EUR/USD ANALYSIS TALKING POINTS

- German GDP dampens recessionary fears backing euro bulls.

- German CPI and U.S. core PCE dominate the calendar later today.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

EURO FUNDAMENTAL BACKDROP

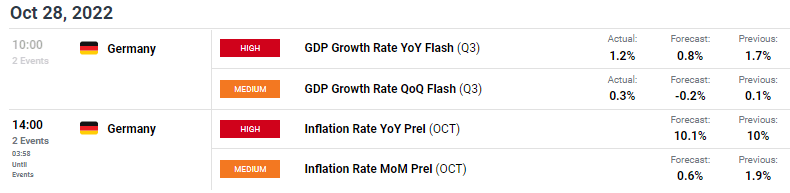

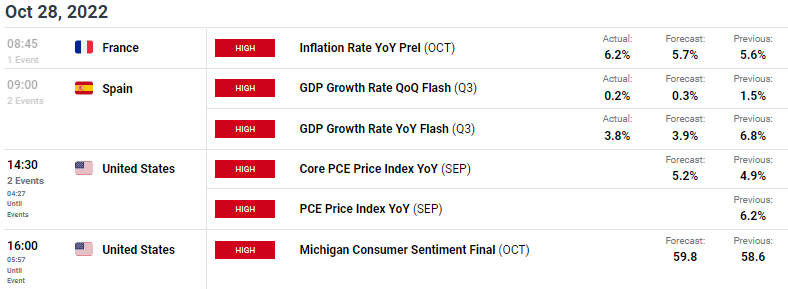

Italy and France kicked off the morning with Italian inflation beating expectations for October while Spanish GDP missed on both YoY and QoQ metrics keeping the euro depressed against the USD. With German GDP at 1.2% and 0.3% (see economic calendar below) respectively, the euro received a slight boost from the stronger GDP print. According to the GDP report, the countries positive performance was mainly attributed to private consumption expenditure while I believe lower energy prices may have had some upside effect on the final figure.

Recommended by Warren Venketas

Get Your Free EUR Forecast

Source: Statistisches Bundesamt (Destatis), 2022

Later today inflation takes center stage, despite Germany looking to increase its prior read to 10.1%, the dollar may gain ascendency later this afternoon should the U.S. core PCE statistic come in as expected.

EUR/USD ECONOMIC CALENDAR

Source: DailyFX economic calendar

After yesterday’s ECB interest rate announcement, markets reacted in a dovish manner leaving the EUR/USD currency pair trading back below parity. ECB officials may look to change this response by making hawkish comments ahead of next week’s FOMC meeting.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

TECHNICAL ANALYSIS

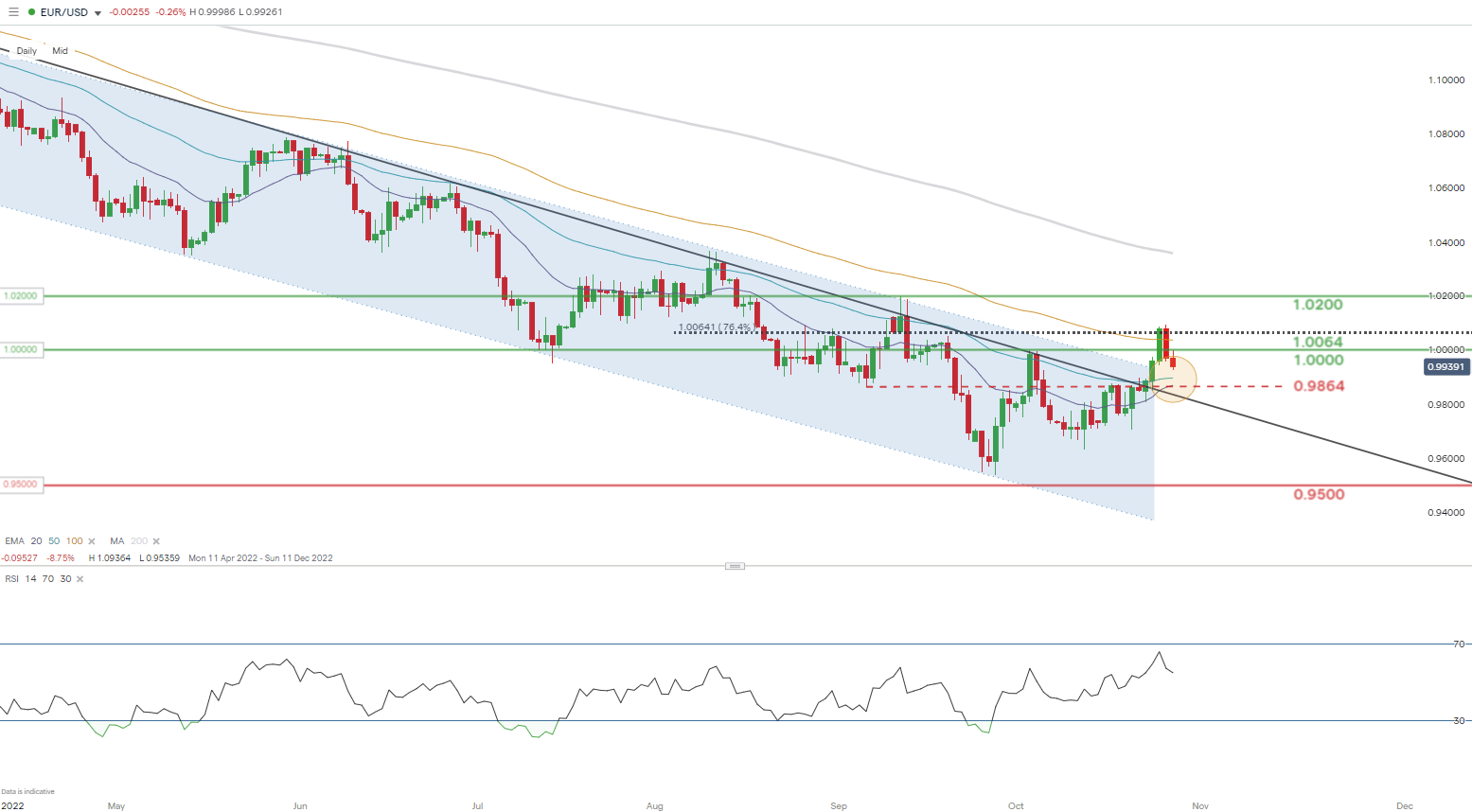

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

EUR/USD price action was relatively muted but marginally supportive of the euro post-release. The long-term down trending channel (blue) is still of key concern for analysts with a weekly close within the channel may limit euro upside. Next week may also see a potential bullish crossover with the 20 (purple) and 50-day (blue) EMA’s highlighted in yellow. Something to watch out for in next week’s sessions.

Resistance levels:

- 1.0064

- 100-day EMA (yellow)

- 1.0000

Support levels:

- 50-day EMA (blue)

- 0.9864/20-day EMA (purple)

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on EUR/USD, with 52% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we favor a short-term cautious bias.

Contact and followWarrenon Twitter:@WVenketas

Be the first to comment