Sundry Photography

General Electric Company (NYSE:GE) withdrew its profit guidance for 2022, as expected, due to ongoing supply-chain challenges and problems in the Renewable Energy segment.

The profit cut is the latest setback for General Electric, which is still dealing with high operating costs as a result of the pandemic.

In my opinion, General Electric will not meet its $7 billion free cash flow target next year, and the stock remains overpriced given the company’s performance.

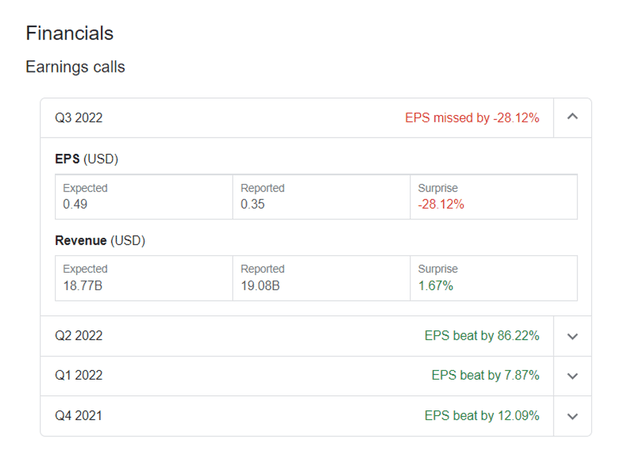

General Electric Delivers Substantial Earnings Miss

General Electric’s earnings report revealed the industrial conglomerate’s ongoing problems, which resulted in the company withdrawing its profit guidance for 2022 and a 28% earnings miss for the third quarter.

The industrial company reported non-GAAP earnings of $0.35 per share for 3Q-22, which fell short of the $0.35 per share consensus. General Electric slightly exceeded the average sales forecast of $18.8 billion.

Earnings Calls (General Electric Company)

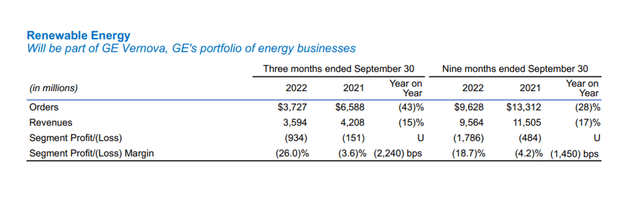

Renewable Energy: General Electric’s Latest Problem Segment

In the third quarter, General Electric’s Renewable Energy segment experienced an unexpected and steep decline in order volume and revenue.

In 3Q-22, General Electric’s order volume in the Renewable Energy segment fell 43% YoY to $3.7 billion, while sales fell 15% to $4.2 billion.

Revenues fell as a result of headwinds in the onshore wind business. The segment lost $934 million in the third quarter alone, bringing total year-to-date losses to $1.8 billion.

Renewable Energy (General Electric Company)

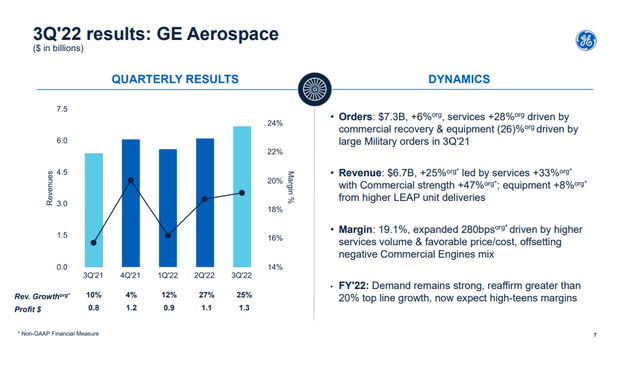

Cyclical Aerospace Segment

General Electric’s aerospace segment performed well, benefiting from 6% YoY order growth and 24% YoY revenue growth. I am wary of the Aerospace sector because it is heavily reliant on strong economic growth in the airline and travel industries.

A recession, which investors must obviously expect, could throw another curve ball at General Electric, as earnings are likely to fall.

3Q’22 Results For GE Aerospace (General Electric Company)

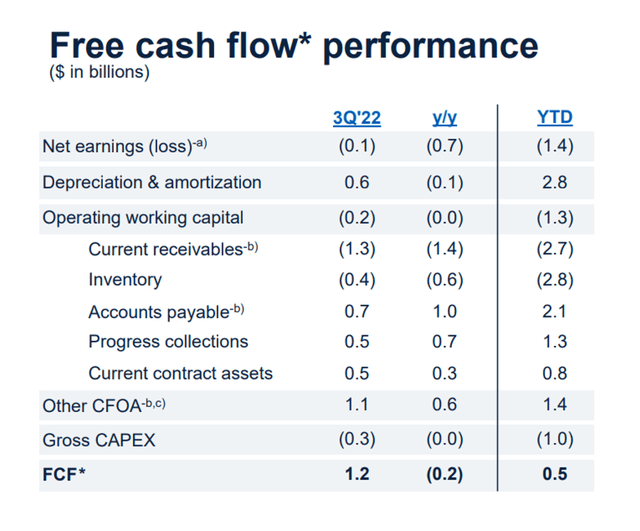

Free Cash Flow And Guidance For 2022

In 3Q-22, however, General Electric earned $1.2 billion in free cash flow. Year to date, the company has earned $0.5 billion in free cash flow, implying that GE will need a monster fourth quarter to meet its current projection of $4.5 billion in free cash flow for the full fiscal year.

Free Cash Flow Performance (General Electric Company)

Due to problems in Renewable Energy and high costs, free cash flow prospects for this year and next year have significantly deteriorated. Earlier this year, General Electric forecasted free cash flow of $5.5 billion to $6.5 billion in 2022 and $7.0 billion in 2023. The projection for 2023, in particular, does not appear to be achievable given the problems in the Renewable Energy industry.

General Electric’s stock currently trades at 11.6x free cash flow, despite having $4.5 billion in free cash flow. For me, this is an excessively high free cash flow multiple that is not justified by the performance of General Electric’s core businesses.

Reduced Guidance For 2022

General Electric expects a $2.0 billion loss in the Renewable Energy segment in 2022 as a result of higher-than-expected warranty expenses, but also of persistent inflation, high costs, and slowing customer demand.

General Electric now expects non-GAAP earnings of $2.40 to $2.80 per share, down from an earlier forecast of $2.80 to $3.50 per share. At the midpoint, the new guidance represents a 17% decrease in earnings per share.

Why General Electric’s Stock Could See A Lower/Higher Valuation

I expected General Electric to reduce its guidance because cyclical industrial conglomerates face higher raw-materials costs, supply-chain issues, and a slowing in customer demand.

Since General Electric now has to deal with growing problems in the Renewable Energy segment, I believe GE is dealing with too many headaches at once.

As a result, the risk-reward relationship is skewed, and General Electric’s stock still carries more risk than investors are willing to bear.

My Conclusion

The third-quarter earnings report from General Electric was dismal, raising the question of why investors would want to buy a cyclical industrial franchise at the start of an economic downturn.

General Electric’s businesses are already suffering from high costs and inflation, and the company’s reduced profit and free cash flow guidance indicates that more pain is on the way.

In addition, given current company performance and execution, General Electric’s stock remains inexplicably expensive, which makes me wonder why investors would want to own GE in the first place.

General Electric is likely to struggle in the next 1-2 years, especially if the economy continues to deteriorate.

Be the first to comment