Andrii Yalanskyi

Investment Thesis

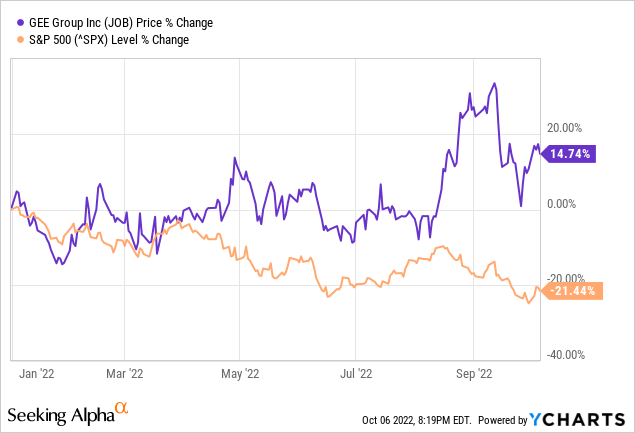

Gee Group, Inc. (NYSE:JOB) is a microcap stock that has overperformed the market in the previous year and YTD by double digits. The stock is comparable to my previously covered stock, RCMT, which also operates in the same sector.

The company is showing organic revenue growth and margin expansion in line with the recovering economy but is likely to be troubled by the recessionary headwinds in the short term. The management has successfully de-risked the business through deleveraging and improving its cash position. Still, the nature of the business makes it highly susceptible to recession-induced strain, resulting in high short-term risk and volatility.

Additionally, the ludicrously attractive valuation metrics make the long-term buy case for the stock significantly strong as even though the short term holds risks of stagnation, the subsequent rebound is likely to pay off for the high risk with high reward.

The Company

JOB is a professional staffing company that operates 28 branch offices across 11 states in the US, including Connecticut, Georgia, Minnesota, New Jersey, Illinois, Massachusetts, Colorado, Texas, Florida, Ohio, and Virginia, and serves 4 additional US locations through remote staff.

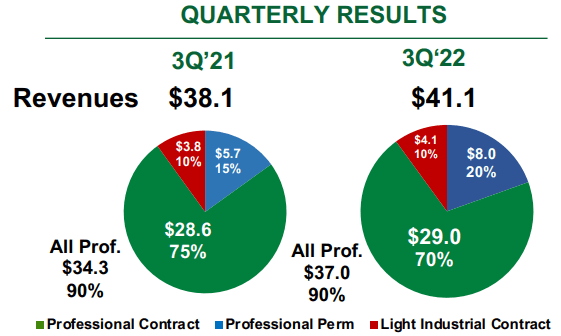

The company’s contract and placement (“C&P”) services are offered under 2 operating segments: Professional Staffing Services, accounting for 88% of C&P revenues and 70% of net revenues, and Industrial Staffing Services, 12% of C&P revenues and 10% of net revenues. The remainder of the revenue is generated through direct hire placement (“DHP”) services.

JOB Q2 Earnings Presentation

Financial Performance

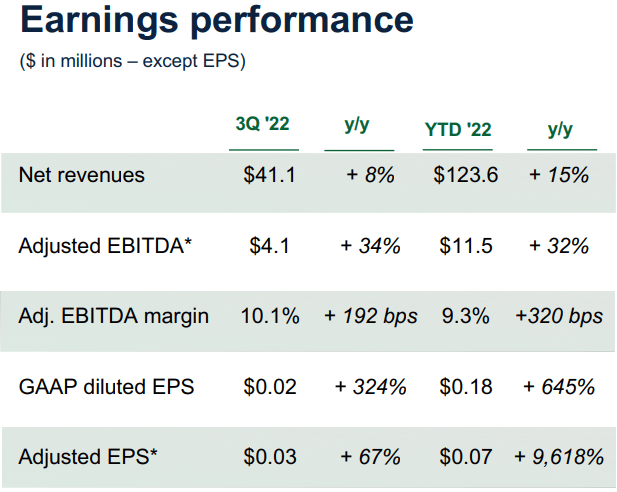

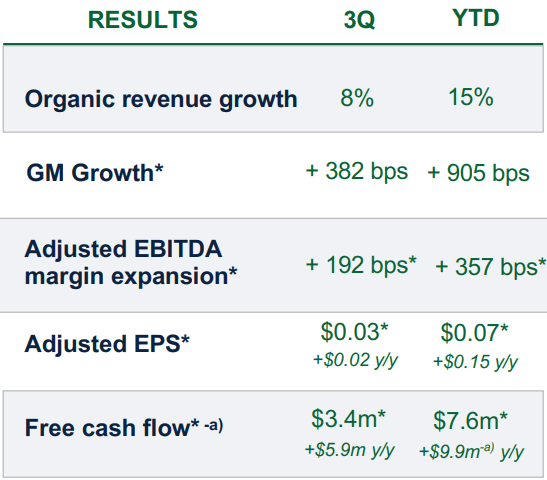

The management is focused on organic growth by expanding its client base, implementing cost-control measures, and pursuing operational leverage for revenue growth and profitability augmentation. I’ve added a snapshot of its recent earnings performance below, which sent the stock price upward to its peak of over $0.75 per share. This is mainly because the job market has been depressed since the pandemic, and the company showed prominent rebound markers in the earnings release with strong YoY growth in revenue and profit.

JOB Q2 Earnings Presentation

The ups and downs in its revenue segments directly correlate with market demand. DHP showed a 60% revenue hike, reaching record highs, and industrial staffing showed a 9% decline, in line with the broader market’s business activities, during the 9 months of the current fiscal year.

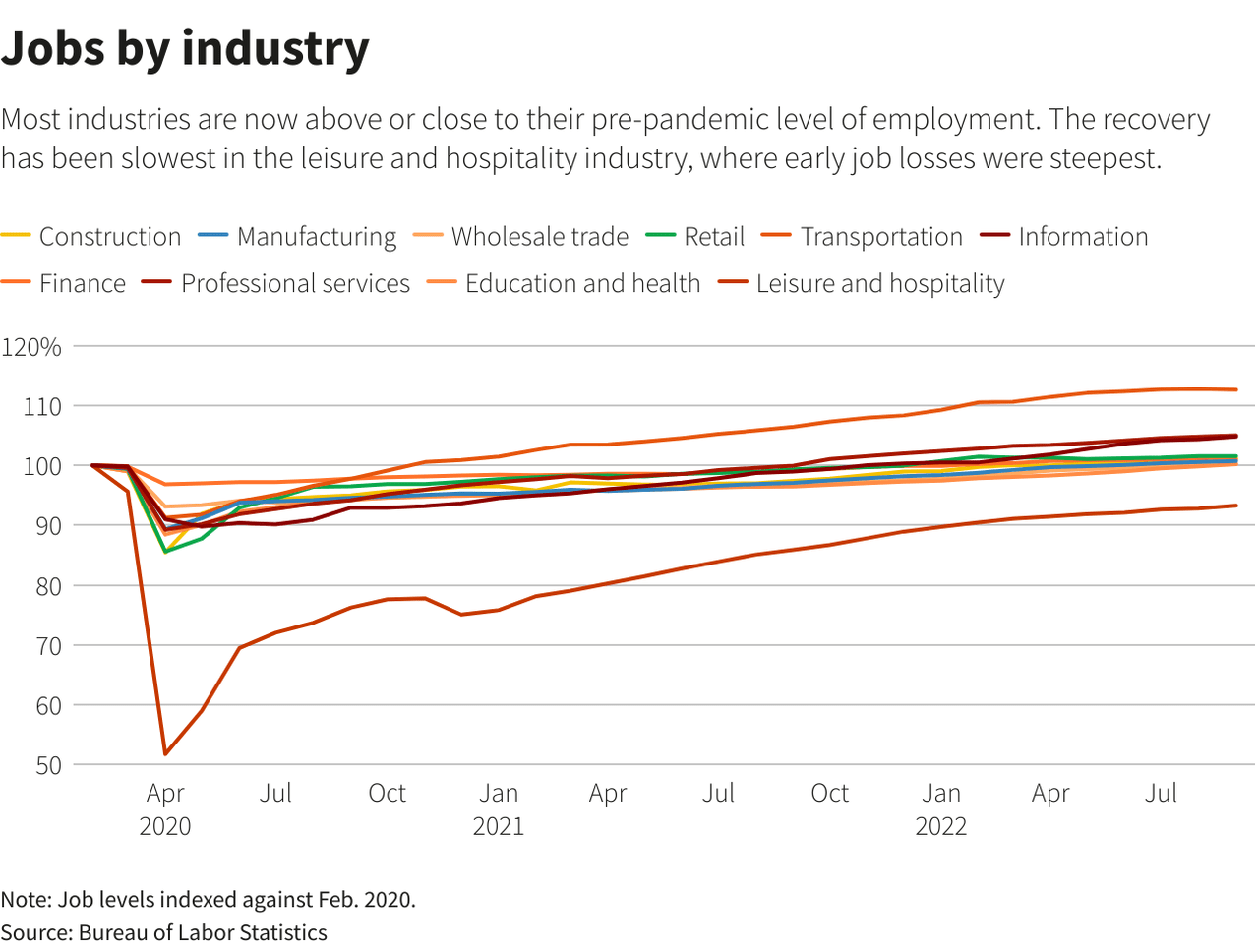

The current figures still appear to be in flux as the market hasn’t fully settled down yet, and is expected to be volatile across the US. Nevertheless, the market is showing improvement despite recessionary pressures. However, potential investors are more concerned with the future than the past, and the recessionary environment, which generally cripples the job market, is a major concern for them.

Reuters

The company’s cyclical nature and the small market cap may seem a risky endeavor during such a time. Still, as I explained in the RCMT article, this combination is precedented to show high returns during an economic recovery. The hiring pullback during the recession may strain the company’s revenues and affect its short-term price performance. Still, the subsequent economic recovery will positively affect its business, showing significant incremental growth.

Additionally, the company’s margins have also been improving down the line, testifying to its cost reduction and operational leverage. This is bolstered by an above-sector ROE of 26% and a ROA of 19.85%. The improving profitability of the business is a positive sign for the long-term performance of the business as it goes through the recession.

JOB Q2 Earnings Presentation

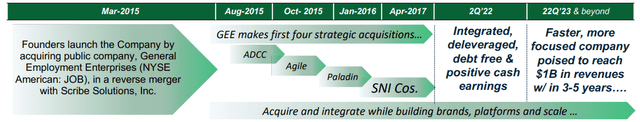

The company’s growth is aided by inorganic growth as it acquires synergetic businesses to complement and consolidate revenues. Over the years, the company has built up its acquisition portfolio to include the following businesses:

General Employment Enterprises, Omni One, Ashley Ellis, Agile Resources, Scribe Solutions Inc., Access Data Consulting Corporation, Paladin Consulting Inc., SNI Companies (including Staffing Now, Accounting Now, and Certes), Triad Personnel Services, and Triad Staffing.

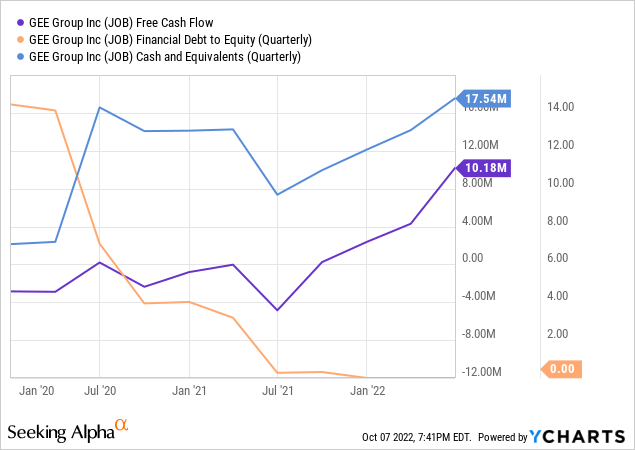

The management has significantly de-risked the business against the recession by deleveraging it, bolstering its FCF, and expanding its cash reserves. This has also resulted in a sequentially augmented book value and an Altman-Z score of 4, improving investor confidence in the company to row through the recessionary tides.

Valuation

The recent price dip from mid-September has resulted in the company’s valuation metrics reaching highly attractive figures, significantly lower than its peers and 5-year averages. If the stock was trading at sector medians, the price churns out to be $2 per share. Even at a 50% discount to the sector, to account for the higher risk, the $1 per share target would hold a 54% upside.

Currently, it is trading at 3.2x its TTM earnings, 0.73x its book value, and 0.45x its sales, despite an expected revenue growth CAGR of 15% in the next 3 to 5 years. Even a significantly conservative TTM FCF-based DCF model, with a growth rate of 5%, a discount rate of 8%, and a terminal rate of 2%, churns out a fair value of $1.28 per share.

Conclusion

The currently bashed-down market is ripe for cheaply valued stocks bound to pay off in the long term. JOB is one of those stocks with high growth prospects and cheap valuation. The growing population, excess vacancies, and the expected post-recession economic rebound are all drivers of the company’s long-term prosperity.

Idiosyncratically, the management has done a great job of securing its position against the recession by building up its cash reserves and becoming debt-free. In addition to the generic favorable risk-reward dynamic that comes with this stock, the idiosyncrasies are especially noticeable in making this stock a buy.

Be the first to comment