Ivan-balvan

Maybe “mic dropper” was not the most appropriate phrase to describe Apple’s (NASDAQ:AAPL) fiscal Q4 performance in 2022. But the print was far from a disappointment, once I took the time to see what was happening under the hood. In fact, the Cupertino-based company may have delivered the best set of numbers and holiday quarter narrative within the Big Tech universe.

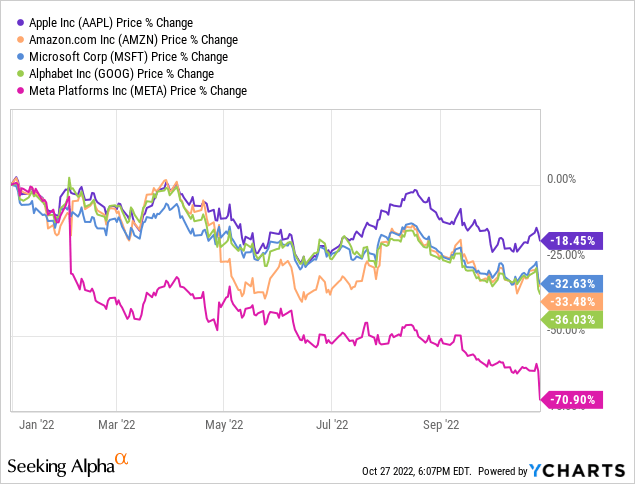

With that, Apple remains the best-performing stock of the year among its FAAMG peers (see below), as well as the most resilient in October so far. I remain an Apple bull for the long haul, understanding that there are enough challenges and uncertainties in the foreseeable future to possibly pressure the share price in the short term.

Apple’s numbers: a quick review

On the headline metrics, Apple did well. The revenue and EPS beats were small, but at least they were delivered: top-line growth of 8% vs. 7% projected, and bottom-line YOY increase of 4% vs. consensus 3%.

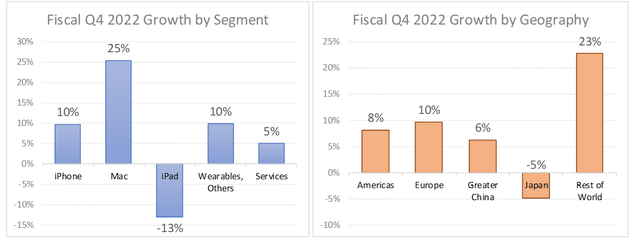

As I had previewed, the iPhone performed well against very tough comps. Growth of 10% timidly topped my expectations of 12% to 15% ex-FX. The Mac also impressed on the back of channel fill and the launch of the M2-equipped MacBook Air, which I had also anticipated: very strong revenue growth of 25%. The iPad suffered from currency movement and the timing of product launches in 2021.

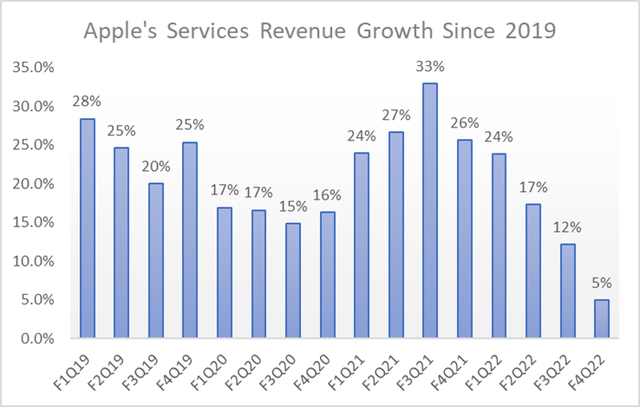

The sore thumb, although also not much of a surprise, was the services segment. Growth of 5% was uninspiring to say the least, even considering low expectations for an increase of 10% or less. Keep in mind that the segment once saw revenues double in five years, then repeat the feat again in the following five. The growth story in this high-margin segment is now on shaky ground (see the next chart below).

Of course, context is needed here. First, the pandemic and stay-at-home tailwinds may have distorted the revenue trajectory a bit. Also, FX headwinds of over six percentage points matter, without which segment revenue growth would have landed closer to 12%. Lastly, softness in the segment may have been mostly confined to digital advertising, which the internet companies had already warned us about earlier in the earnings season, and gaming (a sizable chunk of the App Store business).

Otherwise, I was satisfied with a gross margin of 42.3% which seemed quite rich (10 bps higher YOY) for an environment of inflated labor and component costs and unfavorable currency movements. And as usual, cash flow production was impressive, with operating CF and FCF rising about 15% YOY.

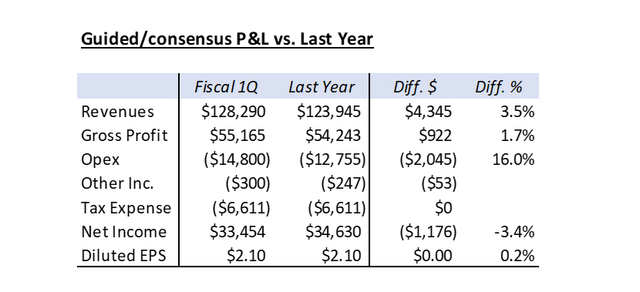

Given the circumstances of high inflation, rising rates, decelerating economic activity, and very unfavorable FX (Apple is projecting a whopping 10 percentage points of drag on revenues next), guidance for the holiday quarter was far from disastrous. Assuming consensus revenue growth of 3.5% (Apple effectively guided for something less than 8%), my projected fiscal Q1 EPS is $2.10, as the table below depicts, or flat YOY on the back of opex that looks very rich.

Apple is still a buy for the long haul

Was Apple’s fiscal Q4 results memorable? Not really. But considering how disastrous earnings season has been for Big Tech, the company’s performance may have been better than feared. With the stock down some 20% YTD, this Thursday’s “all clear” sent from Cupertino may justify some optimism toward Apple’s business and the longer-term performance of the stock.

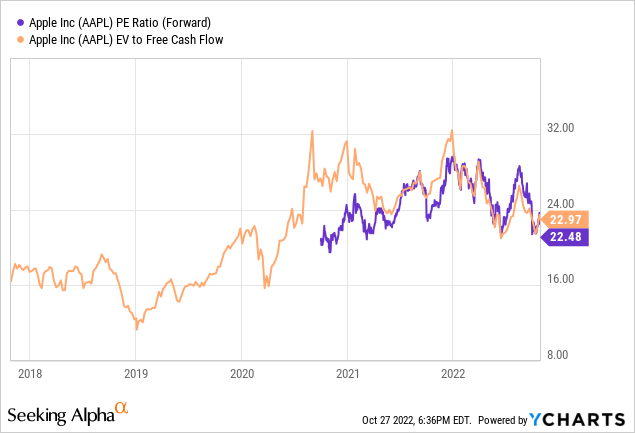

I reiterate my views on AAPL: I like the product portfolio that seems to support strong demand and the company’s recent track record of delivering decent-to-outstanding results in virtually any macro environment. Valuations are a bit rich (see below) for such a weak stock market, but I think that the multiples are justified by the quality execution of the managers, the power of the brand, and the fortress balance sheet.

Be the first to comment