Justin Sullivan/Getty Images News

Investment Thesis

Apple (NASDAQ:AAPL) managed to survive the quarter. Many investors, including me, were very much on the fence about how the results would work out. But Apple managed to reassure investors that it is an extremely high-quality company, despite everything being thrown at it.

As we’ll soon turn to discuss, there was one major theme that will be affecting Apple into the next quarter: currency.

Currency is expected to provide a 10% headwind. That’s just off-the-chart pressure. For a company with Apple’s expected revenue growth rates, this makes the difference between no growth and some growth.

The other consideration, that we’ll discuss is Apple’s valuation continues to be an overhang, preventing more investors from getting involved with the name.

There’s a lot to get through, so let’s jump right in.

Q4 Results, What’s Happening?

It’s perhaps needless to say, but the quarter just passed spans July through September. We know from companies’ commentary that throughout July and August the macro environment was more or less stable, but that starting in September, the backdrop deteriorated.

Hence, what happened in the quarter isn’t as meaningful as what lies ahead. While this is always the case, with the market always looking forward at least 6 months, this is now more applicable than ever.

As a reminder from what I previously highlighted, there are three critical aspects that I believe will negatively impact Apple going ahead.

- China risk.

- There’s Europe.

- There are currency headwinds.

I’ll touch on these in reverse order. The currency headwinds are likely to be around 1,000 basis points headwind to topline growth in Q1 2023. For a company the size of Apple, that can make the difference between some growth and no growth.

Europe is facing a serious economic slowdown. Europe has been plagued by exorbitant energy prices, that are capping manufacturing, and dramatically impacting household income spending power.

Again, this won’t be reflected in the current quarter, because the situation has only reached a crescendo since the summer.

Next, China is growing at the slowest pace in years. China is no longer the growth economy that drove Apple’s revenues higher. Point of fact, China’s growth in the quarter was 6%, a drag on company-wide growth of 8%. A reversal of what we’ve been accustomed to seeing.

With these top 3 considerations in mind, let’s press forward.

Revenue Growth Rates at Single-Digits

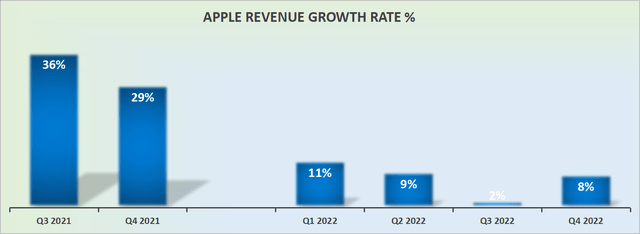

AAPL revenue growth rates

Apple openly states that revenue growth rates “as-reported” will decelerate from the quarter just reported. That means that we are likely to see Apple’s revenues growing by less than 8% y/y in Q1 2023.

Put another way, let’s be honest, for now, Apple is no longer a growth company.

Profitability Profile, Bull Case Weakens

For Q4 2022, operating margins were 29% and this time around operating margins compressed by 100 basis points to 28%. Now, keep in mind, that the bull case is that Apple’s Services should lead to margin expansion, as Services should grow faster than iPhone sales.

But that’s not what we see here. In Q4 2022, Services were up 5% y/y, while the blockbuster iPhone lineup saw revenues from iPhones grow 10%.

Put another way, the core of Apple’s bull case, Services, is slowing down.

That being said, as alluded to above, Apple’s operations are being impacted by currency. For example, during the call, we are told that Services’ revenues on a constant currency basis were up double-digits.

Similarly, looking ahead to Apple’s guidance, Apple states that at the midpoint of its gross margin outlook, there should be 100 basis point compression.

AAPL Stock Valuation – 24x Forward EPS

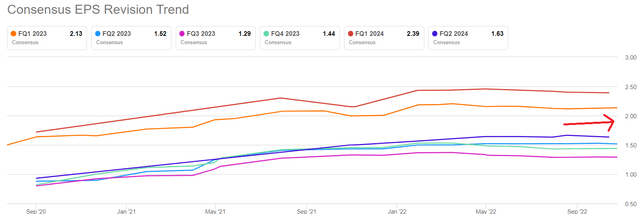

AAPL EPS consensus

Here’s the crux of the matter. Analysts refuse to downwards revise Apple’s EPS estimates. Even now, this late into the game, you can see in the red arrow above that for Q1 2023, analysts are not bringing down their EPS consensus estimates. Why?

Because you don’t want to be the sell-side house that downwards revises Apple’s stock. That’s just bad for business.

Even though Apple mentioned that Q1 2021 would see growth rates decelerating, and gross margins compression, plus currency headwinds impacting operating margins.

Looking ahead, analysts are expecting Apple to deliver $6.55 of EPS. This is a figure that I believe needs to be downwards revised by at least 5% if not 10% to approximately $6.00.

That leaves Apple priced at 24x forward EPS. Simply put, I don’t believe that paying more than 20x forward earnings for a company with mid-single digits growth is a bargain.

The Bottom Line

For investors that don’t own Apple, is this really the time that investors are going to think, the company is reporting so much growth, I have to buy into this growth? I don’t believe that’s the case.

And on the other side of the spectrum, as I’ve discussed already, I simply can’t make the maths work to justify its valuation.

So, the stock is no man’s land. It’s not cheap enough for bargain hunters and not fast enough for growth investors.

That being said, here’s a limitation to my analysis. I recognize that Apple makes 7% of a weighted S&P 500 ETF (SPY). That means that even if AAPL stock is overvalued, whenever investors buy an ETF, they are forced to buy Apple, meaning that capital flows will continue coming into the stock, offering support to the stock.

Does that mean the story ends here? I don’t believe it does. I believe that we are going to start to see more and more investors questioning Apple’s valuation.

I believe that when investors start looking around, where you got countless tech companies, doing exciting things with good profitable prospects, that are down 50%, 60%, and sometimes +80% from the prior highs, that will lead investors to take some winnings here and deploy capital elsewhere. However it works out, good luck with the remainder of the earnings season.

Be the first to comment