cagkansayin

Introduction: Fund Characteristics and Suitability

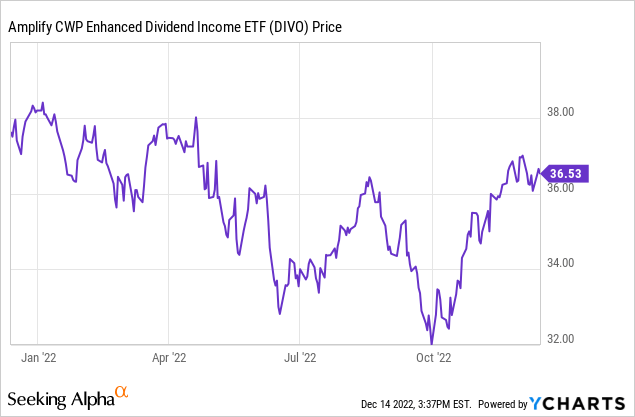

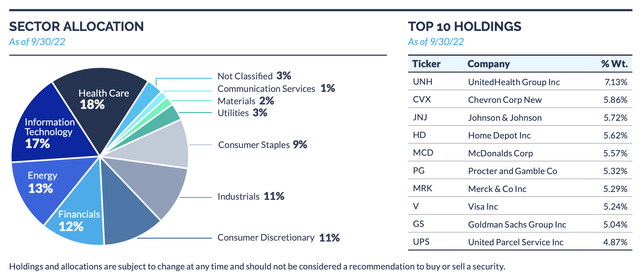

Amplify CWP Enhanced Dividend Income ETF (NYSEARCA:DIVO) is a fund that provides income by primarily investing in high-quality dividend-paying stocks. The fund’s equity screening consists of identifying large capitalization companies within the S&P 500 (SP500) that management believes have a greater likelihood of sustaining and growing its dividends. The portfolio holds approximately 20-25 stocks at any time, with no stock weighing more than 8% at any time.

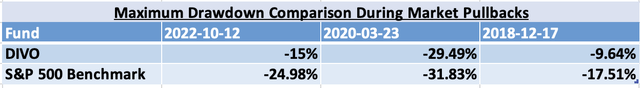

Additionally, the fund utilizes opportunistic tactical call writing to reduce portfolio volatility and generate further income. Lastly, the fund has a specific mandate to not allow a sector to be weighted more than 25% of the entire portfolio. The fund’s strategy has had a good track record of reducing drawbacks during systematic events. When compared to the S&P 500 during the 3 most recent significant market corrections, the fund’s drawdown had been less precipitous.

Also, the fund’s annualized volatility of 16% puts them in the low-risk area of the volatility spectrum. Therefore, I believe DIVO is a solid long-term income play for conservative income-seeking investors.

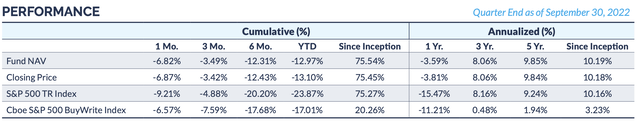

Risk-Adjusted Performance

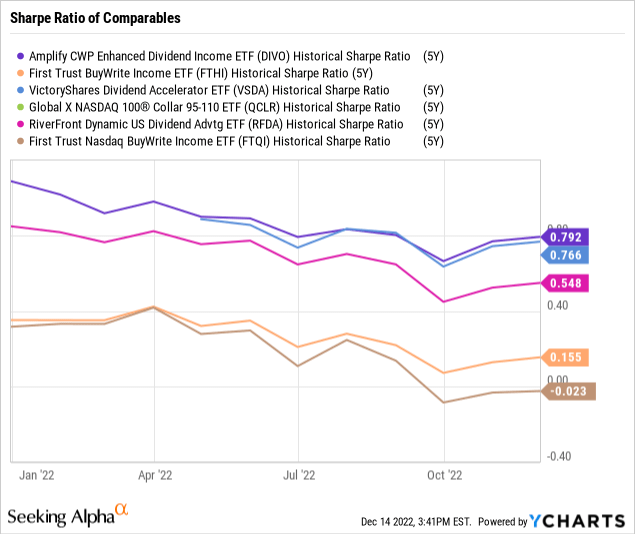

Now that we’ve determined the fund characteristics, it’s time we assess the fund’s risk-adjusted performance since the objective is to obtain income at fairly reasonable levels of volatility. The first risk-adjusted metric being assessed is the Sharpe ratio. The following is the 5-year Sharpe ratio of funds in which their mandates are analogous to DIVO.

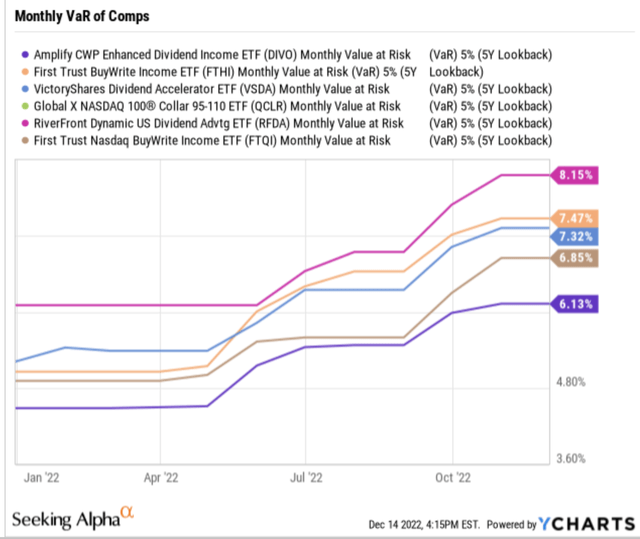

As seen in the exhibit above, DIVO has achieved higher risk-adjusted returns than its peers when looking at the Sharpe ratio. In addition to the Sharpe ratio, I also looked at the monthly value-at-risk measure of the same comparable funds. The next chart displays each of these funds’ value-at-risk using a 5-year look-back period and 95% confidence interval.

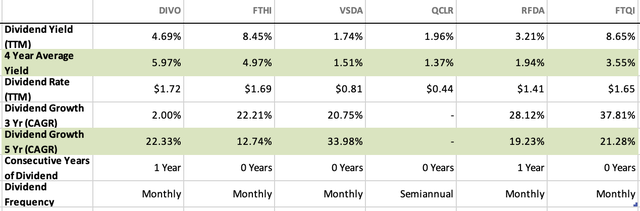

As you can see, in an adverse event when an investment moves to the far right tail of its monthly return distribution, the expected loss for DIVO is less than that of its peers. This is an indication of lower risk, since it implies that DIVO currently has a lower tail risk than its competitors. Furthermore, the fund’s 4-year average yield and 5-year dividend growth have been superior to its peers. Meaning that investors receive a higher income from DIVO than they would by investing in a similar fund, and they will also have lower downside risk.

To conclude, DIVO provides superior risk-adjusted returns based on the fund’s returns per unit of standard deviation and lower tail risk.

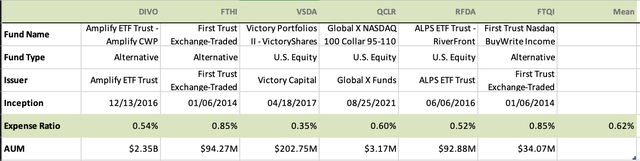

Low Relative Fees

The current MER charged by this fund is 0.55%. When you account for the 89% annual turnover that the portfolio currently obtains, it is understandable that the fund would charge higher fees than typical index ETFs. Moreover, when compared to funds with similar mandates, the fees charged are relatively cheap. In the exhibit below, you see that DIVO’s expense ratio is lower than the average of Seeking Alpha’s comparable funds.

A final note, although the MER fee may be higher than most index replication ETFs, the fees are necessary to compensate management for the high fund’s turnover which has been an integral part in reducing the fund’s volatility.

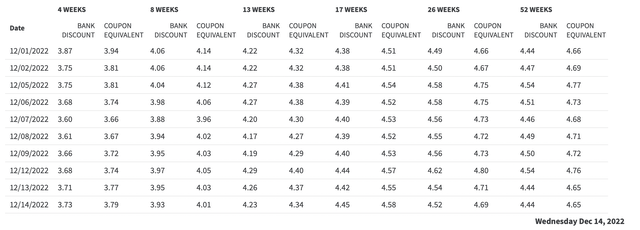

Challenge: Safer Yields Exist

Although I have been praising the fund’s risk-adjusted performance and mitigated downside risks, with the Fed Fund’s Rate currently sitting near 4.5% DIVO’s merely 4.69% yield might not cut it. With default-free assets such as treasury bills hovering at 4-4.5%, it might make more sense for investors to overweight their portfolio in government bonds while underweighting their equity exposure.

The preference for treasuries at this moment has nothing to do with the management, I just believe that with the higher-rate environment, stocks could continue their recent slump. This implies that there would be less sectors for DIVO’s management team to rotate into without incurring some more downside. Therefore, because risk-free assets currently generate an equivalent yield, it’s best for income-seeking investors to lock-in these rates and underweight their equity exposure.

Conclusion: Underweight Now, Overweight Later

To conclude my investment thesis, DIVO is a good addition for conservative income-seeking investors. Due to the current high interest rate landscape, it is best that income investors underweight their equity exposure and hold more fixed-income investments at the moment. With that being said, DIVO still has a spot in a conservative income investor’s portfolio as its historical downside exposure is much lower than typical long-only equity funds. Additionally, once the clouds of inflation and interest rates have subsided, investors may overweight this fund in their holdings since it has achieved stellar total returns.

Overall, if you’re an income-seeking investor concerned about portfolio volatility, Amplify CWP Enhanced Dividend Income ETF is an optimal choice for increasing your portfolio’s utility. With a nice yield and low volatility, income investors can’t go wrong by owning DIVO.

Be the first to comment