s hawkish posture should still see it capture upside benefits to its NII per share growth (as seen above) through H1’23 before moderating (99% of its debt investments are based on floating rate terms). Therefore, we postulate the earnings visibility should valuation support at the current levels, given the battering in ORCC.

However, the NAV impact could further hamper its originations cadence, and investors should expect ORCC to continue trading within a consolidation zone in the near term. It would be challenging for investors to analyze when the market would decide to re-rate ORCC as it anticipates an improvement in the economy after the current downturn.

However, the Fed is confident its actions will lead to markedly lower inflation in 2023 as it strengthens its inflation-fighting capabilities this year. Federal Reserve Bank of New York President John Williams accentuated:

We’re all working on our own to make the decisions to bring the economy back into balance. But most importantly, I see inflation coming down significantly next year. I do see us on the right trajectory of the economy slowing somewhat, and at the same time bringing inflation down over the next couple of years. – Yahoo Finance

ORCC’s Valuations Have Been Battered

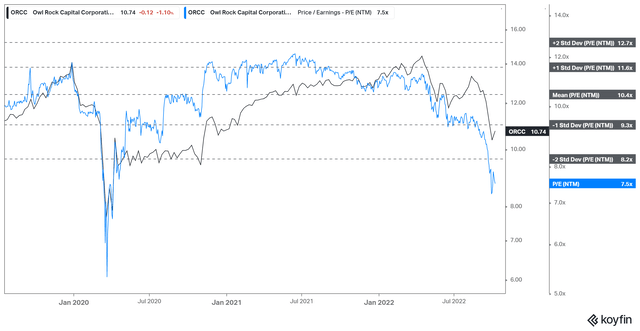

ORCC NTM NII per share multiples valuation trend (Koyfin)

As seen above, the recent battering in August sent ORCC’s NTM NII per share multiples below the two standard deviation zone under its mean. Therefore, we are confident that the selldown has likely de-risked its near-term execution challenges through the economic recession.

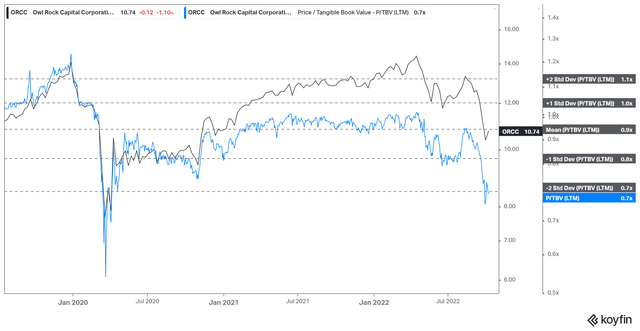

ORCC TTM TBV multiples valuation trend (Koyfin)

Furthermore, its TTM tangible book value (TBV) multiples have also collapsed to the two standard deviation zone under its mean. Notably, ORCC’s TTM P/TBV of 0.7x is at levels last seen in 2020. Hence, we deduce that the market has likely reflected the headwinds discussed earlier in its current valuations.

Is ORCC Stock A Buy, Sell, Or Hold?

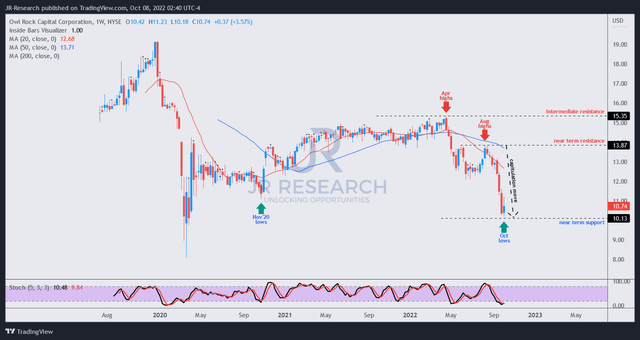

ORCC price chart (weekly) (TradingView)

The capitulation move over the past four weeks from its August highs sent ORCC tumbling nearly 30%, as it underperformed the market significantly.

The steep selloff has also taken out bullish investors all the way back toward April 2020, including the support zone seen in November 2020. We believe the market forced the selling, which likely triggered an avalanche of panic sellers rushing to bail out rapidly as they saw their gains dissipate, given the extent of the selloff.

However, that move has improved the reward-to-risk profile for ORCC significantly, as the stop losses of bullish investors over the past two years have been taken out in a hurry.

Coupled with attractive valuations, we believe the opportunity to add exposure in ORCC at the current levels is appropriate, despite the looming recession. However, investors are reminded that we continue to expect near-term downside volatility, so layering in is encouraged.

We rate ORCC as a Buy.

Be the first to comment