VioletaStoimenova

In the face of economic volatility, New York Community Bancorp, Inc. (NYSE:NYCB) must do better to execute its strategies to avert the impact of inflation. Yet, it continues to prove its fundamental endurance with its stable fundamental health. Its 3Q results may not be impressive, but it is capable of making a solid rebound. Interest rate hikes have been hammering bank holding companies like NYCB. Rate shocks are evident in the market, but NYCB is still performing well. It was much better than anticipated, and now, it is coping with these drastic changes. Indeed, it maintains a durable financial positioning amidst the challenges in the last two years.

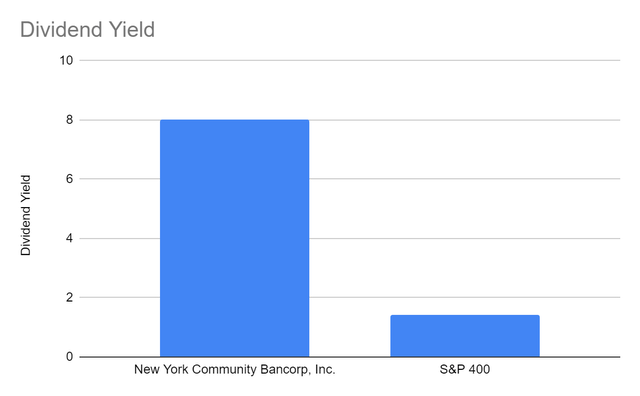

However, it has to be aware of the impending recession since continued inflation and interest rate hikes may slow down economic activities. It may have disruptive impacts on banks and financial holding companies. Fortunately, its growing loans and deposits, improving efficiency, and expanding operations are timely to generate more returns and cover costs and expenses. Also, it has adequate resources to cover its financial leverage and sufficient dividends. This aspect makes the stock price lows favorable with dividend yields becoming more enticing.

Company Performance

New York Community Bancorp, Inc. has been hammered by rate shocks since the first half of the year. But it continues to withstand the pressures, proving that it is a durable and well-run bank. Although headline figures were quite unimpressive, growth prospects in the long run are still promising.

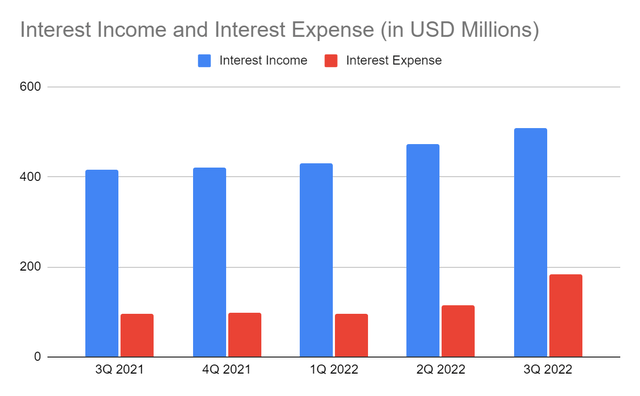

Interest income amounts to $509 million, or a 22% year-over-year growth. The value has been a consistent increase which is not surprising at all. Interest rate hikes intensify driving income on loans. Loans are its primary revenue component so interest rates have a direct impact on its performance as a customer-focused regional bank. It has been hurt by the near-zero interest rates in 2020. As interest rates bounce back, its loans generate more yields. Also, its recent M&A leads to more loans and opportunities to derive more interest income. The combination of stable loan demand, M&A, and interest rate hikes constitutes loan growth. Since the start of 2022, loans have increased by 9% on an annualized basis. Hence, it is no surprise that interest income on loans had a substantial increase.

Likewise, dividend income on its securities is driving interest income growth. Note that its securities are composed of bonds, debentures, and equity. Often, bonds and debentures do not benefit from inflation. Interest rate hikes affect their valuation, lowering unrealized gains and income. But the company enjoys higher interest and dividend income on securities. Its income of $71 million is higher than 3Q 2021 and 2Q 2022 by 71% and 36%, respectively. Thanks to its prudent portfolio diversification that leads to more returns. Most of its bonds and debentures are GSE and TIPS. These are more flexible amidst inflation. They protect returns from lower purchasing power and improve portfolio diversification. They adjust the value of the principal to offset the impact of inflation.

However, interest rate hikes are not advantageous as a whole. Although NYCB benefits from the short and mid-term impact, it must watch out for potential recession. The good thing is that it attracts more deposits, leading to higher funding for loans. But it also raises interest expenses on deposits and borrowings. Interest expense rose to $183 million vs. $97 million in 3Q 2021 and $114 million in 3Q 2021. Hence, the increase in interest expense offsets the increase in interest income. Net interest income margin dropped to 63% vs. the stable 76% from 3Q 2021 to 2Q 2022.

Interest Income And Interest Expense (MarketWatch)

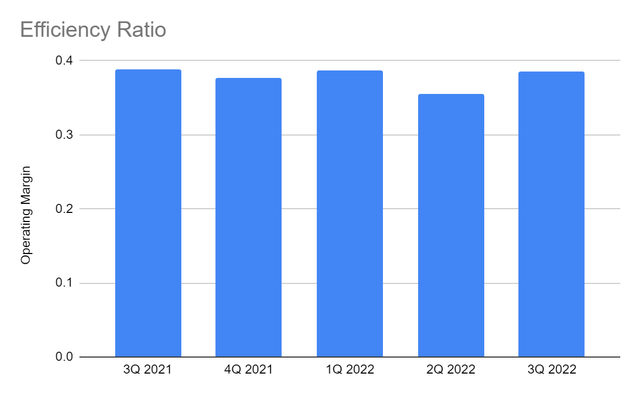

Nevertheless, NYCB’s efficiency worked to help it cushion the blow of interest rate hikes. It was able to stabilize non-interest expenses. It helped create a balance between the interest and non-interest segments. In turn, its efficiency ratio rebounded to 38%, an increase from 35% in the previous quarter. It also explains the impressive quality of assets, which I will discuss in the succeeding sections. The company maintains viability, so the bottom line income is almost unchanged. It may not be impressive, but its stability amidst market volatility means a lot for this company.

Efficiency Ratio (MarketWatch)

How May New York Community Bancorp, Inc. Stay Afloat Amidst Inflation

New York Community Bancorp, Inc. operates a broad range of financial products and services. So, it has a higher vulnerability to risks in a high-inflation environment. Even so, it approaches the year-end on a stable footing while serving clients and maintaining shareholder value. Its core operations remain stable and sound amidst interest rate hikes. It has prudent portfolio diversification and asset management. It also maintains its liquidity and capital base to keep its intact fundamentals. Yet, it must keep a keen eye on external factors affecting its performance.

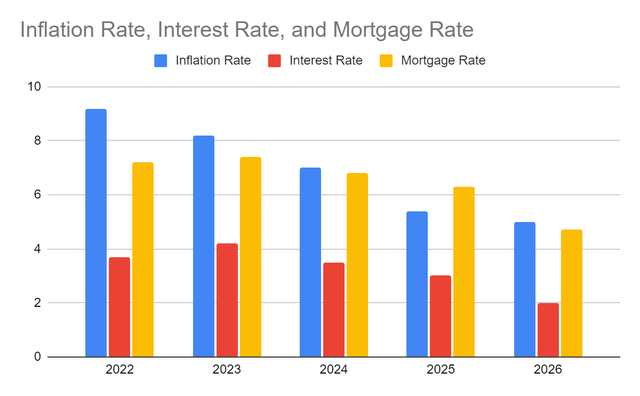

Inflation peaked at 9.1% before it continued to decrease to 8.2%. It may be the reason for a more stable value of its securities. Also, It may suggest that inflation has started to stabilize, but NYCB must not become too complacent. The demand across many industries is cooling down, but the pent-up demand is still evident. It is even higher than pre-pandemic levels. Also, supply chains still have to improve amidst the gradual recovery from port congestion. With that, inflation this year may still exceed 9% for a more conservative estimation.

Likewise, interest rates in the US may go up some more. The Fed made another 75 basis points increase, leading to higher interest rates. From the initial estimation from 3-3.25% to 3.4%, analysts believe it may go beyond 4% in the next 8-12 months. Doing so may help combat inflationary pressures so NYCB must be more careful to stabilize returns. Mortgage rates also had a sharp increase this year. From 4.8-5.2% in the first half, the 15-year average mortgage rate today is 6.59% while the 30-year average reached 7.2%.

Inflation Rate, Interest Rate, And Mortgage Rate (Author Estimation, Barron’s, And Forbes)

Amidst the volatile economy, NYCB continues to perform well. Revenues are stable as interest income offsets the decrease in non-interest income. Expenses are covered to stay viable. More importantly, it has sound fundamentals to stabilize its operations and cover financial leverage. It also has excellent asset quality and prudent portfolio diversification.

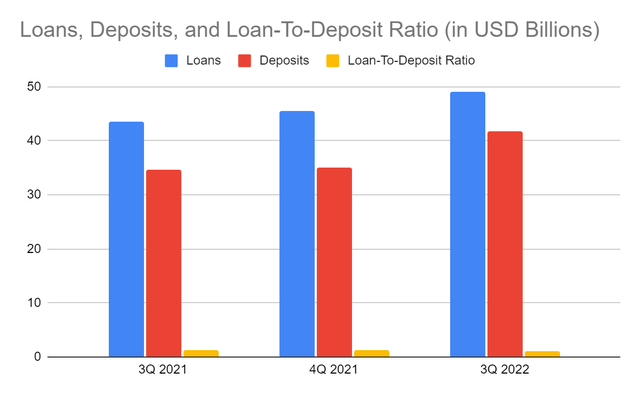

Loans and deposits are growing in line with interest rate hikes. There are more deposit inflows and loan returns. Loans are already $48.98 billion or 78% of the total assets. It is a massive increase from $45.54 billion at the beginning of the year, but the percentage is the same, showing stability. Loans rose by 9% on an annualized basis, particularly in the multi-family lending segment. Likewise, deposits increased by 25% on an annualized basis. It may be the reason the interest segment of NYCB is not impressive. Net interest margin contracted as discussed in the previous section. So, the impact of interest rate hikes is higher in deposits.

Even so, originations remain robust, 27% higher than in the previous year. Indeed, the demand for its loans is still high despite the skyrocketing interest rates. It may increase further once interest rates become more stable. So, growth prospects in the long run may become more promising, especially in the multi-family segment as home values remain high. It may increase its securities in this segment, generating more yields.

Also, it has become more conservative, given the increased allowances for credit losses. It is a nice move since higher interest rates may increase the possibility of defaults and non-performing loans. Its Loan-to-Deposit Ratio is down to 117%, showing a better liquidity position. Despite this, non-performing loans have improved to 0.09% of the total assets vs 0.10% in the previous quarter. Allowances are almost five times as high as non-performing loans, making it conservative and prudent.

Loans, Deposits, And Loan-To-Deposit Ratio (MarketWatch)

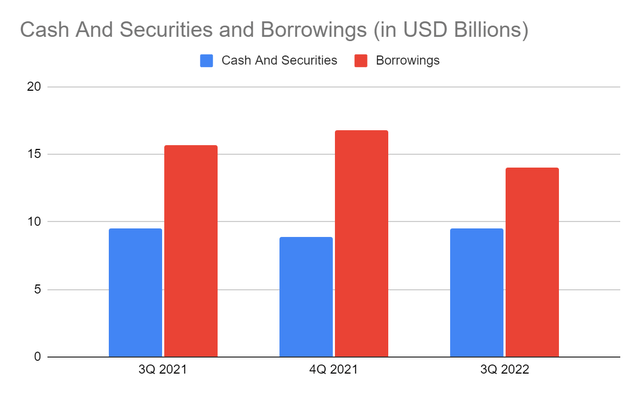

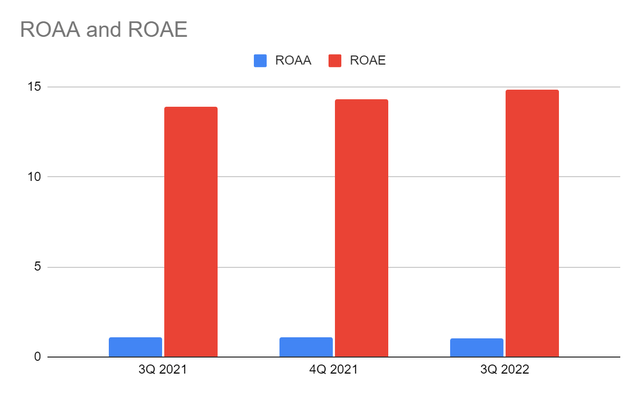

As a whole, the asset quality is impressive with non-performing assets decreasing from 0.09% to 0.08% this quarter. They can even be covered by cash alone. Cash and securities are stable at $9.5 billion while borrowings are lower at $14.02 billion. This trend is ideal, given the interest rate hikes and the recent M&A deal. Indeed, NYCB maintains impressive asset quality with a stellar financial position. It allows its operations to remain sustainable and remain viable. With that, ROAA and ROAE tangible remain solid at 1.02% and 14.81% this quarter.

Cash And Securities And Borrowings (MarketWatch)

Stock Price Assessment

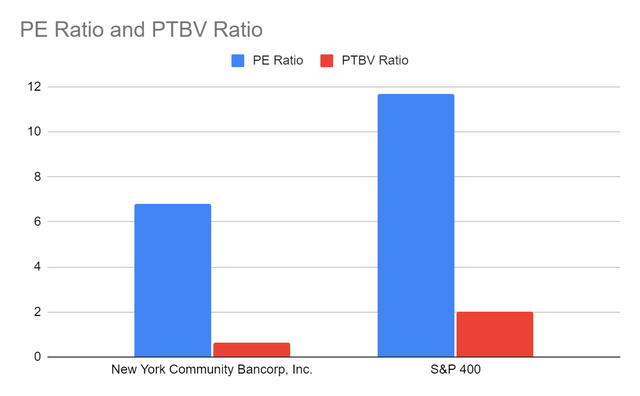

The stock price of New York Community Bancorp, Inc. remains on a downtrend. The decrease was sharper after the temporary reversal in August. At $8.84, the stock price has already been cut by 26% from the starting price. Indeed, it remains hammered, but it opens more opportunities for potential gains. The attractiveness of the stock price is further proven by its PE Ratio of only 6.83, which is way lower than the average of S&P 400 components. Likewise, its tangible book value is ideal with a PTBV Ratio of only 0.63 vs. 2.00 of S&P 400 components. Indeed, the stock price appears cheap and reasonable.

PE Ratio And PTBV Ratio (Seeking Alpha)

Its dividends per share are fixed at $0.17 with an annualized value of $0.68. Given its stock price, the dividend yield of 8.01% makes it enticing. It is also well-covered, given the Dividend Payout Ratio of 57%. As such, dividends appear sustainable and reasonable relative to their income. To assess the stock price better, we will use the DCF Model.

Dividend Yield (Yahoo Finance)

FCFF $451,000,000

Cash $1,700,000,000

Outstanding Borrowings $4,800,000,000

Perpetual Growth Rate 4.2%

WACC 9.2%

Common Shares Outstanding 466,136,056

Stock Price $8.84

Derived Value $12.88

The derived value shows that the stock price has potential undervaluation. There may be a 46% upside in the next 12-18 months. So, the current stock price is a good entry point to make a buy position.

Bottomline

New York Community Bancorp, Inc. faces extreme challenges, but fundamentals remain solid. It has a strong liquidity position with impressive asset quality. It has adequate resources to rebound, expand, and cover dividends. Also, its stock price has potential undervaluation and promising prospects. The recommendation is that New York Community Bancorp, Inc. is a buy.

Be the first to comment