Funtap/iStock via Getty Images

Author’s Note: This article was published on iREIT on Alpha back in January of 2022, on the 24th. While the pricing situation for the company has currently changed, my long-term targets have not. I view the company as anti-fragile in the long-term, and one of the companies you could buy and hold forever.

SAP (SAP) is a giant with plenty of potential upside and appealing fundamentals, even for NA/US investors. In this article, I’m going to show you every last one of these significant upsides, and why this company is a permanent fixture (to some degree) in my core portfolio.

SAP Logo SAP Corporate

Looking at SAP

SAP is a German multinational IT company with a very liquid ADR listing. It’s a company that develops enterprise software, programs, and processes that manage business operations and customer relationships for large and small companies.

Its primary product is its so-called ERP software – Enterprise Resource Planning – which is one of the core issues many companies have. It also offers database software, cloud, human capital management software, customer relationship management, performance measurement software, and supply chain software. Basically – a business does it, and SAP likely has some sort of solution for it.

ERP provides an integrated and continuously updated view of core business processes using common databases maintained by a database management system. ERP systems track business resources—cash, raw materials, production capacity—and the status of business commitments: orders, purchase orders, and payroll.

(Source: Wikipedia)

As you might imagine, based on that description, many companies rely on this sort of software to keep up with the variety of internal and external processes involved in the company.

SAP is the third-largest software company and the largest German company in terms of market capitalization. The acronym SAP is German for Systemanalyse und Programmentwicklung, literally translating to System Analysis and Software Development.

It’s a business founded as a private partnership back in ’72, and its headquarters are still found in Walldorf, with regional offices in 180 countries across the globe. The company employs over 100,000 people. Its size and capital structure dictate its A credit rating, and it has a long-term debt/capital of less than 23%.

I view SAP’s market leadership position in its primary segments of ERP as basically unapproachable by its peers. Its products and services are so ubiquitous among the Fortune 500 that beating out SAP is becoming a real issue for its competitors and peers. The company has over 440,000 customers across the world, and the recent IT trends of cloud transition will bring about lower volatility in the company’s revenues.

The reason for this is that on a high level, a software company like SAP has traditionally been reliant on license sales. The customer may have an option to pay extra for extra support and service – and most do – but it’s an incredibly front-loaded revenue model, with plenty of volatility.

The difference comes in offering subscriptions and SaaS model software, which SAP is now doing, and cloud is enhancing. These developments will flatten the peaks and remove some of the declines otherwise so inherent to such a company.

The company has some of the lowest debt funding costs overall, with financial debt interest rate including swap effects at between 0.87% to just below 1% at this time.

Let me share some fairly nutty numbers with you.

SAP handles 77% of all the world’s transaction revenues. Its geographical revenues hail from EMEA with 44% and Americas with a 41% split, making it one of the most appealingly diversified and solid IT businesses around. It is the absolutely undisputed leader of the ERP/EAS market, and its scalable license model produced COGS of less than 10%, meaning 90%+ gross margins and 80% on the maintenance/support level. While these were impressive numbers, they were also incredibly volatile and dependent on customer flow and specific timings of sales. That’s what the shift to the cloud model and a subscription-based revenue model is going to change. The migration to HANA began back in 2015 – but it’s likely, as current estimates show, that the transition should take until 2022-2023 to see full effects.

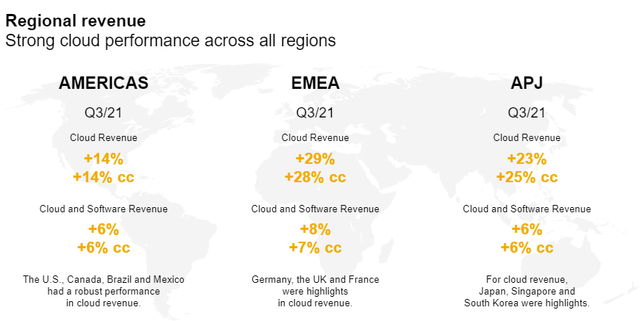

What this means is that growth is likely to be somewhat lackluster for at least 1-2 years. Cloud revenue has and is growing…

SAP Cloud Revenue Growth SAP Presentation

…and despite the COGS increase/GM decrease, we’re looking at a more appealing sales/product mix from a revenue stability perspective. As a comparison, license GM is still well above 88%, while GM for cloud, no matter what sub-segment you look at, won’t breach 80%. Service margins have declined to less than 23% during some quarters but are back up around 30% here.

This is the transition the company is currently in. This hasn’t slowed down company customer growth, which has expanded to 17,500 for S/4HANA (HANA stands for “High-Performance Analytics Appliance) from around 6,400 back in 2017. Key revenue numbers are excellent, with the latest numbers showing 20% YoY cloud revenue plus a 22% increase in the backlog, with a 46% increase in S/4HANA specific revenue and a 58% increase in this backlog.

In short, this is a company that unlike some other IT businesses (Atos) delivers on its growth estimates and targets.

The company has moved its mid-term targets to 2025 as late as 2020, and near-term trends of negative FX, lower pandemic demand, and harmonization of offerings require a higher amount of CapEx, which analysts including me need to account for.

On a high level, the company has already merged its cloud and software/license segment, and now reports Cloud/Software, Services, and the Training segment. Revenue is by far larger in Cloud/Software, with current estimates for a €27.5-€29 billion full-year revenue for the cloud/software segment alone in fiscal 2021.

In short, recent results have been excellent – and I belong to the analysts who have raised their estimates for 2022E SAP, now expecting EPS to bounce back to around €4.05/share, from the €3.95E I expect for 2021 (adjusted basis).

The dividend yield for SAP is meager. At a €1.85 2020 dividend and an expected €1.9 for 2022, the company yields around 1.63% – less than most inflation. Annualized RoR in this investment is expected to come primarily from capital appreciation.

This capital appreciation will be driven by:

- Cloud Migration and the completion of this, as well as harmonization CapEx wind-down once the process is complete

- Continued market dominance in relevant sectors.

- Ever-so-slight margin expansion on an operating margin level, as the company transfer more and more to SaaS.

Debt is expected to go up somewhat for the next few years, only to wind down in 2023-2025.

So – follow me here.

- SAP is one of the most significant IT businesses on earth. It’s fundamentally well-managed, has superb credit ratings, and has a solid balance sheet.

- Its recent years of business have reflected a shift to cloud/SaaS models of sales revenue. This is expected to flatten some of the cyclical trends revenues and earnings have seen.

- This development is expected to take substantially more time – at least 2-4 years for it to be realized fully.

- The recent trends are all positive, and the implications and forecasts for 2021E and going into 2022E are calling for growth, which I’ve modeled for in my valuation.

Risks & issues with SAP

No company is entire without its risk, and SAP does have some.

The primary risk I want to point to is the completion of its cloud objectives which will remain a drag on CapEx as well as resulting earnings and margins. Growth will be poor for as long as this remains, and in a tech-opposed market environment, even SAP will be dropping.

This means that if you expect to invest for the long term, there might be based on mid-term earnings forecasts and market sentiment, come better investment opportunities.

I would argue heavily that operating margins of above 30% on a company-wide base will only be made possible once this transition completes and SAP is more of a pure SaaS company. Based on current estimates, that’s 4 years off on the high end. At the same time, the declining revenues from licenses will be heavy hits on a YoY basis as they decline and flow over into cloud contracts. The effect on earnings will be noticeably, and will likely cause market movements as well.

Based on the current tech rotation and these risks, I would therefore currently view SAP as trading in a negative momentum/environment for the foreseeable future.

What other risks exist?

We can point to some historical trends that I’ve noticed with SAP when viewing their earnings reports and management comments.

SAP is sometimes slow on the uptake. I don’t know if it’s because of “German IT”, but SAP has been incredibly slow, almost last, in pushing SaaS/cloud revenue models to its operations. I’m sure this is based on a multitude of factors, but I can’t help but relate this to how often German companies are to adopt new ways.

Sometimes this is an incredible strength. Just because it’s new doesn’t mean it’s better. Germany has one of the strongest industries on earth, and I believe our conservative nature is an integral part of this.

However, sometimes it’s not as good – especially in areas like IT and software. SAP also grossly underestimated what effects COVID-19 would have on its transitions from legacy to cloud models.

It is in part because of these trends that SAP is now guiding for 2-4 years until things are back “on track”. 2020 results missed forecasts, especially on a quarterly basis, with profits showing massive red ink YoY. In fact, it was in 2020 that they pushed those mid-term targets forward because of FX impacts, environmental impact due to COVID, and finally admitting that increasing pace of transition.

Perhaps one way to characterize the risk or downside to SAP here is to consider it as the “oil tanker in the puddle” sort of thing. SAP, due to its size, is very slow in changing.

Lacking fundamental risk and what I would view as a lack of management risk overall, these are the downsides or risks I would consider relevant for SAP.

SAP is also a great dividend payor, that hasn’t cut or modified its dividend since at least 2001, and issued special dividends even after the financial crisis in 2011 (Source: SAP)

Valuations & Possibilities

All right – so now that we know what SAP does, how they’ve been doing and some of the risks, let’s look at the possibilities of investing in the company.

While the expectations to 2025 need to be recalculated according to management comments back in 2020, we can still see some growth for the company. However, both FY21 and FY22 are expected to be transition-type years with a modest cash flow growth rate.

SAP’s European peers include Dassault (OTCPK:DASTY), Sage Group (OTCPK:SGPYY), and Software AG (No Symbol). International competition includes Microsoft (MSFT) to some degree, Salesforce (CRM), Workday (WDAY), and a whole host of other new-brand “tech”/growth businesses. This makes valuing the company on an international or even EU basis hard, because P/E multiples, revenue multiples, sales multiples, and EBITDA multiples range all the way from sub-10X to above 46X and more. The spread between peers is massive.

I will argue based on SAP’s products and market share, that the company offers something that most of the mentioned peers do not offer. Based on this, comparing the business fairly to any other business is tricky.

I believe the best approach to take to come up with a fair value assessment is to apply discounts to SAP’s multiples on a public comp basis, and try to compare it to overall averages, as well as doing growth forecasts, Sum-of-the-parts analysis, and look at overall targets.

What can be said is that SAP has a very low cost of debt, and a WACC of around 7.58%, reflecting its cost of equity. Even considering not much growth compared to historical numbers either in EBITDA or in EBITDA margins (4-6%, compared to double-digit historical growth) and a 1-2% growth in CapEx/sales to reflect its transition from License to SaaS, we reach some very appealing implied value/share here.

I would argue that on a conservative DCF basis under these expectations and with pressured 2022-2025, SAP should be worth around €125-€129 for the native share, implying a DCF upside of a few percentages at least.

However, DCF isn’t everything, and certainly not for a software company. If we even start glancing at peers, we see competition trading at significant P/E premiums compared to SAP’s native 29.1X, or the ADR trades at a different P/E – around 18-19X – but also carries no more of a premium on a historical basis than 20X, which does imply a not dissimilar upside to the native.

Based on current estimates for the native, Equity analysts are calling for an EPS growth of less than 5% on average until 2023 (Source: Alpha Value), including a 12.4% YoY EPS drop in 2021E. The dividend is forecasted to increase €0.1/share every year until 2023E. S&P Global dividend forecasts are more modest, calling for a 0.3%-15% growth rate, with an average of 7% towards 2025E – but this estimate is very back-end loaded with growth in 3-4 years from now. S&P Global EPS forecasts are similar, but have a higher growth closer in time, estimating the cloud revenue transition to take less time (Source: S&P Global).

I would personally err on the side of caution here, and consider the more conservative view to be better here.

Combining DCF, P/E comparisons to peer and other multiples lead me to severely under-target (compared to both S&P Global and equity analysts) SAP as a business. While Alpha value targets are above €150/share and S&P Global is close to €140/share, I would go no higher than €135/share on the high end.

What is reflected in this target is the combination of a potentially tech-negative market trend. While SAP is a market leader and safe, it will most definitely be dragged down with other stocks – even if it’s less, which we saw in the XETRA SAP loss of 1.45% yesterday (Friday). It’s also included that we have a low dividend, and around 3-4 years of potential stagnation until things pick up again.

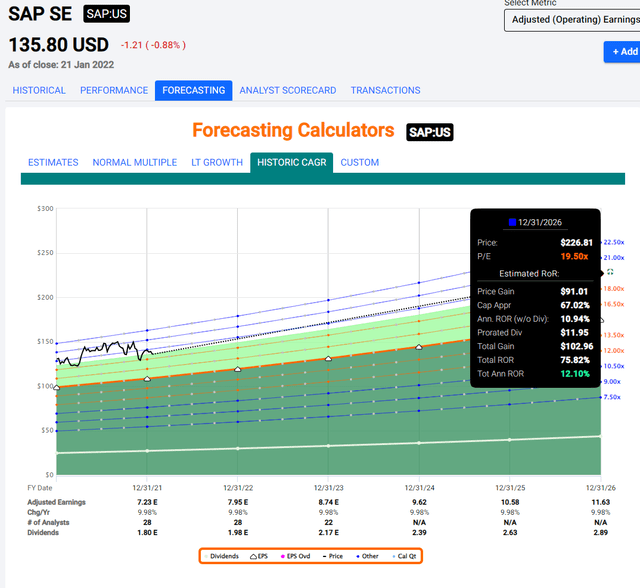

When combining these expectations, we need to find a fairly positive long-term growth rate in order to make money off SAP.

I want to very clearly state that the results above are based purely on historical growth rates for SAP, not current analyst estimates. The current SAP analyst forecasts from FactSet only go to 2022-2023, and result forecasts until that time are somewhat questionable, barely breaking even if some of those FactSet forecasts come true and valuation remains.

I view (mainly) two approaches as valid for an SAP investment.

First, you can buy the company now as a safe investment for the long-term, assuming a long-term growth rate in the low-double-digits. I believe you would be fine with this in the long term, given current long-term growth forecasts as well as historical ones and the company’s market-leading position. I myself have a LONG SAP position, and I’m not touching the “sell” here unless it reaches over €175/share.

Second, perhaps more conservative, you could also view the company’s near-term development and see where this tech rotation goes. It could be that in February and March, we might be able to “BUY” SAP far cheaper than we’re currently seeing. If this is the case, the conservative long-term upside quickly goes to 18-22%, at which point, I’d start buying again.

Closing, I want to say that SAP has lagged its target prices not just for Equity analysts, including my own, but most analyst sources, including S&P Global.

The company has underperformed and is currently considered a “BUY” pretty much across the board – including by me.

Concluding SAP

However, I would be careful going “too far” out on a positive limb here for the company. There are near-term risks and lack of growth that have serious potential to limit your near-term returns. Investors need awareness of this – and this is what I’m providing you with here.

I’ve read most of the opinions on SAP currently going around on the free part of the site. I do not view many of them as accurately, including the risks SAP faces during the transition, either through lack of expertise/knowledge, or again, overestimation.

There’s a lot to like about SAP. That’s why I’m invested in the business. But there are also some risks we need to know.

Be the first to comment